Selecting the right financial data management platform can make or break your company’s financial operations. Poor choices lead to data silos, compliance headaches, and wasted resources.

We at adding technology have seen businesses transform their financial workflows with the right platform selection. The key lies in evaluating specific features, performance metrics, and long-term costs before making your decision.

Real-time data processing stands as the most important feature in any financial data management platform. Companies that use advanced data analytics are 23 times more likely to acquire customers. Your platform must process transactions, update balances, and generate reports within seconds, not hours. Look for platforms that offer sub-second query response times and can handle concurrent user sessions without performance drops.

Seamless integration with your existing accounting and ERP systems determines platform success more than any other factor. Platforms should connect with QuickBooks, SAP, Oracle, and Microsoft Dynamics without custom code requirements. The best platforms offer pre-built connectors that sync data automatically every 15 minutes or less. Test integration speed during demos – if data takes more than 5 minutes to appear across systems, the platform will create bottlenecks. Strong APIs enable custom integrations when standard connectors fall short.

Financial data platforms must meet SOC 2 Type II certification and maintain ISO 27001 compliance at minimum. End-to-end encryption, multi-factor authentication, and role-based access controls protect sensitive information. The platform should offer audit trails that show exactly who accessed what data and when. Look for providers that undergo quarterly penetration testing and maintain 99.9% uptime guarantees. Data residency options matter for international businesses – choose platforms that store data in your preferred geographic regions to meet local regulations.

Modern platforms prioritize intuitive interfaces that reduce training time and boost team productivity. Drag-and-drop functionality allows users to create custom reports without technical expertise. Mobile accessibility enables finance teams to access critical data from anywhere (especially important for remote work environments). The platform should support multiple user roles with customizable dashboards that display relevant metrics for each team member.

These core features form the foundation of effective financial data management, but platform performance and reliability metrics reveal how well these features actually function in practice.

Performance metrics separate functional platforms from exceptional ones. Data accuracy rates should exceed 99.95% with automated error detection that flags discrepancies within 30 seconds. Processing speed becomes critical during month-end closings when your team processes thousands of transactions simultaneously. Test platforms during peak usage periods – query response times must remain under 2 seconds even with 100+ concurrent users. Gartner research shows that companies lose $5,600 per minute during system downtime, making reliability non-negotiable for financial operations.

Verify accuracy rates through independent testing with your actual financial data samples. The platform should detect duplicate entries, flag unusual transactions, and validate data formats automatically. Processing speed tests reveal platform limitations under real-world conditions. Run simultaneous report generation, data imports, and user queries to measure performance degradation.

Monitor response times during different hours – some platforms slow significantly during peak business hours when multiple clients access servers simultaneously.

Demand 99.9% uptime guarantees with financial penalties when providers fail to meet commitments. Review historical performance data spanning at least 24 months to identify patterns in outages or slowdowns. The best platforms maintain redundant data centers across multiple geographic regions and offer automatic failover within 60 seconds. Check maintenance windows – scheduled downtime should occur outside business hours and never exceed 4 hours monthly. Request detailed incident reports from the past year to understand how quickly providers resolve technical issues and communicate with customers during problems.

Test platforms with data volumes 10 times larger than your current requirements to assess future readiness. Processing capabilities should scale linearly – doubling your transaction volume should not quadruple processing times. Cloud-based platforms typically handle growth better than on-premise solutions, but verify auto-scaling features work automatically without manual intervention. Storage costs should scale predictably as data grows (avoid platforms with sudden price jumps at specific volume thresholds). Monitor memory usage and CPU performance during stress tests to identify potential bottlenecks before they impact daily operations.

Performance testing reveals the true capabilities of financial platforms, but understanding the total cost of ownership requires a deeper analysis of implementation expenses and long-term value creation.

Implementation costs for financial data management platforms vary significantly depending on data complexity and integration requirements. Enterprise platforms like SAP or Oracle demand higher upfront investments but offer comprehensive features, while mid-market solutions typically cost $25,000 to $75,000 for initial setup. Factor in data migration expenses, which average $5,000 to $25,000 for businesses with complex financial histories. Training costs add another $3,000 to $15,000 per platform, though this investment pays dividends through faster user adoption and reduced support tickets.

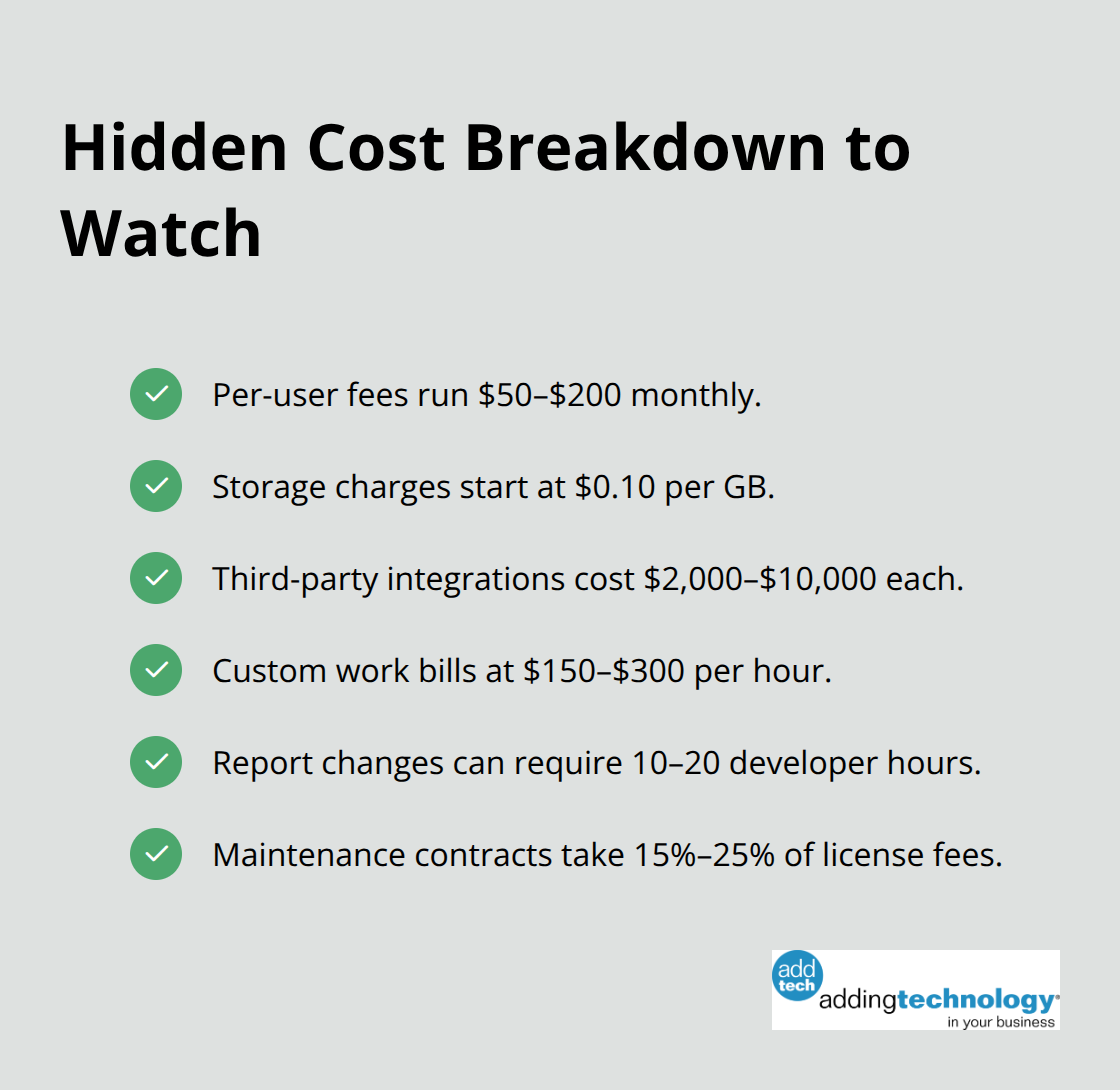

Subscription fees appear straightforward but escalate quickly with user additions and data volume growth. Most platforms charge $50 to $200 per user monthly, plus storage fees that start at $0.10 per gigabyte. Third-party integration costs often surprise buyers – expect $2,000 to $10,000 per additional system connection beyond standard offerings. Customization requests typically cost $150 to $300 per hour, and simple report modifications can require 10 to 20 hours of development time.

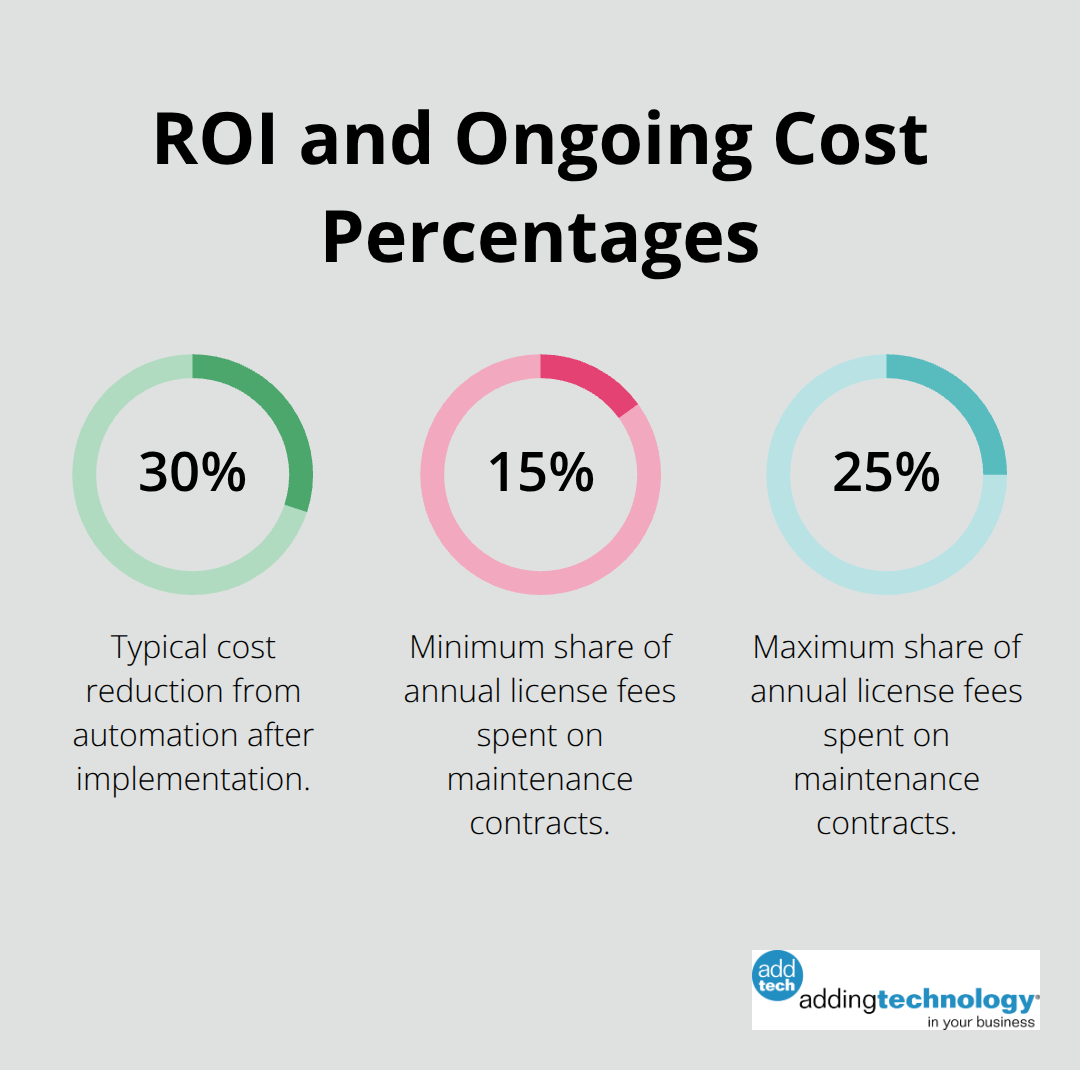

Maintenance contracts consume 15% to 25% of your annual license fees, covering updates and basic support that should be included by default.

Platform providers structure pricing to maximize long-term revenue through escalation clauses and feature restrictions. Basic plans often exclude essential features like automated reporting or advanced analytics (forcing upgrades within months of implementation). User seat pricing creates budget pressure as teams grow – a 50-person finance department pays $2,500 to $10,000 monthly just for access rights. Data storage costs compound annually as historical records accumulate, with some providers charging premium rates for data older than 24 months.

Measure efficiency gains through concrete metrics rather than vague productivity claims. Companies typically reduce month-end closing time from 10 days to 3 days after platform implementation, saving approximately 56 hours of staff time monthly. Automated financial processes can reduce costs by more than 30 percent within implementation timeframes. Calculate hourly savings by multiplying reduced manual work hours by average finance team salaries – most businesses save $25,000 to $75,000 annually through automation alone.

Track error reduction rates, as financial mistakes cost companies an average of $2,500 per incident according to Aberdeen Group data. Platforms that achieve 99.9% accuracy eliminate costly reconciliation errors and regulatory penalties that can reach six figures for compliance violations.

The right financial data management platform transforms your company’s operations through real-time processing, seamless integrations, and enterprise-grade security. Performance metrics reveal platform quality – demand 99.95% data accuracy and sub-second response times from any serious contender. Cost analysis must account for hidden expenses like user licensing, storage fees, and customization charges that often double initial budgets.

Thorough testing with actual financial data under peak conditions prevents costly implementation failures. Companies that skip comprehensive evaluation face operational disruptions and budget overruns within months of deployment. Request uptime records spanning 24 months, conduct stress tests with 10x your current data volume, and verify all integration capabilities work flawlessly before contract signature.

Success requires detailed implementation plans, comprehensive staff training, and continuous performance monitoring after deployment. We at adding technology help businesses navigate complex financial system transformations and achieve streamlined operations. Adding Technology specializes in accounting system renovations and technology integrations for companies seeking operational efficiency.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.