Financial leaders face complex choices daily that directly impact their company’s bottom line. Poor decision-making in financial management costs businesses an average of 15% of their annual revenue, according to McKinsey research.

At adding technology, we’ve seen how the right frameworks and tools transform financial outcomes. Smart financial decisions require clear data, proven processes, and technology that supports rapid analysis.

Cash flow patterns tell the real story about your financial health, not profit margins. Companies with positive monthly profits can still collapse within 90 days due to cash flow problems. You must track daily cash positions for 12 months minimum to identify seasonal trends and payment delays.

Construction businesses typically experience 30-45 day payment cycles, while retail operations face weekly fluctuations. Real-time cash flow monitoring prevents the 82% of business failures that result from poor cash flow management (according to U.S. Bank research). Weekly cash flow forecasts help you anticipate shortfalls before they become critical.

Your current assets should exceed current liabilities by at least 1.5:1 for healthy operations. This current ratio measures a company’s ability to cover its short-term obligations with its current assets. Inventory turnover rates above 6 times annually indicate efficient asset use, while rates below 4 suggest overstocking problems.

Accounts receivable reports highlight collection issues when more than 15% of receivables exceed 60 days. Equipment depreciation schedules affect both cash flow and tax planning, which makes accurate asset valuation essential for strategic decisions.

Revenue stream concentration creates dangerous dependencies in your business. Single customers who represent over 20% of total revenue threaten your stability. Gross margins by product line or service category reveal which offerings drive profitability.

Service-based businesses should maintain margins above 40%, while product sales typically range from 25-35%. Cost structure analysis identifies fixed versus variable expenses, with fixed costs staying below 60% of total expenses for operational flexibility. Variable cost percentages help you understand how expenses scale with revenue growth.

These financial position insights form the foundation for effective decision-making frameworks that transform raw data into actionable strategies.

Financial leaders who base decisions on data outperform those who rely on intuition by 23% in profit margins, according to Harvard Business Review research. Companies that implement systematic data analysis frameworks reduce financial errors compared to organizations that depend on gut instincts alone.

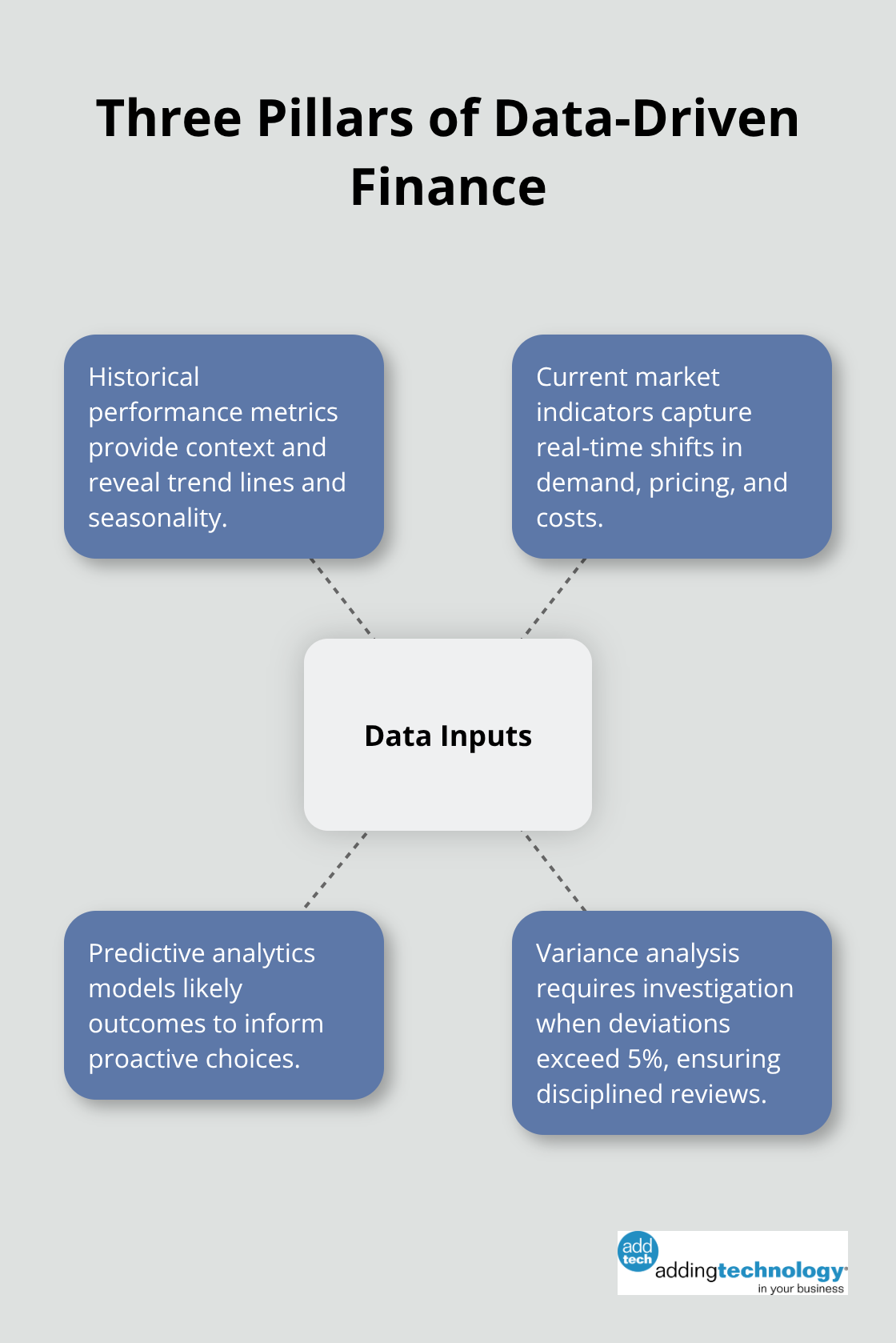

The most effective approach combines three data points: historical performance metrics, current market indicators, and predictive analytics. Quarterly financial reviews must include variance analysis that compares actual results to forecasts, with any deviation that exceeds 5% requiring immediate investigation.

Real-time financial dashboards prevent the average 8-week delay between problem identification and corrective action that affects intuition-driven organizations. These systems provide immediate visibility into financial performance and enable rapid response to emerging issues.

Financial risk assessment demands quantifiable metrics rather than subjective opinions. Companies should maintain debt-to-equity ratios that align with industry standards, with larger companies naturally maintaining higher ratios due to capital requirements.

Stress tests that examine your financial model against 10% revenue drops and 15% cost increases reveal operational vulnerabilities before they become critical. Diversification rules require that no single revenue source exceeds 25% of total income and no single expense category surpasses 40% of operational costs.

Emergency funds that cover 90 days of fixed expenses protect against market volatility. Scenario planning for best-case, worst-case, and most-likely outcomes guides strategic investments and prepares organizations for multiple future conditions.

Financial decisions often require rapid execution to capture opportunities or prevent losses. Monthly risk assessments that use systematic frameworks help financial leaders make decisions that protect long-term stability while they pursue growth opportunities (particularly in volatile markets).

Decision trees that outline specific triggers and response protocols reduce reaction time from weeks to days. These structured approaches eliminate hesitation and provide clear pathways for action when financial conditions change rapidly.

The next component of effective financial management involves selecting the right tools and technologies that support these decision-making frameworks with accurate, real-time data.

Modern financial management software eliminates manual data compilation burdens for small businesses. Cloud-based platforms like NetSuite and Sage Intacct provide real-time financial visibility that reduces decision-making delays from days to hours. These systems automatically categorize transactions, generate variance reports, and flag anomalies that exceed predefined thresholds.

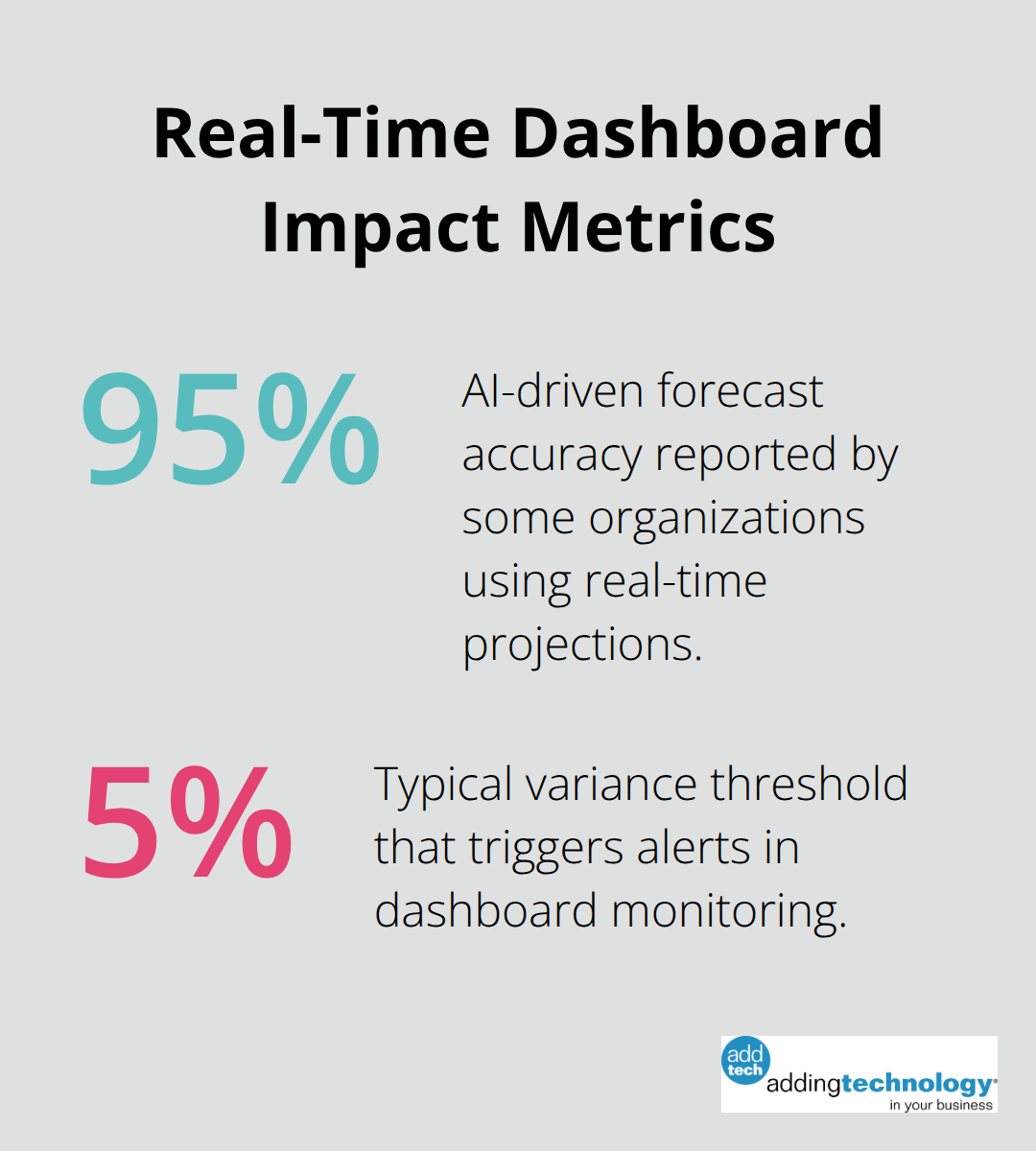

Financial dashboards that update every 15 minutes prevent the costly delays that result from outdated information. Companies that use real-time systems identify cash flow problems earlier than those that rely on monthly reports, with some organizations reaching 95% forecast accuracy using AI-driven projections that adapt in real time. Effective dashboards display key performance indicators including current ratio, days sales outstanding, and gross margin trends on a single screen.

Mobile dashboard access enables financial leaders to monitor performance during travel and respond to urgent situations within hours rather than wait for office access. These systems alert managers when metrics fall outside acceptable ranges (typically 5% variance from targets).

Seamless integration between accounting systems and project management platforms eliminates duplicate data entry that consumes significant time for finance teams. API connections between QuickBooks, Xero, and project management tools like Monday.com or Asana create automated workflows that update financial records immediately when project costs change.

Construction companies benefit most from integrated systems that track job costs in real-time, with some companies reporting improved project profitability through better cost visibility. Effective job costing helps contractors streamline their financial processes while maintaining compliance requirements.

Predictive analytics tools analyze historical patterns to forecast future cash flow with high accuracy rates. Machine learning algorithms identify spending patterns that human analysts miss, particularly in seasonal businesses where revenue fluctuates throughout the year. These tools process thousands of data points to predict which customers will pay late (based on payment history and industry trends).

Variance analysis features automatically highlight deviations that exceed 3% from budgeted amounts, enabling immediate corrective action. Financial modeling software tests multiple scenarios simultaneously, showing how different decisions affect profitability over 12-month periods.

Effective decision-making in financial management requires three fundamental components: accurate data analysis, systematic risk assessment, and technology integration. Companies that implement data-driven frameworks achieve 23% higher profit margins than those who rely on intuition alone. Real-time monitoring prevents the 82% of business failures that cash flow problems cause.

Financial leaders must maintain current ratios above 1.5:1 while they keep fixed costs below 60% of total expenses. Modern dashboard systems that update every 15 minutes enable rapid responses to market changes and reduce decision delays from days to hours. Integration between accounting and project management platforms eliminates manual errors and provides immediate cost visibility.

Monthly variance analysis that flags deviations above 5% from targets prevents small issues from becoming major problems (particularly in volatile markets). Construction companies benefit from specialized financial management that combines industry expertise with advanced technology. We at adding technology help contractors streamline their financial processes through expert accounting and financial management services tailored specifically for the construction industry.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.