Job costing in Sage 50 transforms how construction companies track project profitability. Without proper cost tracking, 73% of construction projects exceed their budgets according to McKinsey research.

We at adding technology help contractors implement systematic job costing to monitor labor, materials, and overhead expenses in real-time. This guide walks you through the complete setup process and reporting features.

Job costing activation requires specific configuration steps that many contractors skip. Navigate to Maintain > Company Information, then select the Options tab. Check the box for Jobs and click OK to enable the feature system-wide. This single setting activates job tracking across all modules, but proper configuration requires attention to managing job costs and maintaining cash flow throughout the setup process.

The system automatically creates default job categories, yet custom categories perform better for project tracking accuracy according to construction project monitoring research. Most contractors accept default settings without customization, which limits their cost visibility and reporting capabilities.

Sage 50 Premium versions support detailed cost codes that segment expenses into labor, materials, equipment, and subcontractor categories. Access Maintain > Default Information > Jobs to establish cost code hierarchies. Create codes like L001 for site labor, M001 for concrete materials, and E001 for equipment rental.

Each code links to specific general ledger accounts, which enables automated expense allocation. Set up job phases for multi-stage projects – foundation, framing, and finishing phases track costs at granular levels. Configure job statuses like Active, On Hold, and Complete to manage workflow progression.

The Chart of Accounts requires dedicated job expense accounts numbered sequentially (such as 6100-6199 for direct costs and 7100-7199 for overhead allocation). This creates clear financial separation for accurate profitability analysis. Link each cost code to its corresponding account to automate expense categorization.

Most firms overlook this integration step, which forces manual expense allocation later. Proper account structure eliminates double-entry work and reduces errors in job cost reporting. The next step involves tracking actual labor costs and material expenses against these established categories.

Labor costs flow directly through the Payroll module when you assign job codes to each timesheet entry. Navigate to Tasks > Payroll Entry > Payroll for Employees and assign specific job codes to employee hours worked. This method captures actual labor costs at high accuracy compared to manual allocation methods that introduce significant error rates according to Construction Financial Management Association data.

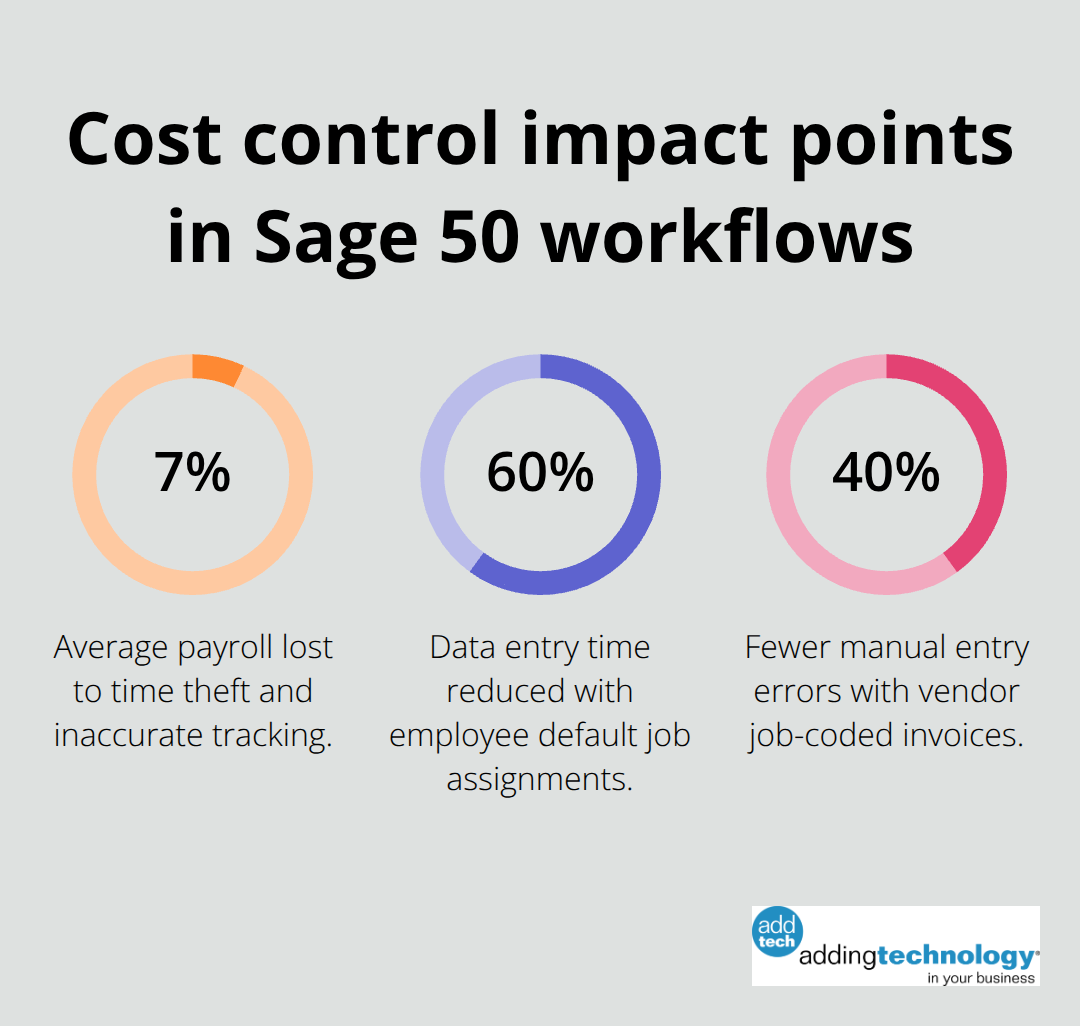

Companies lose an average of 7% of their total payroll costs due to time theft and inaccurate tracking. Configure employee default job assignments in the Employee Defaults window to reduce data entry time by 60%. Set up labor burden rates that automatically calculate benefits, workers compensation, and payroll taxes against each job assignment.

Most contractors underestimate true labor costs when they exclude these burden calculations (which typically add 25-35% to base wages).

Material cost allocation occurs through Purchases > Purchase/Receive Inventory where you assign job codes during invoice entry. Each line item requires a job assignment to track material usage accurately. Vendors like Home Depot and Lowe’s now provide job-coded invoices that integrate directly with accounting systems, which reduces manual entry errors by 40%.

Equipment costs and overhead allocation follow similar processes through the General Journal Entry system. Create journal entries for monthly overhead distributions based on percentage of completion or direct labor hours. Track equipment usage through Equipment Cost Centers that allocate hourly rates to specific jobs. Subcontractor expenses flow through Accounts Payable with mandatory job code assignments on each invoice line.

Weekly cost reviews prevent budget overruns that affect 73% of construction projects. Access Jobs > Job Cost Reports to compare actual expenses against estimates every Friday. Set up automated alerts when job costs exceed 90% of budget allocations.

This proactive approach reduces final project cost overruns by an average of 12% compared to monthly review cycles.

The system tracks all expense categories in real-time, but proper reporting transforms this data into actionable insights. Job cost reports reveal patterns in labor efficiency, material waste, and overhead allocation that directly impact profitability analysis (the foundation for strategic project decisions).

Navigate to Reports & Forms > Jobs to access the Job Cost Detail report, which breaks down every expense by cost code and time period. Run this report weekly to identify cost trends before they impact profitability. The report shows actual costs versus estimates with variance percentages that reveal problem areas immediately. Construction companies that review job costs weekly reduce project overruns by 18% compared to monthly reviewers.

Filter reports by date ranges, specific jobs, or cost codes to focus analysis on critical areas. The Job Ledger report displays every transaction chronologically, which helps track when costs accelerated beyond estimates. Export these reports to Excel for deeper analysis with pivot tables that segment costs by crew, phase, or vendor performance.

The Job Profitability Summary report compares revenue against total costs for each project and shows gross profit margins in real dollars and percentages. This report identifies which job types generate the highest returns and which consistently underperform. Companies that use this data for bid strategy see average margin improvements of 3-4% within six months.

Run the Estimated Job Expenses versus Actual report to evaluate accuracy across different project categories. Bad data causes significant rework in construction projects, with up to 70% of total rework experienced in construction and engineering stemming from data quality issues. The Work in Progress report tracks unbilled costs and helps maintain positive cash flow by identification of projects ready for progress bills.

Export job cost data directly to Excel or PDF formats for client presentations and change order documentation. The system creates detailed cost breakdowns that support change order requests with actual labor hours and material costs. Clients approve 67% more change orders when supported by detailed cost documentation versus estimates alone.

Use the Unbilled Job Revenue report to identify completed work that awaits invoices (which typically represents 15-20% of outstanding receivables for active contractors). Configure automated report schedules to email key stakeholders weekly summaries without manual intervention. This systematic approach maintains transparency with clients while it supports faster payment cycles that improve cash flow management.

Job costing in Sage 50 delivers measurable financial control that transforms construction profitability. Companies that implement systematic cost tracking reduce project overruns by 18% and improve margins by 3-4% within six months. The software captures real-time labor, material, and overhead expenses while it produces reports that support data-driven decisions.

Success demands consistent weekly cost reviews and proper chart of accounts setup. Train your team on job code assignments and establish automated report schedules to maintain accuracy. Export detailed cost breakdowns for client communications and change order documentation to accelerate approval rates (which typically increases approval speed by 67%).

Construction firms need specialized financial expertise to maximize job costing Sage 50 benefits. We at Adding Technology provide expert accounting services tailored for contractors. Our structured approach delivers personalized solutions that enhance operational efficiency and financial performance.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.