Sound financial management separates thriving construction companies from those struggling to survive. Poor financial oversight leads to 82% of business failures, according to U.S. Bank research.

At adding technology, we see companies transform their operations through strategic financial practices. This guide covers the essential components, proven strategies, and critical mistakes that determine your company’s financial success.

Modern construction companies need accounting software that tracks every transaction in real-time. QuickBooks Construction and Sage 300 handle complex job costing better than general business software.

Companies using specialized construction accounting platforms avoid the errors found in 90% of spreadsheets. Daily transaction recording prevents the cash flow disasters that hit 60% of construction firms (according to Associated General Contractors research). Your records must separate direct costs, overhead, and profit margins for each project. Manual tracking leads to cost overruns that average 27% per project based on McKinsey data.

Construction companies face payment delays, with 60% of businesses reporting lower payments when projects aren’t completed on time and under budget. Smart contractors create 13-week rolling cash flow forecasts that account for retainage, change orders, and seasonal variations. Track your accounts receivable aging weekly and implement automated billing systems that send invoices within 24 hours of milestone completion. Companies that use automated payment reminders collect payments 31% faster than those that rely on manual follow-ups. Monitor your cash conversion cycle monthly and negotiate payment terms that align with your project schedules.

Project budgets must include 8-12% contingency reserves for unforeseen costs (based on Construction Industry Institute guidelines). Break down budgets by work breakdown structure elements rather than broad categories. This granular approach helps identify cost variances before they spiral out of control. Review budget performance weekly during active projects and monthly for overall company operations. Companies that implement real-time budget tracking reduce project overruns by 43% according to Procore research data.

These foundational systems create the framework for advanced financial strategies that construction companies need to maximize profitability and maintain competitive advantages in today’s market.

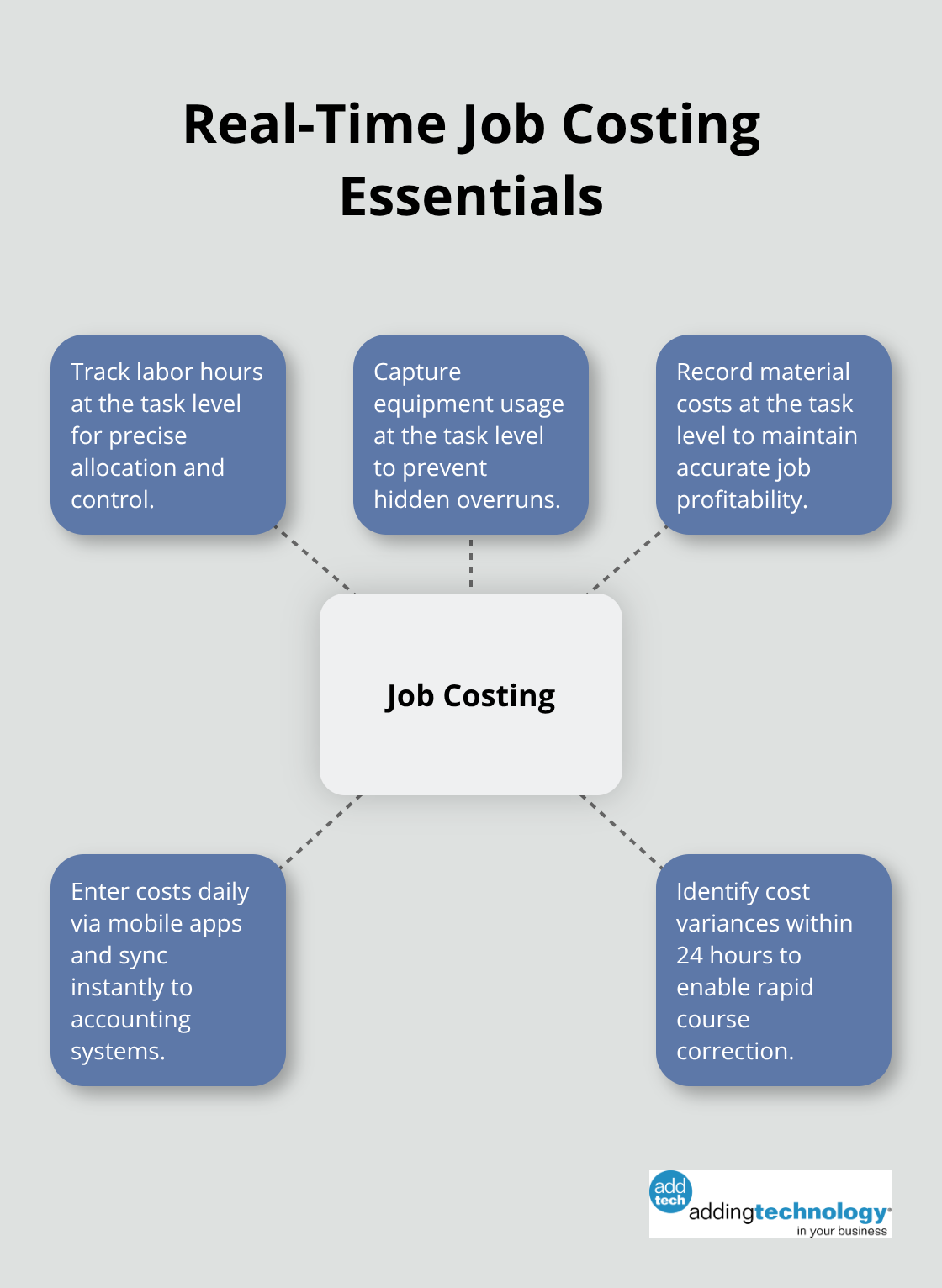

Construction companies that implement real-time job costing systems reduce project overruns by 35% according to Autodesk Construction Cloud data. Smart contractors use integrated platforms that connect field data directly to accounting systems, which eliminates the 48-72 hour delay found in manual cost tracking. Procore’s construction management software manages more than USD 1 trillion in projects annually across the US, with a user base growing at 30%.

Your job costing system must track labor hours, equipment usage, and material costs at the task level rather than project level. Field supervisors should input costs daily through mobile apps that sync with your accounting software instantly. This granular approach identifies cost variances within 24 hours instead of discovering overruns at month-end when corrections become expensive.

Modern construction accounting requires API connections between project management, payroll, and accounting systems. Companies that use integrated platforms like Sage Intacct Construction or Foundation Software report 67% fewer data entry errors compared to standalone systems. Your technology stack should automatically transfer approved timesheets to payroll, sync purchase orders with accounts payable, and update job costs without manual intervention.

Construction firms that use cloud-based financial systems access real-time reports from any location, which enables faster decision-making when projects face cost pressures. Compliance tracking becomes automatic when your systems maintain audit trails for prevailing wage requirements, certified payroll, and tax reporting obligations (mandated by federal and state regulations).

Field teams need mobile applications that capture costs at the point of work completion. Modern apps allow workers to scan material receipts, log equipment hours, and record labor time directly from job sites. This immediate data capture reduces the administrative burden on office staff and improves cost accuracy by 41% according to Construction Executive research.

Mobile solutions also enable photo documentation of work progress, which supports change order requests and protects against disputes. Project managers can approve costs remotely and maintain real-time visibility into project performance without constant site visits.

These real-time tracking capabilities form the foundation for comprehensive compliance management, which protects construction companies from regulatory penalties and audit complications.

Construction companies that monitor cash flow monthly instead of weekly face 73% higher bankruptcy rates according to Sage Research data. Most contractors track cash positions reactively and discover shortfalls only when payroll deadlines approach or supplier payments become overdue. This reactive approach creates emergency situations that cost companies an average of 4-6% more in interest rates compared to planned finance options.

Smart contractors implement daily cash position tracking and maintain 90-day forecasts that account for payment delays, retainage schedules, and seasonal fluctuations. Companies that track accounts receivable weekly collect payments 28% faster than those that use monthly reviews. Weekly monitoring prevents the cash flow disasters that force contractors into expensive emergency loans or supplier payment delays.

Manual cost tracking systems create dangerous blind spots that hide project overruns until damage becomes irreversible. Construction firms that use weekly or monthly cost updates miss critical variance signals that could prevent budget disasters. Projects tracked with real-time systems identify cost overruns within 48 hours, while manual systems often discover problems 3-4 weeks later when corrections become expensive or impossible.

Spreadsheet-based tracking contains errors in 90% of cases, which leads to inaccurate project profitability calculations. Modern construction companies use integrated platforms that capture labor, equipment, and material costs at the point of work completion through mobile applications. This immediate data capture eliminates the delays that turn minor variances into major financial problems.

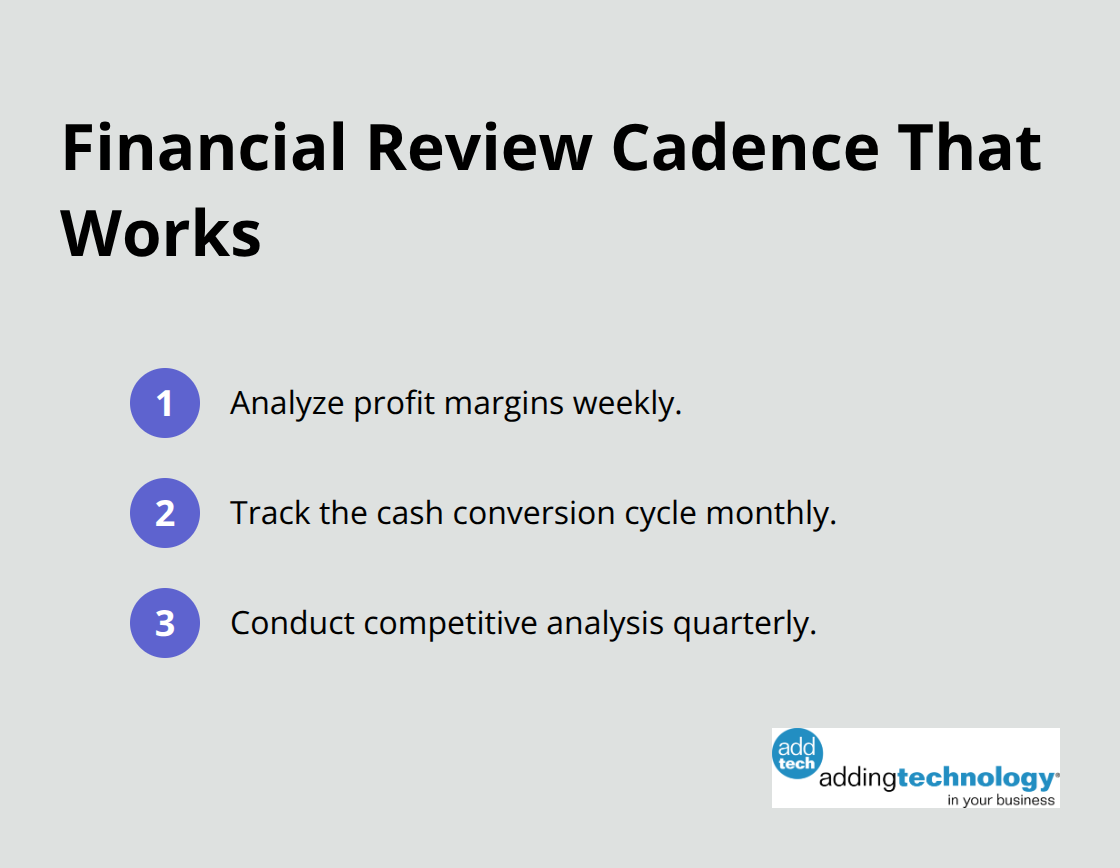

Construction executives who review financial statements only at month-end miss critical trends that affect profitability and competitiveness. Companies that analyze gross margins weekly identify profitable work categories and eliminate unprofitable services before they damage overall performance. Quarterly financial reviews arrive too late to influence current project decisions or next quarter’s strategies.

Construction firms need weekly profit margin analysis, monthly cash conversion cycle tracking, and quarterly competitive analysis to maintain financial health in volatile markets. Companies that wait for month-end reports lose opportunities to adjust pricing, renegotiate contracts, or redirect resources toward profitable projects.

Sound financial management transforms construction companies from reactive survivors into proactive market leaders. The data shows clear patterns: companies that implement real-time job costing reduce overruns by 35%, while those that track cash flow weekly face 73% lower bankruptcy rates than monthly trackers. Modern construction demands integrated systems that capture costs at the point of work completion and provide instant visibility into project performance.

We at adding technology see contractors struggle with spreadsheet errors, delayed cost recognition, and manual processes that hide critical financial signals. Professional financial management services eliminate the administrative burden that prevents contractors from focusing on profitable projects. Adding Technology offers specialized accounting solutions that streamline financial processes and provide real-time job costing capabilities tailored for construction operations.

Your next step involves evaluating current financial systems against industry benchmarks (companies that delay financial system upgrades lose competitive advantages in bidding accuracy and project profitability). Start with automated cost capture, implement weekly cash flow monitoring, and establish real-time budget tracking to build the financial foundation that supports sustainable growth. These strategic financial practices separate successful contractors from those that struggle to survive in today’s competitive construction market.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.