Construction companies lose thousands monthly to fragmented financial systems. Spreadsheets, disconnected software, and manual data entry create blind spots that hurt profitability and cash flow visibility.

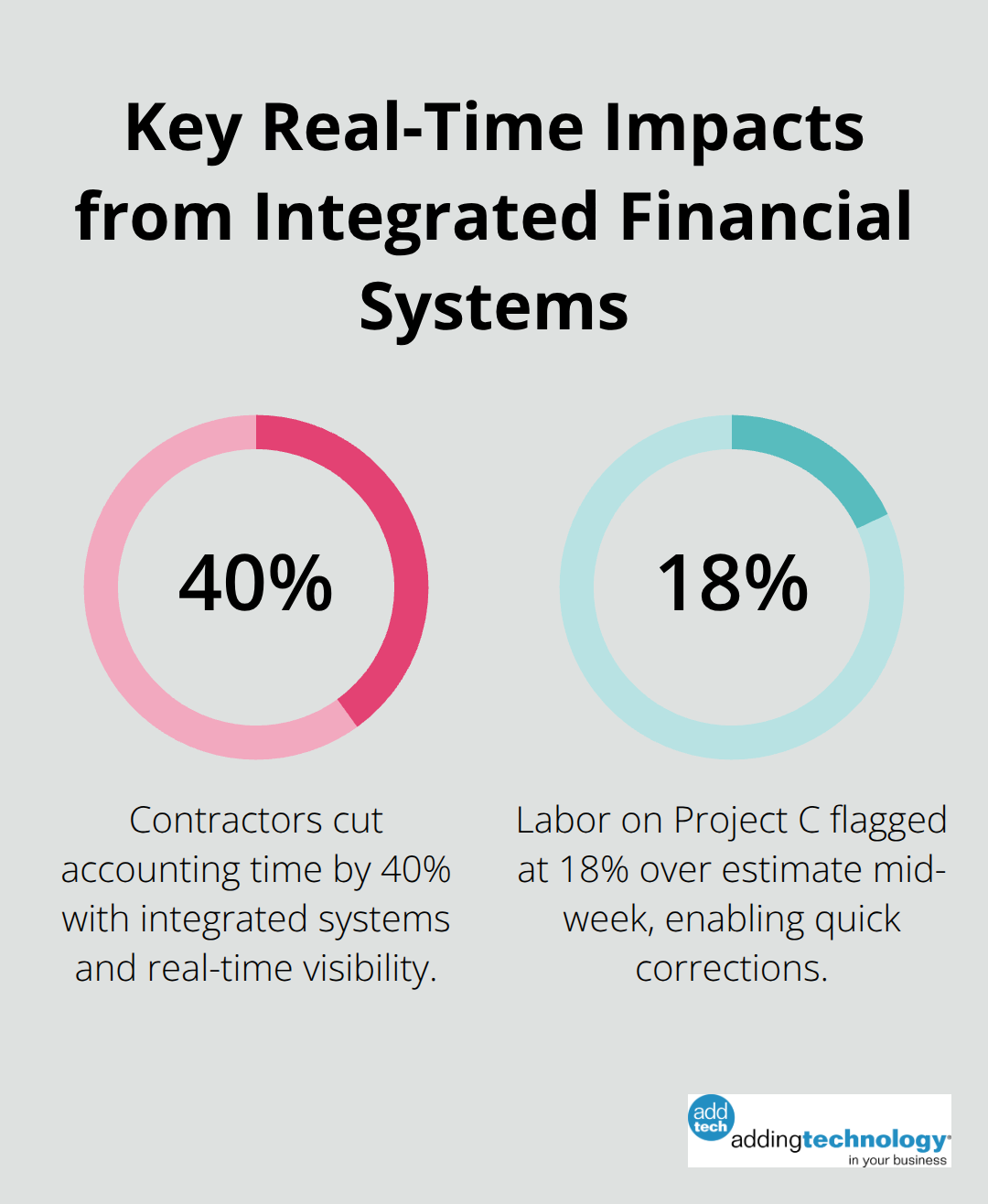

An integrated financial management system fixes this. At adding technology, we’ve seen contractors cut accounting time by 40% while gaining real-time project insights that actually drive better decisions.

The construction industry runs on complexity. Contractors juggle multiple projects, subcontractors, material suppliers, and equipment costs simultaneously. Yet most still rely on spreadsheets, email, and disconnected accounting software to track it all. This fragmentation creates real problems. When job costing data sits in one system, payroll in another, and project budgets in a third, nobody gets accurate answers fast. A contractor managing five concurrent projects might spend 15 hours weekly consolidating numbers across platforms before they can even assess profitability. Worse, the data becomes outdated the moment they compile it. Manual data entry introduces errors at every stage. A simple transposition error in a $50,000 invoice gets missed because the accounting team drowns in administrative work rather than reviewing actual numbers. Construction companies lose visibility into job costs in real time, which means they don’t know if a project runs over budget until weeks after problems started.

Cash flow management in fragmented systems becomes guesswork. Contractors don’t know what cash ties up in open invoices, what they owe suppliers, or what subcontractors expect to receive next week. This uncertainty forces companies to maintain higher cash reserves than necessary just to stay safe, which ties up capital that could fund growth or equipment. A contractor with $2 million in annual revenue might hold $300,000 in excess cash reserves simply because they can’t forecast accurately. Project profitability gets buried too. A project that looked profitable at bid time might hemorrhage money through scope creep, material waste, or labor inefficiencies, but the contractor won’t know until the final invoice gets issued. Real-time job costing helps contractors avoid profit drains by enabling immediate corrective actions. When contractors see that labor runs over estimate on a particular task type, they adjust staffing or methods on the next similar project immediately.

The accounting team disappears from operational work every month during close. Spreadsheet reconciliation, manual posting, and chasing down missing documentation consume days. For a 10-person construction company, this means 40 hours of lost productivity monthly just to produce financial statements. That’s nearly a full-time position spent on administrative work that doesn’t generate revenue. Integrated systems compress this timeline dramatically.

Automated reconciliation, real-time posting, and centralized data shrink month-end close from five days to one or two. That freed capacity lets the finance team focus on actual financial analysis instead of data hunting.

Fragmented systems hide the truth about your business. Project managers can’t see actual costs against budget without waiting for the accounting department to compile reports. Owners can’t answer basic questions about cash position without calling their accountant. Subcontractors and suppliers don’t get paid on time because invoices get lost in email chains or spreadsheet queues. An integrated financial management system is essential for achieving effective financial management in construction projects. Real-time data flows from the job site into accounting automatically. Cost overruns surface within days, not weeks. Cash position updates continuously, not monthly. Payment schedules stay on track because the system flags what’s due and when. This visibility transforms how construction companies operate and make decisions.

An integrated financial management system in construction pulls cost data directly from the job site into your accounting records automatically. When a crew logs hours, materials arrive, or equipment gets used, that information flows into one central system where it calculates real costs against your bid instantly. Contractors using real-time job costing catch budget problems within days instead of weeks. A roofing contractor managing ten concurrent projects sees that labor on Project C runs 18% over estimate by Wednesday afternoon, not after final invoicing. That speed matters because scope creep and inefficiencies compound fast. The moment you spot overage, you adjust crew size, methods, or scheduling on remaining work before losses pile up.

Real-time job costing also reveals which project types or task categories consistently underperform. If concrete foundation work runs over on three consecutive jobs, your system shows that pattern clearly. You then adjust future bids or methods for that work type. Without this visibility, you repeat the same profit drains across multiple projects annually.

Automated accounting features handle the administrative work that buries your finance team. When invoices arrive, the system matches them against purchase orders and receipts automatically. Payments to subcontractors and suppliers post without manual entry. Payroll integrates so labor costs flow directly to job codes without spreadsheet transfers. Bank reconciliation happens automatically as transactions clear.

A 15-person construction company spends roughly 30 hours monthly on manual data entry and reconciliation alone-that’s nearly a full week of lost productivity. Automation compresses this to under five hours. Compliance becomes built-in rather than something your accountant scrambles to verify. Tax classifications, wage and hour regulations, and financial reporting standards stay consistent across every transaction. You don’t have to worry about a misclassified expense creating audit problems six months later.

Construction contractors often think they need the most feature-rich system available. They don’t. What matters is whether data flows seamlessly between the functions you actually use. If your system doesn’t connect accounting to project management, you still maintain two separate views of project profitability. If it doesn’t link to banking, you still reconcile manually. If it doesn’t sync with payroll, labor costs get entered twice.

Integration matters more than individual features because disconnected pieces force you to manage multiple systems instead of one unified platform. The best system for your business depends on your project size, number of concurrent jobs, and growth plans. A contractor managing three small projects annually needs different functionality than one handling fifteen large commercial builds.

Start with the specific pain points you face today. Are you drowning in month-end reconciliation? Do project managers lack cost visibility? Are payments getting delayed because invoices disappear? Your answers determine what you actually need, not what vendors claim sounds impressive.

Integration with your existing tools means you don’t replace everything at once. Your system connects to the accounting software you use, the project management platform your crews rely on, and the banking system you already work with. Data flows between platforms without manual re-entry. A crew member entering actual labor costs in the field app automatically updates your job costing and accounting records. This eliminates the broken handoffs that plague fragmented systems and creates the foundation for choosing the right solution.

Most construction contractors fail at financial system implementation not because they chose the wrong software, but because they skipped the planning phase. You need three things before you sign anything: a clear picture of what breaks today, a realistic assessment of what your business actually needs, and a timeline that doesn’t force rushed decisions.

Start by mapping your current process from job site to final invoice. Write down every step your crew takes, every spreadsheet your office maintains, and every manual handoff between departments. Track how many hours your team spends each week on data entry, reconciliation, and chasing missing information. A contractor with five people in the office might discover they collectively spend 60 hours weekly on administrative tasks that an integrated system could automate. That’s 1.5 full-time employees worth of labor. Quantify your pain points in dollars and hours because this becomes your business case for investment.

Interview your project managers about what information they need but don’t currently get. Ask your accounting team which tasks consume the most time. Talk to your subcontractors about payment delays. These conversations reveal whether you need real-time job costing urgently or whether your biggest problem is month-end close bottlenecks. Different problems require different solutions, and vendors will sell you features you don’t need if you haven’t defined what actually matters.

Choosing software matters far less than choosing the right implementation partner. The software itself handles the mechanics fine, but how you implement it determines whether you gain real value or just replicate your broken processes in a new platform. Ease of use ranks as the most important vendor selection criterion for finance applications, yet contractors often pick based on price or because a friend recommended something.

Request demos from three to five vendors and require them to show how their system handles your specific workflows, not generic examples. Ask whether they integrate with your existing tools or force you to replace everything at once. A system that connects to your current project management platform and banking system lets you implement gradually instead of a painful big-bang migration.

Implementation timelines matter too. Reputable vendors achieve go-live within 90 days or less with careful planning. If someone promises faster or quotes longer without explaining why, that’s a warning sign. During your evaluation, ask for references from construction companies similar to yours in size and project type. Real-world users tell you what actually works versus what looks good in a demo.

Once you’ve selected your solution, assign one internal person as project owner who drives decisions and maintains accountability. This prevents the drift that kills implementations. Your team needs structured training before go-live, not a one-hour overview. Plan for role-specific training so your project managers learn what they need, your accounting team learns their piece, and your field crews understand their part. Most benefits appear within one to two months after go-live when your data gets cleaned up and your team stops fighting the new system.

An integrated financial management system transforms how construction companies operate by eliminating the administrative burden that drains your team’s productivity. Contractors who implement these systems stop losing thousands monthly to fragmented data and manual work, gaining real-time visibility into project costs while compressing month-end close from days to hours. The financial impact compounds quickly-a contractor saving 40 hours monthly on administrative tasks recovers the system cost within months, while real-time job costing prevents profit drains by surfacing cost overruns while you can still correct them.

Implementation success depends on selecting the right partner who understands construction workflows and integrates with your existing tools, letting you implement gradually instead of forcing a disruptive overhaul. Your internal project owner maintains momentum, and structured training ensures your team adopts the system rather than fighting it. Accurate cash forecasting lets you reduce excess reserves and deploy capital toward growth instead of maintaining safety buffers.

Adding Technology offers expert accounting and financial management services tailored for the construction industry, helping contractors build solid financial foundations through streamlined processes and real-time visibility. Start your implementation planning this week-the sooner you move from fragmented systems to integrated financial management, the sooner your business stops bleeding money to administrative inefficiency and starts making decisions based on accurate, real-time data.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.