Financial losses from poor risk management cost businesses billions annually. Companies without proper financial risk management strategies face bankruptcy rates 40% higher than those with structured approaches.

We at adding technology have seen firsthand how systematic risk assessment transforms business stability. The right framework protects cash flow and builds long-term resilience.

Market fluctuations hit construction companies hardest during economic downturns. Material costs can swing 15-30% within six months, according to Construction Dive data from 2023. Steel prices saw significant increases from 2021 to 2022, which forced contractors to absorb massive cost overruns on fixed-price contracts.

Interest rate changes affect project financing immediately. When the Federal Reserve raised rates by 525 basis points in 2022-2023, construction loan costs doubled for many firms. Track commodity price indices weekly and build escalation clauses into contracts that exceed $100,000. Monitor Federal Reserve announcements and adjust your bidding strategies within 48 hours of rate changes.

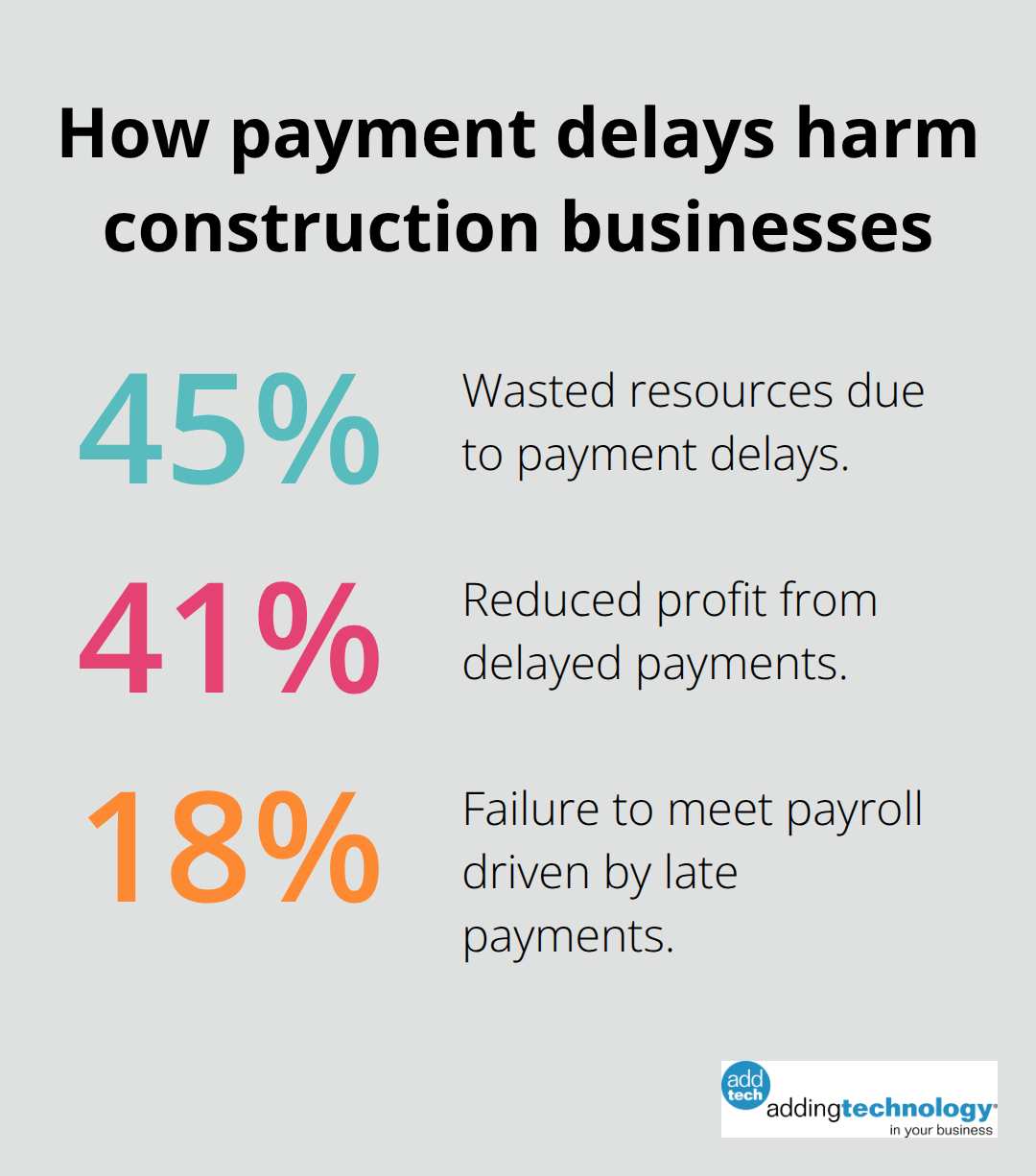

Payment delays contribute to wasted resources (45%), reduced profit (41%), and failure to meet payroll (18%) according to construction businesses. Subcontractors face the worst exposure and wait up to 120 days for payment while they cover material costs upfront.

Credit checks reveal financial instability before it becomes catastrophic. Run credit reports on clients who exceed $50,000 project values and require payment bonds on contracts over $250,000. Implement progress billing every two weeks instead of monthly to reduce exposure. Mechanics liens provide legal protection but cost $2,000-5,000 in legal fees per filing.

Equipment breakdowns cost construction firms an average of $50,000 per incident in lost productivity and emergency repairs. Human error accounts for 23% of construction accidents and generates workers compensation claims that average $42,000 per incident. Inadequate job costing systems hide profit erosion until projects complete.

Install GPS tracking on equipment valued above $25,000 and schedule preventive maintenance every 250 operating hours (this prevents 70% of major breakdowns). Document all safety training and conduct weekly toolbox talks to reduce liability exposure. Real-time job costing systems flag budget overruns when they reach 5% variance and allow immediate corrective action.

These risks compound when businesses lack proper measurement and assessment tools. The next step requires systematic approaches to quantify and monitor these threats before they damage your bottom line.

Monte Carlo analysis runs thousands of scenarios to calculate probability distributions for project outcomes. Construction firms that use this method identify potential cost overruns with greater accuracy compared to traditional estimates. Input variables include material price volatility, weather delays, and labor availability to generate realistic ranges. Run simulations on projects that exceed $500,000 and adjust contingency reserves based on the 90th percentile outcomes. Software like @RISK or Crystal Ball processes complex variables and delivers actionable probability ranges within hours.

Value at Risk calculations show maximum potential losses over specific timeframes. A 95% confidence VaR of $100,000 over 30 days means you face only a 5% chance of losses that exceed that amount. Construction companies track VaR weekly on active projects and monthly on overall portfolio exposure. Set VaR limits at 10% of capital for individual projects and 25% for total company exposure.

Thirteen-week cash flow forecasts capture payment schedules with precision that monthly projections miss. Update forecasts every Tuesday with actual receipts and disbursements from the previous week. Include contract milestone payments, material delivery schedules, and subcontractor payment terms in your model. Construction firms that maintain 13-week forecasts reduce cash shortfalls significantly through enhanced accuracy and realistic budgeting.

Stress test your forecasts against delayed payment scenarios. Model what happens when your largest client extends payment from 30 to 90 days. Calculate the exact credit line requirements to maintain operations when payment delays occur. Most construction firms need credit facilities equal to 45 days of expenses to weather typical payment disruptions.

Debt-to-equity ratios above 2.5 signal dangerous leverage levels for construction companies. Current ratios below 1.2 indicate potential liquidity problems within 90 days. Track these metrics weekly and establish automatic alerts when ratios approach dangerous thresholds. Profitable construction firms maintain current ratios between 1.5 and 2.0 while they keep debt-to-equity below 1.5.

Days sales outstanding measures collection efficiency and cash flow health. Construction industry average sits at 65 days, but top firms collect within 45 days. Calculate DSO weekly and investigate any client that exceeds 75 days immediately. Automated systems reduce DSO by an average of 12 days according to Sage Construction research.

These measurement tools provide the foundation for effective risk control. The next step involves implementing specific strategies and technologies that actively reduce your exposure to financial threats.

General liability insurance costs construction firms 1-3% of revenue but prevents bankruptcy from single incidents. Professional liability coverage protects against design errors and costs $2,500-8,000 annually for mid-sized contractors. Workers compensation premiums average $3.50 per $100 of payroll but reduce lawsuit exposure by 95% according to NCCI data. Purchase umbrella policies that provide $2-5 million coverage above base limits for projects that exceed $1 million. Payment bonds guarantee subcontractor payments and cost 0.5-2% of contract value but eliminate mechanic lien risks entirely. Performance bonds protect clients from contractor default and typically cost 1-3% of project value while they improve bid competitiveness on public works.

Cyber liability insurance becomes mandatory as construction firms digitize operations. Data breaches cost construction companies an average of $4.88 million per incident according to IBM research. Purchase policies that cover business interruption, data recovery, and legal defense costs. Equipment breakdown coverage costs $500-2,000 annually but pays for emergency repairs and rental equipment during failures. Builder risk insurance protects work in progress and materials on site with premiums that range from 0.1-0.5% of completed value.

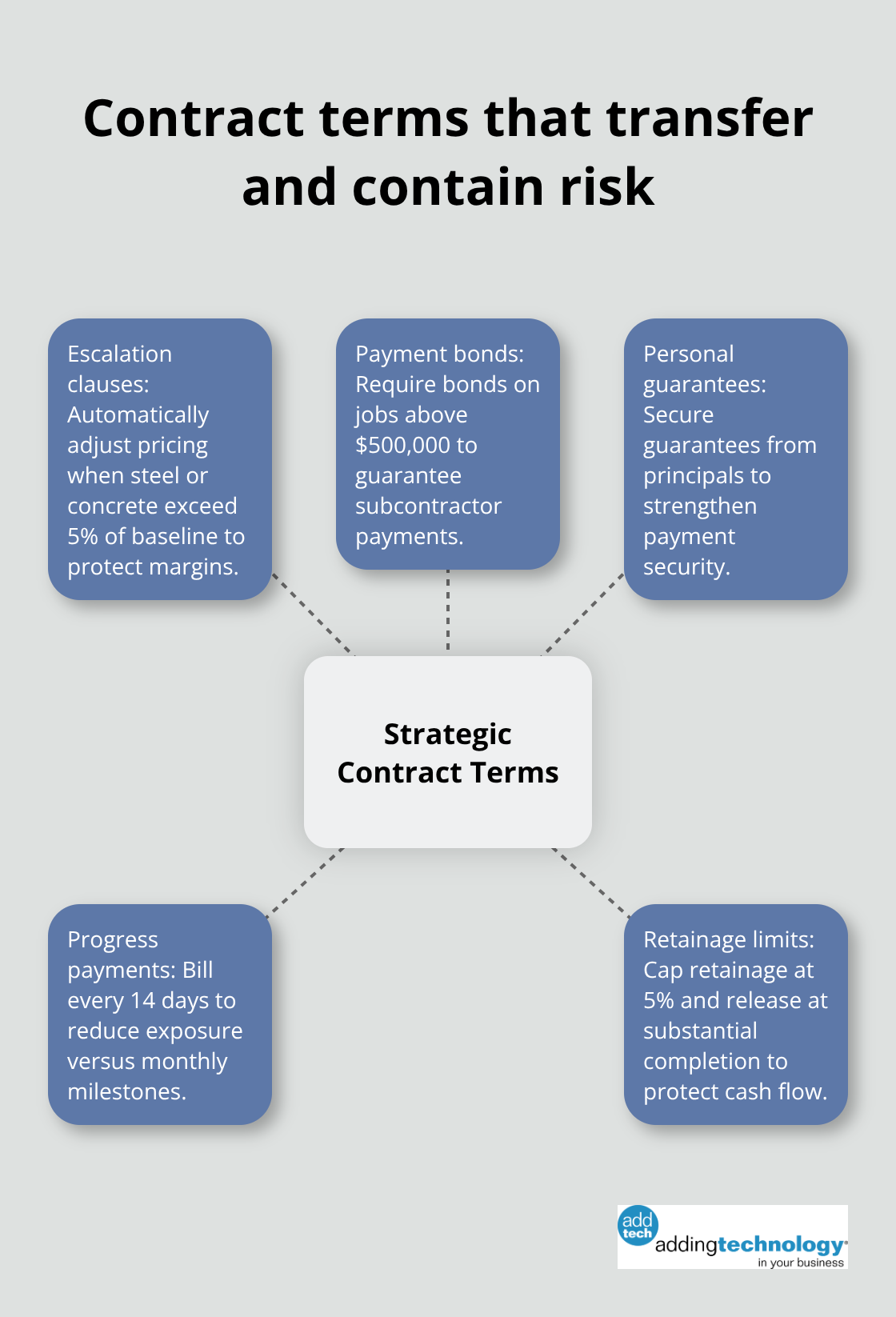

Escalation clauses shift material cost increases to clients and prevent profit erosion on long-term projects. Include automatic adjustments when steel or concrete prices exceed 5% of baseline costs. Require clients to provide payment bonds on contracts above $500,000 and personal guarantees from company principals.

Progress payment schedules reduce exposure by requiring payments every 14 days instead of monthly milestones. Retainage should never exceed 5% and must release automatically upon substantial completion.

Joint venture agreements spread risk across multiple firms for large projects. Structure partnerships where each party assumes responsibility for specific trades or project phases. Subcontractor agreements must include pay-when-paid clauses and require certificates of insurance before work begins. Force majeure clauses protect against weather delays, labor strikes, and material shortages beyond contractor control. Change order procedures require written approval within 48 hours and automatic markup rates of 15-20% for overhead and profit.

GPS tracking systems cost $30-50 per vehicle monthly and help reduce equipment theft. Telematics systems monitor equipment usage, maintenance needs, and operator behavior to prevent breakdowns. Project management software like Procore or Buildertrend provides real-time budget tracking and alerts when costs exceed 5% variance. Time tracking applications eliminate payroll fraud and improve labor cost accuracy by 15-20%. Drone surveys cost $200-500 per project but identify safety hazards and progress delays before they become expensive problems.

Automated invoicing systems reduce payment delays by sending bills within 24 hours of milestone completion. Integration between field data collection and accounting systems eliminates manual entry errors that cost firms an average of $12,000 annually. Mobile apps allow foremen to document daily progress, weather conditions, and change orders in real-time. These systems provide seamless financial visibility and eliminate data silos that hide profit erosion (which affects 60% of construction firms according to industry research).

Financial risk management strategies transform construction businesses from reactive survivors into proactive leaders. Companies that implement systematic risk frameworks reduce bankruptcy rates by 40% while they maintain stable cash flows during market volatility. Start your implementation within 30 days with comprehensive risk assessments on active projects.

Install real-time monitoring systems and establish weekly cash flow forecasts within 60 days. Complete insurance coverage reviews and contract restructuring within 90 days to maximize protection. The long-term benefits compound rapidly as firms with structured risk management report 25% fewer payment delays and 30% reduction in cost overruns.

We at adding technology provide expert accounting and financial management services that support effective risk management through real-time job costing and advanced technology integration. Equipment tracking prevents 70% of major breakdowns while automated systems reduce collection periods by 12 days on average (which directly improves cash flow stability). Your financial stability depends on proactive risk management rather than reactive crisis response.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.