Financial risk management fees eat into your bottom line faster than most construction businesses realize. Many companies overpay simply because they don’t understand what they’re actually paying for.

At adding technology, we’ve seen firsthand how the right tools and strategies can cut these costs significantly. This guide walks you through identifying unnecessary fees, negotiating better rates, and using technology to eliminate hidden expenses.

Financial risk management fees come in three main forms, and most construction businesses pay all three without realizing it. Advisory fees represent what you pay for guidance on identifying and managing risks-these typically range from 0.25% to 2% of assets under management or fixed annual retainers starting around $5,000 to $50,000 depending on company size. Compliance and monitoring fees cover ongoing regulatory requirements, internal audits, and documentation updates, which can add another $10,000 to $100,000 annually for mid-sized contractors.

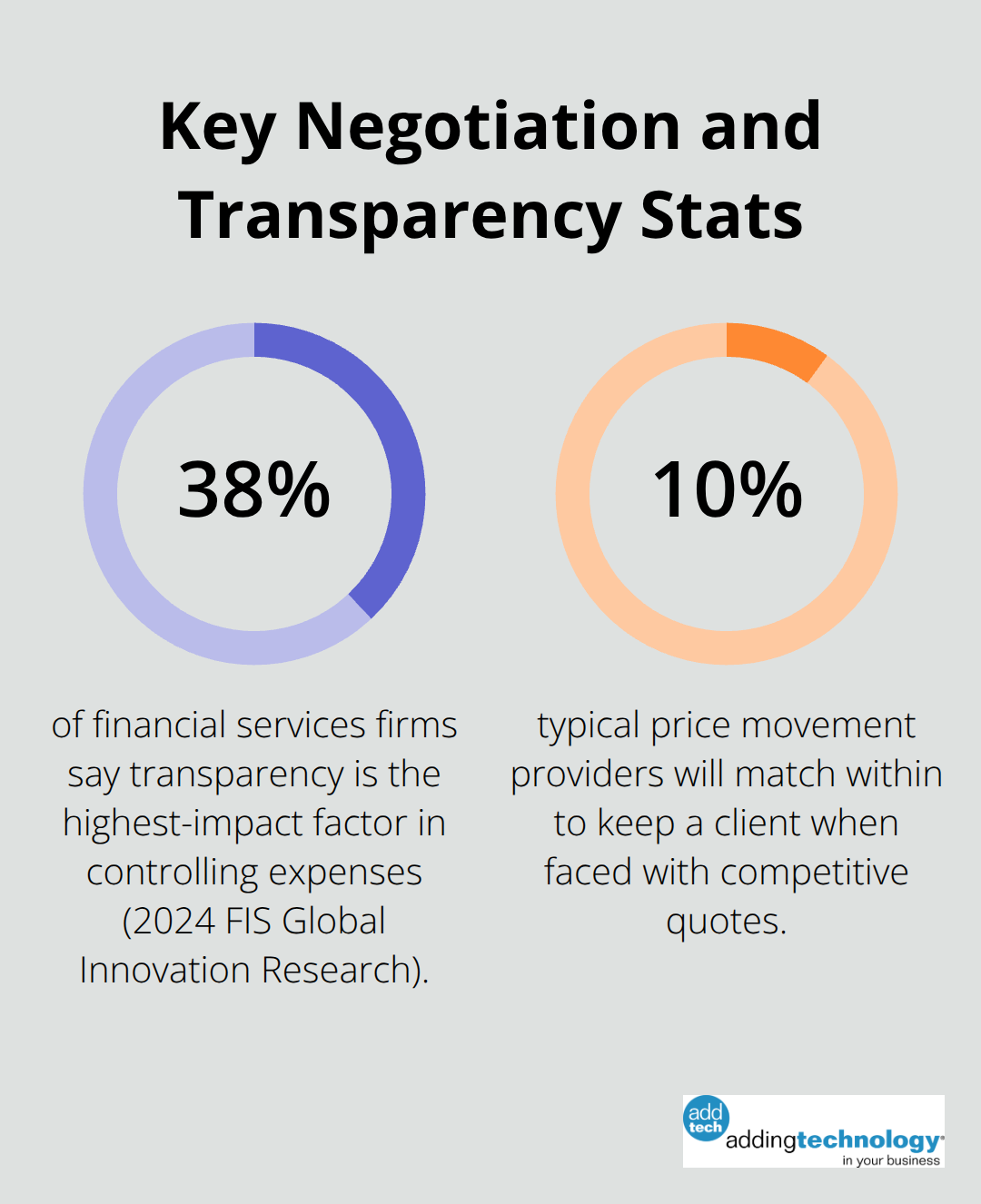

Then there are the hidden fees embedded in your banking relationships, insurance policies, and financial service contracts-these are what most construction companies miss entirely. A 2024 FIS Global Innovation Research study found that transparency in risk management directly impacts costs, with 38% of financial services firms identifying transparency as the highest-impact factor in controlling expenses. When you lack visibility into what each fee covers, you end up paying for duplicate services or outdated protections that no longer match your actual risk profile.

Fee structures fall into three categories: percentage-based models where advisors charge a percentage of your assets, flat-fee arrangements with fixed annual costs, or hourly billing for specific projects. The problem is most advisors use percentage models because they benefit from your company growing-your fees grow with you, creating misaligned incentives. Construction companies with $5 million in assets paying 1% annually spend $50,000 just for risk management oversight, yet many have never received a detailed breakdown of what that covers. Fixed fees are more transparent but often padded with contingencies you’ll never use.

The real issue is that traditional fee structures don’t reward efficiency-your provider gets paid the same whether they use manual spreadsheets or modern cloud-based systems to monitor your risks. This is where most construction businesses overpay. Cloud-based ERP systems like NetSuite provide real-time dashboards and automated risk alerts that reduce the manual analysis work your advisors charge for. Companies switching from traditional advisory models to technology-enabled risk management cut their annual fees by 30% to 40% because the work that once required expensive hours now happens through automation. Your current fee structure likely includes costs for activities that technology can handle instantly and at a fraction of the price.

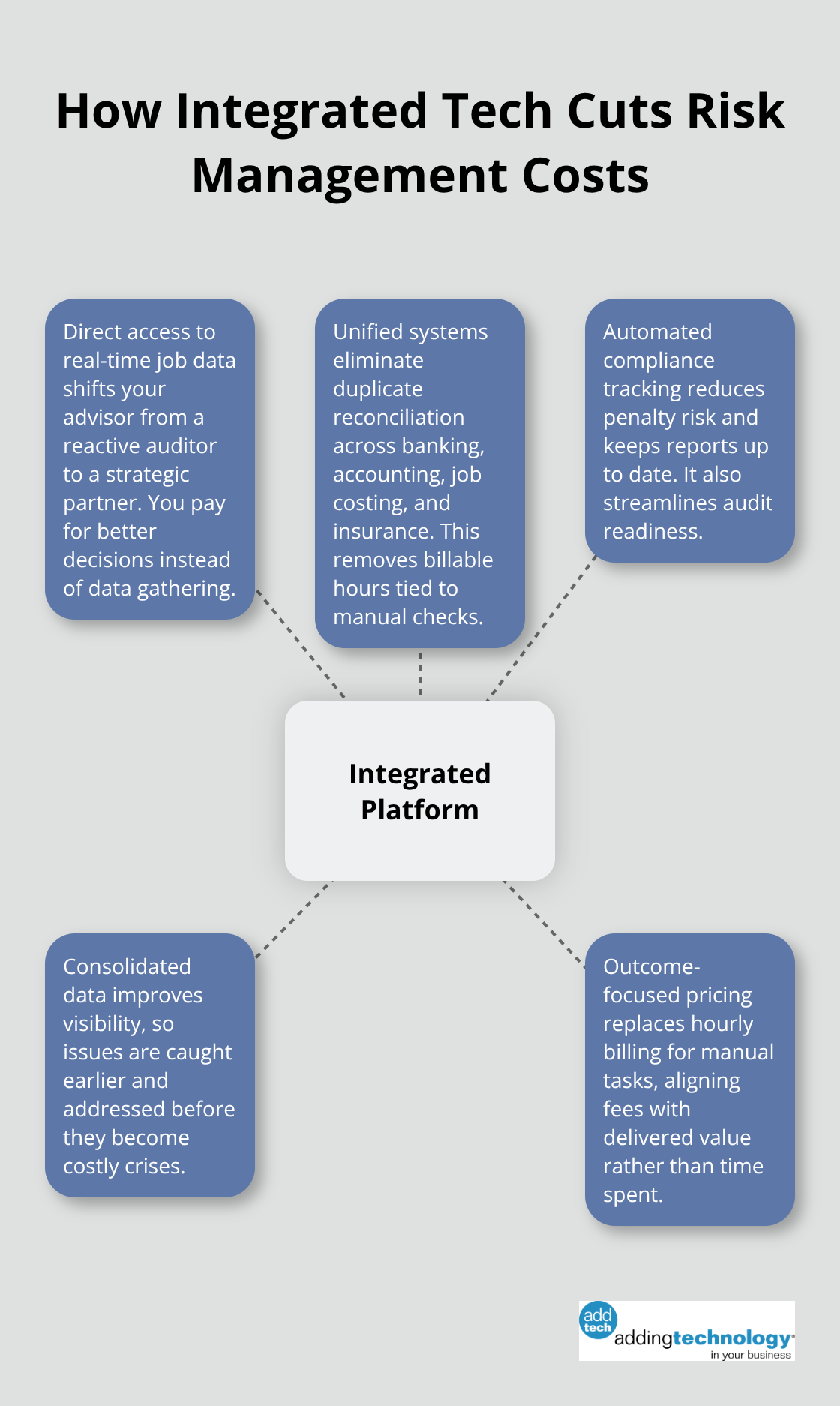

Modern risk management platforms eliminate the manual processes that inflate your bills. Real-time visibility into your financial position means your team identifies risks before they become expensive problems. Automated compliance tracking removes the need for quarterly manual audits and documentation reviews. These systems also consolidate data from multiple sources (banking, insurance, operations), so you stop paying separate fees for fragmented risk oversight. The shift from advisory-heavy to technology-enabled approaches fundamentally changes your cost structure-you move from paying for hours worked to paying for outcomes delivered.

The next section explores how you can negotiate better terms with your current providers and what to look for when comparing alternatives.

The fastest way to reduce what you pay for risk management is to stop accepting the first number your provider quotes. Most construction companies never push back on fees because they assume pricing is fixed, but it’s not. Your current advisor has flexibility built into their pricing model, and they’re counting on you not knowing it.

Start by requesting an itemized breakdown of every fee you pay monthly and annually. Don’t accept vague descriptions like administrative costs or compliance oversight. Demand specifics: how many hours they actually spend on your account, what systems they use to monitor your risks, and whether they manually review data or use automated tools. If they hesitate to provide this detail, that’s your signal they’re overcharging.

Once you have the breakdown, you can negotiate. The key is showing them you understand the market. Research what other advisors charge for similar services in the construction industry, not just generic financial advisory rates. Construction-specific risk management for general contractors typically runs between 12-16%, while specialty contractors range from 15-25%.

If your current provider charges $50,000 annually and you find competitive quotes at $35,000 to $40,000 for identical services, you have leverage. Present those quotes directly and ask them to match or justify their premium. Most will match within 10% rather than lose a client.

Consolidating your services with a single provider that specializes in construction accounting and financial management eliminates the fragmentation fees eating your budget. Many contractors split their work across a traditional financial advisor, a separate compliance firm, a bookkeeper, and banking relationships, with each charging independent fees. This setup creates overlap where multiple providers monitor the same risks or manage the same data.

Consolidation cuts costs because one integrated system replaces three separate ones. A construction-focused firm has already built processes tailored to your industry rather than forcing you into generic advisory templates. The real savings appear in time and accuracy. When your bookkeeper, accountant, and risk advisor all access the same real-time job costing data and financial records, no one spends hours requesting reports or reconciling conflicting information. That efficiency translates directly to lower fees.

A mid-sized contractor consolidating services typically saves $15,000 to $30,000 annually just from eliminating duplicate work. Before switching providers, calculate your total annual spend across all current relationships and get a comprehensive quote from a single construction-focused firm. The combined price almost always undercuts what you’re paying separately.

The real opportunity lies in what happens next: technology integration. When your financial systems actually talk to each other and automate the manual work your advisors currently charge for, your fee structure transforms entirely.

Cloud-based accounting systems eliminate the waste that drives your advisory fees higher. When your financial data flows automatically from job sites to your accounting platform, your risk advisor stops spending hours pulling numbers from spreadsheets and banking portals. A construction company with 15 active projects typically saves 200 to 300 manual hours annually just from automating data consolidation. At $200 per hour advisory rates, that’s $40,000 to $60,000 in direct fee reduction.

Real-time job costing systems track real costs in real time-so you can protect your margins before the project is over. Traditional monthly or quarterly financial reviews catch issues too late to prevent damage. NetSuite and similar ERP platforms provide instant visibility when a project drifts into loss territory, allowing your team to adjust labor allocation or material sourcing immediately. Construction firms using real-time job costing report catching problems an average of 45 days earlier than those relying on manual reporting cycles. That early intervention prevents the expensive crisis management and emergency advisory work that drives fees through the roof.

Your current setup likely requires your risk advisor to manually reconcile data from your bank, your accounting software, your job costing system, and your insurance provider-a process that takes 8 to 12 hours monthly and costs $1,600 to $2,400 in billable time. Integrated technology eliminates manual reconciliation entirely.

When your risk monitoring platform has direct access to real-time job data, cash flow forecasts, and expense tracking, your advisor shifts from a reactive auditor to a strategic partner. That shift means you pay for advice on managing risk better, not for hours spent gathering information you already have. By automating these tasks, the software helps reduce the risk of penalties, ensures that financial reports are up-to-date, and streamlines the audit process. Most construction firms consolidating to a fully integrated technology platform report fee reductions of 35% to 45% because the administrative work that justified premium advisory pricing simply disappears.

The real transformation happens when your accounting system, job costing, banking, and compliance monitoring work as one integrated platform rather than disconnected tools. This integration directly reduces the hours your advisor spends on administrative tasks. Your team gains visibility into financial operations that previously required expensive manual analysis. The shift from fragmented systems to unified platforms fundamentally changes what you pay for-you move from funding administrative overhead to funding strategic risk management that actually protects your business.

Reducing your financial risk management fees starts with understanding what you’re actually paying for. Most construction companies overpay because they accept the first quote without pushing back or comparing alternatives. Request itemized breakdowns from your current provider, research competitive rates in the construction industry, and consolidate fragmented services into a single integrated platform. Each step cuts costs, but the real savings come from eliminating the manual work that inflates your bills.

When you move from reactive advisory relationships to technology-enabled risk oversight, your team gains real-time visibility into financial operations that previously required expensive manual analysis. You catch problems 45 days earlier, prevent costly crisis management, and shift your advisor’s role from administrative auditor to strategic partner. Construction firms consolidating to integrated platforms report fee reductions of 35% to 45% because the administrative overhead simply disappears.

Start with that itemized fee breakdown from your current provider this week, then research what construction-focused firms charge for comparable services. adding technology helps construction businesses streamline their accounting systems, implement real-time job costing, and integrate technology across their financial operations to lower financial risk management fees and improve visibility into project profitability.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.