Construction contractors face unique financial challenges that standard bookkeeping methods can’t handle. Project-based work, irregular cash flows, and complex cost tracking require specialized approaches.

At adding technology, we’ve seen how proper accounting for construction contractors transforms struggling businesses into profitable operations. The right systems and practices make the difference between financial chaos and clear project profitability.

Construction accounting operates on fundamentally different principles than traditional business accounting. Each project functions as its own profit center, which requires meticulous cost, revenue, and timeline tracking that spans months or years. The Bureau of Labor Statistics reveals that 34.7 percent of business establishments born in 2013 were still operating in 2023, highlighting the challenges of business survival and the importance of proper financial management.

Job costing forms the backbone of successful construction financial management. Every expense must tie directly to specific projects, from labor hours and material purchases to equipment rentals and subcontractor payments. Companies that use detailed job cost sheets can identify cost overruns within days rather than months, which allows immediate corrective action.

Track actual costs against budgets weekly, not monthly. Include change order forecasts in your job cost calculations from day one, as these modifications can swing project profitability by 15-20%. The percentage-of-completion method works best for projects that exceed six months, while the completed contract method suits shorter projects with predictable timelines.

Construction cash flow patterns differ dramatically from other industries due to retainage practices and progress billing cycles. Contractors typically face 30-60 day payment delays, with 5-10% retainage held until project completion. Smart contractors maintain cash reserves equal to 90 days of operating expenses and negotiate payment terms that align with their own vendor payment schedules.

Implement automated invoicing systems that trigger immediately when milestones complete. Companies with gross receipts that exceed $25 million must use accrual accounting methods, which provide better cash flow projections than cash-basis systems but require more sophisticated tracking capabilities.

Revenue recognition in construction differs significantly from standard business practices. The percentage-of-completion method allows contractors to recognize revenue based on project progress (measured by costs incurred or work completed). This method provides more accurate financial statements for long-term projects but requires precise cost tracking and reliable completion estimates.

The completed contract method defers all revenue recognition until project completion, which eliminates estimation uncertainties but can create misleading financial statements during active construction periods. Companies must choose methods that align with their project types and regulatory requirements.

These fundamental differences in construction accounting create the foundation for specialized financial practices that contractors must master to achieve consistent profitability and sustainable growth.

Construction companies need chart of accounts structures that track project profitability at granular levels. Standard business accounting categories fail to capture the complexity of construction operations, where each project requires separate cost centers and revenue streams.

Set up asset accounts that distinguish between current projects (construction-in-progress) and completed work that awaits final payment. Create liability accounts that separate retainage payable by project and vendor accounts payable by trade category.

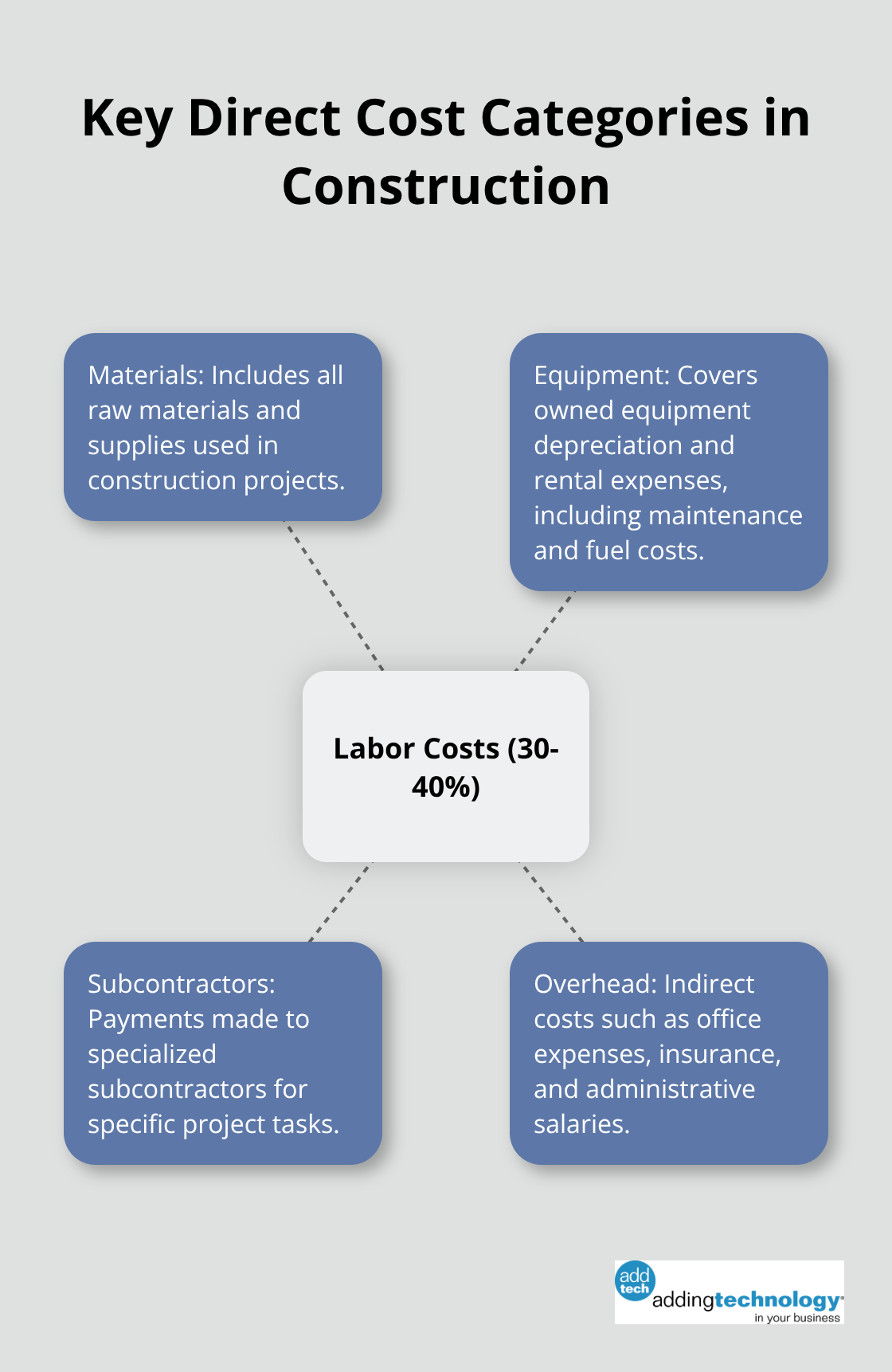

Labor costs represent 30-40% of total project expenses, which makes accurate tracking essential for profitability. Implement time-tracking systems that capture not just hours worked but specific activities and project phases.

Equipment costs should separate owned equipment depreciation from rental expenses, with hourly rates that include maintenance and fuel costs. Material tracking requires purchase order systems that tie every delivery to specific job numbers, with waste factors built into initial estimates.

Companies that track these three cost categories separately can identify profit leaks within 48 hours of occurrence.

Track payroll expenses by project phase rather than simple hourly totals. Union agreements often dictate wage rates for public projects under the Davis-Bacon Act, which requires contractors to pay prevailing wages that can vary significantly by location and trade.

Multi-state operations complicate payroll management further, as contractors must withhold taxes according to each jurisdiction’s requirements. Automated payroll systems reduce errors and streamline compliance across different regulatory environments.

Purchase orders must connect directly to job numbers before vendors deliver materials. This practice prevents cost allocation errors that can distort project profitability by 5-15%.

Equipment tracking should include both owned assets (with depreciation schedules) and rental equipment with clear hourly rates. Fuel costs, maintenance expenses, and operator wages all factor into true equipment costs that many contractors underestimate.

Retainage typically represents 5-10% of contract values but can create significant cash flow pressure over project lifecycles. Create separate accounts receivable categories for billed amounts versus retained amounts, as these have different collection timelines and risk profiles.

Progress billing should align with project milestones rather than calendar months, with automated invoicing that triggers when predetermined completion percentages are met. Smart contractors negotiate retainage release schedules that provide partial releases at 50% and 90% completion rather than waiting for final project acceptance.

This approach improves cash conversion cycles by 15-25% compared to standard retainage practices. These construction accounting foundations prepare contractors for the technology solutions that can automate and streamline these complex financial processes.

Modern construction accounting software has evolved beyond basic bookkeeping to provide integrated project management and financial control systems. NetSuite leads the cloud-based ERP solutions for larger contractors and offers real-time job costing with multi-project tracking capabilities that scale with company growth. QuickBooks Desktop Contractor edition remains popular for smaller operations but lacks the project integration features that companies need as they expand. Procore and Buildertrend excel at project management integration but require separate accounting modules to handle complex financial requirements.

Construction companies that implement real-time financial dashboards can significantly improve project oversight and financial control. Real-time dashboards show pacing across builds, overdrawn projects, stale loans, and pending inspections. Dashboards should display current job profitability, cash position, and work-in-progress values with daily updates rather than weekly ones. Key performance indicators must include current ratio tracking, days sales outstanding, and project margin analysis across all active jobs. Companies that use automated expense capture through mobile apps see 40% faster month-end closes and eliminate 85% of manual data entry errors that plague traditional systems.

Successful construction technology deployments connect accounting systems directly with project management platforms and eliminate duplicate data entry plus version control issues. Change orders that process through integrated systems update job costs automatically, while standalone accounting software requires manual updates that create profit margin calculation errors. Field crews use mobile time tracking apps that sync with payroll systems and provide accurate labor cost allocation within 24 hours instead of the typical week-long delay with paper timesheets.

Cloud-based accounting platforms allow construction teams to access financial records from any location (job sites, offices, or remote locations). This accessibility enables project managers to review budgets and costs in real-time without waiting for office-based updates. Cloud storage eliminates the need for physical document storage and facilitates quick document retrieval when auditors or clients request financial information. The SaaS model provides automatic software updates and enhanced security features that protect sensitive financial data from cyber threats.

AI technology handles repetitive tasks in construction accounting and minimizes human error while lowering operational costs. Automated payroll tools enable remote clock-in/clock-out for job site crews and simplify data retrieval for payroll processing. AI technology provides improved accuracy in data entry, reconciliation, and financial reporting processes. This technology allows financial professionals to focus on analytics and high-level decisions rather than mundane calculations that consume valuable time.

Construction contractors who master specialized financial practices transform their operations from reactive cost management to proactive profit optimization. Companies that restructure their chart of accounts to separate direct costs by project and trade category see immediate improvements in project visibility. Weekly job cost reviews catch overruns before they damage profitability, while cloud-based software eliminates data silos that plague traditional systems.

Professional support becomes essential as construction companies scale beyond basic operations and face complex multi-project management challenges. We at adding technology provide expert accounting for construction contractors with real-time job costing and advanced technology integration that enhances operational efficiency. Our clients report improved cost visibility and smoother operations that drive sustainable business growth.

The construction industry demands financial precision that standard bookkeeping cannot provide (with project-based accounting and specialized revenue recognition methods). Contractors who combine proper accounting foundations with modern technology solutions create the financial control systems that separate industry leaders from companies struggling with cash flow challenges. Success requires commitment to systematic implementation and professional expertise that addresses the unique complexities of construction financial management.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.