Construction businesses face unique financial challenges that standard bookkeeping methods can’t handle. Poor financial tracking leads to project losses, cash flow problems, and tax compliance issues.

At adding technology, we’ve seen how proper bookkeeping for construction business transforms companies from struggling with finances to achieving consistent profitability. The right systems make all the difference.

Construction companies require three foundational bookkeeping systems to track their finances accurately. Companies must create a construction-specific chart of accounts that separates direct costs like materials and labor from indirect costs such as equipment depreciation and office expenses.

Standard business accounting categories miss the complexity of construction projects. Your chart should include separate accounts for each type of material, equipment rental versus purchase, subcontractor payments, and retainage receivables. Companies that use construction-specific charts of accounts report better cost visibility according to industry research.

Job costing tracks every dollar spent on individual projects and separates profitable jobs from money losers. Set up cost codes for labor, materials, equipment, and overhead allocation before you start each project. Track actual costs against estimates weekly, not monthly.

Construction firms that practice detailed job costing optimize project tracking and budget management for better profitability and efficiency compared to those that use general expense tracking. Each project needs its own cost center with real-time expense allocation. Materials purchased for Project A should never accidentally get charged to Project B.

Maintain completely separate financial records for each construction project from start to finish. This means individual folders for invoices, receipts, change orders, and payment records. Create project-specific bank accounts for larger jobs to simplify cash flow tracking.

Document every expense with photos, receipts, and project codes. Poor documentation costs construction companies significant amounts annually in missed tax deductions and compliance penalties according to construction industry studies. Separate records also protect you during audits and help resolve payment disputes faster.

Allocate overhead costs proportionally across all active projects to understand true profitability. Office rent, insurance, and administrative salaries must be distributed fairly among jobs. Many contractors skip this step and wonder why profitable-looking projects actually lose money.

Calculate overhead as a percentage of direct costs and apply it consistently. Track executive time spent on specific projects and allocate those costs accordingly. This practice reveals which project types generate the highest returns and which clients drain resources.

These foundational systems create the framework for accurate financial tracking, but even the best systems fail without proper implementation and consistent monitoring.

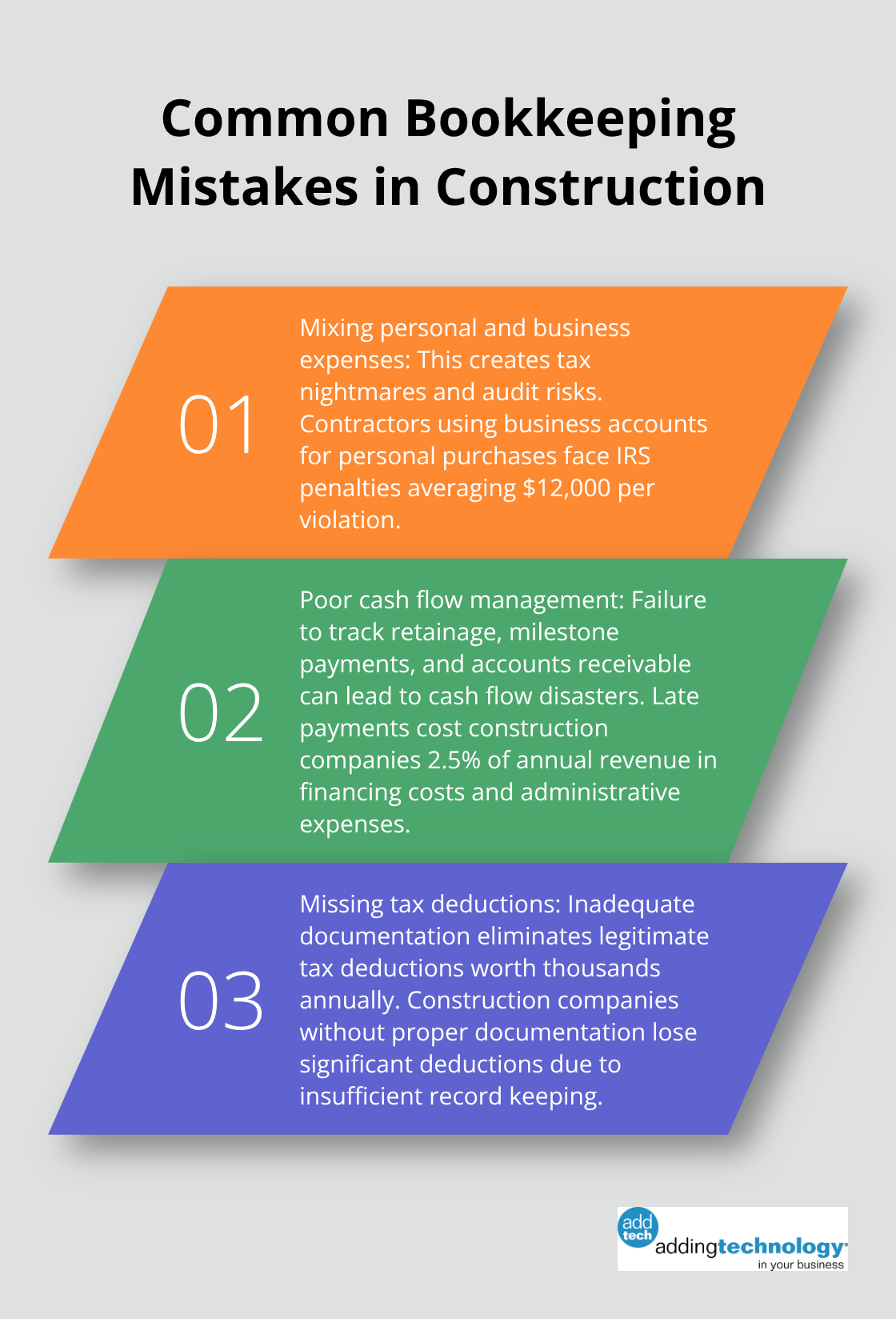

Construction companies lose thousands of dollars annually through three devastating bookkeeping errors that destroy profitability. The first mistake involves mixing personal and business expenses, which creates tax nightmares and audit risks. Contractors who use business accounts for personal purchases face IRS penalties averaging $12,000 per violation according to construction industry compliance data. Personal expenses charged to projects inflate costs and reduce apparent profitability, which leads to incorrect pricing decisions on future bids.

Separate business bank accounts prevent commingling issues that trigger IRS audits and pierce corporate liability protection. Construction companies with mixed expenses lose legal protection when lawsuits arise, which exposes personal assets to business creditors. Set up dedicated accounts for payroll, taxes, and operational expenses to maintain clear financial boundaries. Document every transaction with proper business purposes and maintain receipts for seven years minimum.

Poor cash flow management kills more construction companies than project losses. Contractors who fail to track retainage, milestone payments, and accounts receivable run out of money despite profitable projects. Industry research shows organizational factors contribute to business failures in construction companies. Track every invoice, payment due date, and collection status in real-time systems that send automated reminders. Late payments cost construction companies 2.5% of annual revenue in financing costs and administrative expenses.

Inadequate documentation eliminates legitimate tax deductions worth thousands annually for construction businesses. Equipment depreciation, vehicle expenses, and material costs require detailed records with photos, receipts, and project allocation codes. Construction companies without proper documentation lose significant deductions annually due to insufficient record keeping. Mobile receipt capture prevents lost documentation and creates instant expense categorization for accurate tax filing.

These costly mistakes highlight why construction companies need specialized technology solutions that automate financial processes and prevent human error. Proper job costing systems help track project expenses accurately and avoid these common pitfalls.

Construction-specific accounting software eliminates manual errors that cost contractors thousands annually in misallocated expenses and missed deductions. The construction accounting software market is projected to grow from USD 2.0 billion in 2025 to USD 4.0 billion by 2035, at a CAGR of 6.9%, providing instant project cash flow reports with patented facial recognition time tracking that reduces payroll errors. QuickBooks users report 37% faster invoice processing through batch functionality, while automated invoice reminders accelerate payments by five days on average according to internal company testing.

Construction companies need software that handles retainage tracking, certified payroll reports, and prevailing wage calculations automatically rather than generic business accounting tools. These specialized systems prevent the costly mistakes that destroy project profitability and cash flow.

Field expense tracking through mobile apps prevents documentation disasters that eliminate legitimate tax deductions worth thousands annually. Shoeboxed automates receipt management and expense tracking, while mobile apps allow workers to photograph receipts and categorize expenses instantly from job sites.

Construction workers face significant challenges with paper receipt management, but mobile capture creates permanent digital records with GPS location data and project codes. Real-time expense entry reduces data entry time by 60% and eliminates the month-end scramble to reconstruct project costs from incomplete records.

Payroll and project management integration prevents double data entry that creates discrepancies between labor costs and project budgets. FOUNDATION integrates time tracking with accounting to provide real-time discrepancy alerts and automated cost allocation across multiple projects simultaneously.

Companies that use integrated systems report 40% fewer accounting errors and complete month-end closings three days faster than businesses that manage separate systems. Integration also enables centralized dashboards that give project managers instant access to budget versus actual spending without waiting for accounting reports (eliminating delays that cost projects money).

Construction accounting software generates dozens of reports that reveal project profitability patterns and cash flow trends. FOUNDATION provides certified payroll reports, work-in-progress statements, and job cost summaries that satisfy compliance requirements automatically.

Real-time financial insights allow contractors to address budget overruns before they destroy project margins. Automated alerts notify managers when projects exceed predetermined cost thresholds, while customizable dashboards track key performance indicators across all active jobs simultaneously.

Construction companies need construction-specific chart of accounts, detailed job costing systems, and separate project financial records to master bookkeeping for construction business. These foundational practices prevent costly mistakes that destroy profitability and cash flow. Technology solutions eliminate manual errors through automated expense tracking, integrated payroll systems, and real-time financial reporting.

Construction-specific software provides specialized features contractors need for retainage tracking, certified payroll, and compliance reporting that generic accounting tools cannot handle. Professional bookkeeping support accelerates implementation and maintains accuracy in complex construction financial management. Adding Technology offers expert accounting services tailored for construction companies with real-time job costing and advanced technology integration.

The construction industry demands precise financial tracking to survive competitive bidding and project complexity. Companies that invest in proper bookkeeping systems and professional support report improved cost visibility, faster payments, and sustainable business growth. These investments position construction businesses for long-term success in an increasingly competitive market (where accurate financial data drives better decision-making).

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.