Construction companies lose thousands annually due to poor financial tracking. At adding technology, we’ve seen firsthand how weak bookkeeping practices drain profits and create compliance headaches.

Bookkeeping for construction companies isn’t just about recording transactions-it’s about controlling costs, understanding profitability by project, and making smarter business decisions. This guide walks you through the mistakes holding you back and the systems that fix them.

Most construction companies don’t realize their bookkeeping failures until tax season arrives or a project suddenly shows losses instead of gains. We at adding technology have identified three patterns that appear in nearly every struggling contractor’s books, and they’re all fixable with discipline and the right systems.

The first mistake is treating business and personal finances as one account. Contractors often deposit project revenue into personal checking accounts, pay household bills from business funds, and wonder why their tax liability is unclear and their actual project profitability is invisible. The IRS expects clear separation, and more importantly, you cannot calculate true job costs when personal spending obscures project expenses.

If you mix accounts, your cost-to-complete estimates become guesses, your gross margins become fiction, and your ability to price future work accurately disappears. Open a dedicated business checking account and a separate credit card for expenses today. Route all project income into the business account and pay yourself via payroll or draws, not random transfers. This single change eliminates hours of reconciliation headaches and reveals your actual financial position within weeks.

The second mistake is failing to document labor and material costs as they happen. Many contractors track hours on job sites but never link those hours to specific projects in their accounting system, or they receive material invoices weeks after delivery and cannot match them to the correct job. Without real-time cost capture, you cannot spot budget overruns until the project is nearly complete, when correcting course is expensive or impossible.

Construction profit margins in the industry average significantly higher than historical norms, meaning even small cost overruns can erode profitability. Implement job costing software that captures labor through time-tracking tools and materials through purchase orders tied to specific projects. Tools like Hubstaff connect on-site hours directly to job codes, while construction accounting platforms automatically allocate material costs to the correct project when invoices are entered.

The third mistake compounds the first two: poor documentation of what work was actually completed and what costs were actually incurred. Without detailed records linking invoices, receipts, and timesheets to projects, you cannot defend your billing to clients, cannot prove your costs to auditors, and cannot identify which jobs are profitable and which are bleeding money.

Establish a document management system where every receipt, contract, change order, and timesheet is filed by project and date. This audit trail protects you in disputes and makes monthly financial reviews factual rather than guesswork. Once you fix these three mistakes, you gain visibility into which projects actually make money-and that visibility opens the door to smarter pricing and better systems.

Stop relying on spreadsheets and manual entry to track job costs. Construction companies that eliminated guesswork invested in software that connects time tracking, material purchases, and invoicing to individual projects automatically. Real-time job costing software gives you instant visibility into whether a job is profitable before it finishes, not after. When a subcontractor invoice arrives or a crew logs hours on site, the system allocates those costs to the correct project immediately, so your cost-to-complete estimate stays accurate. This matters because construction profit margins average around 6.3%, meaning a single untracked cost overrun can significantly impact profitability on that job.

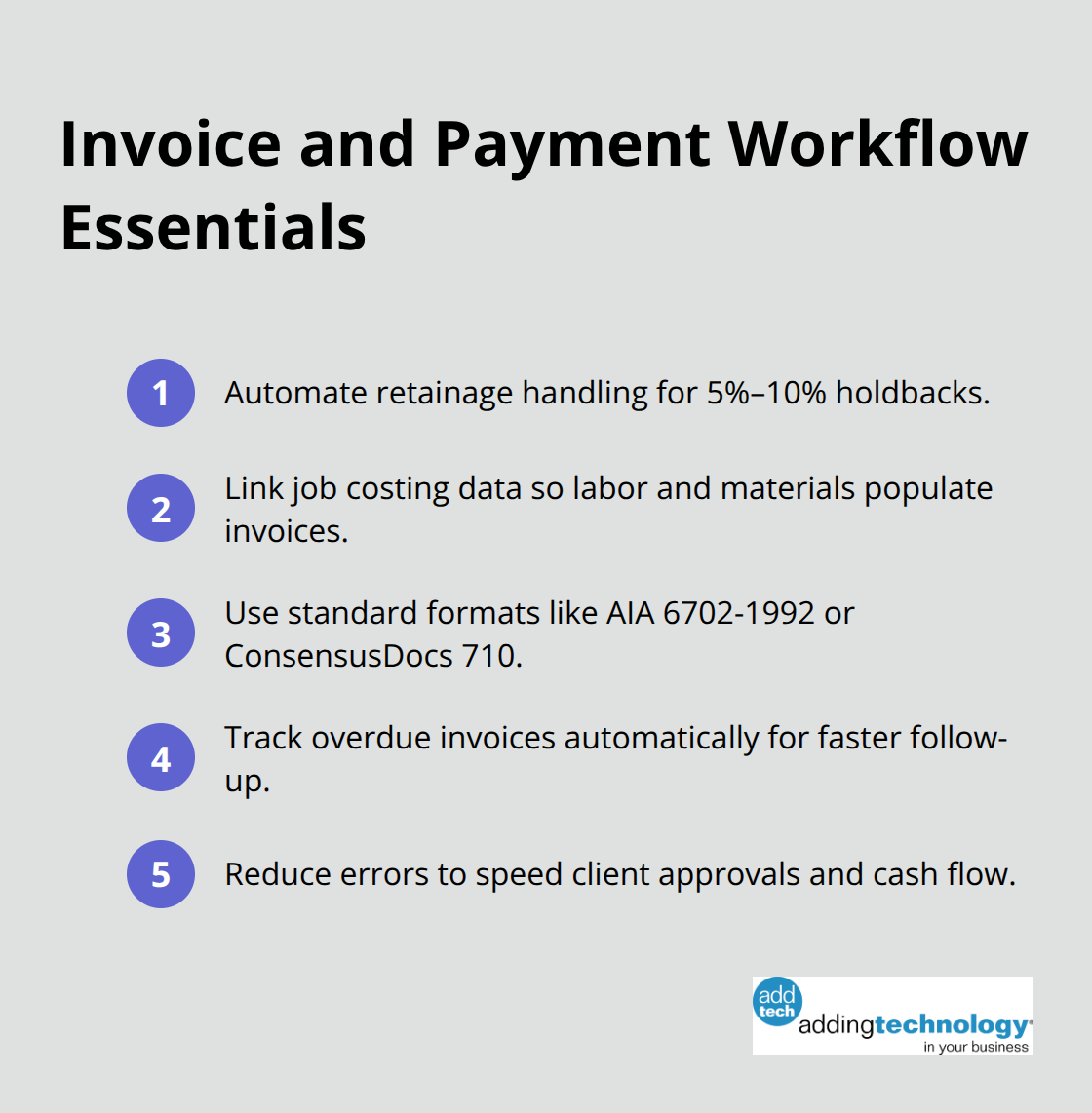

Manual invoicing delays cash flow and creates disputes. Construction contracts often include retainage holdbacks of 5% to 10%, and if you invoice late or inaccurately, you lose weeks of working capital you desperately need. Link your job costing data directly to invoicing so that milestone payments, materials costs, and labor populate automatically on each invoice.

This approach reduces billing errors and accelerates payment cycles. Use construction-standard payment apps like AIA 6702-1992 or ConsensusDocs 710 to format invoices in ways clients expect, which speeds approval and reduces back-and-forth negotiation. Automated payment tracking then flags which invoices are overdue so you can follow up before cash flow tightens.

The biggest weakness in construction bookkeeping is the gap between what your project managers track and what your accountant records. Your project team knows which jobs are ahead of schedule and which are behind, but your accounting system shows only costs and revenues. Integrate your accounting platform with your construction management tools so that changes to project scope, timelines, and budgets flow automatically into your financial records. When a change order is approved in your project management system, the accounting software captures it immediately, updating both your job cost estimate and your revenue forecast. This integration eliminates the delays and errors that come from manual data entry and allows you to spot problems in real time rather than discovering them during monthly reconciliation.

The right software stack depends on your company size and project complexity. Smaller contractors often start with basic accounting software paired with time-tracking tools (like Hubstaff, which connects on-site hours directly to job codes). Mid-sized firms typically add dedicated construction accounting platforms that handle job costing, WIP reporting, and subcontractor management in one system. Larger operations benefit from fully integrated platforms that combine accounting, project management, and financial forecasting. When evaluating software, prioritize features that matter most: core accounting, expense management, bank reconciliation, billing and invoicing, payroll, and financial reporting. Test free trials before committing, and favor interfaces your team can actually use without extensive training.

Your bookkeeping foundation now rests on systems that capture costs accurately and connect your financial data to your project reality. With real-time visibility into job profitability and automated workflows handling routine tasks, you can shift your focus from data entry to the decisions that actually grow your business. The next step is establishing the practices and disciplines that keep these systems working effectively month after month.

Your bookkeeping foundation matters only if you maintain it consistently. The software and systems you selected in the previous section will fail if you treat them as set-it-and-forget-it tools. Construction companies that report accurate financials and catch cost overruns early share one discipline: they track money by project from day one and reconcile their accounts monthly without exception. Contractors who implement project-level accounting see cost visibility improve within 30 days and cash flow predictability improve within 60 days. The difference between a contractor who survives on thin margins and one who scales profitably is not access to better tools-it is the commitment to separating every dollar by project, reviewing account balances weekly, and negotiating payment terms that keep cash flowing.

Start with a chart of accounts built specifically for construction. Your account structure must reflect how you actually spend money: labor, materials, equipment, subcontractors, and overhead tracked separately for each project. When you receive a material invoice, it goes to Materials for Job 47, not a generic expense category. When your crew logs hours, those hours attach to a specific job code in your time-tracking system, then flow into Labor for that same project. This separation is non-negotiable because you cannot calculate true job profitability without it.

Reconcile your bank statements every week, not monthly. Weekly reconciliation takes 20 minutes if you have automated bank feeds, and it catches duplicate charges, missing invoices, and payroll errors before they compound into larger problems. Many contractors wait until month-end reconciliation and discover that a subcontractor was paid twice or a vendor invoice was never recorded-by then, the mistake has already distorted your job costs. Set a standing appointment for Thursday morning or Friday afternoon, review every transaction, and mark each one as matched to a project or expense category immediately. This habit alone prevents thousands in reconciliation headaches and keeps your financial reports honest.

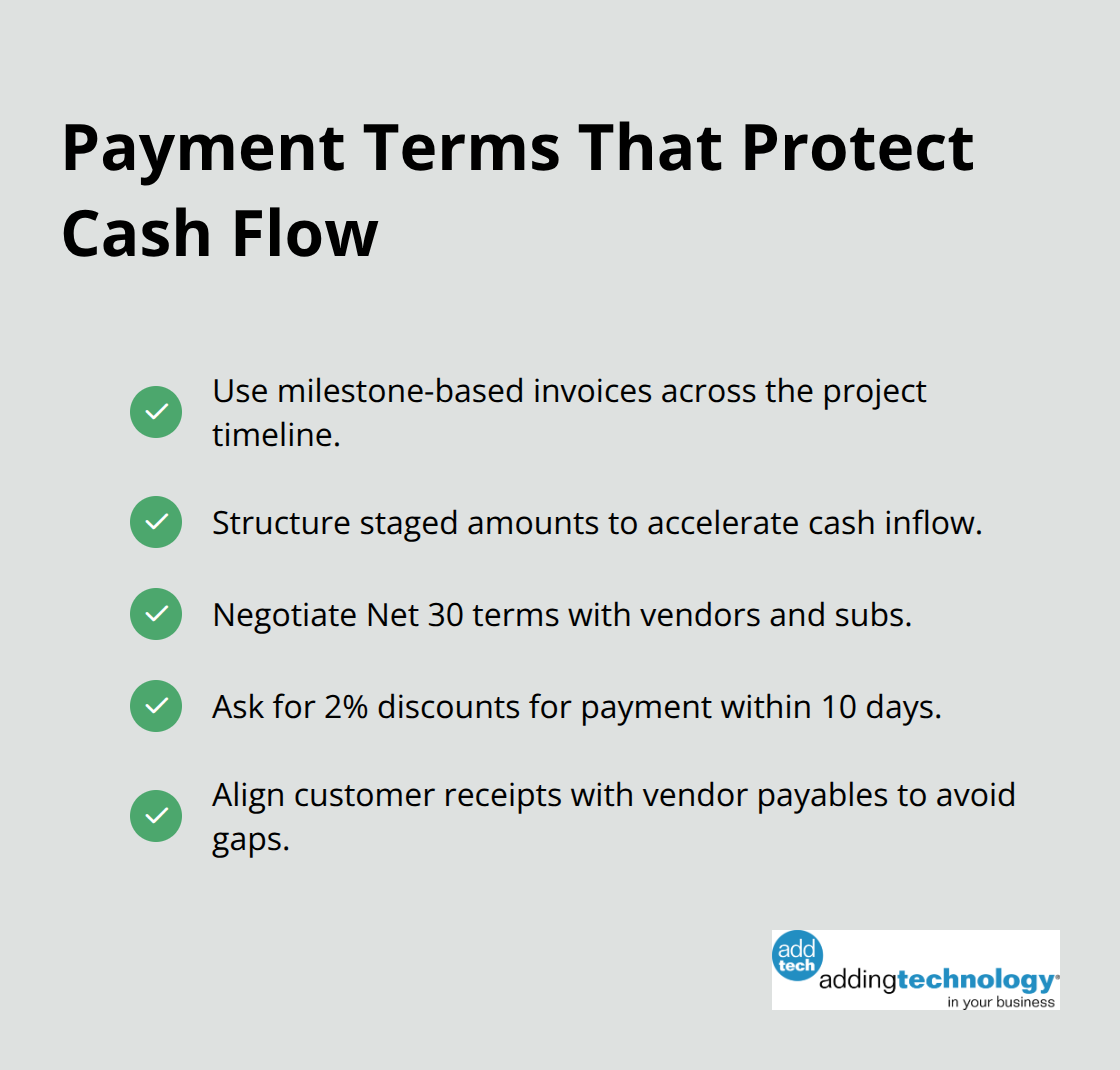

Payment terms directly control your cash flow, and most construction contractors accept terrible terms without negotiating. Standard construction contracts include retainage holdbacks of 5% to 10% of invoice value, which means you complete work, invoice the client, and wait weeks to receive payment while holding back money yourself. Push back on unfavorable terms with every client.

Propose milestone-based payments tied to specific completion stages rather than a single payment at project end. If a project spans six months and costs $200,000, structure invoicing so you receive $30,000 at foundation completion, $40,000 at framing, $50,000 at rough-ins, and so on. This approach accelerates cash inflow and reduces the amount of working capital you must finance yourself. With your vendors and subcontractors, negotiate Net 30 payment terms instead of Net 45, and ask for 2% discounts if you pay within 10 days. On a $100,000 subcontractor invoice, a 2% discount saves $2,000 and improves your job margin directly.

Document all payment terms in writing before work starts, include them in your contracts, and reference them in your invoices so clients know exactly when payment is due. Late payments destroy construction companies far more often than unprofitable jobs do, so treat payment terms as a financial control tool, not an afterthought.

Bookkeeping for your construction company transforms from a compliance task into your competitive advantage when you separate finances by project, track costs in real time, and reconcile accounts weekly. Contractors who implement these practices spot cost overruns before they spiral, negotiate better payment terms because they understand their cash position, and price future work accurately because they know which jobs actually made money. The three mistakes we covered-mixing personal and business finances, failing to document labor and materials, and poor record-keeping-are fixable today with the systems and practices we outlined.

Start this week by opening a dedicated business checking account if you haven’t already, then select accounting software that captures job costs automatically. Assign one person to reconcile your bank statement every Friday, and within 30 days you will see spending patterns that were invisible before. Within 60 days your cash flow forecasts will become reliable enough to guide hiring and equipment decisions, and within 90 days you will know which projects are profitable and which drain margin.

We at adding technology offer expert accounting and financial management services designed specifically for construction companies. Adding Technology streamlines financial processes, implements real-time job costing, and integrates technology so your accounting reflects your project reality. Strong bookkeeping is the foundation that allows you to scale profitably and focus on what you do best-building.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.