At adding technology, we understand the challenges construction businesses face when managing project finances. Construction job costing in QuickBooks Online is a powerful tool for tracking expenses, labor, and materials accurately.

Mastering this feature can significantly improve your project profitability and financial control. In this guide, we’ll walk you through the essential steps to set up, track, and analyze job costs effectively using QuickBooks Online.

Setting up QuickBooks Online for construction job costing is a key step in managing your project finances effectively. This process involves customizing your account structure, organizing your customer data, and configuring your items and services. Let’s break down each of these steps:

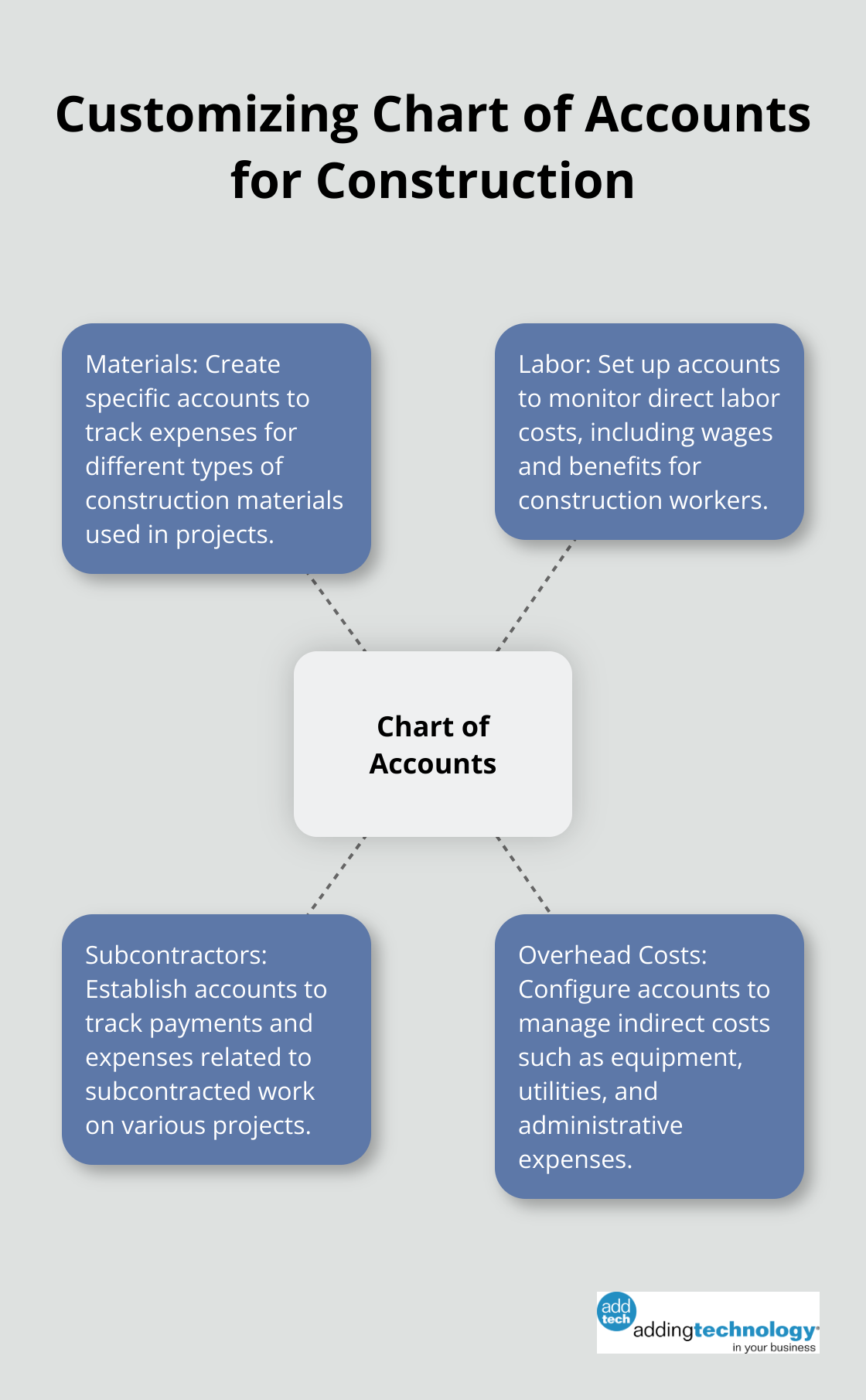

Start by tailoring your chart of accounts to reflect the unique aspects of your construction business. Create specific accounts for materials, labor, subcontractors, and overhead costs. This detailed approach allows for precise tracking of expenses across different projects.

For example, you might create accounts like:

This level of detail will prove invaluable when you generate job cost reports in the future.

Next, set up your customer list with a hierarchical structure. Create parent customers for your main clients and sub-customers (or jobs) for individual projects. This organization allows you to track costs and revenue for each specific job while still maintaining an overview of the entire client relationship.

Consider this example:

Parent Customer: ABC Development

This structure enables you to run reports on individual projects or aggregate data for the entire client.

Set up your items and services to reflect the various cost components of your projects. Create items for different types of materials, labor categories, and subcontractor services. Assign these items to the appropriate income and expense accounts in your chart of accounts.

Examples of items you might create include:

Linking items to specific accounts ensures that costs are automatically categorized correctly when you enter transactions.

It’s important to review and update your QuickBooks setup as your business evolves. This ongoing maintenance will ensure your job costing remains accurate and relevant.

With a properly configured QuickBooks Online, you’re now ready to start tracking your construction costs in detail. This setup will serve as the foundation for generating insightful reports and making data-driven decisions about your projects and overall business performance. In the next section, we’ll explore how to effectively track costs within this newly optimized QuickBooks Online setup.

For more accurate job costing, consider implementing these tips: assign cost codes, use mobile time tracking, and utilize accounting and payroll software.

Create purchase orders in QuickBooks Online for each project to track material costs. This method records committed costs before invoice receipt. When creating a purchase order, select the specific job or sub-customer it relates to. After material receipt, convert the purchase order into a bill to ensure accurate cost assignment to the correct project.

For materials purchased without a prior purchase order, enter the bill directly into QuickBooks Online. Always select the appropriate job and cost category when entering these expenses. This practice ensures correct allocation of every material cost to its respective project.

Accurate labor tracking is essential for project profitability. Use QuickBooks Time (formerly TSheets) integrated with QuickBooks Online to capture employee hours directly against specific jobs. This integration increases accountability, allows for real-time labor cost tracking, and eliminates manual data entry errors. It also helps you use data to create accurate estimates for labor costs and sync payroll and time tracking, potentially cutting payroll costs by over 4%.

When processing payroll, distribute labor costs to the correct jobs based on the time entries. QuickBooks Online can automatically allocate these costs if set up correctly, which saves time and increases accuracy.

Enter subcontractor bills into QuickBooks Online immediately upon receipt. Assign each bill to the appropriate job and cost category. For progress billing with subcontractors, create purchase orders to track committed costs before receiving the final invoice.

Regularly reconcile subcontractor bills with their contracts to avoid cost overruns. QuickBooks Online allows you to run reports comparing actual subcontractor costs against budgeted amounts, helping you identify any discrepancies early.

Allocating overhead expenses requires a fair method to distribute costs across your projects. This could be based on labor hours, project value, or another relevant metric.

In QuickBooks Online, use journal entries to allocate overhead expenses to different jobs periodically. Alternatively, set up items for common overhead expenses and assign a portion to each job when entering transactions.

Review your overhead allocation method regularly to ensure it accurately reflects the true cost of running your projects. This practice helps in pricing future projects more accurately and identifies areas where overhead costs can be reduced.

With these cost tracking methods in place, you’ll have a solid foundation for generating insightful reports. In the next section, we’ll explore how to leverage this data to create powerful job cost reports that drive informed decision-making for your construction business.

Job profitability reports provide essential information about the financial health of each project. Access these reports in QuickBooks Online by navigating to the Reports section and selecting the Job Profitability Detail report. This report breaks down income and expenses for each job, allowing you to identify your most profitable projects and those that require attention.

Customize the report to show specific date ranges and include additional details like labor hours. QuickBooks Online allows you to save custom report settings for quick access in the future.

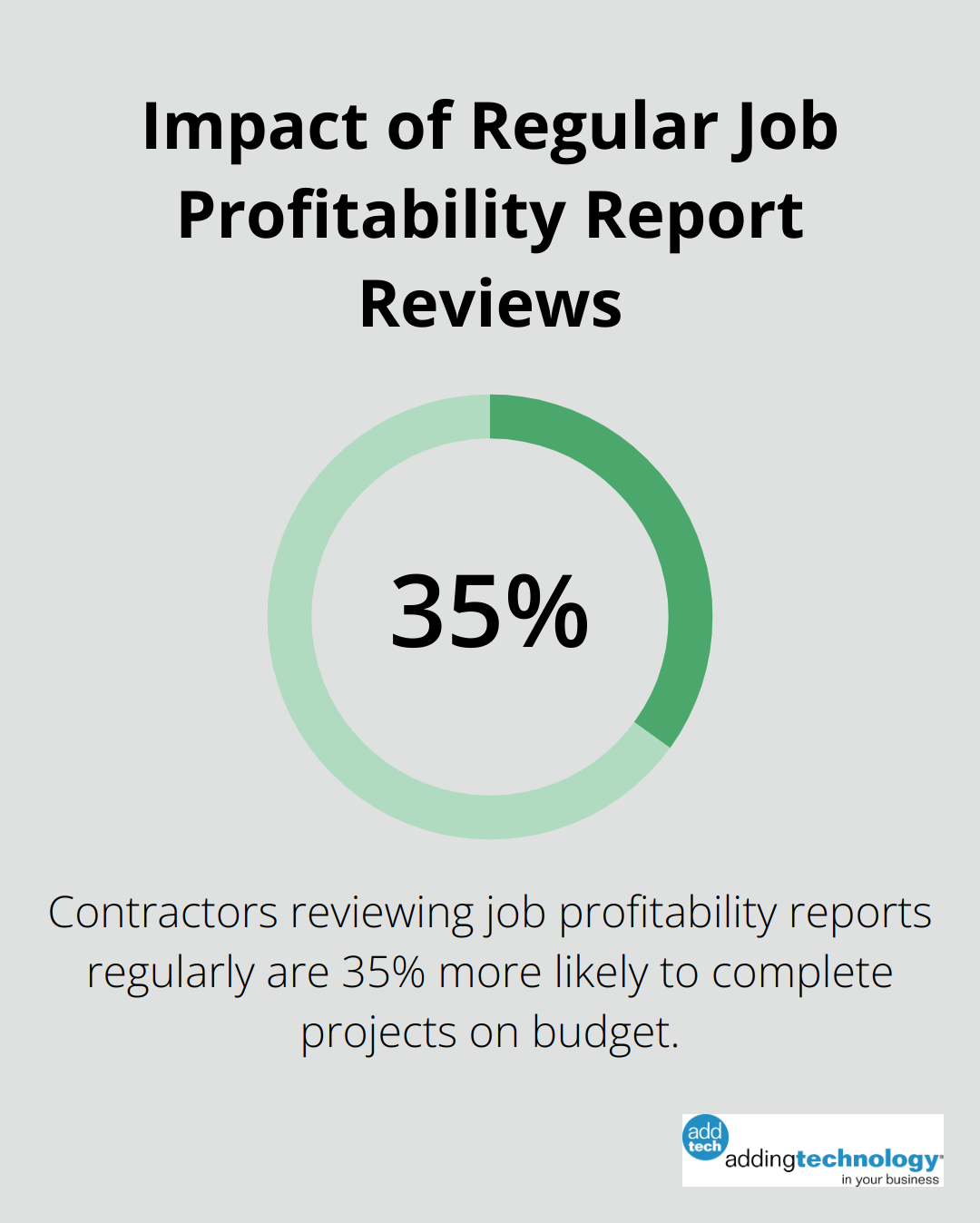

A study by the Construction Financial Management Association found that contractors who regularly review job profitability reports are 35% more likely to complete projects on budget. This statistic highlights the importance of frequent analysis.

Work in process (WIP) inventory refers to materials that are waiting to be assembled and sold. WIP inventory includes the cost of raw materials, labor, and other expenses associated with ongoing projects.

To create a WIP report in QuickBooks Online, use custom fields to track percentage of completion for each job. Then, create a custom report that pulls this data along with actual costs and estimated total costs.

Regular review of WIP reports helps identify potential issues early. For example, if a project is 50% complete but has used 75% of its budget, it signals the need for intervention to prevent cost overruns.

Comparing estimated costs to actual costs improves future estimates and identifies areas of inefficiency. QuickBooks Online offers an Estimates vs. Actuals report for this comparison.

To maximize the usefulness of this report, create detailed estimates that break down costs by category (labor, materials, subcontractors). When reviewing the report, focus on significant variances. A variance of more than 10% in any category warrants investigation.

A survey by the National Association of Home Builders revealed that contractors who regularly compare estimated to actual costs report a 22% improvement in estimate accuracy over time.

To get the most out of these reports, establish a regular review schedule. Set aside time weekly for active projects and monthly for overall business review. This consistent approach keeps you informed about your project finances and enables timely decision-making.

Try to identify patterns across projects. Look for recurring cost overruns in specific categories or consistently underestimated expenses. Use these insights to refine your estimating process and improve project management practices.

QuickBooks Online allows extensive customization of reports. Experiment with different layouts and data points to create reports that best suit your business needs. Consider creating dashboard-style reports that provide at-a-glance information on key performance indicators (KPIs) for your projects.

Construction job costing in QuickBooks Online transforms financial management for construction businesses. It provides a solid foundation for accurate tracking, comprehensive project oversight, and data-driven decision-making. Regular analysis of job profitability, work in progress, and cost comparison reports enables businesses to identify trends, address issues promptly, and refine estimating processes.

Effective job costing enhances project profitability, improves cash flow management, and aids in precise bidding for future projects. It allows construction companies to optimize resource allocation and improve overall business performance through data-driven decisions. Consistent review and analysis of cost data help businesses stay on top of project finances and make timely adjustments to keep projects on track and within budget.

Adding Technology offers expert services tailored to the construction industry, which can help streamline financial processes (including job costing). Their structured approach to accounting allows construction businesses to focus on building great projects while maintaining financial control. Construction companies that implement these strategies in QuickBooks Online set themselves up for long-term success and growth.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.