Construction accounting is a complex field that requires specialized knowledge and skills. At Adding Technology, we understand the unique challenges faced by construction businesses when it comes to financial management.

In this blog post, we’ll explore the key principles of construction accounting and provide practical strategies for mastering this essential aspect of your business. From job costing to cash flow management, we’ll cover the critical elements that can make or break your construction company’s financial success.

Construction accounting differs significantly from traditional accounting methods. At Adding Technology, we recognize the unique financial challenges in the construction industry. Project-based accounting forms the cornerstone of effective construction financial management.

In construction, each project operates as a distinct financial entity. This approach requires separate tracking of costs, revenues, and profits for individual jobs.

To implement project-based accounting effectively:

Construction companies require additional reports beyond the standard balance sheet, income statement, and cash flow statement:

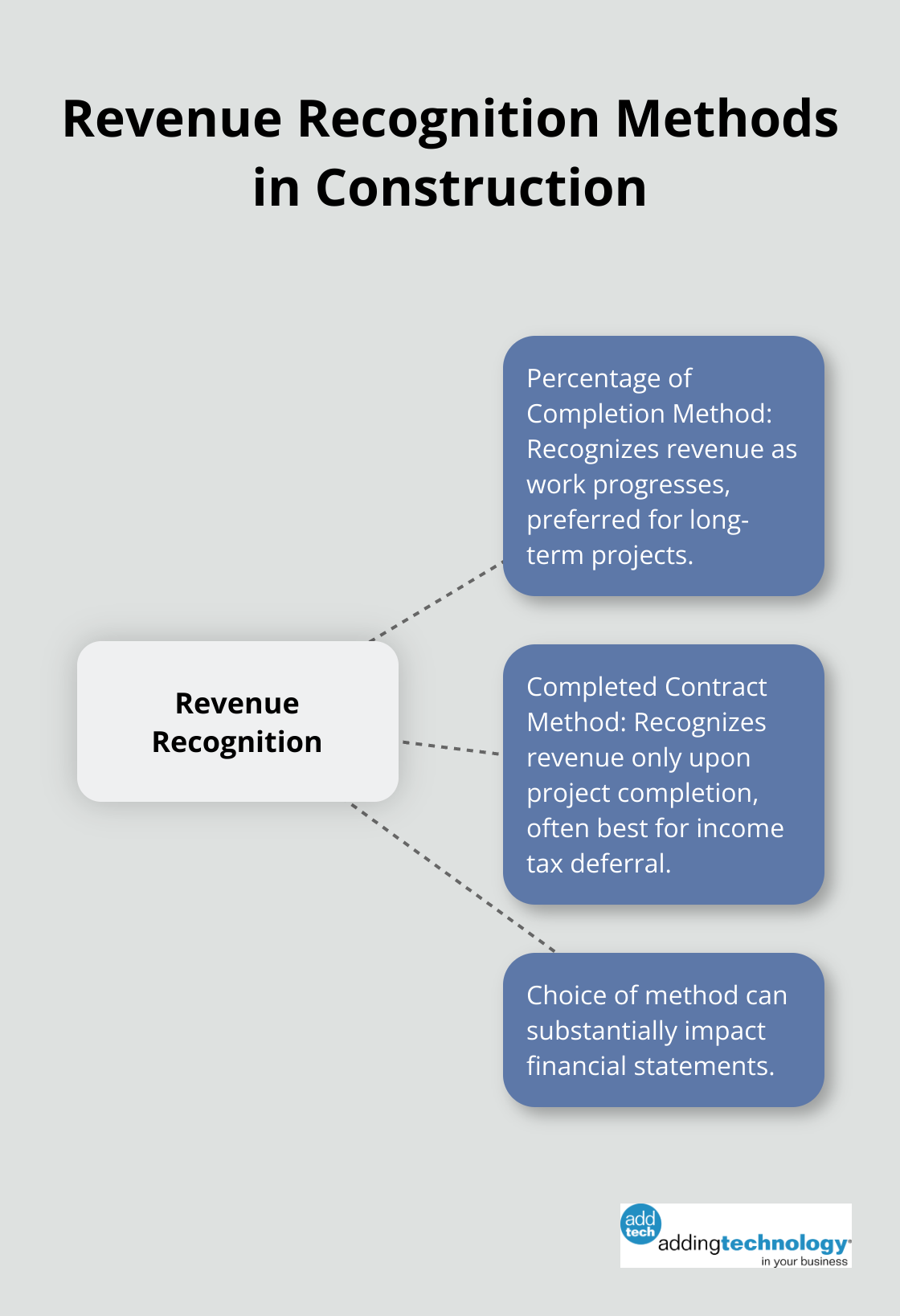

Long project timelines in construction complicate revenue recognition. The two primary methods include:

The choice between these methods can substantially impact financial statements.

Job costing serves as the backbone of construction accounting. It involves tracking all costs associated with a specific project. To execute job costing effectively:

Accurate job costing proves invaluable for bidding on future projects and analyzing profitability.

As we move forward, let’s explore how these foundational principles translate into effective cash flow management strategies for construction projects.

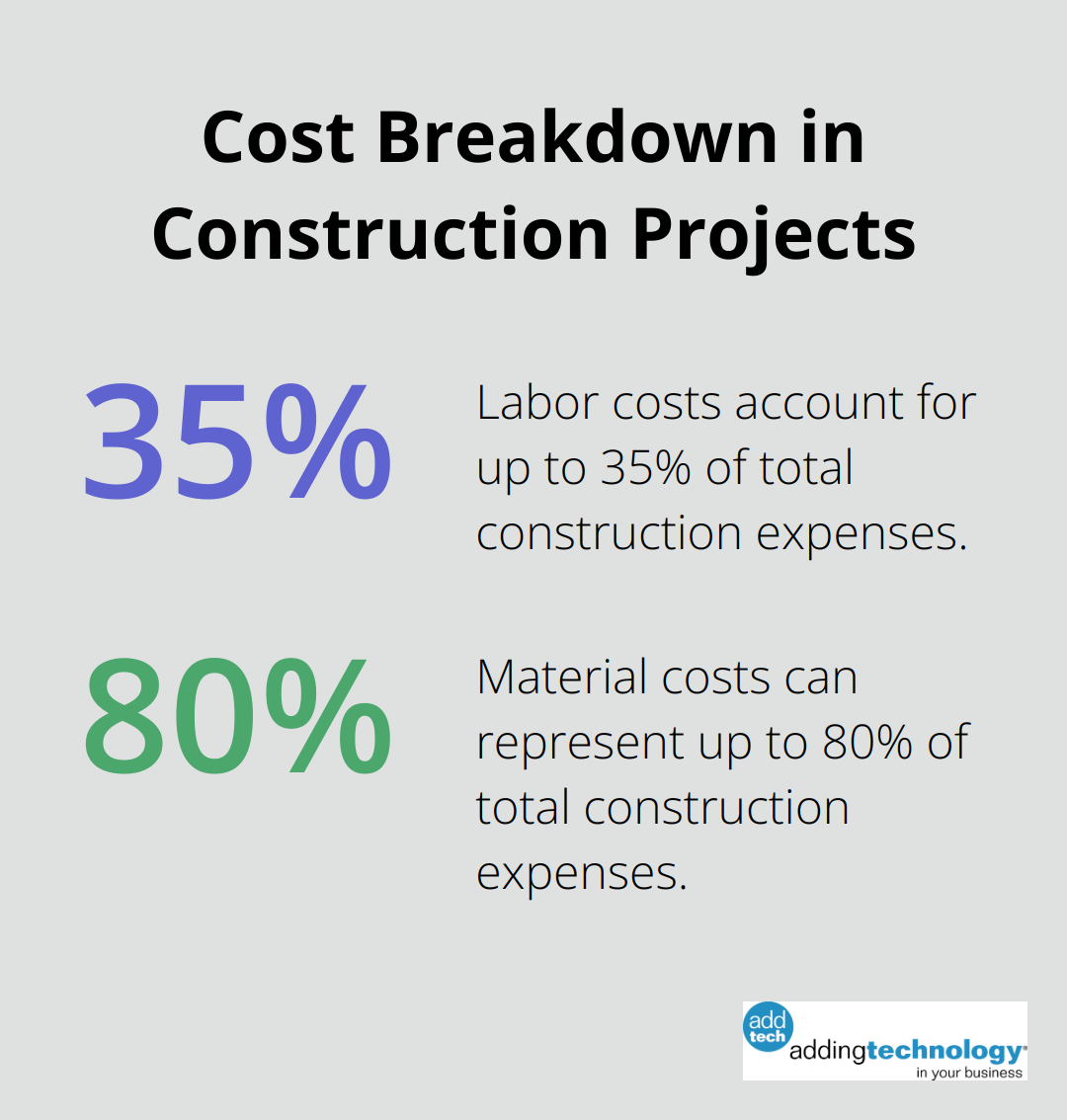

Job costing forms the foundation of successful construction accounting. The first step in effective job costing involves a detailed breakdown of project costs. This process requires the identification of every expense associated with a project (materials, labor, equipment rentals, and subcontractor fees). Generally, labor accounts for anywhere from 20-35% of total construction expenses, while materials account for 65-80%.

To achieve this level of detail, create a standardized cost code system. This system should categorize expenses into main groups such as direct direct labor, materials, equipment, and overhead. Within each group, assign specific codes to individual cost items. For instance, under materials, you might have separate codes for concrete, steel, and lumber.

After establishing cost codes, it’s important to distinguish between direct and indirect costs. Direct costs tie directly to a specific project, such as on-site labor and materials. Indirect costs, or overhead, benefit multiple projects, like office rent or administrative salaries.

Accurate allocation of indirect costs can present challenges. A common method distributes overhead based on direct labor hours. For example, if a project accounts for 20% of your company’s total labor hours, it would receive 20% of the overhead costs.

In today’s fast-paced construction environment, real-time job costing is essential. Manual tracking methods often lead to errors and delays. Construction-specific accounting software can automate much of the job costing process, providing up-to-the-minute cost data.

Mobile time-tracking apps allow workers to log hours directly to specific job codes from the field. This data then flows automatically into your job costing system, eliminating manual data entry and reducing errors.

Integrated purchase order systems can automatically assign material costs to the appropriate job code as soon as materials are ordered. This real-time tracking allows project managers to make informed decisions based on current cost data, rather than relying on outdated information.

Job cost reports provide a comprehensive view of project finances. These reports compare actual costs to budgeted costs, highlighting variances that require attention. Regular review of these reports (weekly or bi-weekly) enables proactive management of project finances.

Try to customize these reports to your specific needs. Some companies find value in including profit margins or labor productivity metrics alongside cost data.

Effective job costing doesn’t end with data a project concludes. Post-project analysis of job cost data offers valuable insights for future projects. Compare final costs to initial estimates, identify areas of unexpected expense, and use this information to refine future bids and improve overall profitability.

The implementation of these job costing strategies can significantly enhance financial control and profitability in construction projects. As we move forward, we’ll explore how these precise cost tracking methods contribute to effective cash flow management in construction projects.

Cash flow forecasting plays a vital role in long-term construction projects. We create detailed project timelines and break them down into phases. For each phase, we estimate expected cash inflows and outflows. This process accounts for potential delays or cost overruns.

Historical data from similar projects informs our forecasts. Construction management software with forecasting tools enhances prediction accuracy. A study developed a Cash Flow Risk Index (CFRI) to quantify the impact of risks on a project’s cash flow from an owner’s perspective.

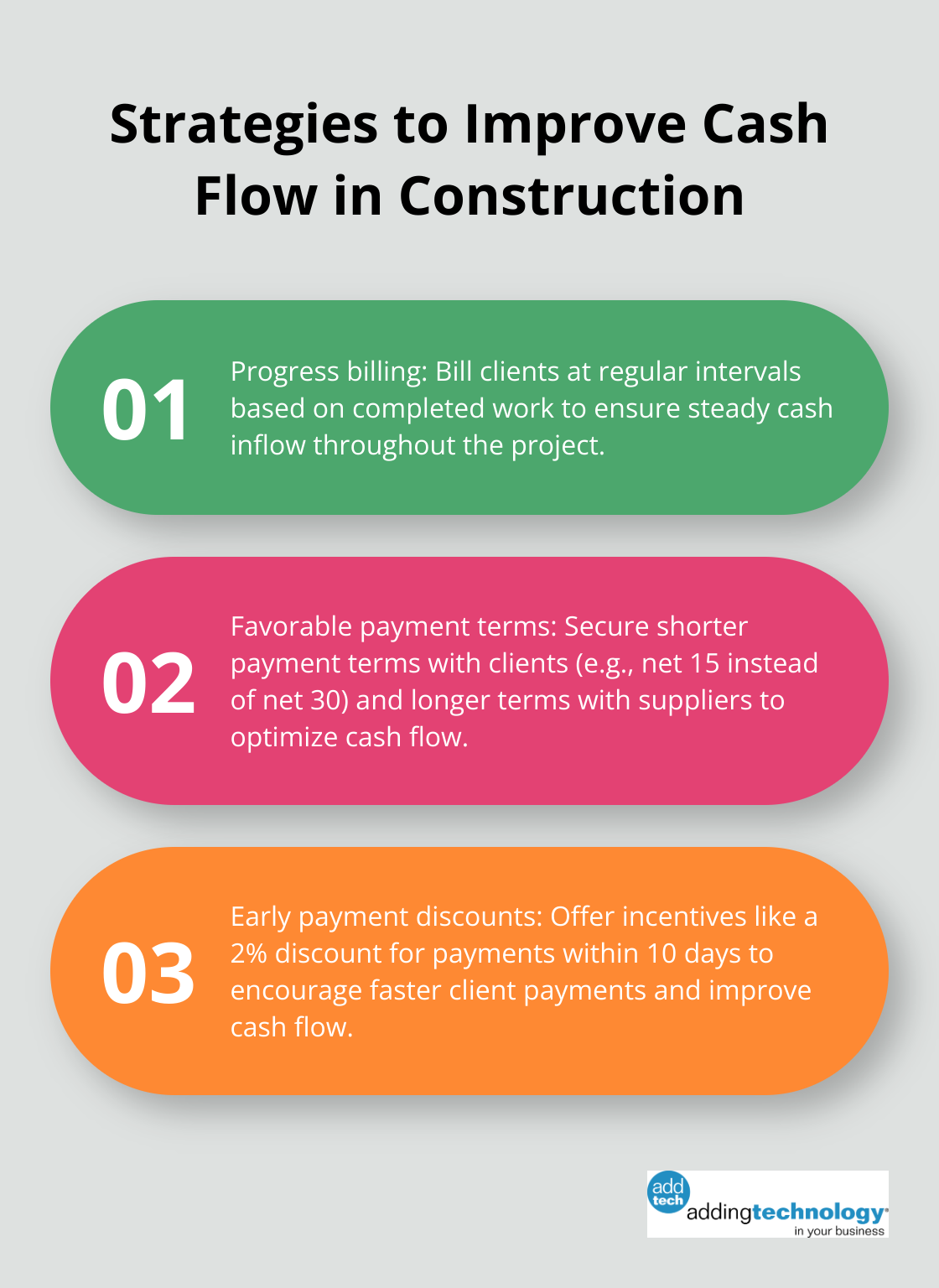

Accelerating receivables and delaying payables without straining relationships improves cash flow. Here are some proven strategies:

Retainage (typically 5-10% of the contract value held back until project completion) significantly impacts cash flow. To mitigate its effects:

For progress billing, we clearly define milestones in contracts and tie them to specific payment amounts. We use software to track progress and automatically generate invoices when milestones are reached. This approach reduces billing delays and improves cash flow predictability.

Modern construction accounting software provides powerful tools for cash flow management. These systems offer real-time visibility into financial positions, automate invoicing and payment reminders, and generate detailed cash flow reports.

Companies that implement specialized construction accounting software (such as Adding Technology) often see improvements in their cash flow cycle. These tools allow for proactive cash flow management, helping identify and address potential issues before they become critical.

Construction accounting forms the bedrock of financial success in the building industry. Mastery of project-based accounting, effective job costing strategies, and efficient cash flow management allows construction businesses to thrive in a competitive landscape. These principles enable data-driven decision-making, improve project planning, and enhance overall operational efficiency.

Companies that excel in construction accounting position themselves better to weather economic uncertainties and capitalize on growth opportunities. Accurate job costing not only helps in current project management but also informs future bids, which leads to more competitive and profitable contracts. Cash flow forecasting and management prove particularly important in construction, where long project timelines and retainage can strain finances.

We at Adding Technology specialize in construction accounting solutions, offering services that streamline financial processes and ensure compliance. Our expertise can help you implement advanced job costing systems, integrate cutting-edge technology, and develop robust cash flow management strategies. Investment in solid construction accounting practices builds a foundation for long-term success and growth in the construction industry.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.