At adding technology, we often encounter businesses struggling to choose between job costing and process costing methods. This decision can significantly impact a company’s financial management and profitability.

In this post, we’ll explore job costing vs process costing examples to help you understand which method is best suited for your business. We’ll break down the key differences, advantages, and ideal applications of each approach.

Job costing is a method that tracks and allocates costs to specific projects or jobs. This approach revolutionizes financial management for businesses that handle unique, custom orders.

Job costing assigns direct costs (materials and labor) and indirect costs (overhead) to individual projects. This granular approach allows businesses to understand the true cost of each job, enabling more accurate pricing and profitability analysis.

A construction company using job costing would track the exact amount of lumber, nails, and labor hours used for building a specific house. They’d also allocate a portion of their overhead costs (such as office rent and equipment depreciation) to that project.

Job costing benefits many businesses, but it’s particularly valuable in industries with project-based work. Construction companies, advertising agencies, law firms, and custom manufacturers often find job costing indispensable.

Job costing offers several advantages:

Despite its benefits, job costing isn’t without challenges:

Adding Technology has helped numerous construction companies implement effective job costing systems. Clients report significant improvements in project profitability after adopting tailored job costing solutions.

Now that we’ve explored job costing, let’s turn our attention to process costing and how it differs from job costing. This comparison will help you determine which method aligns best with your business needs.

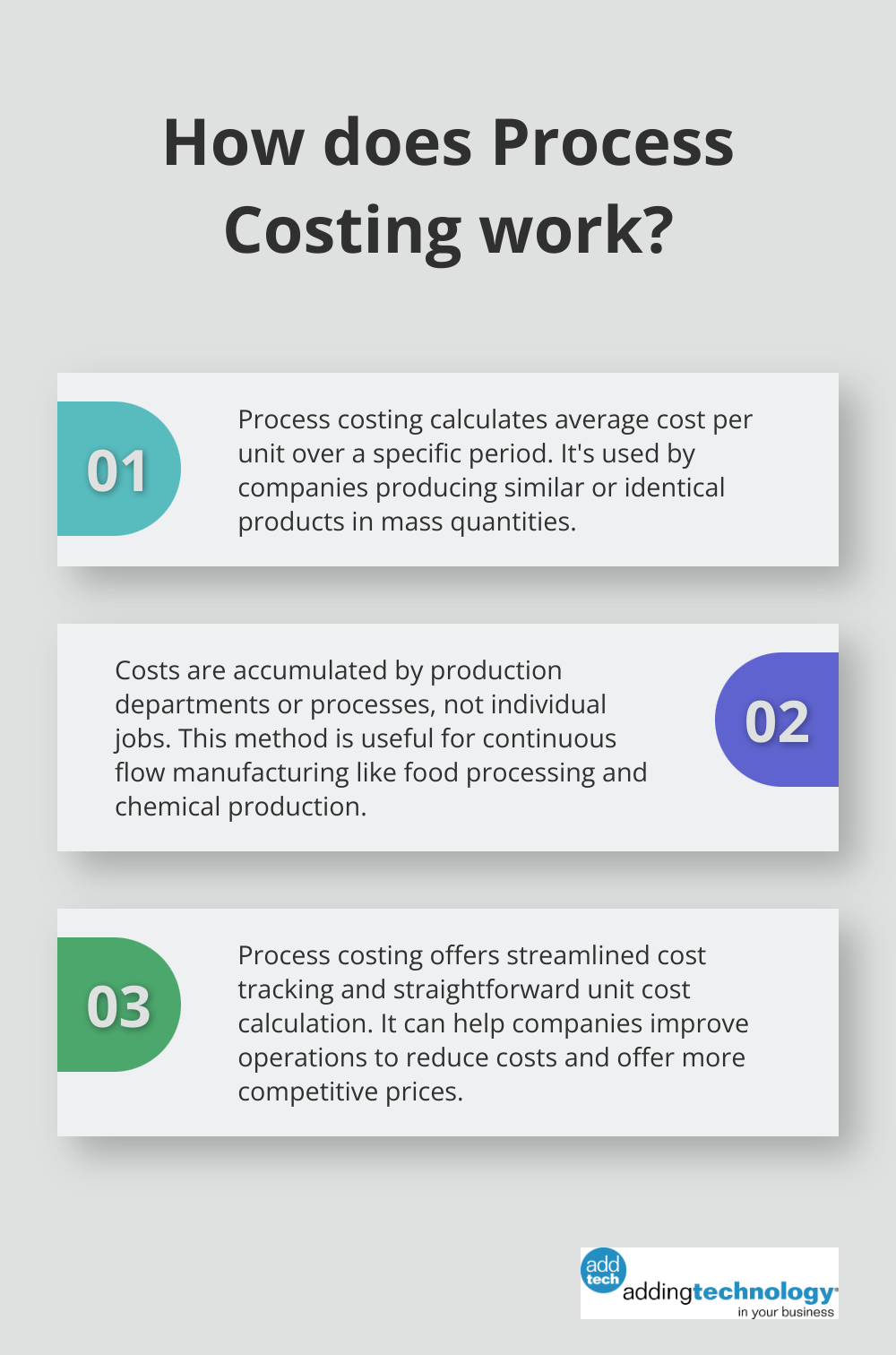

Process costing is an accounting method typically used by companies that mass produce very similar or identical products or units of output. Unlike job costing, which focuses on individual projects, process costing calculates the average cost per unit produced over a specific period.

In process costing, companies accumulate costs by production departments or processes, not by individual jobs. A beverage company, for instance, might have separate departments for mixing, bottling, and packaging. Each department tracks its costs, which are then divided by the number of units produced to determine the average cost per unit.

This method proves particularly useful for companies that manufacture products in a continuous flow, where tracking costs for each individual item becomes impractical or impossible. Industries such as food processing, chemical manufacturing, and textile production often rely on process costing.

Process costing offers several benefits for businesses with standardized production:

While process costing can be highly effective for certain industries, it comes with its own set of challenges:

To implement process costing effectively, companies should:

The decision to use process costing depends on your production processes and the level of cost detail you require. In the next section, we’ll compare job costing and process costing side-by-side to help you make an informed decision for your business.

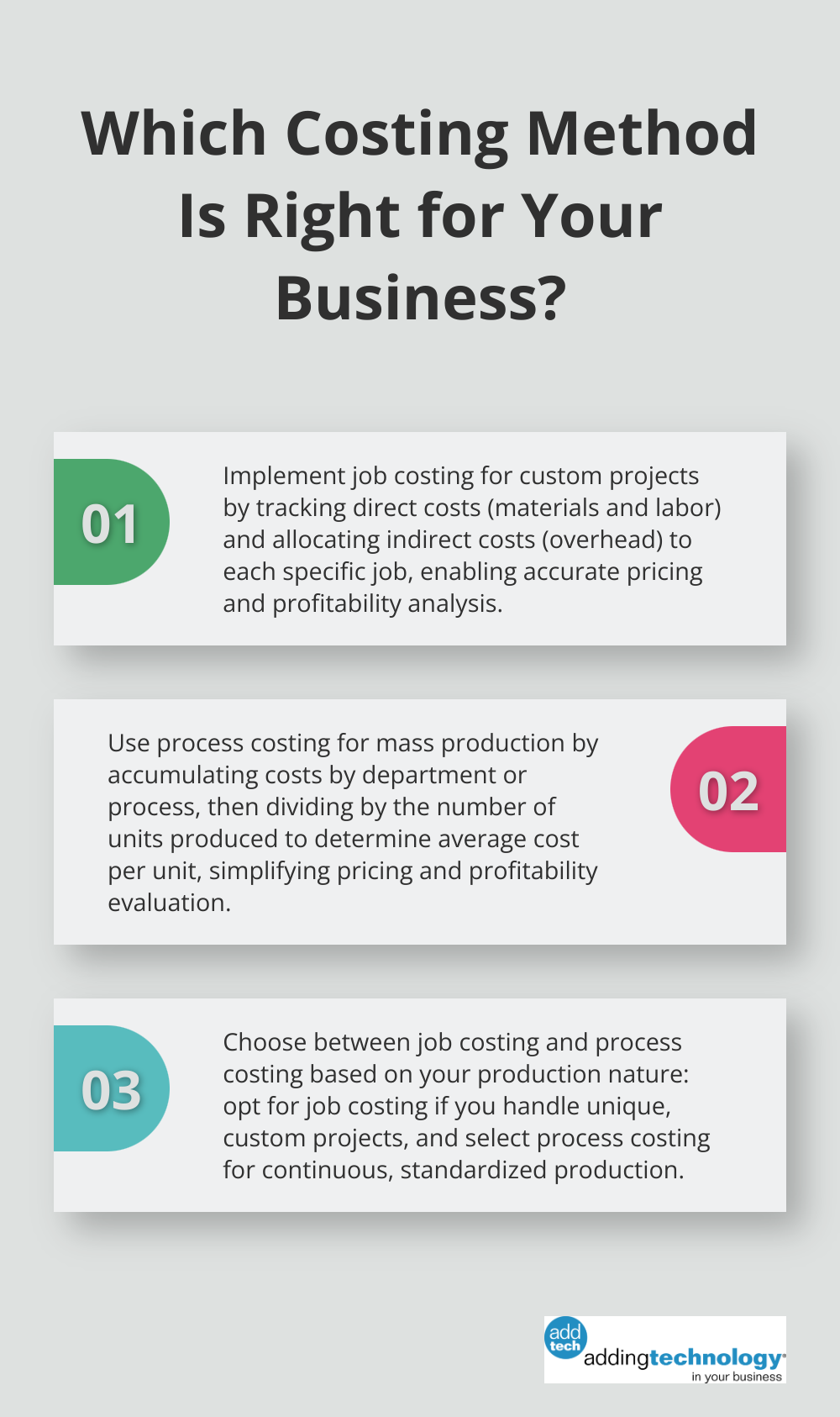

Job costing excels in industries with unique, custom projects. Construction, consulting, and custom manufacturing benefit from job costing’s ability to track costs for each specific project. A custom furniture maker uses job costing to track materials, labor, and overhead for each unique piece they create.

Process costing suits businesses with continuous, standardized production. Food processing plants, chemical manufacturers, and textile producers often select this method. A bottling plant uses process costing to calculate the average cost per bottle produced across their entire production line.

Job costing provides specific cost information for each project. This detail is essential for businesses that need to price their services accurately or analyze individual job profitability. A construction company using job costing can identify the exact cost to build a specific house (down to the last nail).

Process costing offers a broader view, focusing on departmental costs and average unit costs. While less detailed, this approach often suffices and proves more practical for mass production environments. A paper mill using process costing might not know the exact cost of each sheet, but they can calculate the average cost per ream produced.

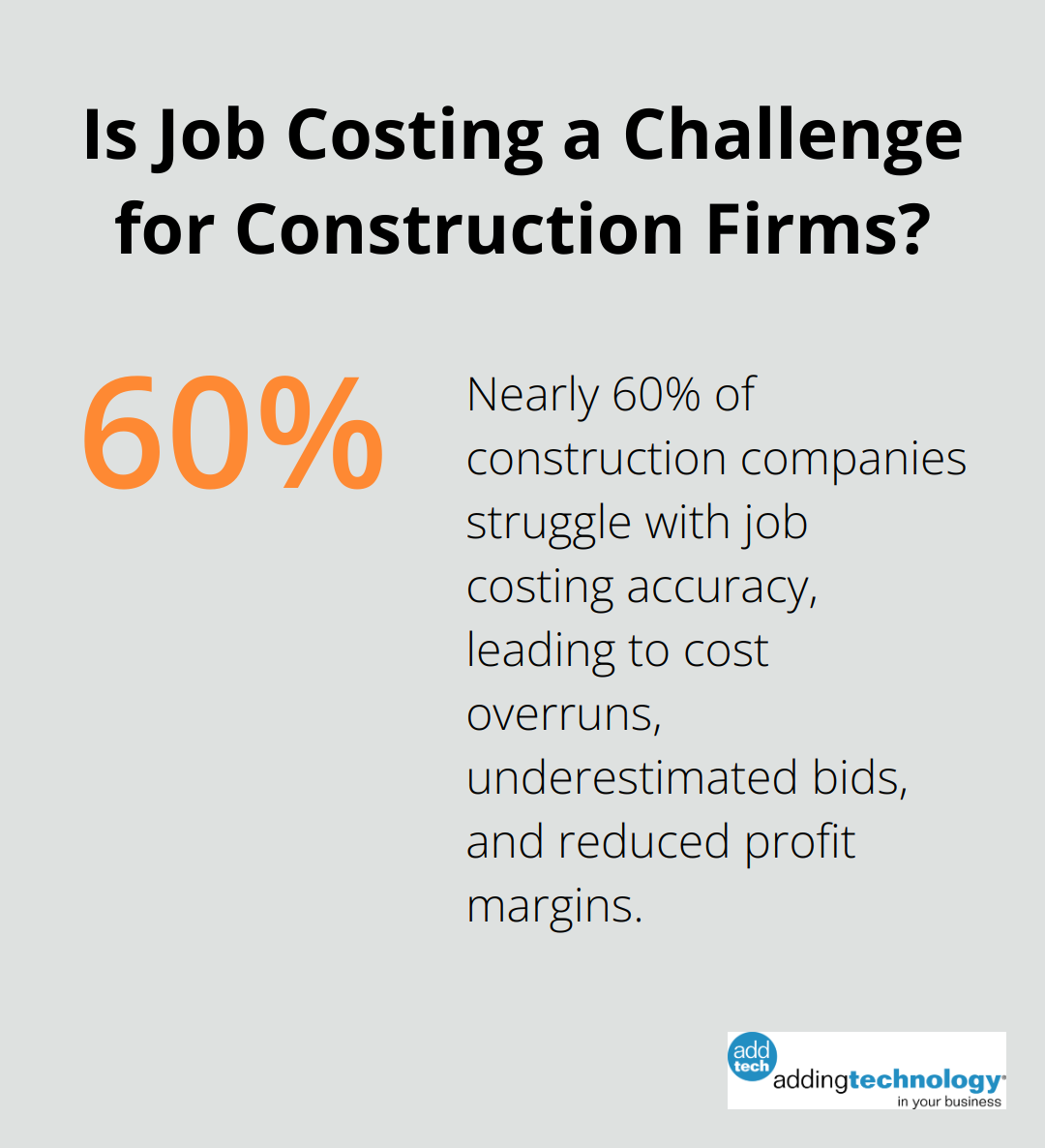

Job costing demands more intensive record-keeping and cost allocation. Each project needs its own cost sheet, and overhead must be carefully allocated. This can consume time without proper systems in place. A survey found that nearly 60% of construction companies struggle with job costing accuracy, leading to cost overruns, underestimated bids, and reduced profit margins.

Process costing typically involves less administrative overhead. Costs are tracked at the departmental level, which simplifies record-keeping. However, process costing can become complex when dealing with work-in-progress inventory or multiple product variations.

Job costing allows for precise pricing of individual projects or services. This method helps businesses ensure profitability on each job and adjust prices based on specific project requirements. For example, a graphic design agency can price each client project based on its unique specifications and resource requirements.

Process costing supports pricing strategies for standardized products. It provides an average cost per unit, which businesses can use as a basis for setting competitive prices while maintaining profit margins. A company producing bottled water can use process costing to determine a consistent price point for their product.

Job costing suits industries with project-based work or customized products. These include:

Process costing fits industries with homogeneous products or continuous production. Examples include:

Job costing and financial insights are crucial for businesses to make informed decisions and maintain profitability in their respective industries.

The choice between job costing and process costing impacts financial management and profitability. Job costing excels for unique projects, providing detailed insights for precise pricing. Process costing suits standardized, high-volume production, offering streamlined cost tracking and unit pricing.

Selecting the right costing method aligns with your business model and production processes. Consider your products or services, required cost tracking detail, and industry needs. Implement your chosen system by defining processes, investing in accounting software, and training your team thoroughly.

Job costing vs process costing examples demonstrate the importance of accurate financial insights for decision-making. Adding Technology offers expert guidance in implementing effective job costing systems for construction businesses. Their solutions help contractors enhance financial management, potentially improving project profitability and business growth.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.