Choosing the right costing method is crucial for businesses to accurately track expenses and maximize profitability. At Adding Technology, we often get asked when to apply job costing over process costing.

This blog post will explore both methods, their key differences, and the factors to consider when deciding which approach best suits your business needs.

Job costing is a method to track and allocate costs to specific projects or jobs. This approach can transform financial management for businesses that handle unique, custom projects.

Job costing involves meticulous tracking of direct materials, direct labor, and overhead costs for each individual project. This level of detail allows businesses to understand the true cost of each job (which is essential for accurate pricing and profitability analysis).

Job costing excels in industries where each project is unique. Construction, custom manufacturing, professional services, and film production are prime examples. These sectors often deal with varying client requirements, making standardized costing ineffective.

A study introduced five separate logical data flow modules for Contract Basis Work, Labor Payments, Progress Payment, Material Requisition and Purchasing in construction cost accounting models for residential construction companies.

Job costing provides a clear picture of profitability for each job, allowing businesses to identify which types of projects are most lucrative. It helps capture all the expenses related to a project from labor costs, consultant fees, the price of raw materials, software licenses, and more. This information is invaluable for strategic decision-making and resource allocation.

Job costing also enhances accountability. When costs are tracked at a granular level, it’s easier to identify inefficiencies and areas for improvement. A manufacturing company reduced material waste by 15% after implementing detailed job costing.

Moreover, job costing facilitates more accurate estimates for future projects. By analyzing historical data from similar jobs, businesses can provide clients with more precise quotes, reducing the risk of cost overruns.

To harness the full potential of job costing, businesses need robust systems and processes. Manual tracking can be time-consuming and error-prone. That’s why many companies turn to specialized software solutions.

The key is to choose a solution that’s user-friendly enough for field workers to input data accurately, yet sophisticated enough to provide meaningful insights to management.

Consider a construction company using job costing to track the exact amount of lumber, nails, and other materials used for a specific house build. They’d also record the hours worked by carpenters, electricians, and other tradespeople on that particular project. Overhead costs like equipment depreciation and supervisory salaries would be allocated based on the job’s size or duration.

This level of detail allows the company to price jobs accurately, identify cost overruns quickly, and make informed decisions about which types of projects to pursue in the future.

Now that we’ve explored job costing in depth, let’s turn our attention to process costing and how it differs from this project-specific approach.

Process costing is a cost accounting method used by companies that produce large quantities of identical or similar products. This approach aggregates and averages costs across an entire production run, unlike job costing which tracks costs for individual projects.

Companies divide production into distinct stages or departments when implementing process costing. Costs accumulate for each stage and distribute evenly across all units produced during that period. This method suits industries with continuous, standardized production processes.

For instance, a beverage manufacturer might separate stages for mixing ingredients, bottling, and packaging. The costs associated with each stage (including materials, labor, and overhead) are totaled and then divided by the number of units produced to determine the average cost per unit.

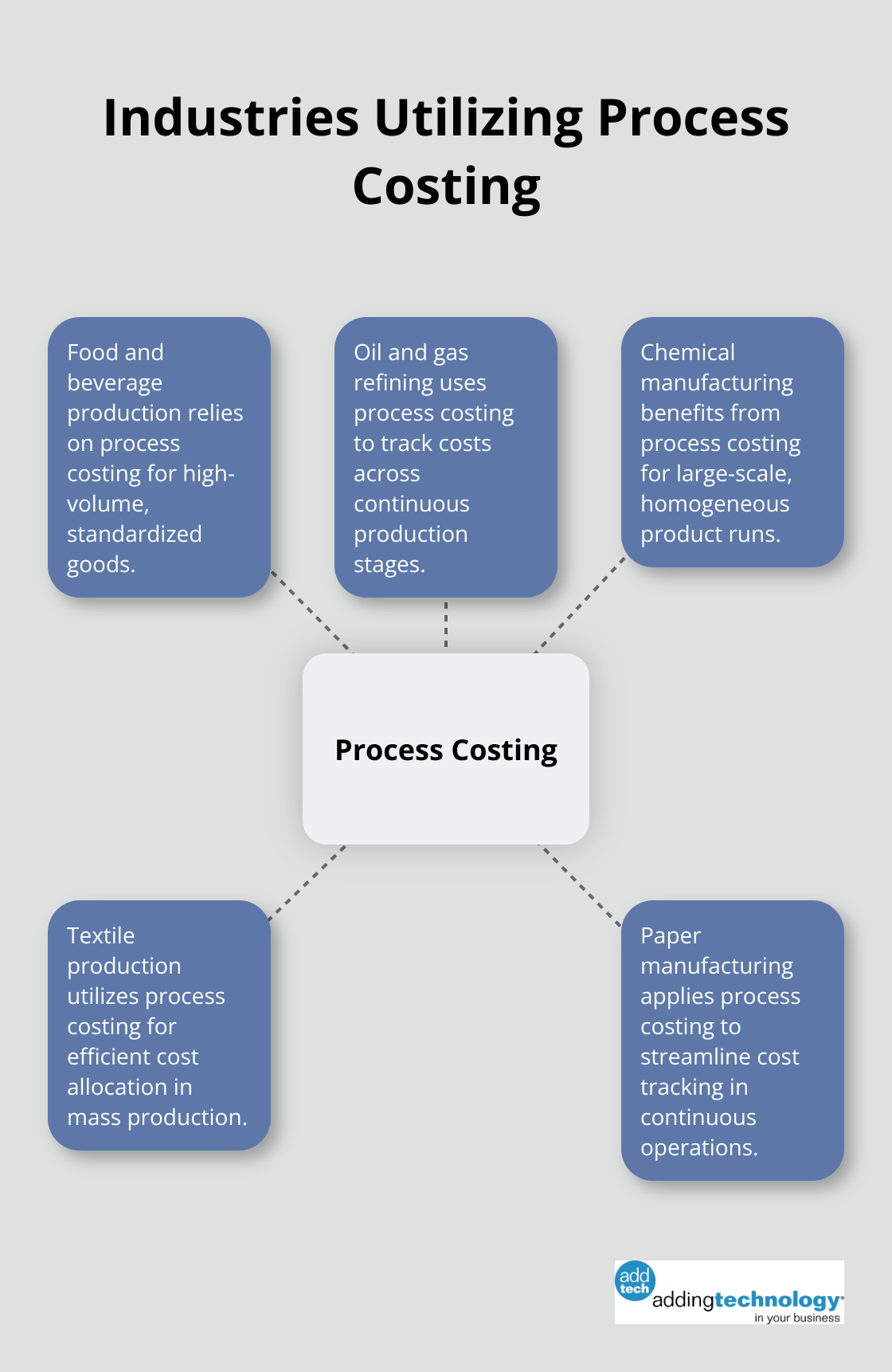

Process costing proves particularly useful in industries with high-volume, standardized production. Common examples include:

These industries typically deal with homogeneous products where individual unit tracking isn’t practical or necessary.

Process costing offers several advantages for businesses with continuous production cycles:

To maximize the benefits of process costing, companies should:

While process costing offers many advantages for continuous production environments, it’s not suitable for every business. The next section will explore key factors to consider when choosing between job costing and process costing methods, helping you determine which approach best fits your company’s needs.

The nature of your production process primarily determines the choice between job costing and process costing. Job costing fits businesses that produce unique, customized products or services. A custom furniture maker would benefit from job costing to track specific materials and labor for each piece.

Process costing suits companies that manufacture large quantities of identical or similar products. A soft drink manufacturer would find process costing more efficient for tracking costs across its continuous production line.

The diversity of your product offerings and customer requirements influences your costing method choice. Job costing excels when dealing with a wide range of products or services tailored to individual customer specifications. It allows precise tracking of costs associated with each unique order.

Process costing works better for businesses with a limited product range and minimal variations. This method suits businesses that produce standardized goods in large volumes to meet consistent customer demands.

The required level of detail in cost tracking plays a crucial role in this decision. Job costing provides granular cost information for each project or product. It involves looking at direct and indirect costs, which is essential for businesses that need to track the cost of individual projects and jobs.

Process costing offers a broader view of costs across your entire production process. This approach often suffices for companies with stable, predictable production costs (where individual product profitability is less critical).

Different industries often have established norms for costing methods. Construction and professional services typically use job costing, while manufacturing and chemical processing industries often prefer process costing. Research industry standards and consult with experts to understand the most common practices in your field.

Your company’s technological infrastructure impacts the feasibility of implementing different costing methods. Job costing often requires more sophisticated software to track individual project costs. Process costing might need systems that can handle large volumes of data and perform complex calculations.

Adding Technology offers solutions that can support both job costing and process costing, depending on your specific needs. Our crew can help you assess your current capabilities and recommend the most suitable approach for your business.

The decision to apply job costing over process costing depends on your business’s unique characteristics. Job costing excels for customized projects, while process costing suits continuous production of similar items. Your production process, product variety, and cost tracking needs will guide this choice.

Implementing the right costing system can be complex, but you don’t have to face this challenge alone. Adding Technology offers expert accounting and financial management services tailored for the construction industry. We can help you streamline your financial processes and implement real-time job costing.

The appropriate costing method will provide better visibility into your costs and inform pricing decisions. It will build a solid financial foundation for your business’s future growth and success. Adding Technology’s structured approach can enhance your operational efficiency and financial soundness.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.