Construction contracts are where projects either succeed or spiral into disputes. At adding technology, we’ve seen countless projects derailed by vague terms, unclear payment schedules, and poorly defined scopes of work.

The right construction contract negotiation tips can protect your interests and keep projects on track. This guide covers the pitfalls to avoid and the strategies that actually work.

Payment terms and cash flow management in construction contracts are where most construction contracts fail. Contractors accept vague language around when they’ll receive money, and this creates a cash flow crisis that sinks entire projects. The typical construction cash flow gap is brutal: you pay suppliers upfront, handle weekly payroll, but clients pay 30 to 60 days later with retainage delays on top. Extending payment terms frees up more working capital for the average contractor, yet most negotiations skip this conversation entirely.

A mid-sized general contractor negotiated Net 45 terms with three suppliers and freed up about $180,000 to fund two additional projects without tapping a line of credit. The real mistake isn’t accepting standard terms-it’s failing to tie payments to concrete progress events. Use a milestone-based payment schedule that links each payment to measurable project progress like framing completion, drywall installation, or final inspection. This protects your cash flow and prevents disputes over whether work actually justifies payment.

Scope of work definition construction contracts is the second killer. Vague descriptions like “complete renovation” or “as needed” guarantee conflict. California law requires written contracts for home improvement work under Business and Professions Code § 7151, and for good reason-verbal agreements create exactly the kind of disputes that drain time and money. Define scope in detailed terms: specify exact tasks, materials, finishes, exclusions, and who supplies what.

Attach diagrams or plans when possible. Clarify who handles permits, site cleanup, and material sourcing upfront to avoid gaps that appear mid-project. These details transform a contract from a source of friction into a shared roadmap that all parties understand and accept.

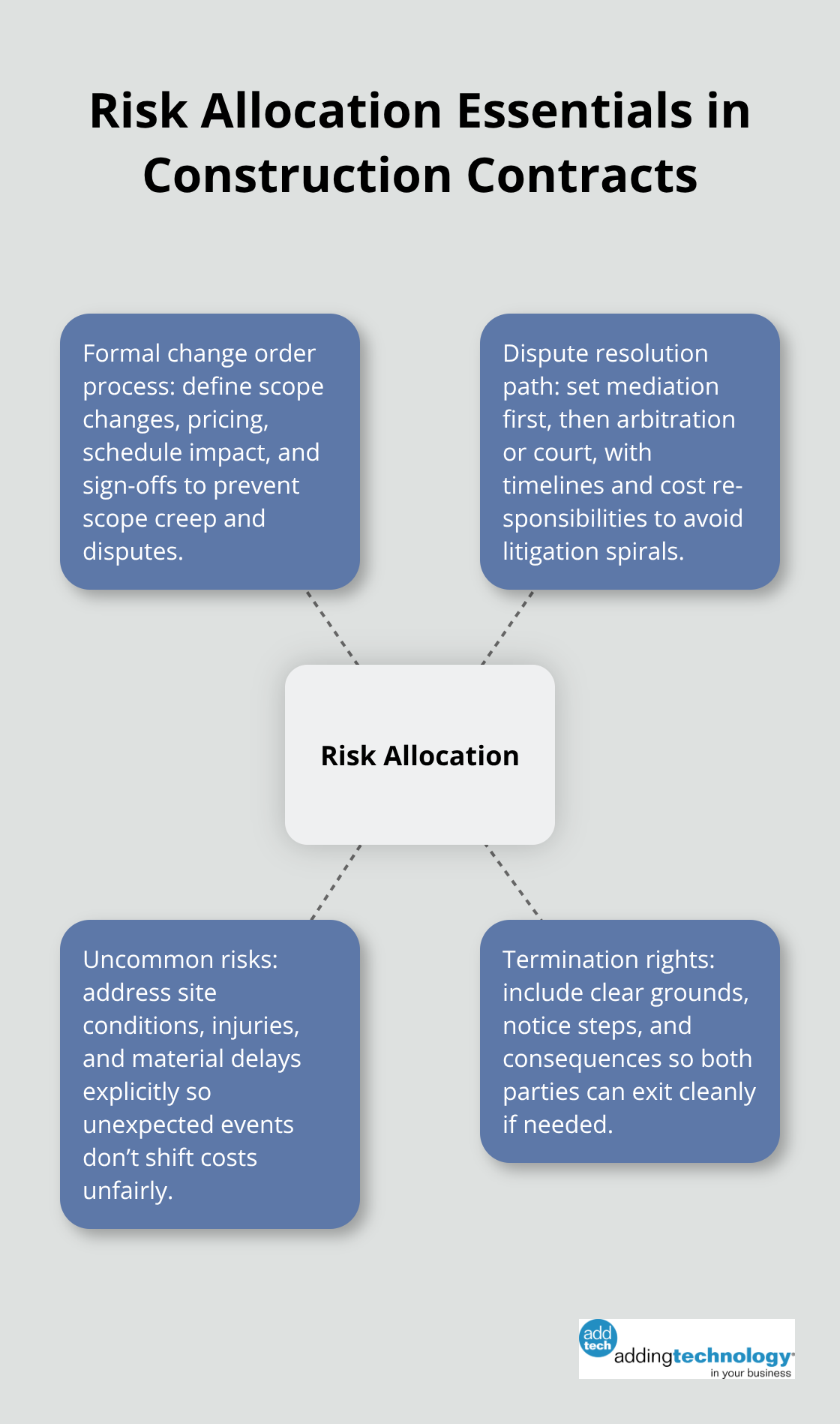

Risk allocation is the third mistake, and it’s where contractors lose leverage entirely. Uncommon risks like site conditions, injuries, or material delays need explicit handling in writing. Define a formal change order process that governs mid-project modifications with clear pricing, schedule impact, and sign-off requirements. Include a dispute resolution path-mediation, arbitration, or court-so conflicts don’t spiral into litigation.

Add termination rights with defined consequences and steps to exit cleanly. These three elements prevent the disputes that destroy project profitability and client relationships. Once you’ve locked down these fundamentals, the next step is building the relationships and documentation practices that actually enforce what you’ve negotiated.

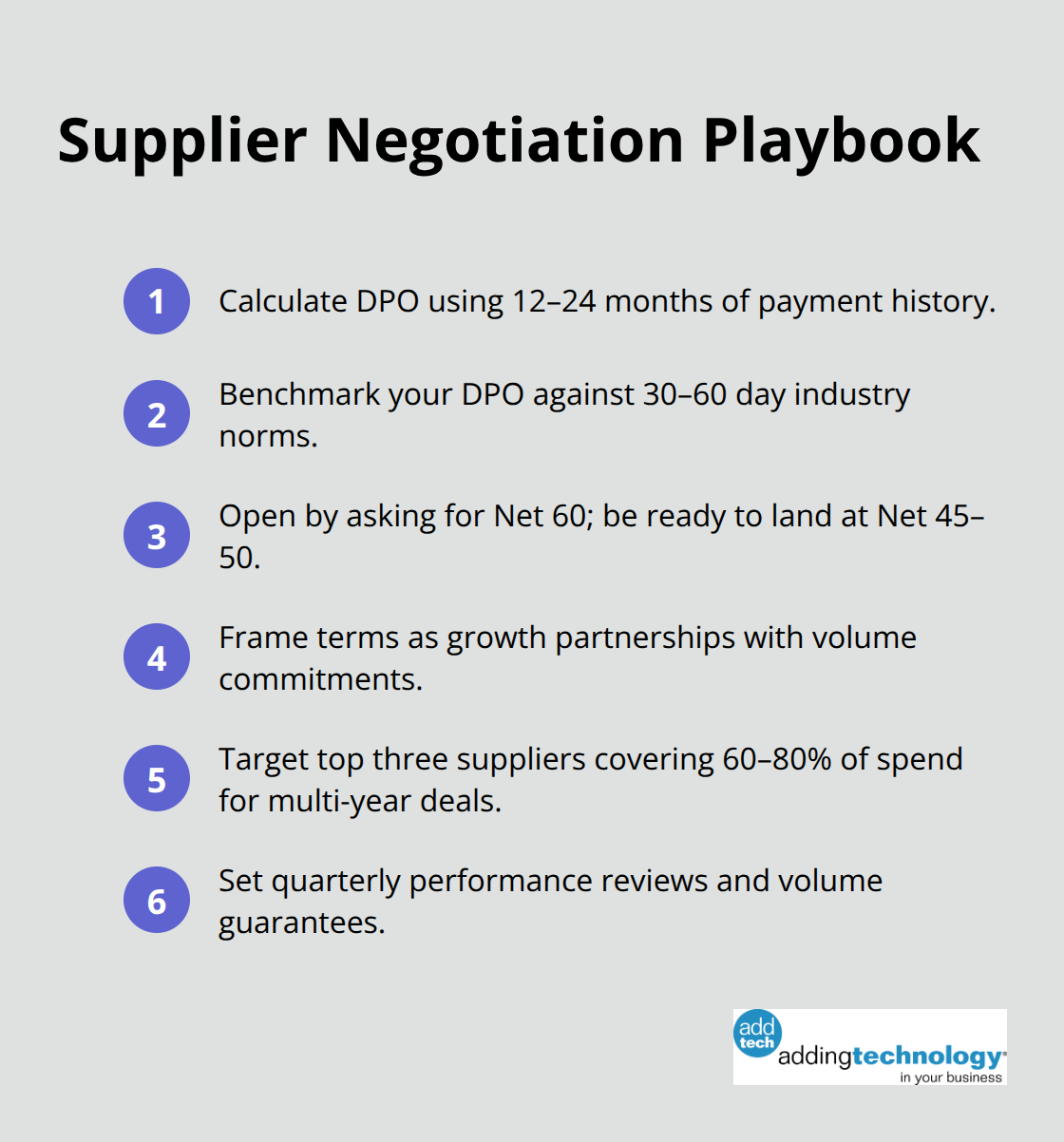

Relationships with suppliers and clients determine whether your negotiated terms hold up when pressure hits. Start relationship building before you sit down to negotiate by pulling 12 to 24 months of payment history data and calculating your Days Payable Outstanding (DPO). This metric shows where you stand: DPO equals Accounts Payable divided by Cost of Goods Sold, multiplied by the number of days. Industry benchmarks run 30 to 60 days, so comparing your actual performance against this range tells you where you have leverage. A contractor who paid suppliers in 35 days on average has real negotiating power when asking for Net 45 or Net 60 terms. Frame these conversations as growth partnerships, not demands. Propose that extended terms come with increased volume commitments and minimum monthly orders. For your top three suppliers that consume 60 to 80 percent of spending, pursue multi-year agreements with quarterly performance reviews and volume guarantees.

This approach shifts the conversation from you asking for a favor to both parties investing in a shared future.

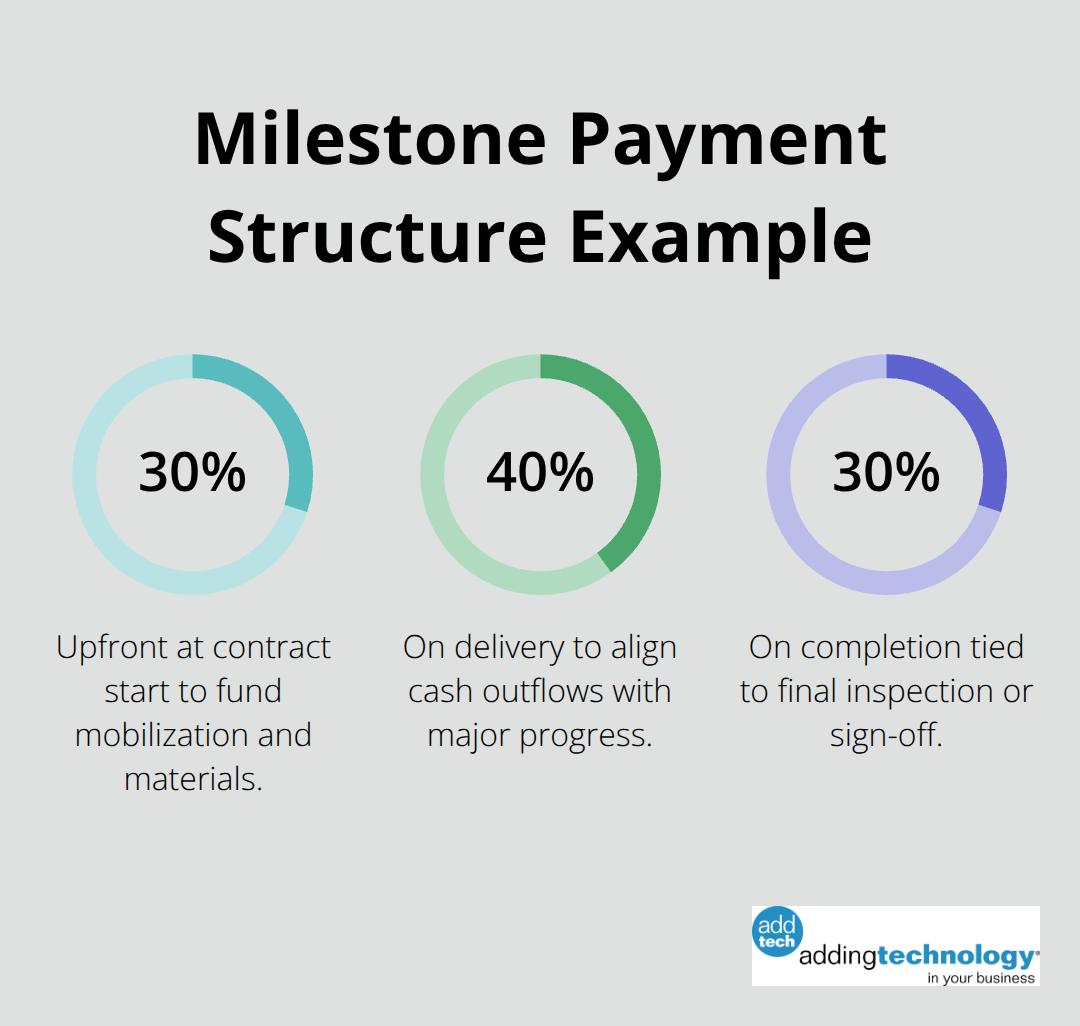

Written documentation separates successful negotiations from disputes that resurface months later. Specify Net 45 from invoice date, not just Net 45 with vague timing. Include payment methods (ACH, check, wire), discount structures like 2/10 Net 60 (two percent off if paid in ten days), late payment penalties, and grace periods. Set up automated payment reminders and designate a single approver to avoid bottlenecks that sabotage extended terms. When negotiating change orders, separate price discussion from payment terms timing. Lock in annual pricing first, then discuss payment terms two weeks later so suppliers don’t trade one concession for another. Propose creative payment structures like 30 percent upfront, 40 percent on delivery, and 30 percent on completion to align cash flow with actual work progress. A four-week trial period for new terms lets both parties test reliability before permanent adoption.

Realistic timelines fail when contractors underbid to win work. Overestimate rather than underbid, then build contingency into both cost and schedule to reduce negotiation stress later. Start negotiation with a request for Net 60 or better, knowing Net 45 or Net 50 becomes the compromise. Flag elements that are unusually complex or require custom parts early because these cause delays that derail timelines. When a deadline request seems impossible, state this directly instead of agreeing and failing later. Offer well-considered alternatives like phased completion or temporary solutions that keep the project moving. If state law restricts an element, propose compliant legal solutions instead of deadlocking. This honest, firm communication demonstrates expertise and prevents the false promises that destroy client relationships and project profitability. Once you’ve mastered these negotiation fundamentals, the next challenge is protecting your financial interests through retainage agreements and dispute resolution mechanisms that actually work when conflicts arise.

Retainage clauses trap most contractors because they accept vague language that lets clients hold 5 to 10 percent of each payment indefinitely. You’ve already paid suppliers and crews while the client controls your money. The typical construction cash flow gap means you front working capital for weeks or months with no relief. Specify that retainage applies only to the final payment, not to every milestone, or cap it at a percentage that won’t strangle cash flow during active construction. Tie retainage release to concrete milestones like final inspection sign-off or substantial completion within 30 days, not vague phrases like when the client feels satisfied.

Structure payment schedules around what you actually owe suppliers and crews. If you pay suppliers on Net 45 terms, your client payment should arrive no later than Net 40 to maintain working capital. A contractor who negotiated milestone-based payments tied to framing, drywall, and final inspection kept cash flowing consistently instead of facing the typical 60-plus day payment delay. This approach prevents the cash crunch that forces you to tap lines of credit or delay payroll. Link each payment directly to measurable progress so both parties understand exactly when money moves.

Include an explicit contingency for cost overruns in your contract by defining what triggers a change order and how pricing adjusts when unforeseen conditions appear. California’s home improvement law requires written documentation of any work beyond the original scope, so formalize this process with a change order template that specifies the scope addition, labor cost, material cost, timeline impact, and sign-off requirements from both parties. Build 10 to 15 percent contingency into your initial estimate and communicate this to the client upfront so change orders don’t become surprise negotiations mid-project. This transparency prevents disputes over whether additional work justifies additional payment.

Waiting until disputes happen guarantees expensive litigation that drains both time and money. Specify mediation as the first step, where a neutral third party helps both sides reach agreement without court involvement. Define which disputes go to mediation versus arbitration, set clear timelines for each step, and specify who pays for resolution costs. Include a clause stating that both parties continue performing their contract obligations during dispute resolution to prevent project shutdown. When disputes do occur, this structured approach keeps projects moving instead of grinding to a halt while lawyers argue in court.

Construction contract negotiation tips work only when you implement them consistently. The three mistakes we covered-vague payment terms, unclear scope, and poor risk allocation-appear in contracts across the industry because contractors rush negotiations instead of treating them as the foundation of project success. Strong contracts prevent the disputes that destroy profitability and client relationships.

The tactics that stick are the ones you document in writing and enforce consistently. Milestone-based payments tied to measurable progress protect your cash flow. Detailed scope definitions with attached plans eliminate the ambiguity that breeds conflict. Formal change order processes and dispute resolution mechanisms keep projects moving when problems arise (these aren’t theoretical best practices-they’re the difference between projects that run smoothly and projects that drain your resources fighting over who owes what).

Your negotiation process improves when you approach contracts as partnerships, not transactions. At adding technology, we work with contractors who struggle with cash flow because their contracts don’t align payments with their cost obligations. Adding Technology offers expert accounting and financial management services tailored for the construction industry, including real-time job costing and advanced technology integration that gives you visibility into project profitability before disputes happen.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.