At Adding Technology, we understand the critical role of a Construction Accounting Manager in the success of any construction project. This position requires a unique blend of financial expertise and industry-specific knowledge.

Our comprehensive guide delves into the Construction Accounting Manager job description, highlighting the key responsibilities that make this role indispensable. From financial reporting to risk management, we’ll explore the diverse tasks that shape this challenging yet rewarding career path.

Financial statements form the core of any construction business. These documents offer a clear view of a company’s financial health and project performance. Construction accounting managers must prepare balance sheets, income statements, and cash flow statements that accurately reflect the unique aspects of construction projects. This includes proper accounting for long-term contracts, progress billings, and retainage.

A study by the Construction Financial Management Association reveals that 73% of construction firms face challenges with timely financial reporting. This delay can result in missed opportunities and poor decision-making. To address this issue, we recommend the implementation of a standardized month-end close process. This process should include reconciliations, accruals, and review procedures.

The analysis of project costs and profitability showcases the expertise of construction accounting managers. This process requires a breakdown of costs by category (labor, materials, equipment, and overhead) and a comparison against the project budget. Job cost reports and work-in-progress (WIP) schedules serve as essential tools for this analysis.

The gross profit margin stands out as a key metric to monitor. The Construction Financial Management Association reports an average gross profit margin of 21.8% for general contractors. However, this figure can fluctuate widely based on project type and market conditions. Close monitoring of this metric allows accounting managers to identify underperforming projects early and take necessary corrective actions.

The development and maintenance of budgets for construction projects represent a critical responsibility. This process begins with the creation of an initial project budget based on the contract and estimated costs. As the project advances, regular updates to the budget must reflect actual costs and any changes in scope.

Rolling wave planning serves as an effective technique for budget management. This approach involves the creation of detailed budgets for the near-term (next 3-6 months) while maintaining a higher-level budget for later stages. This method allows for more accurate short-term planning while preserving flexibility for long-term changes.

The creation of forecasts and financial projections plays a vital role in strategic planning for construction companies. These projections help companies anticipate cash flow needs, plan for equipment purchases, and make informed bidding decisions.

We suggest the use of a combination of historical data, current market trends, and project pipeline information to create these forecasts. For instance, the Associated Builders and Contractors’ Construction Backlog Indicator increased to 8.4 months in January, which can provide valuable insights into future workload and revenue potential.

Construction accounting managers should prepare to run various scenarios to account for potential risks and opportunities. This might include modeling the impact of material price fluctuations, labor shortages, or changes in project timelines.

The mastery of these financial reporting and analysis skills positions construction accounting managers as key players in guiding their companies toward financial success. Adding Technology remains committed to helping construction firms build a solid financial foundation through expert accounting and management services.

As we move forward, let’s explore how job costing and project management intertwine with these financial responsibilities to create a comprehensive approach to construction accounting.

Job costing software transforms how construction firms manage their projects. These systems enable accurate pricing and tracking of job progress, budgets, and cash flow. A survey by the Construction Financial Management Association reveals that companies using real-time job costing report a 15% increase in project profitability.

To implement an effective job costing system, break down your project into cost codes. These codes should align with your work breakdown structure (WBS) and cover all aspects of the project, from site preparation to final finishes. Use mobile apps to capture data on-site, which ensures that your cost information remains up-to-date.

Accurate tracking of project expenses and revenues maintains healthy cash flow. The American Subcontractors Association reports that 60% of subcontractors face cash flow problems due to poor expense tracking. To avoid this, implement a system that categorizes expenses as they occur and matches them to the appropriate cost codes.

For revenue tracking, use progress billing based on completed work. This method aligns your cash inflows with project progress, which reduces the risk of cash shortages. Consider software that integrates with your accounting system to automate this process, reducing errors and saving time.

Early identification and addressing of cost overruns can make the difference between a profitable project and a financial disaster. Research by the Construction Institute found that 15% of total project activities are performed out-of-sequence, causing a 33% increase in construction schedule and a 25% increase in costs.

Set up a system of cost variance reports that compare actual costs to budgeted costs on a weekly basis. When variances exceed a predetermined threshold (5% is recommended), trigger an automatic alert to project managers. This allows for quick corrective action, whether it involves renegotiating with suppliers or adjusting work methods.

Effective collaboration between accounting managers and project managers ensures financial accuracy. Regular weekly meetings between these teams can help align financial data with on-site realities. During these meetings, review key performance indicators (KPIs) such as cost performance index (CPI) and schedule performance index (SPI) to get a holistic view of project health.

Encourage project managers to take ownership of their project’s financial performance. Provide them with user-friendly dashboards that display real-time financial data. This empowers them to make informed decisions on the spot, rather than waiting for monthly financial reports.

The mastery of these job costing and project management techniques significantly impacts a company’s bottom line. The next chapter will explore how compliance and risk management intertwine with these financial responsibilities to create a comprehensive approach to construction accounting.

Construction accounting managers face a complex web of regulations and standards. This challenge stems from the industry’s unique financial practices and ever-changing regulations.

Construction accounting requires adherence to specific standards like ASC 606 for revenue recognition. This standard significantly impacts how construction companies recognize revenue from long-term contracts, particularly in the engineering and construction (E&C) industry.

To ensure compliance, create a detailed checklist of applicable standards and regulations. Review this checklist quarterly to capture any updates or changes. Implement a system of internal audits to verify compliance regularly. These audits should cover areas like revenue recognition, job costing, and contract accounting.

Construction tax compliance is notoriously complex. Key areas of focus include the treatment of long-term contracts, equipment depreciation, and worker classification.

Develop a comprehensive tax calendar that outlines all filing deadlines and estimated payment dates. This calendar should integrate with your accounting software to generate automatic reminders. Consider engaging with a tax specialist who has specific experience in construction accounting. Their expertise can help navigate complex issues like the look-back method for long-term contracts or the domestic production activities deduction.

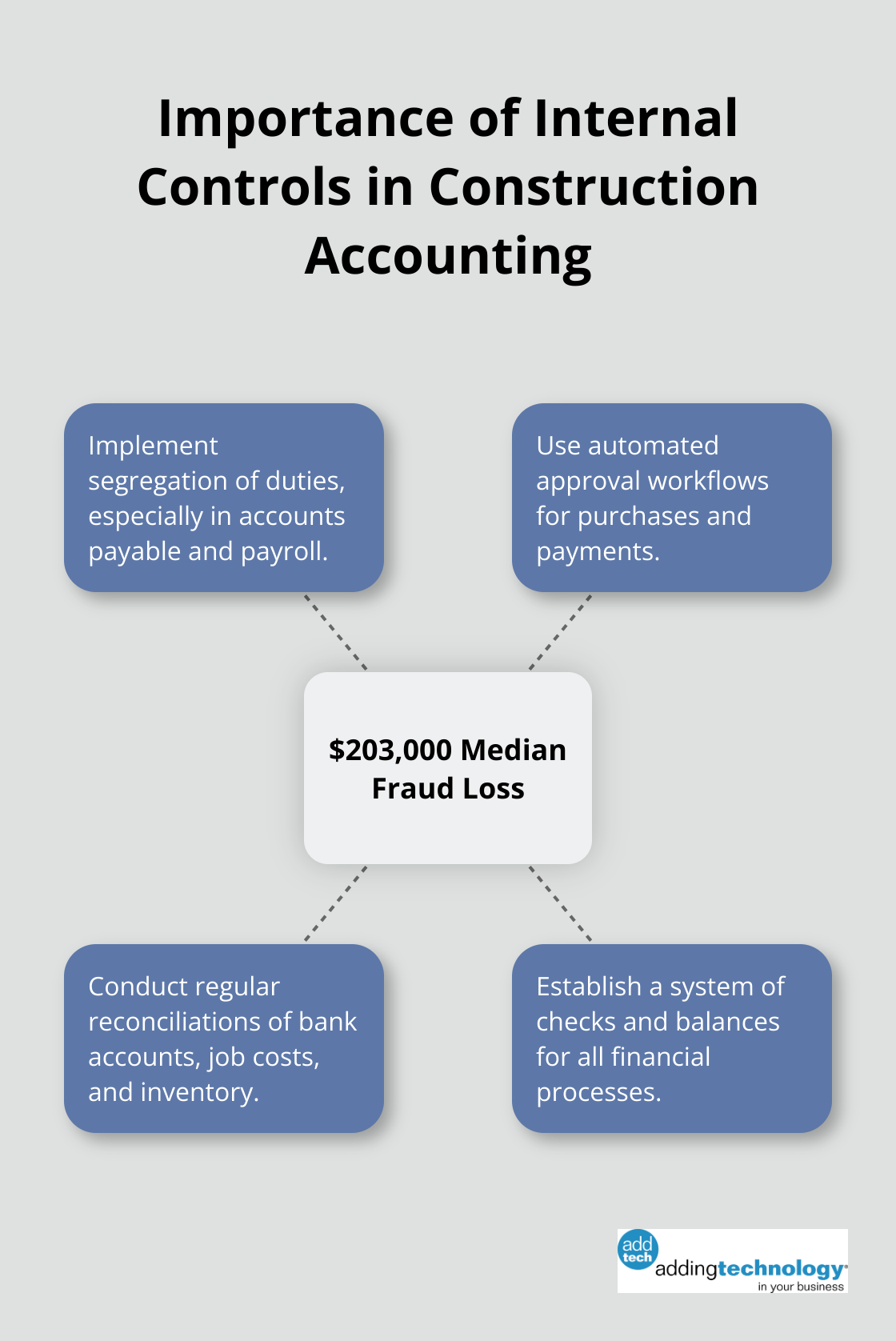

Strong internal controls are essential for mitigating financial risks in construction accounting. The Association of Certified Fraud Examiners reports that the construction industry faces a median loss of $203,000 per fraud case, highlighting the importance of robust controls.

Implement a system of checks and balances for all financial processes. This should include segregation of duties, especially in areas like accounts payable and payroll. Use technology to your advantage by implementing automated approval workflows for purchases and payments. Regular reconciliations of bank accounts, job costs, and inventory can help catch discrepancies early.

Modern accounting software can significantly ease the burden of compliance. These tools often come with built-in features to handle industry-specific requirements (such as percentage-of-completion accounting). They can also automate many compliance-related tasks, reducing the risk of human error.

Invest in training for your team to fully utilize these technological solutions. Regular software updates ensure that your systems remain compliant with the latest regulations. Consider cloud-based solutions that offer real-time updates and accessibility from multiple locations, which is particularly useful for construction projects spread across different sites.

The regulatory landscape in construction accounting is constantly evolving. Subscribe to industry publications and join professional organizations to stay informed about upcoming changes. Attend seminars and webinars focused on construction accounting compliance.

Establish a process for reviewing and implementing new regulations. This might involve creating a compliance team or designating a compliance officer within your accounting department. Regular meetings to discuss regulatory changes and their impact on your operations can help keep your entire team aligned and prepared.

The construction accounting manager job description encompasses a wide array of responsibilities essential for the financial success of construction projects. These professionals prepare accurate financial statements, analyze project costs, and develop budgets that provide invaluable insights for decision-making at all levels of the organization. Their expertise in tracking expenses, monitoring profitability, and forecasting financial outcomes directly impacts a company’s bottom line.

Construction accounting managers implement robust job costing systems and foster collaboration between accounting and project management teams. They create a framework for financial transparency and accountability while navigating the complex landscape of accounting standards, tax regulations, and industry-specific compliance requirements. Their vigilance safeguards companies from potential legal and financial pitfalls (through the implementation of strong internal controls and leveraging of modern accounting technologies).

At Adding Technology, we offer specialized services designed to support construction firms in optimizing their financial processes. We help ensure compliance and leverage cutting-edge technologies to build a solid financial foundation. Our partnership allows construction companies to focus on what they do best – delivering exceptional construction projects.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.