Construction finance management makes or breaks project success. Poor financial oversight leads to 70% of construction business failures within the first five years.

We at adding technology see companies struggle with cost overruns, cash flow gaps, and payment delays daily. Smart financial systems and proven strategies can transform your construction business profitability.

Construction finance management operates through three interconnected systems that determine whether projects generate profit or drain resources. Job costing tracks every dollar spent against specific work phases and reveals where money disappears. Companies that use dedicated construction accounting software like FOUNDATION report 15% higher profitability compared to those that rely on generic accounting systems. Real-time cost tracking prevents the 39% project failure rate that stems from poor estimation practices.

Job costing assigns every expense to specific project phases and creates visibility into actual versus budgeted costs. Construction firms handle over $100 billion in revenue annually through specialized ERP systems that track labor, materials, and equipment costs in real time. Standard accounting systems fail because they operate on annual cycles while construction projects span multiple years with variable costs. Each project requires separate cost estimations due to weather conditions, contractor terms, and material price fluctuations (factors that change project by project).

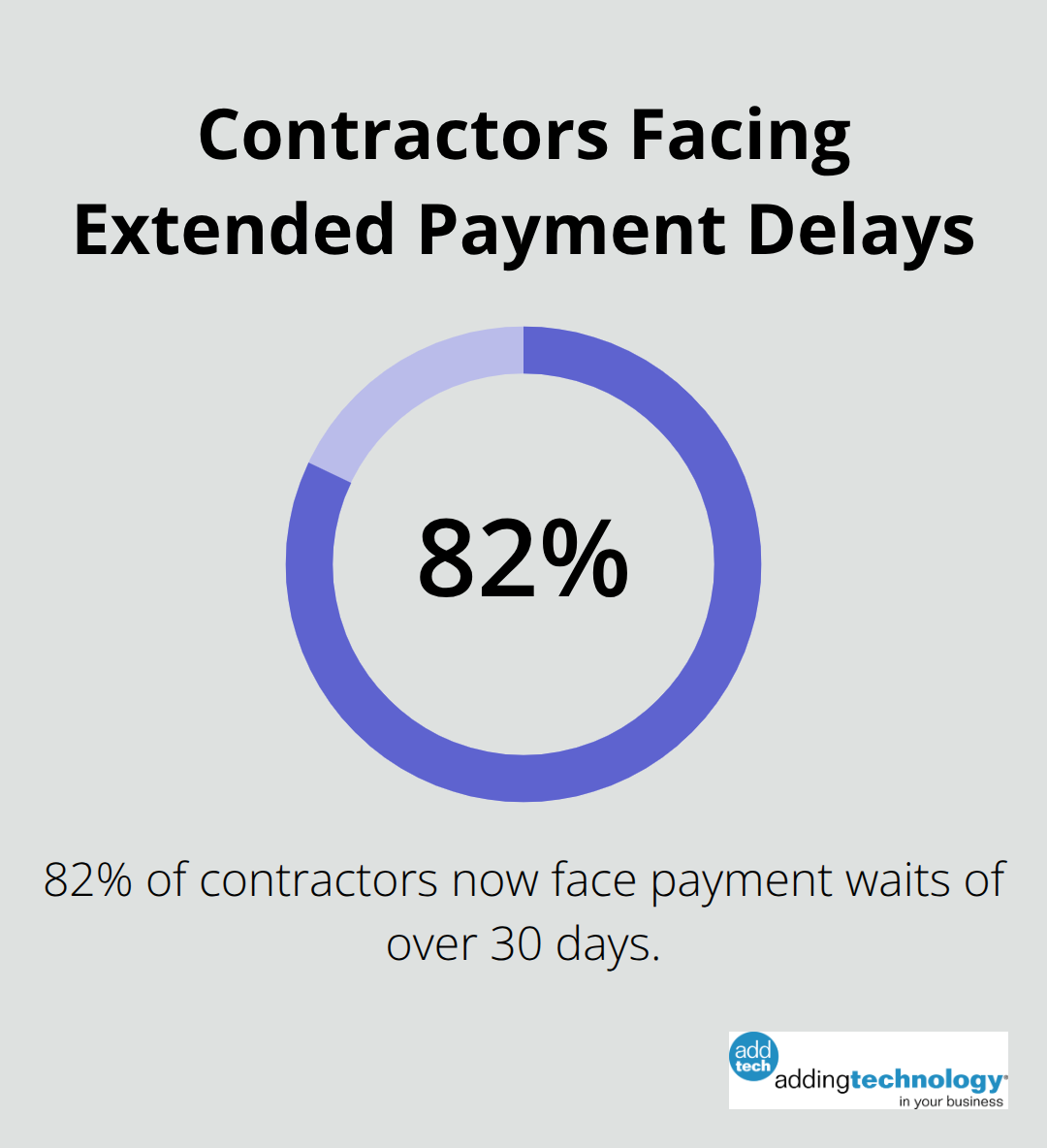

82 percent of contractors now face payment waits of over 30 days, up from 49 percent two years ago. Strategic payment schedules align material purchases with client payment milestones and prevent cash flow gaps that kill projects. Smart contractors time equipment rentals and material orders after they receive progress payments, which maintains positive cash flow throughout project lifecycles. Payment terms vary wildly in construction and make cash flow forecasts more complex than other industries.

Real-time financial dashboards provide instant visibility into project profitability and budget variance. 88% of spreadsheets contain errors, which makes automated financial systems necessary for accurate decisions. Construction-specific reports include work-in-progress analysis, retention tracking, and change order impacts that generic accounting software cannot handle. Weekly financial reviews identify cost overruns before they become project killers and enable immediate corrective action (preventing small problems from becoming major losses).

These financial control systems work together to create the foundation for profitable construction operations, but technology solutions amplify their effectiveness exponentially.

Construction finance technology transforms manual processes that drain productivity and create costly errors. Companies that use specialized construction software report 25% faster project completion and 18% better cost control compared to those that rely on spreadsheets and generic accounting tools. Modern construction finance platforms integrate real-time cost tracking with automated payment processing and field data collection. This creates a unified financial management system that prevents the delays and overruns that kill profitability.

Construction-specific software like CMiC provides instant visibility into project costs as they occur. Real-time tracking captures labor hours, material deliveries, and equipment usage automatically through mobile apps and IoT sensors. This eliminates the 40% error rate that manual data entry creates. FOUNDATION software users report 15% higher profitability because the system alerts managers to budget variances within hours instead of weeks. This allows immediate corrective action before small overruns become project killers.

Automated invoice systems reduce payment delays from the industry average of 60 days to under 30 days. These systems generate progress bills automatically when milestones complete. Digital payment platforms process construction invoices 3x faster than paper systems and provide real-time payment tracking that eliminates the guesswork around cash flow timing. Smart contractors use payment automation to trigger material orders and payroll processing immediately after client payments clear (maintaining positive cash flow throughout project lifecycles).

Modern construction finance platforms connect field operations directly to accounting systems through mobile apps that capture timesheet data, photo documentation, and material usage in real time. This integration eliminates the disconnect between field activities and financial records that causes inadequate cost estimates in 29% of projects. Workers submit daily reports through tablets that automatically update job costs and budget forecasts. This gives project managers instant financial visibility without waiting for weekly reports or month-end closings.

Even with the best software systems in place, construction companies still face persistent financial challenges that require strategic solutions and proven management approaches.

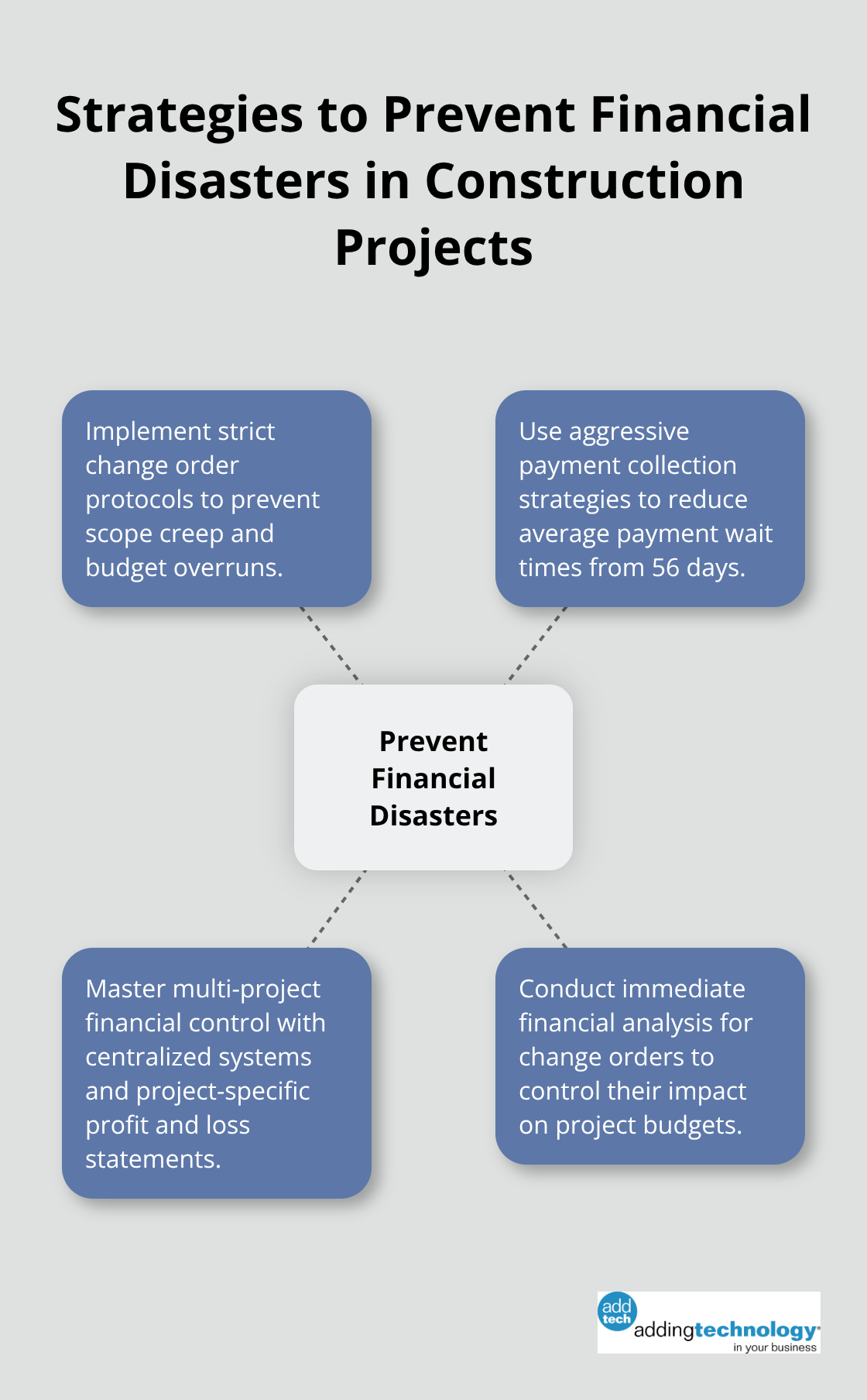

Change orders destroy more construction budgets than any other single factor. The average construction project experiences 12-15 change orders that increase costs by 8-12% according to industry data. Smart contractors build change order processes that require written approval before work begins and immediate cost impact analysis. Change orders must include labor adjustments, material price updates, and timeline extensions that affect other project phases. Companies that implement strict change order protocols report fewer cost overruns because they prevent scope creep from becoming financial disasters.

Construction companies wait an average of 56 days for payment while subcontractors often wait longer. This creates cash flow gaps that kill projects. Aggressive payment collection starts with detailed progress bills that document completed work with photos and measurements. Invoice within 24 hours of milestone completion and follow up weekly until payment clears. Factor delayed payments into project budgets and add 2-3% contingency for carrying costs. Smart contractors use invoice factoring services that advance 80-90% of invoice value within 48 hours (this eliminates cash flow gaps that force project delays or equipment returns).

Financial records across multiple projects require centralized systems that prevent cost allocation errors and budget confusion. Each project needs separate accounting codes for labor, materials, and overhead that feed into consolidated reports. Weekly cross-project analysis identifies which jobs drain profitability and which generate excess cash for reinvestment. Construction firms that use project-specific profit and loss statements catch problems 40% faster than those that rely on company-wide financial reports. Accurate multi-project tracking prevents profitable jobs from subsidizing losing projects and enables data-driven decisions about which project types to pursue or avoid (this approach maximizes overall portfolio profitability).

Change orders require immediate financial analysis before approval to prevent budget disasters. Calculate direct costs, indirect impacts, and timeline adjustments for every change request. Document how changes affect subsequent project phases and overall completion dates. Require client approval in writing before work begins and update project budgets immediately after approval. Track change order patterns across projects to identify common issues and improve initial estimates for future work.

Construction finance management success requires proven systems that prevent the financial disasters that destroy 70% of construction businesses. Real-time cost tracking, automated payment processes, and integrated field operations create the foundation for profitable projects. Companies that master these three components report 25% faster completion times and 18% better cost control.

Professional financial management services transform construction operations and eliminate manual processes that create costly errors. Adding Technology offers expert accounting and financial management services tailored for the construction industry. We provide real-time job costing and advanced technology integration that enhances operational efficiency and financial soundness.

Construction businesses must implement specialized software that tracks costs in real time to improve financial health. Strict change order protocols require written approval before work begins and prevent budget disasters. Payment collection processes that reduce delays from 60 days to under 30 days eliminate the cash flow gaps that kill construction profitability (these strategic changes position your business for sustainable growth).

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.