Construction accounting terms can be confusing, but understanding them is vital for successful project management. At adding technology, we’ve compiled a comprehensive guide to help you navigate the financial landscape of the construction industry.

This blog post will break down essential construction accounting terms into three key categories: basic concepts, job costing terminology, and financial reporting. By mastering these terms, you’ll be better equipped to make informed decisions and improve your company’s financial performance.

Construction accounting involves unique terminology that’s essential for effective financial management. Let’s break down these terms to enhance your understanding and decision-making capabilities.

Revenue recognition is used by contractors, banks, and other financial institutions to measure the profitability and financial health of a construction project. This includes the initial agreed-upon sum, approved change orders, and any other adjustments. Accurate tracking is crucial for assessing a project’s financial performance.

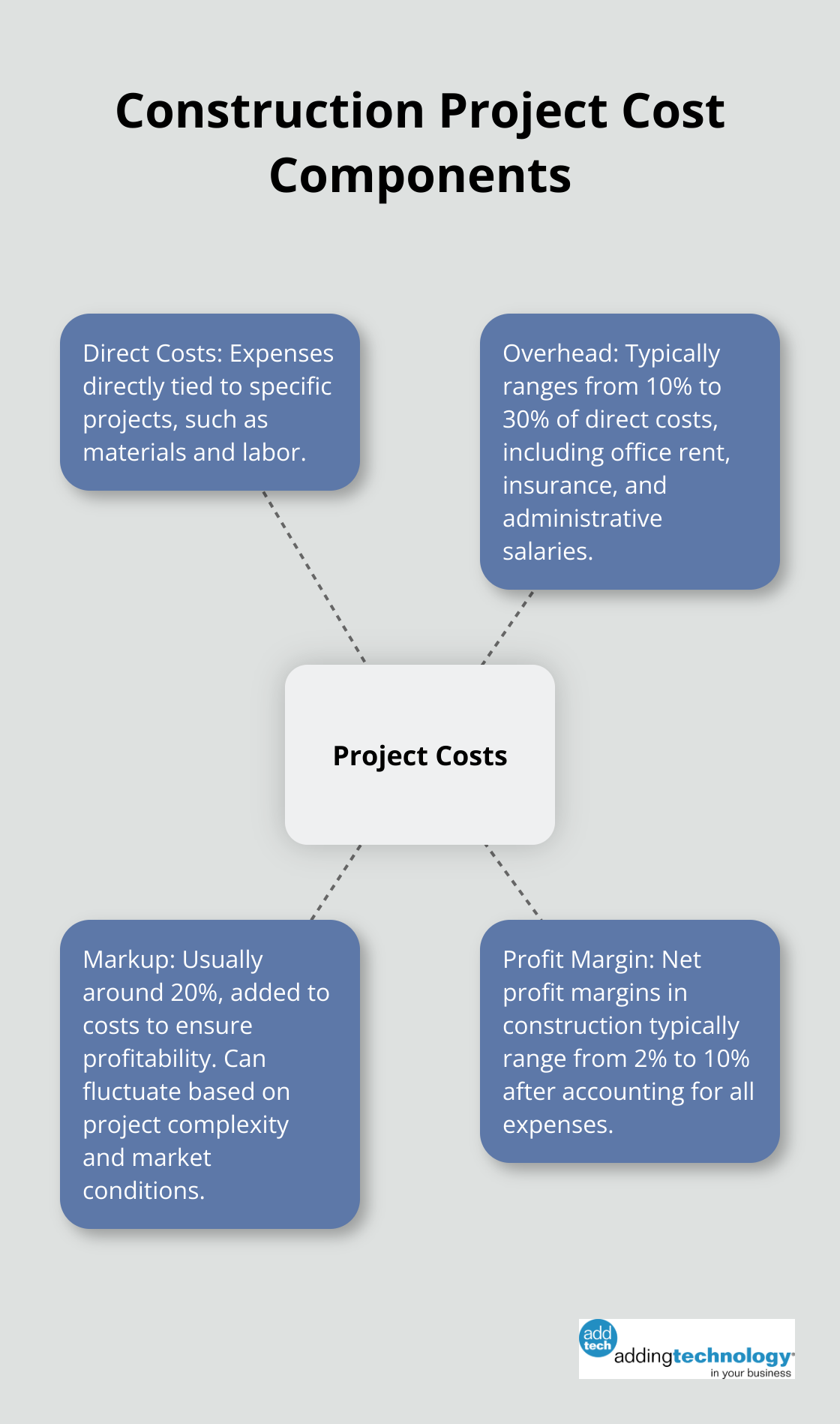

Direct costs are expenses tied to a specific project, such as materials and labor. Indirect costs, however, are overhead expenses that can’t be attributed to a single project (e.g., office rent or administrative salaries). Proper cost allocation is essential for accurate project pricing and profitability assessment.

WIP reports help identify potential risks such as cost overruns, schedule delays, or scope changes that could impact a project’s profitability. These reports compare actual costs and billings to estimated figures, helping identify potential issues early.

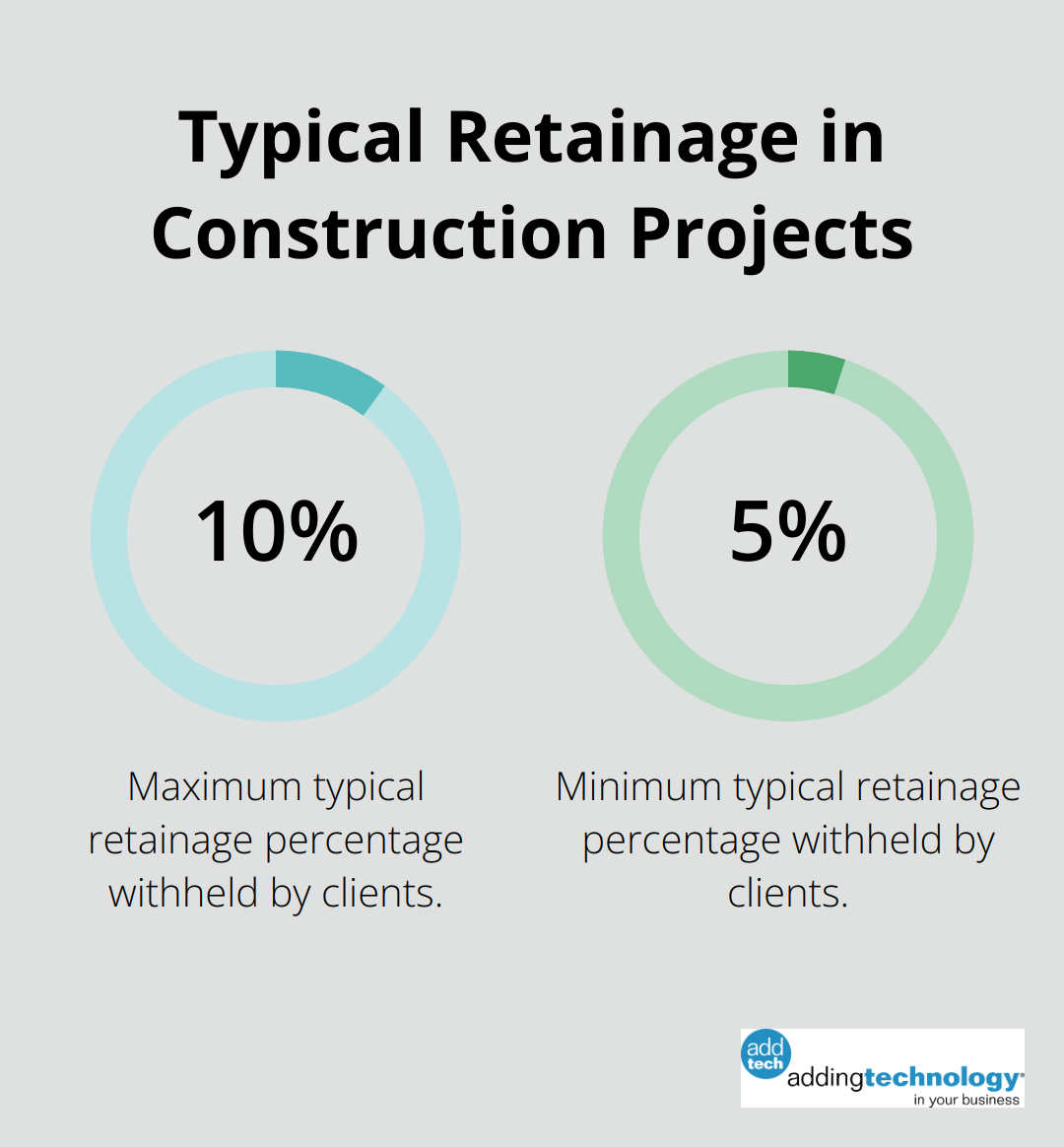

Retainage refers to a portion of the contract amount (typically 5-10%) withheld by the client until project completion. While it protects clients, it can strain contractors’ cash flow. Understanding and managing retainage is crucial for maintaining healthy cash flow throughout a project.

Companies that implement robust systems to track these elements often see substantial improvements in their financial performance. This underscores the importance of partnering with experts who understand the intricacies of construction accounting.

As we move forward, we’ll explore job costing terminology, which builds upon these basic concepts to provide a more comprehensive view of project finances.

Construction cost codes are unique identifiers that allow companies to track, organize and categorize their costs. These codes enable you to categorize and monitor expenses for each project component. Implementing a standardized cost code system allows for easy comparison of costs across projects and identification of improvement areas.

Overhead costs often slip under the radar in construction. These expenses include office rent, insurance, and administrative salaries. Accurate overhead calculation is essential for determining the right markup for your projects. Industry benchmarks indicate that overhead typically ranges from 10% to 30% of direct costs (depending on the size and type of construction company).

Markup represents the percentage added to your costs to ensure profitability. While the average markup in construction hovers around 20%, it can fluctuate widely based on project complexity and market conditions. Regular review of your markup strategy helps maintain competitiveness while preserving profitability.

Profit margin reflects the percentage of revenue that becomes profit after paying all expenses. In construction, net profit margins typically range from 2% to 10%. To increase your profit margins, focus on efficient project management, accurate estimating, and cost control. Companies that consistently achieve higher profit margins often invest in advanced job costing software and regular financial analysis.

Change orders can significantly impact a project’s profitability. To manage change orders effectively, establish a clear process for documenting, pricing, and approving changes. This includes prompt updates to your job costing system to reflect the impact on project finances.

Mastering these job costing essentials equips you to make informed decisions and improve your company’s financial performance. Effective job costing requires ongoing attention and analysis. If you seek to enhance your job costing practices, Adding Technology offers expert services tailored to the construction industry. These services help streamline financial processes and boost profitability.

As we transition to the next section, we’ll explore financial reporting terms that are essential for a comprehensive understanding of construction accounting.

The balance sheet provides a clear picture of a construction company’s assets, liabilities, and equity at a specific point in time. Key items to focus on include equipment assets, accounts receivable, and long-term debt. A ratio above 15.0 may signal a company will have trouble growing in the future.

The income statement (also known as the profit and loss statement) shows revenue, expenses, and profit over a specific period. Analysis of gross profit margins by project type is essential in construction. The Construction Financial Management Association reports that average gross profit margins in the industry range from 15% to 20% (but can vary significantly based on project complexity and company efficiency).

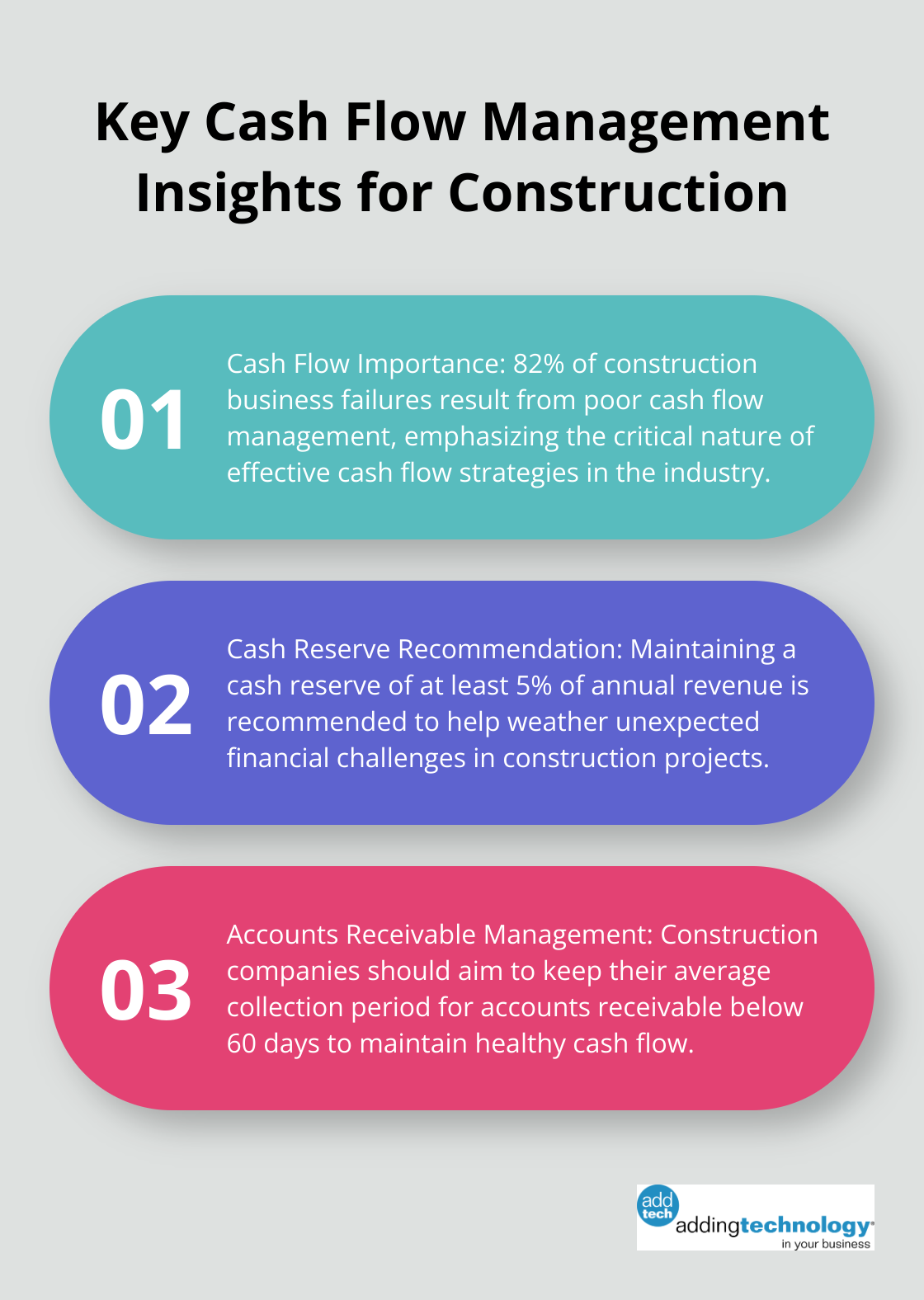

Cash flow management is particularly important in construction due to the timing differences between expenses and payments. The cash flow statement tracks the inflows and outflows of cash, which helps identify potential liquidity issues. A study by the National Association of Home Builders found that 82% of construction business failures result from poor cash flow management. We recommend maintaining a cash reserve of at least 5% of annual revenue to weather unexpected financial challenges.

Effective management of accounts receivable (AR) and accounts payable (AP) is essential for maintaining healthy cash flow. Construction companies should try to keep their average collection period for AR below 60 days. For AP, negotiation of favorable payment terms with suppliers can help improve cash flow. Implementation of automated AR and AP systems can significantly reduce processing time and errors (with some companies reporting up to 30% improvement in collection times after adopting such systems).

Regular analysis of these financial reports provides deeper insights into a company’s financial health and enables data-driven decisions. Expert guidance from firms like Adding Technology can lead to improved financial performance and long-term success in the competitive construction industry.

Construction accounting terms form the foundation of successful project management and business growth in the construction industry. These terms describe the financial health and performance of projects and companies, enabling informed decisions and accurate profitability assessments. Mastery of these terms allows for precise project pricing, efficient cost tracking, and effective cash flow management.

Construction accounting complexities can challenge contractors who must balance financial management with project execution. Adding Technology specializes in tailoring accounting and financial management services to the unique needs of the construction industry. Our expertise allows contractors to focus on their core competencies while optimizing their financial processes.

A solid grasp of construction accounting terms combined with expert financial management can transform financial processes from a necessary task into a strategic advantage. It empowers data-driven decisions, improves operational efficiency, and builds a strong financial foundation for construction businesses. As the industry evolves, proficiency in financial management will remain key to achieving long-term success and sustainability in construction.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.