Construction companies lose an average of 2-5% of their revenue due to poor financial oversight. Most contractors struggle with cash flow gaps, inaccurate job costing, and delayed payment collections.

We at adding technology have identified the key strategies that separate profitable construction businesses from those barely breaking even. Better financial management performance directly impacts your bottom line and business growth potential.

Construction companies that use real-time job costing systems report 15-20% better profit margins compared to those that rely on monthly or quarterly cost reviews. The National Association of Home Builders found that contractors who track costs daily identify budget overruns 3 weeks earlier than those who use traditional methods.

Real-time systems connect field data directly to your accounting software and eliminate the 48-72 hour delay that kills profitability. When material costs spike or labor hours exceed estimates, you know immediately rather than discover problems at project completion. Smart contractors install mobile apps that allow foremen to input labor hours, material usage, and equipment time directly from job sites.

The Construction Financial Management Association reports that 82% of construction business failures stem from cash flow problems, not lack of work. Successful contractors maintain cash flow forecasts that extend 90 days ahead and update projections weekly based on payment schedules and project milestones.

Progressive billing structures with 10% down payments and weekly progress invoices generate 40% faster payment cycles than traditional monthly billing. Automated payment reminders sent 7 days before due dates increase collection rates by 23% according to recent industry data. Strategic invoice timing and follow-up systems can reduce average collection periods from 45 days to 28 days.

Construction companies with standardized weekly financial reports make strategic decisions faster than those that review finances monthly. Your reports must include job profitability per project, accounts receivable aging, and cash position forecasts (updated weekly for maximum accuracy).

The most profitable contractors generate profit-and-loss statements for individual projects every Friday, which allows immediate course corrections on underperforming jobs. Standard reporting formats enable quick identification of trends across multiple projects and help predict which jobs will generate the highest returns.

These financial management foundations set the stage for technology solutions that can automate and optimize your construction company’s financial performance even further.

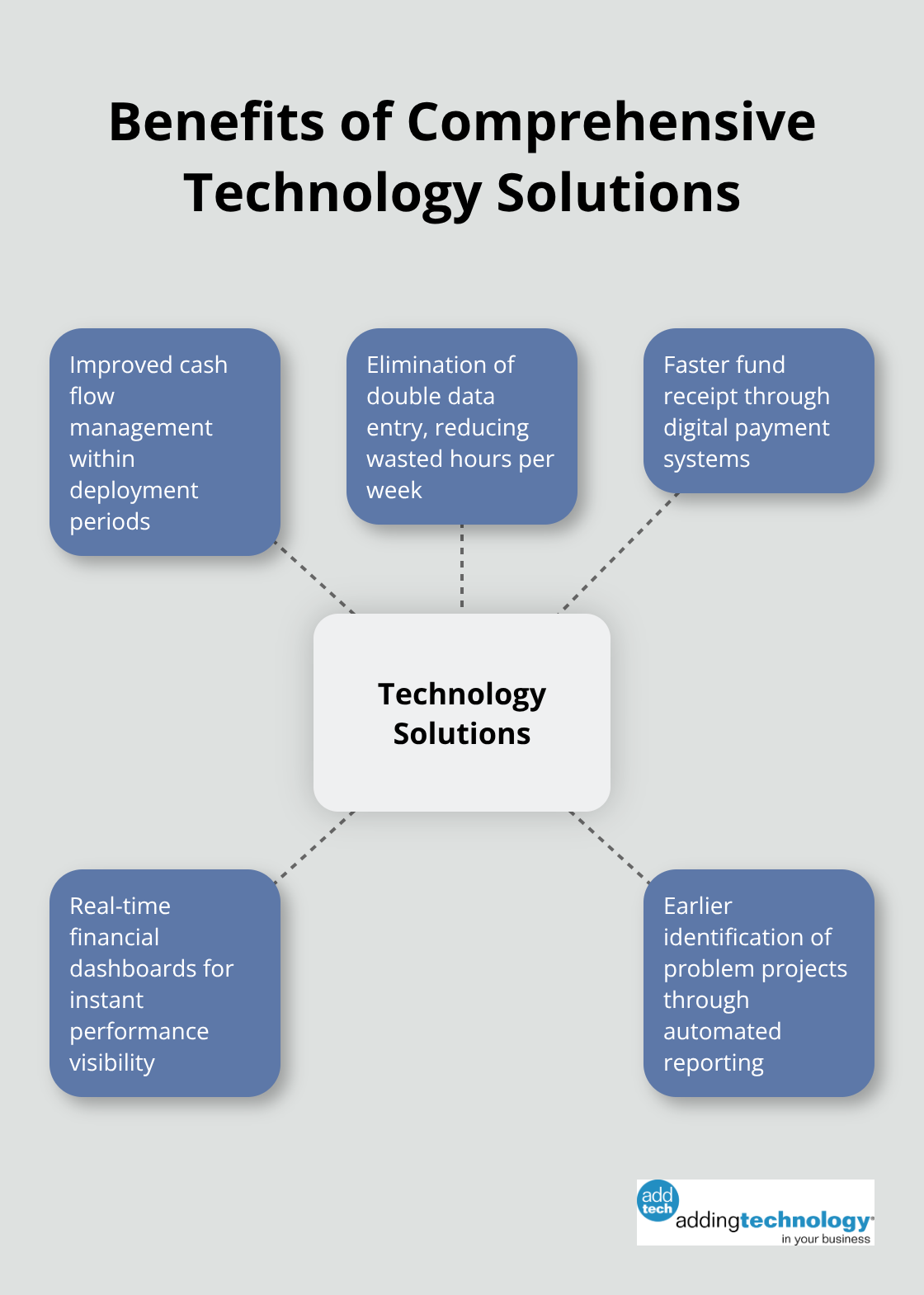

Construction financial software integration provides significant operational improvements according to recent Construction Technology Report data. Contractors who implement comprehensive technology solutions report improved cash flow management within deployment periods.

Modern construction accounting platforms like QuickBooks Enterprise and Sage 300 Construction connect directly to project management systems and eliminate double data entry that wastes hours per week for typical contractors. Automated bank reconciliation features reduce monthly closing time while improving accuracy rates.

The most effective systems sync field time tracking with payroll processing and automatically update job costs regularly. Integration between estimating software and accounting systems prevents cost overruns that affect contractors who manually transfer project data between platforms.

Construction companies that accept credit card payments receive funds faster than those limited to checks and ACH transfers. Digital payment platforms help reduce collection periods for improved cash flow management.

Automated payment processing systems send invoices immediately upon project milestone completion and follow up with payment reminders at regular intervals. Mobile payment acceptance increases payment rates for field invoicing situations where immediate payment collection becomes possible.

Real-time financial dashboards display cash position, accounts receivable aging, and project profitability. These systems enable construction executives to make decisions based on current data rather than outdated monthly reports.

The most valuable dashboards update regularly and highlight projects with negative profit margins, overdue receivables, and cash flow projections that fall below operating expenses. Construction companies that use automated financial reporting systems identify problem projects earlier than those that rely on manual reporting processes.

Even the best technology solutions cannot prevent the financial management mistakes that destroy construction company profits.

Construction companies that fail to track project costs accurately face significant financial challenges, with cost overruns being a persistent issue across the industry. Most contractors discover cost overruns only after project completion when profits have already evaporated. The biggest mistake involves contractors who use outdated spreadsheets or monthly cost reviews instead of real-time systems that capture labor, materials, and equipment expenses daily.

Contractors who rely on manual cost tracking methods miss budget overruns that compound throughout project lifecycles. Weekly cost reviews identify problems too late to implement corrective measures that preserve profitability. Smart contractors implement daily cost capture systems that flag budget variances within 24-48 hours of occurrence.

The most damaging practice involves estimators who create budgets but never compare actual costs against projections during construction phases. This disconnect prevents teams from adjusting labor allocation, material orders, or subcontractor schedules when projects exceed planned expenses. Proper job costing methods help contractors track these variances effectively.

Construction companies face significant challenges with working capital management, which prevents them from bidding on profitable projects. The industry also struggles with workforce shortages that delay projects and impact financial planning. Smart contractors maintain cash reserves equal to 3-6 months of operating expenses and establish credit lines before they need them.

Companies that wait until cash flow problems emerge typically face 18-24% higher borrowing costs and may lose bonding capacity that limits project opportunities. Working capital management requires weekly cash flow projections that account for payment delays, seasonal fluctuations, and equipment purchases (updated every Friday for maximum accuracy). Understanding construction in process accounting helps maintain accurate financial positions.

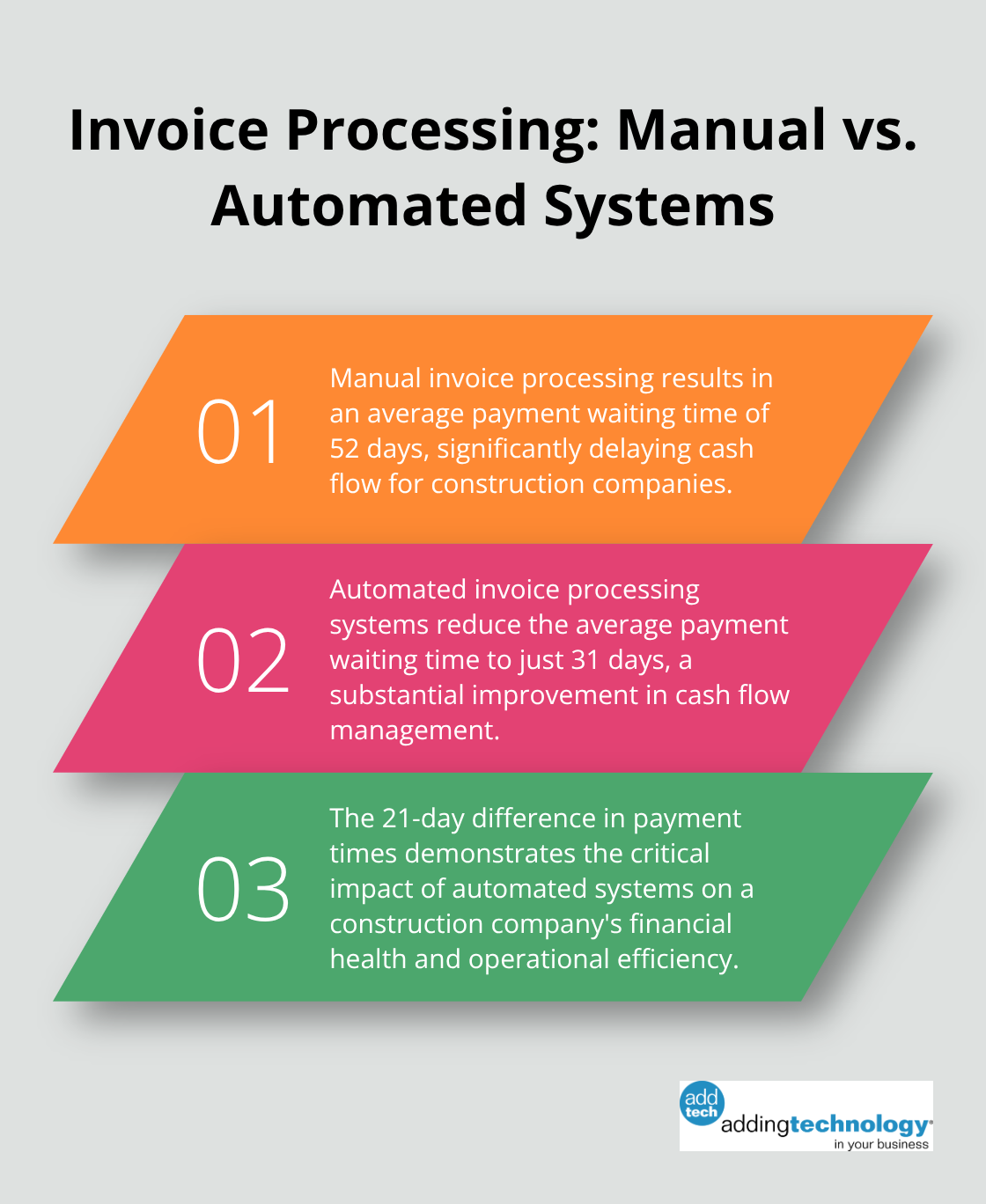

Construction companies that process invoices manually wait an average of 52 days for payment compared to 31 days for those who use automated systems according to recent industry surveys. Late invoice submission costs contractors approximately 2-3% of total revenue through extended collection periods and increased bad debt write-offs.

The most damaging practice involves contractors who batch invoices monthly rather than send them immediately upon milestone completion. This approach delays cash flow and increases collection risk significantly. Progressive contractors submit invoices within 24 hours of work completion and follow up with automated payment reminders (sent every 7 days until payment arrives).

Construction companies transform their financial management performance when they adopt real-time job costing systems, streamline cash flow processes, and establish standardized reports. These strategies boost profitability directly, with companies that track costs daily achieving 15-20% better profit margins than those who review monthly. Technology integration accelerates these improvements through automated accounting systems, digital payment processing, and real-time financial dashboards.

Construction businesses that implement comprehensive financial technology solutions cut collection periods from 45 days to 28 days while they eliminate costly manual data entry processes. The most damaging mistakes include poor project cost tracking, inadequate working capital management, and delayed invoice processing (which costs contractors 2-3% of total revenue annually). Companies that avoid these pitfalls maintain stronger cash positions and capture more growth opportunities in competitive markets.

Construction companies ready to transform their financial operations should partner with professional accounting specialists who understand industry-specific solutions. Expert implementation of these financial management improvements creates the foundation for sustained business growth and operational efficiency. We at adding technology help contractors implement these systems to maximize their financial performance and competitive advantage.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.