Construction projects require precise financial planning, especially when managing interest during construction project finance. Most builders struggle with tracking these costs accurately throughout the building phase.

We at adding technology see this challenge daily in our work with construction companies. Poor interest calculations can derail project budgets and reduce profitability significantly.

Construction loans operate fundamentally differently from traditional mortgages, which creates unique interest calculation challenges that most builders underestimate. Unlike standard mortgages where you pay interest on the full loan amount from day one, construction loans only charge interest on funds actually drawn during each phase of the project. This means your monthly interest payments start small and gradually increase as more funds are disbursed, which creates a variable payment structure that requires careful tracking.

The timing of fund draws directly impacts your total interest costs throughout the construction period. Most construction loans follow a predetermined draw schedule tied to completion milestones, with typical draws at foundation completion, framing, roofing, and final stages. Each draw triggers interest charges only on the newly disbursed amount plus any previously drawn funds.

For example, if you draw $50,000 for foundation work at a 7.5% annual rate, your monthly interest payment starts at approximately $312. When you draw another $75,000 for framing (bringing your total to $125,000), your interest jumps to about $781 monthly. This compounding effect means projects with longer construction phases face significantly higher total interest costs, which makes timeline management a financial priority.

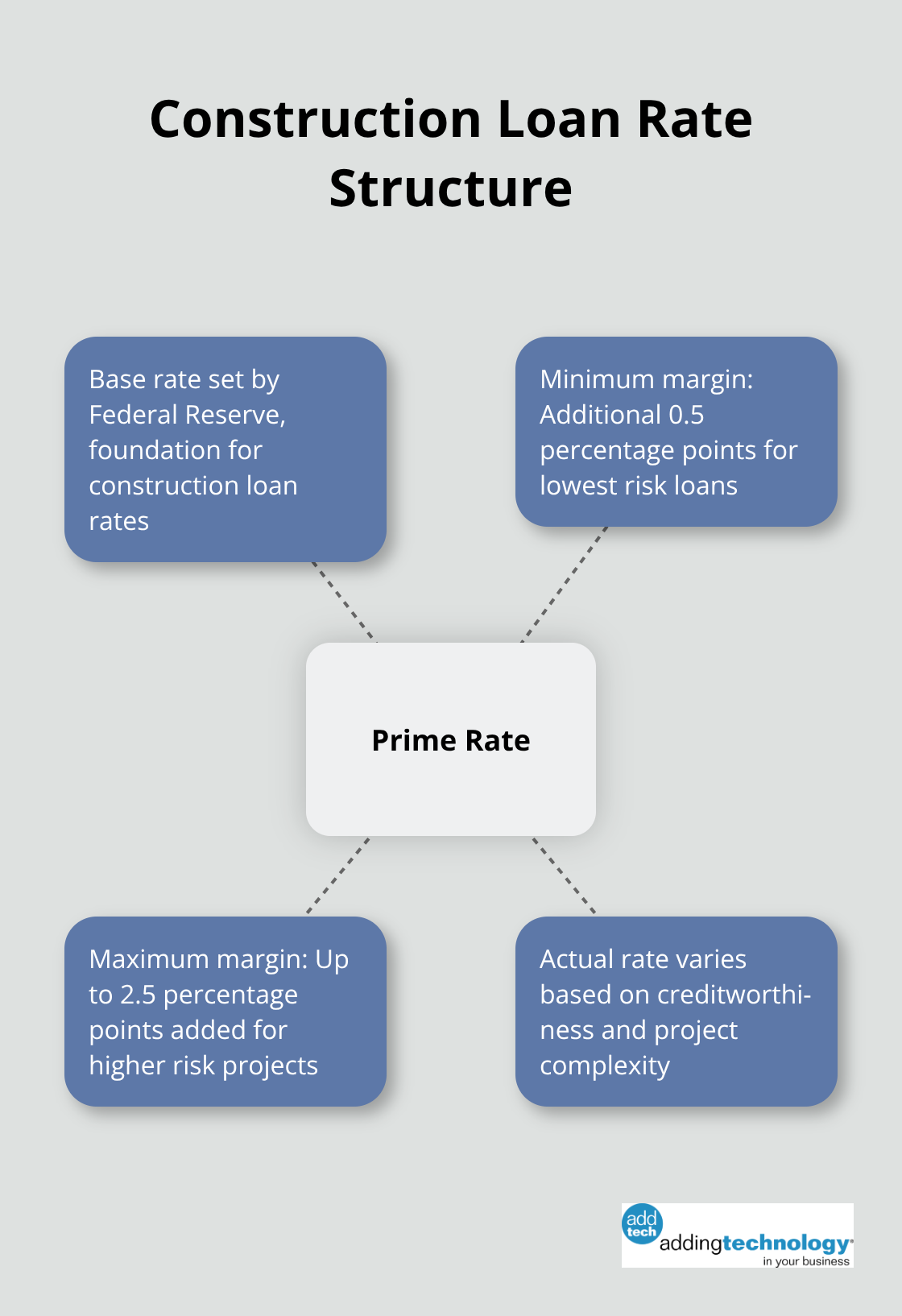

Construction loan rates tend to be higher than traditional mortgage rates due to their short-term nature and the risk associated with construction loans. Variable rate structures dominate this market, with most loans tied to prime rate plus a margin from 0.5% to 2.5% depending on your creditworthiness and project complexity.

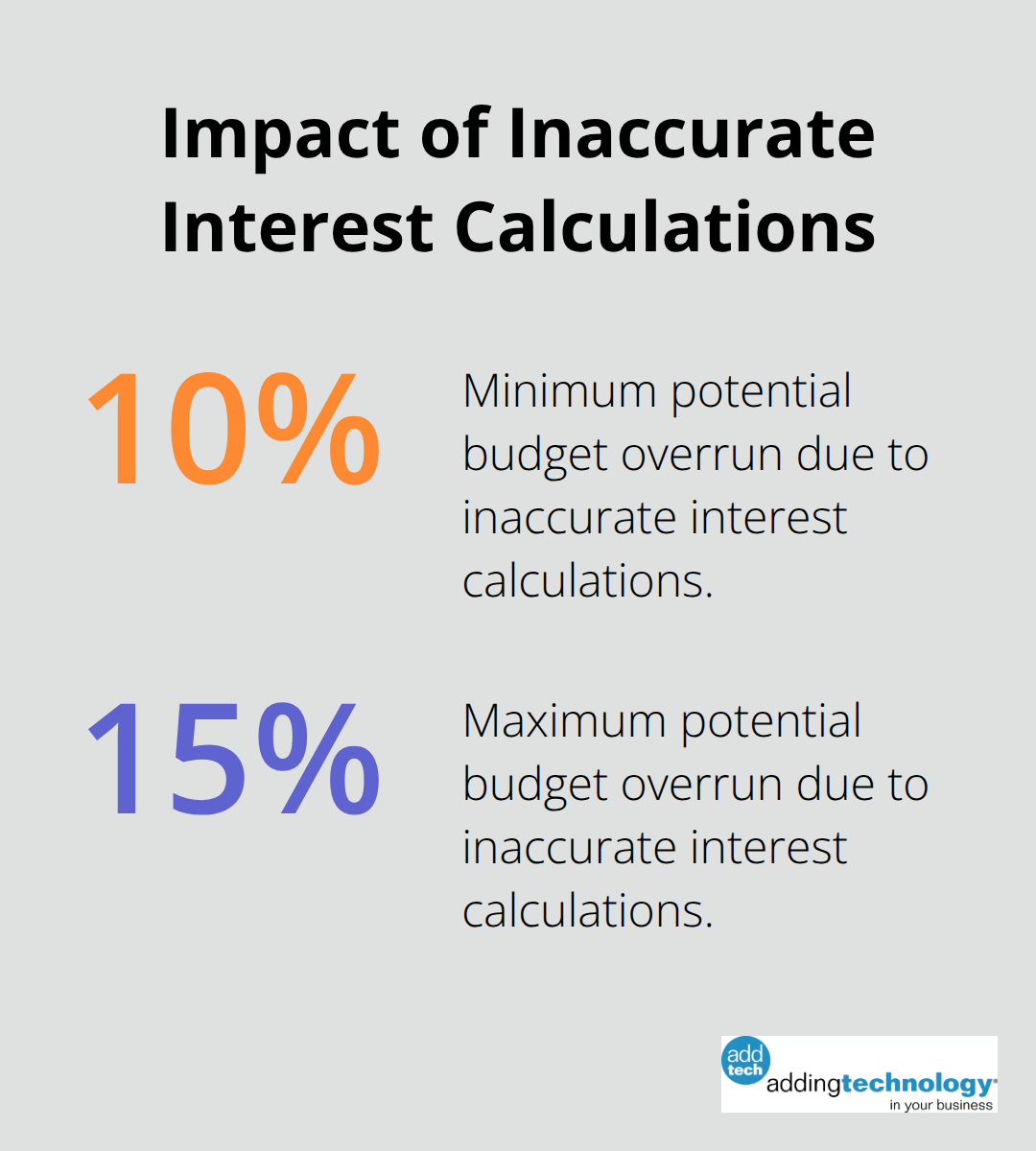

The Federal Reserve’s rate changes directly affect your monthly payments, which makes rate forecasting essential for accurate budgeting. Construction periods that extend beyond 12 months often trigger rate adjustments or conversion requirements, potentially increasing your costs by 10-15% of the total project budget when interest compounds over extended timelines.

Construction loan payments fluctuate based on the amount drawn each month rather than a fixed payment schedule. You calculate monthly interest by multiplying the outstanding loan balance by the annual interest rate, then dividing by 12. This calculation method means your payments increase incrementally with each draw, creating cash flow challenges that traditional mortgage payments don’t present.

The next step involves understanding the specific formulas and methods that construction professionals use to calculate these variable interest costs accurately. Creating a separate ledger for interest costs related to each project simplifies tracking and ensures accurate capitalization throughout the construction phase.

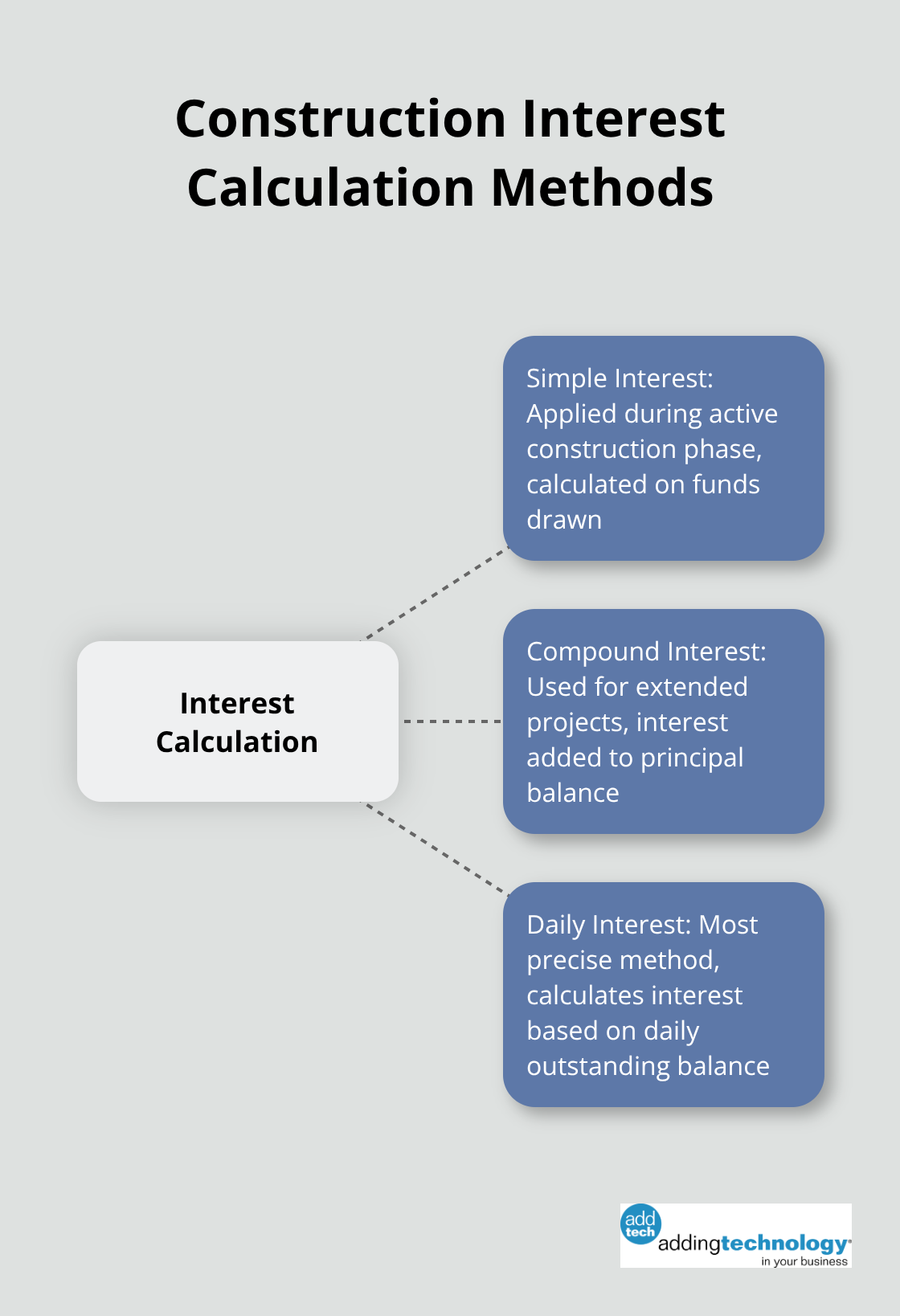

Construction interest calculations demand three distinct approaches based on your loan structure and project timeline. The standard simple interest formula multiplies your outstanding balance by the annual interest rate divided by 12 for monthly calculations. For a $200,000 draw at 8% annually, your monthly interest equals $1,333. This basic calculation works only when you maintain a constant balance throughout the month, which rarely happens in construction projects where draws occur at different intervals.

Most construction loans apply simple interest calculations during the active construction phase. You pay interest only on funds actually drawn, with monthly payments that increase as you access more capital. This structure benefits builders because you avoid interest charges on unused loan capacity. The calculation remains straightforward: multiply your current outstanding balance by your annual rate, then divide by 12. Projects with consistent monthly draws find this method most predictable for cash flow planning.

Compound interest scenarios emerge when interest payments face deferral or capitalization into the loan principal. Construction projects that extend beyond 18 months often encounter compound interest situations where unpaid interest gets added to the principal balance. This creates interest charges on previously accrued interest, which can increase your total project costs significantly. Projects funded through Special Purpose Vehicles can issue bonds to raise additional capital at more favorable borrowing rates, making compound interest calculations mandatory for accurate cost projections.

Your draw schedule directly controls interest accumulation patterns and represents the most controllable factor in construction finance costs. Front-loaded draw schedules where you request larger amounts early create higher interest burdens throughout the project timeline. Smart builders structure draws to match actual cash needs rather than milestone percentages, reducing average daily balances and minimizing total interest costs. A project that draws $100,000 monthly over 10 months pays significantly less interest than one that draws $300,000 in month three and $700,000 in month eight, even with identical total amounts.

Calculate interest on a daily basis when draws occur mid-month for maximum accuracy. Use the formula of outstanding balance multiplied by daily rate multiplied by days outstanding. This precision prevents overpayment and provides accurate budget tracking for projects with irregular draw patterns. The daily rate equals your annual rate divided by 365 (or 360 for some lenders), giving you exact interest costs regardless of draw timing.

Modern accounting software and specialized tracking systems can automate these calculations and provide real-time visibility into your interest costs as they accumulate.

Construction professionals need specialized software that handles the unique complexity of variable interest calculations and draw schedules. Generic accounting programs fail because they cannot automatically adjust interest calculations based on fluctuating loan balances or track multiple draw dates within single billing periods.

Procore leads the construction-specific software market with integrated financial modules that calculate daily interest rates and automatically update costs when new draws occur. Their system connects directly with most major construction lenders and updates interest calculations in real-time as funds get disbursed.

QuickBooks Desktop Premier with construction-specific add-ons provides a more affordable alternative, though it requires manual input for draw schedules and interest rate changes.

Excel remains the most flexible tool for construction interest calculations when projects involve complex draw schedules or unusual rate structures. Create separate worksheets for each loan with columns for draw date, amount, outstanding balance, daily interest rate, and cumulative interest costs.

The formula =Outstanding_BalanceAnnual_Rate/365Days calculates precise daily interest charges. Monthly reconciliation tabs compare calculated interest with lender statements to catch discrepancies early.

Advanced users can build dynamic models that forecast interest costs based on projected draw schedules, which helps identify optimal timing for fund requests. These templates work particularly well for projects under $2 million where specialized software costs exceed the benefits.

Projects that exceed $5 million benefit from integrated systems that connect accounting software directly with construction management platforms and lender portals. Sage 300 Construction and Real Estate offers automatic interest capitalization features that comply with ASC 835-20 accounting standards while it tracks costs across multiple funding sources.

The system updates interest calculations within 24 hours of draw approvals and generates reports that satisfy both internal management and external auditor requirements. Foundation Software provides similar capabilities with stronger project management integration, which allows interest costs to flow directly into job costing modules.

These systems typically reduce interest calculation errors by 90% compared to manual methods while they provide audit trails that satisfy lender requirements (essential for projects with multiple funding sources). Modern accounting software helps construction companies maintain precise records and ensures accurate financial reporting throughout the construction process.

Construction professionals who master interest during construction project finance calculations gain significant competitive advantages through better cost control and cash flow management. Simple interest formulas handle most standard projects, while compound interest scenarios require more advanced calculation methods. Strategic draw schedule timing reduces total interest costs and protects profit margins from unexpected financial burdens.

Accurate interest calculations prevent budget overruns that typically consume 10-15% of total project costs. Projects with precise tracking maintain stronger cash flow control and avoid the financing gaps that cause completion delays. Poor calculation methods create unexpected expenses that damage profitability and strain important contractor relationships.

Excel templates serve smaller projects under $2 million effectively, while specialized software like Procore or Sage 300 handles larger developments with complex requirements. We at adding technology provide construction accounting solutions that help contractors implement these systems successfully. Our team focuses on financial process optimization so construction companies can concentrate on what they do best while we handle the complex calculations and compliance requirements.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.