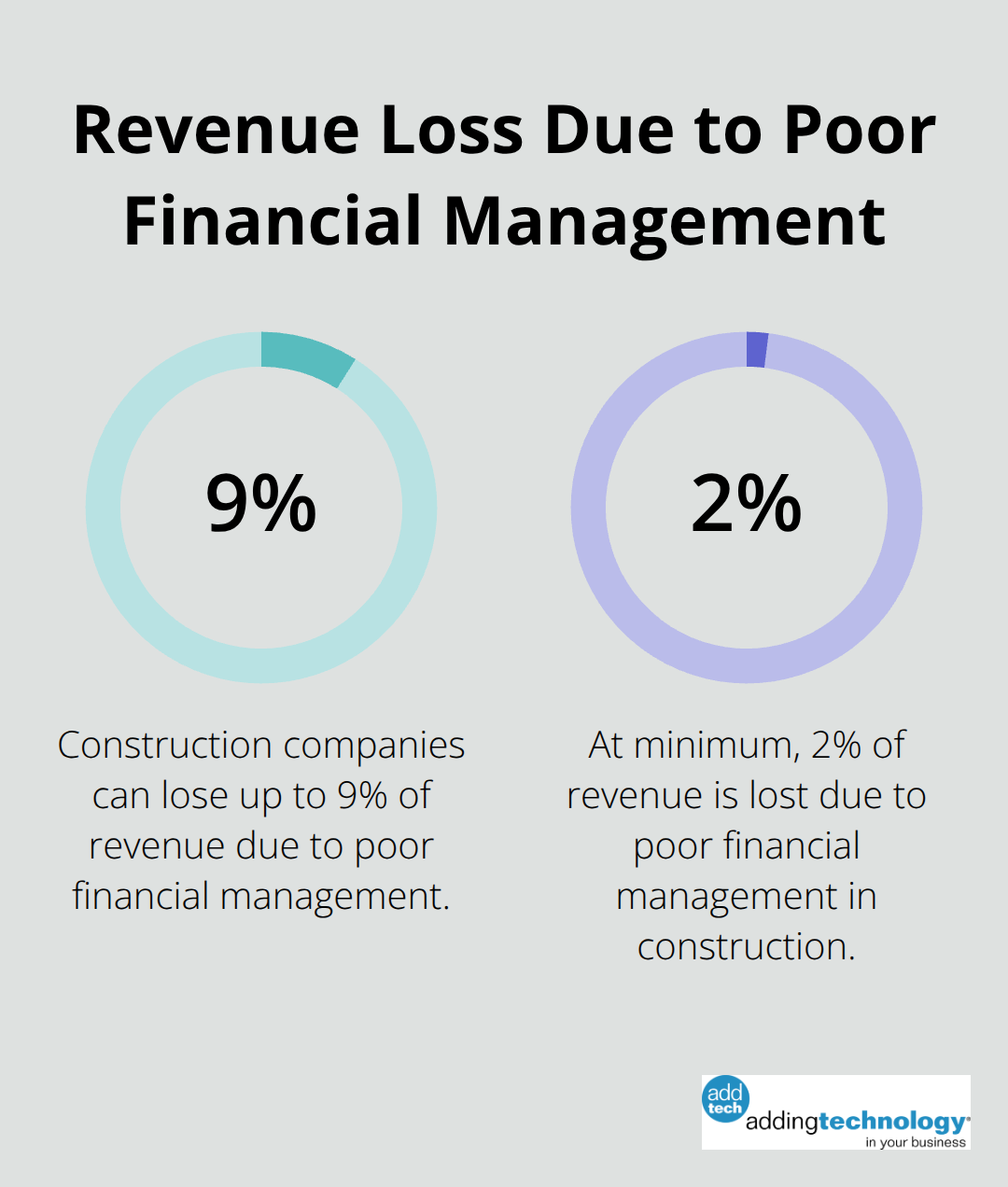

Construction companies lose an average of 2-9% of their revenue to poor financial management. The right bookkeeping partner can prevent these costly mistakes.

At adding technology, we’ve seen how proper construction bookkeeping services transform project profitability. The wrong choice, however, can drain resources and create compliance headaches.

This guide reveals exactly what separates exceptional providers from mediocre ones.

Construction bookkeeping differs fundamentally from standard business accounting. Your provider must understand percentage-of-completion accounting methods, retention management, and prevailing wage requirements. According to CFMA’s 2024 Financial Benchmarker Executive Summary, best in class companies achieved a gross profit margin of 21.8% of total revenue. Look for providers who track WIP schedules, manage certified payroll, and handle union reports daily.

Your bookkeeping service must integrate seamlessly with construction management platforms like Procore, Buildertrend, and PlanGrid. QuickBooks Online alone won’t cut it – you need providers experienced with Deltek ComputerEase, Sage 100 Contractor, or similar construction-focused systems. Real-time job costing capabilities separate mediocre providers from exceptional ones.

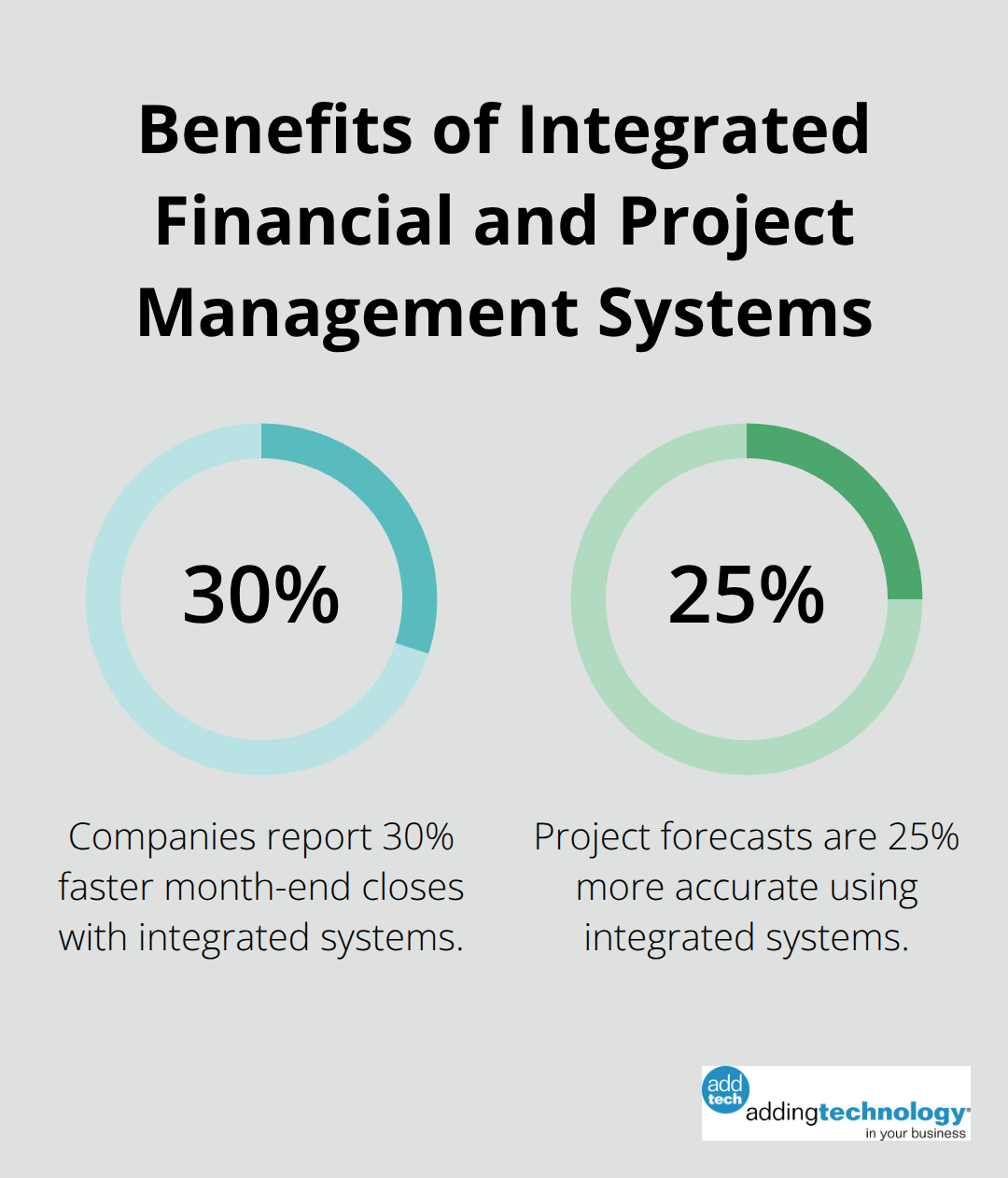

Your service should track labor, materials, and overhead costs by project phase (not just overall project totals). Companies that use integrated financial and project management systems report 30% faster month-end closes and 25% more accurate project forecasts.

Response time matters more in construction than other industries. Project decisions happen fast, and financial questions can’t wait three days for answers. Demand providers who respond to urgent requests within four hours on business days. Monthly reports should include job-specific profit and loss statements, cash flow projections by project, and variance analysis that compares actual costs to estimates. Providers who send generic financial statements without construction-specific metrics waste your time and money.

Your bookkeeping partner should provide instant access to project financials through dashboards and mobile apps. Construction projects move quickly, and you need current data to make informed decisions about labor allocation, material purchases, and change orders. The best providers offer cloud-based systems that update automatically as transactions occur (eliminating the delays that plague traditional monthly reports). This immediate visibility helps you spot cost overruns before they damage project margins and allows you to adjust strategies mid-project.

These foundational requirements set the stage for evaluating specific providers, but you’ll need to ask the right questions to separate qualified candidates from those who simply claim construction expertise.

The right questions expose whether a provider truly understands construction finance or just claims they do. Ask for specific client examples: How many construction companies between $1M and $50M do you currently serve? Request contact information for three clients who have used their services for over two years. Legitimate providers gladly share references because satisfied construction clients become their best marketing tool. Demand to see sample job costing reports they generate monthly. Generic profit and loss statements signal inexperience, while detailed cost breakdowns by project phase demonstrate real construction knowledge.

Test their experience with direct questions about their construction portfolio. How many years have you specialized in construction accounting? What percentage of your client base consists of contractors, subcontractors, and construction service companies? Ask for specific examples of challenges they’ve solved for construction clients. Can you describe how you helped a client recover from a failed job costing system? Their answers should include concrete examples of retention management, certified payroll processing, and bonding company interactions (not vague promises about “understanding construction”).

Test their communication commitment with direct questions about response guarantees. How quickly do you respond to urgent financial questions during project crises? The answer should be four hours maximum on business days. Ask about their schedule: Do you provide weekly cash flow updates during peak construction seasons? Monthly reports alone leave you blind when project costs spiral. Inquire about their experience with bonding companies and banks. Can you prepare financial statements that meet bonding agent requirements within 48 hours? Providers who hesitate or seem uncertain about these timelines lack the construction-specific experience your projects demand.

Construction tax requirements differ significantly from other industries, and your provider must demonstrate expertise in prevailing wage reports, certified payroll, and union compliance. Ask specific questions: How do you handle retention accounting for tax purposes? Can you manage multi-state tax filings for projects across different jurisdictions? Their answers should include references to percentage-of-completion method implications and strategies for timing revenue recognition to minimize tax liability. Request examples of how they handle equipment depreciation under Section 179 and bonus depreciation rules.

These questions separate qualified providers from those who simply claim construction expertise, but certain warning signs should immediately eliminate candidates from consideration.

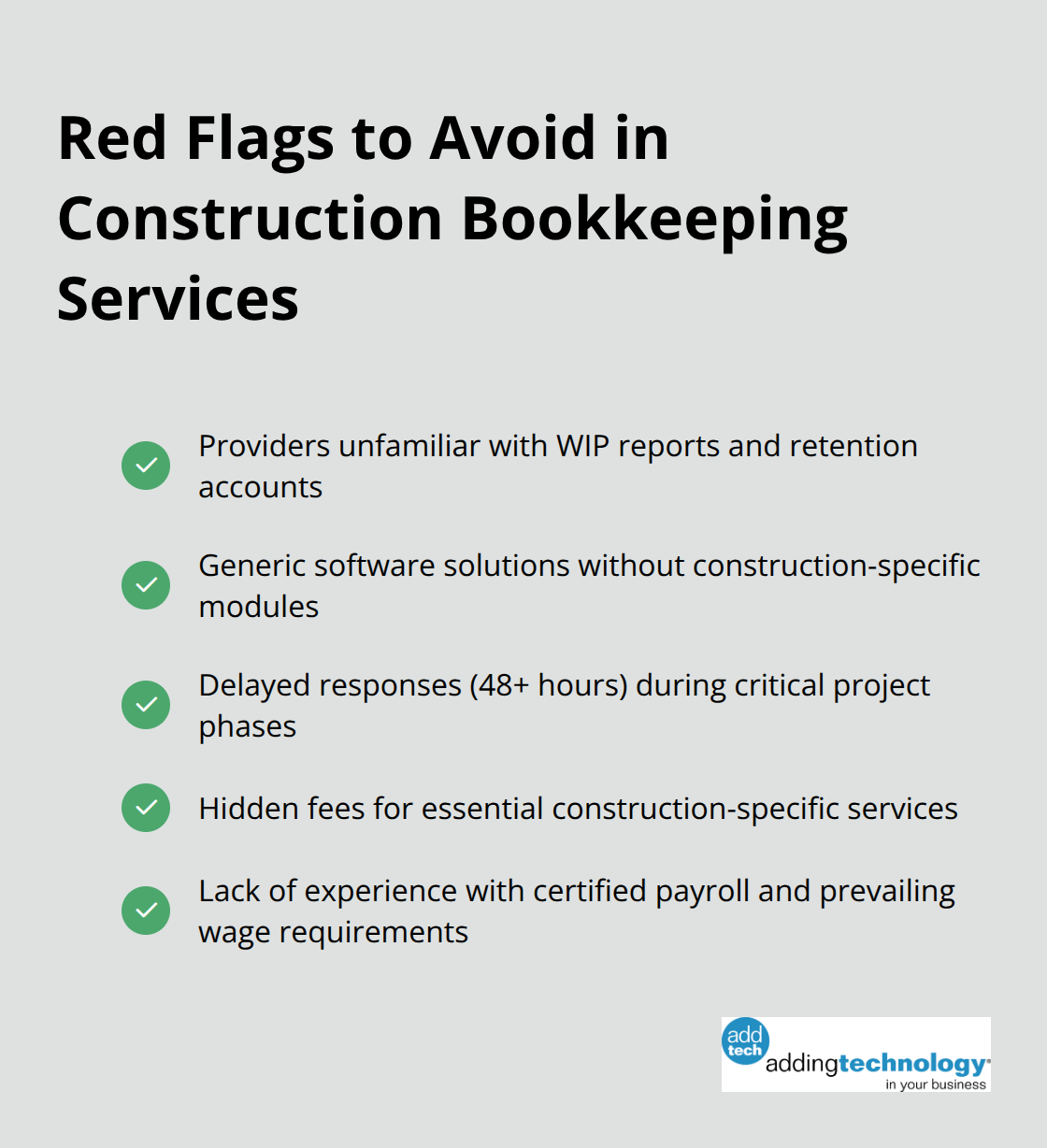

Providers who claim construction expertise but can’t explain the difference between WIP reports and standard accrual accounts lack the specialized knowledge your projects demand. Contractors waste months with bookkeepers who treat construction jobs like retail inventory. Red flags include providers who suggest basic QuickBooks without construction-specific modules, those unfamiliar with retention accounts, or services that can’t explain percentage-of-completion revenue recognition. Companies with inadequate financial systems experience higher project cost overruns than those with proper construction accounts.

Run from providers who offer one-size-fits-all solutions or those who primarily serve restaurants, retail, or professional services. Construction requires specialized cost codes that track labor by trade, materials by project phase, and equipment costs by job site. Providers who suggest standard chart of accounts templates don’t understand your industry. Test their knowledge: Ask how they handle certified payroll reports for Davis-Bacon projects or retention release procedures. Legitimate construction bookkeepers discuss these topics confidently with specific examples from current clients.

Construction moves fast, and financial questions can’t wait days for answers. Providers who take 48+ hours to respond to urgent requests during active projects will cost you money. Material purchase decisions, change order approvals, and subcontractor payments require immediate financial clarity. Services that operate on traditional monthly cycles without real-time project data leave you blind when costs spike unexpectedly. Demand four-hour response times for urgent matters and weekly financial updates during peak construction seasons (not monthly summaries that arrive too late).

Avoid providers who quote low monthly fees but charge extra for job cost reports, WIP schedules, or bond company financials. Construction bookkeepers include these services as standard requirements, not optional add-ons. Legitimate providers quote comprehensive packages that cover all construction-specific needs upfront. Hidden fees for certified payroll process, multi-state tax files, or rush financial statements signal inexperience with construction accounts demands. Request detailed prices that include all services you’ll need throughout typical project cycles (including peak season support).

Construction bookkeeping services require three essential elements: industry expertise, technology integration, and communication standards. Your provider must demonstrate experience with percentage-of-completion methods, retention management, and real-time job costing capabilities. Response times under four hours for urgent requests and weekly financial updates during active projects separate qualified providers from generic services.

The wrong choice costs construction companies 2-9% of their revenue annually through poor financial management. The right partner transforms project profitability by providing accurate WIP reports, certified payroll processing, and bonding company support. Avoid providers who offer cookie-cutter solutions, delayed responses, or hidden fees for construction-specific services.

Start your search by requesting client references from construction companies similar to your size and project types. Test their knowledge with specific questions about retention practices and prevailing wage compliance (these topics reveal true construction expertise). Adding Technology provides construction financial management solutions that help contractors maintain compliance while improving operational efficiency.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.