Information technology financial management presents unique challenges that can make or break tech companies. Budget overruns hit 89% of IT projects according to McKinsey research, while poor financial tracking costs businesses an average of $2.9 million annually.

At adding technology, we’ve seen firsthand how proper financial controls transform struggling IT operations into profitable ventures. The right systems and practices can reduce project costs by up to 23% while improving cash flow predictability.

IT projects face inherent cost unpredictability that traditional methods cannot handle. Software development scope creep affects 52% of projects according to Project Management Institute data, while hardware procurement costs fluctuate 15-30% quarterly due to supply chain disruptions. Companies that use fixed annual IT budgets fail 73% more often than those that implement dynamic cost allocation models.

Smart IT leaders implement 90-day budget reviews instead of annual cycles. This approach catches cost deviations early when corrections still matter. Technology procurement should follow market strategies – hardware purchases during Q4 typically cost 12-18% less than Q1 purchases due to vendor quota pressures. Project managers must track actual versus estimated costs weekly to prevent runaway expenses.

The shift from capital expenditures to operational expenses fundamentally changes IT financial management. Cloud migration moves traditional CapEx into OpEx categories, which creates monthly cash flow obligations that many finance teams underestimate. Companies that switch to Software-as-a-Service models see 40% higher monthly IT costs in year one, despite lower total cost of ownership over three years.

Successful IT financial management requires budget splits of 30% CapEx for infrastructure investments and 70% OpEx for operations. This ratio works for most mid-size technology companies (based on Gartner analysis). OpEx demands monthly cash flow forecasts rather than quarterly reviews, since subscription costs compound quickly when business growth accelerates.

Technology ROI fails at 67% of companies because they measure outputs instead of business outcomes. Revenue attribution to specific IT investments requires direct connections between technology spend and customer acquisition costs, sales cycle reduction, or operational efficiency gains. Most companies track server uptime instead of measurement of how faster response times increase customer retention rates.

Effective ROI measurement starts with baseline metrics before technology implementation. Customer service software should reduce average resolution time by measurable percentages, not just improve satisfaction scores. Sales automation tools must demonstrate specific increases in deal closure rates or sales team productivity. IT investments without measurable business impact within 12 months typically indicate poor technology selection or implementation failures.

These financial control breakdowns create the perfect storm for IT budget disasters. However, companies can implement specialized accounting and financial management practices that transform chaotic financial management into predictable, profitable operations.

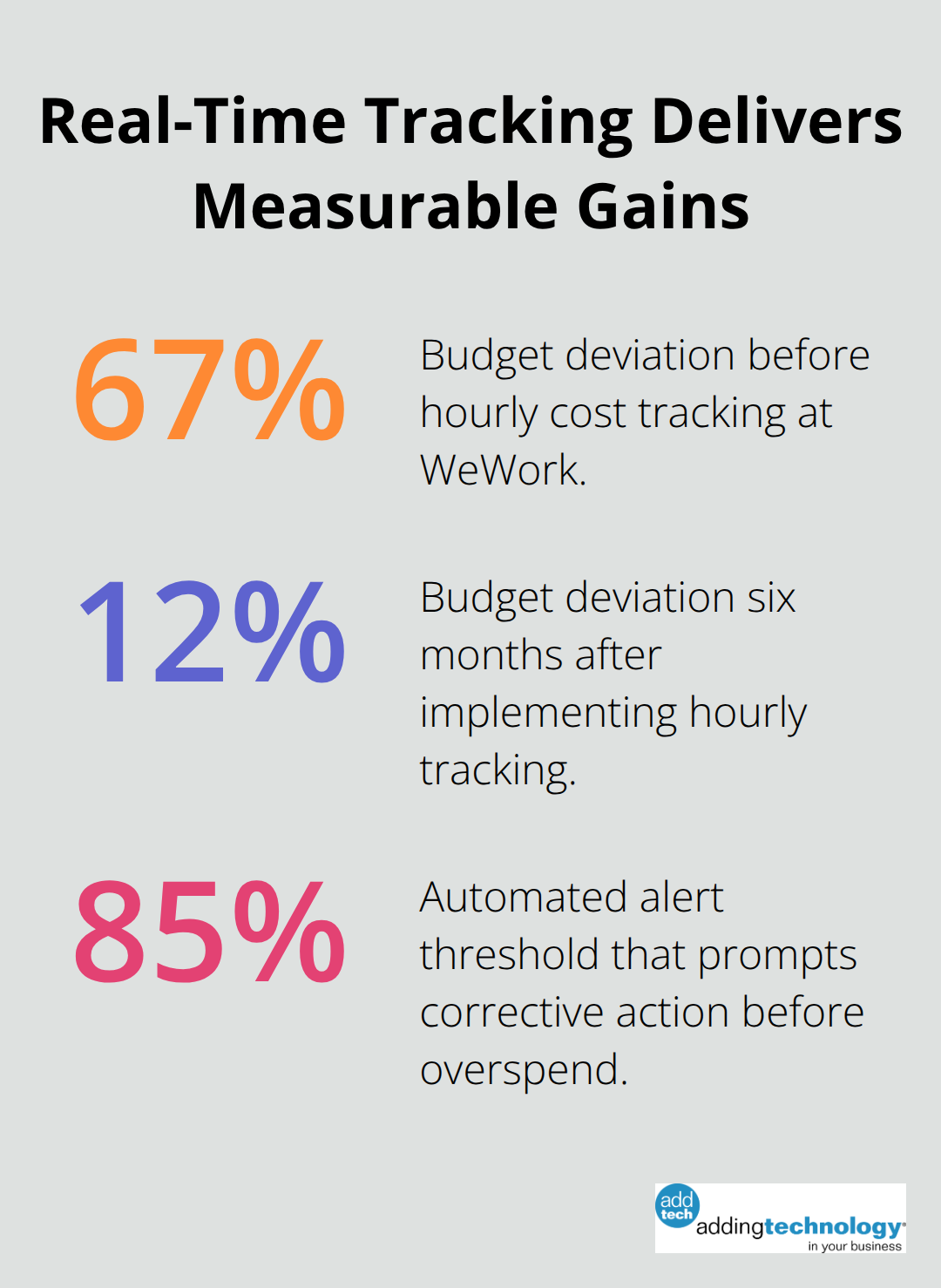

Real-time budget tracking transforms IT financial chaos into predictable operations. Companies that use daily budget monitoring can significantly improve project performance, as organizations on average waste 9.9 percent of every dollar due to poor project performance according to PMI research. WeWork implemented hourly cost tracking for development projects and cut budget deviations from 67% to 12% within six months. The secret lies in automated alerts when project costs exceed 85% of allocated budgets – this gives teams time to adjust scope before financial damage occurs.

Detailed project cost structures separate successful IT companies from failures. Effective budget allocation requires careful consideration of different cost components across development labor, infrastructure provisioning, and software licensing based on industry benchmarks. Spotify tracks developer time in 15-minute increments across specific features, which enables precise cost attribution and prevents scope creep. Every project needs three cost categories: development labor, infrastructure provisioning, and third-party integrations. Companies that skip granular cost tracking face 34% higher project costs on average.

Weekly financial reports beat monthly reports for IT project management. Atlassian switched from monthly to weekly financial reviews and reduced project delays by 28% while improving budget accuracy. Reports must include burn rate calculations, remaining budget allocations, and projected completion costs. The most effective format shows actual versus planned spending with variance explanations for any deviation that exceeds 10%. Financial dashboards should display real-time metrics accessible to project managers, not just finance teams. This transparency prevents the communication gaps that destroy 41% of IT budgets (according to Standish Group data).

Smart IT companies implement automated warning systems that trigger when spending patterns indicate trouble ahead. These systems monitor daily burn rates and project completion percentages to calculate budget exhaustion dates. Slack sends automatic notifications when projects reach 75%, 85%, and 95% of budget allocation, which allows managers to take corrective action before costs spiral out of control. The most effective alerts include recommended actions like scope reduction or resource reallocation rather than simple warnings.

Modern financial management tools make these practices accessible to companies of all sizes, from startups to enterprise organizations.

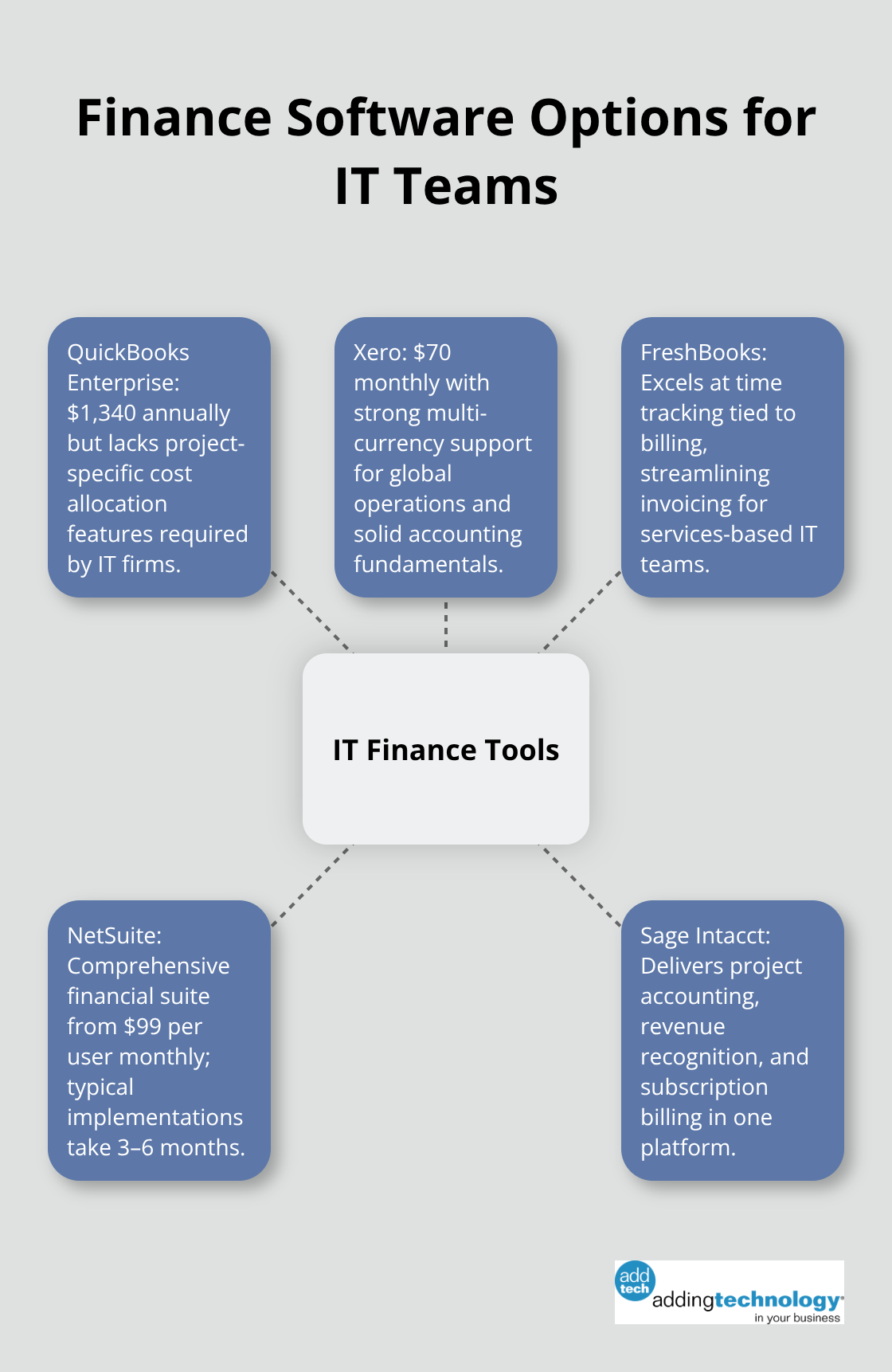

Modern IT financial management requires specialized software that handles the complexity of technology projects and variable costs. QuickBooks Enterprise costs $1,340 annually but lacks project-specific cost allocation features that IT companies need. Xero at $70 monthly provides better multi-currency support for global IT operations, while FreshBooks excels at time tracking integration with billing systems. NetSuite offers comprehensive financial management starting at $99 monthly per user, but implementation takes 3-6 months for most IT companies.

Sage Intacct handles project accounting, revenue recognition, and subscription billing in one platform. Fixed assets represent the largest line item on Fortune 500 company balance sheets according to Aberdeen Group research.

Asana Business costs $24.99 per user monthly but transforms project financial tracking when teams integrate it with accounting systems. Monday.com provides superior budget monitoring dashboards at $16 per user monthly, while ClickUp offers time tracking and expense management for $12 monthly. Smartsheet connects project timelines directly to budget burn rates and sends automated alerts when teams exceed spending by more than 15%.

Basecamp fails at financial integration despite its popularity for project communication. Companies that use project management tools with built-in financial tracking reduce budget overruns by 41% compared to those that use separate systems. Integration between project management and accounting eliminates the manual data entry that causes 67% of financial reporting errors in IT companies.

FreshBooks automates invoice generation based on project milestones and reduces payment delays from 45 days to 23 days on average. Zoho Invoice integrates with 40+ payment gateways and costs only $10 monthly for unlimited invoices. Bill.com automates both accounts payable and receivable processes while providing real-time cash flow forecasts.

Automated payment reminders increase collection rates by 28% (according to Atradius research). Companies that use automated invoice systems achieve faster cycle times and access early payment discounts in the 2% to 3% range. Integration with bank accounts enables automatic payment matching that eliminates manual reconciliation tasks that consume 8-12 hours weekly for most IT finance teams.

Information technology financial management success requires the right combination of tracking systems, reporting processes, and automated tools. Companies that adopt real-time budget monitoring reduce project overruns by 23%, while detailed cost breakdowns prevent the scope creep that affects 52% of IT projects. Weekly financial reviews outperform monthly cycles, and automated payment systems cut collection delays from 45 to 23 days.

The financial benefits extend beyond cost control. Proper IT financial planning improves cash flow predictability, enables better vendor negotiations, and provides the data needed for strategic technology investments. Organizations with structured financial controls achieve 41% fewer budget deviations and can redirect savings toward innovation initiatives (according to industry research).

Companies should start with cloud-based accounting software that integrates with project management tools. Weekly budget reviews and automated cost alerts at 75% spending thresholds prevent financial disasters. At adding technology, we understand that comprehensive financial management solutions create the foundation for sustainable IT operations that transform chaotic project costs into predictable, profitable technology investments.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.