At adding technology, we understand the complexities of construction accounting. Construction Work in Progress (WIP) accounting is a critical aspect of financial management in the industry.

In this post, we’ll explore the essentials of WIP accounting, including methods, best practices, and common challenges. We’ll also discuss how proper WIP tracking can significantly impact your project’s financial health and overall business success.

Construction Work in Progress (WIP) represents a financial metric that tracks the value of ongoing construction projects. It encompasses the costs incurred for projects that are not yet complete, including labor, materials, and overhead expenses associated with active construction jobs. A work-in-progress (WIP) is a partially finished good awaiting completion and includes such costs as overhead, labor, and raw materials.

Tracking WIP proves essential for several reasons:

To account for WIP effectively, you must track several key elements:

Consistent monitoring of these components enables the generation of accurate WIP reports that provide valuable insights into your project’s financial health.

Implementing a comprehensive WIP accounting system can yield significant benefits:

Adding Technology offers expert services to help construction businesses implement and maintain effective WIP accounting systems. Our tailored solutions ensure that you can harness the full power of WIP data to drive your business forward.

As we move forward, let’s explore the various methods used for accounting construction WIP, each with its own advantages and applications in different scenarios.

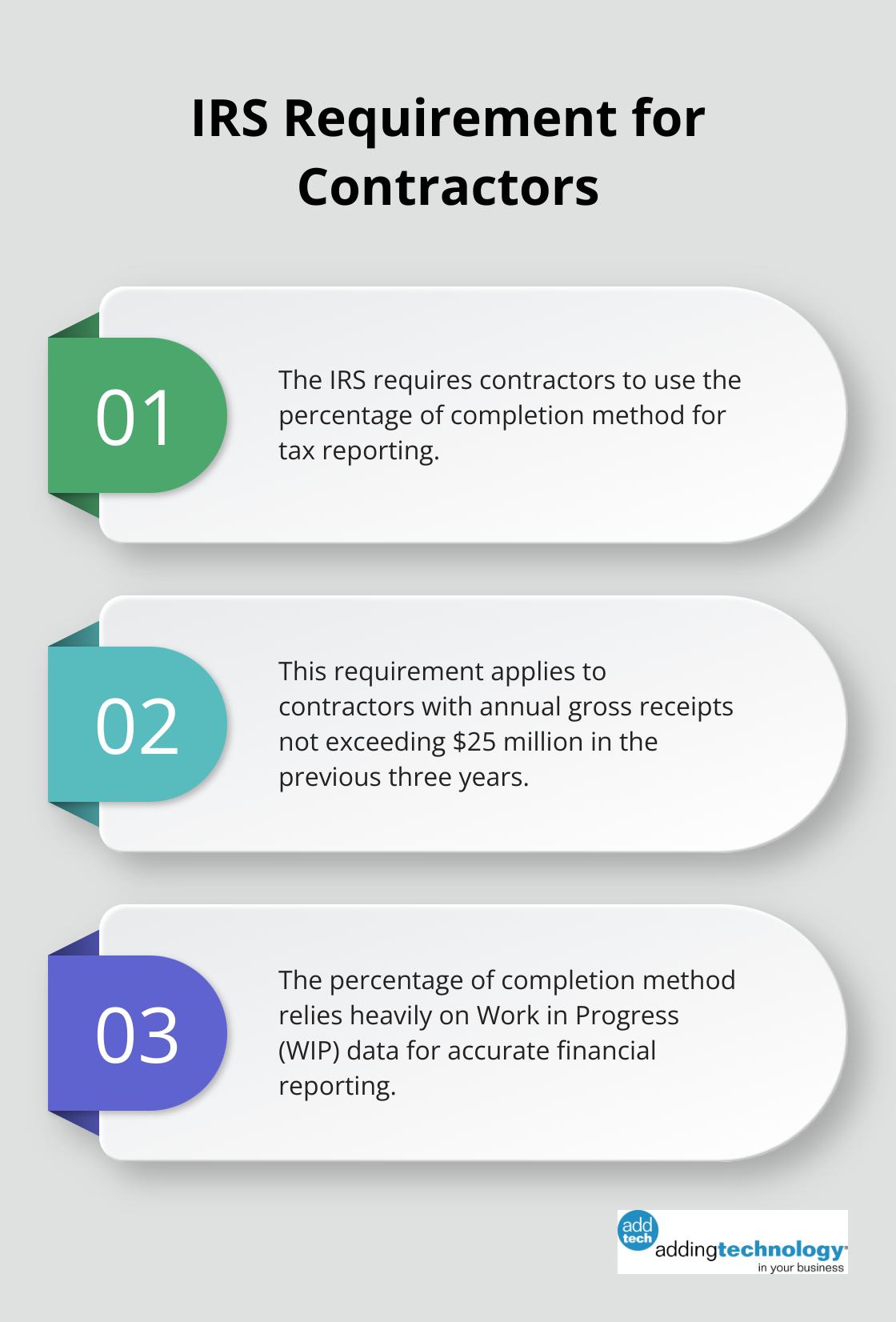

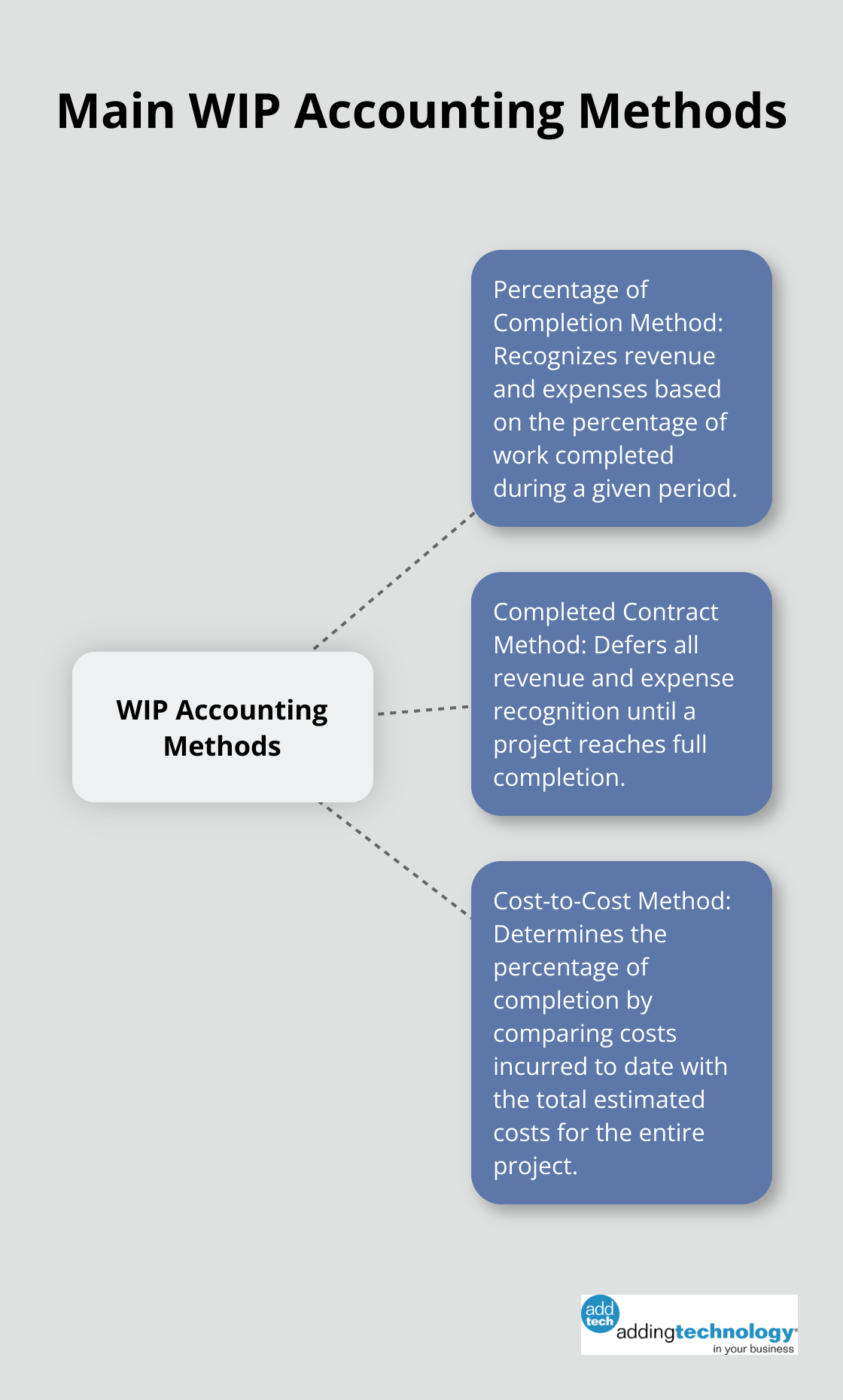

The Percentage of Completion Method is an accounting method in which the revenues and expenses of long-term contracts are reported as a percentage of the work completed during a given period. This method stands out as a popular choice in the construction industry, especially for long-term projects. It offers a more accurate representation of a company’s financial performance over time.

Contractors calculate the percentage of work completed based on costs incurred to date compared to total estimated costs. For instance, if a project’s total estimated cost is $1,000,000 and $250,000 has been spent, the project is 25% complete. The contractor would then recognize 25% of the total contract revenue.

This method proves particularly useful for projects that span multiple accounting periods. It allows for more consistent revenue recognition and better matches expenses with revenues. However, it requires accurate cost estimates and regular updates to maintain its effectiveness.

The Completed Contract Method defers all revenue and expense recognition until a project reaches full completion. This method often suits shorter-term projects or situations where accurate cost estimation proves challenging.

Under this approach, all costs accumulate as an asset on the balance sheet until project completion. Upon finishing, the entire revenue receives recognition, and all associated costs become expenses. This can result in significant fluctuations in reported income from year to year, especially for companies with few, large projects.

The Completed Contract Method offers simpler implementation but may not provide an accurate representation of a company’s ongoing financial performance. It generally suits smaller contractors or those with projects lasting less than one year.

The Cost-to-Cost Method gauges the expenses incurred during an accounting period in relation to the total estimated costs of the project. It represents a specific application of the Percentage of Completion Method. This method determines the percentage of completion by comparing costs incurred to date with the total estimated costs for the entire project.

This method stands as one of the most accurate ways to measure project progress. It particularly benefits large, complex projects where physical progress assessment might prove difficult. The formula remains straightforward: (Costs Incurred to Date / Total Estimated Costs) x 100 = Percentage Complete.

For example, if a project has incurred $400,000 in costs out of a total estimated cost of $1,000,000, it would be considered 40% complete. This percentage would then be used to recognize revenue and expenses.

The Cost-to-Cost Method demands diligent tracking of all project costs and regular updates to cost estimates. It’s important to include all relevant costs (direct costs like materials and labor, as well as indirect costs such as overhead allocations).

The choice of WIP accounting method significantly impacts accurate financial reporting and decision-making. While the Percentage of Completion and Cost-to-Cost methods often receive preference for their accuracy, the Completed Contract Method can suit specific circumstances.

Companies must consider factors such as project duration, complexity, and the ability to estimate costs accurately when selecting a method. The goal is to choose an approach that best reflects the company’s operations and provides the most useful financial information for management and stakeholders.

As we move forward, let’s explore the best practices for implementing WIP accounting in construction, ensuring that whichever method you choose, you can execute it effectively and efficiently.

A precise job costing system forms the foundation of effective WIP accounting. We recommend software that allows real-time cost tracking across multiple projects. This system should categorize costs into direct labor, materials, and overhead, providing a detailed view of each project’s financial status.

Procore’s job costing tools help avoid cost overruns and keep projects on schedule. The implementation of similar systems can help you catch discrepancies early and adjust your estimates accordingly.

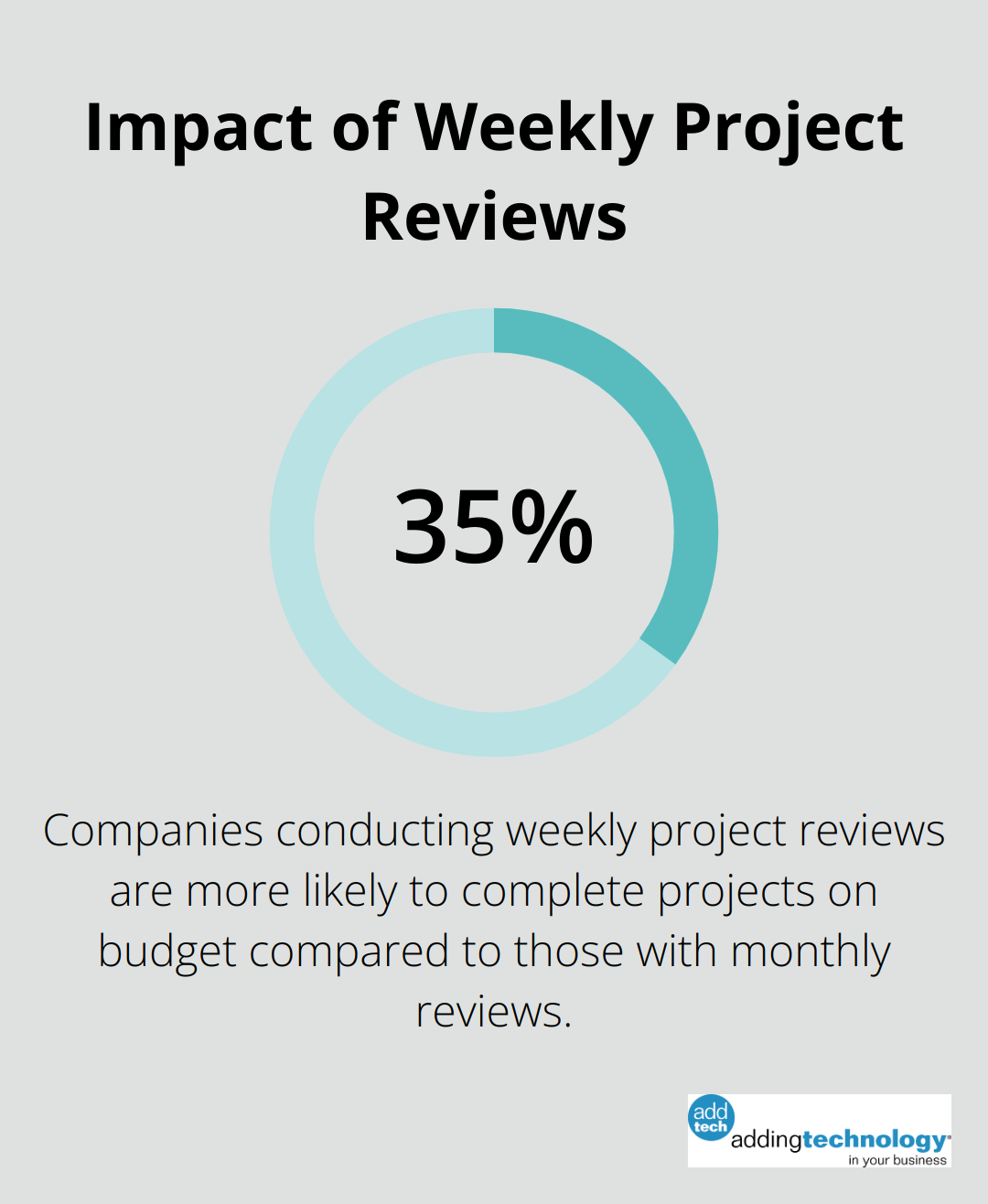

Weekly or bi-weekly project status meetings are essential for accurate WIP reporting. These meetings should involve project managers, accountants, and key stakeholders to review progress, update cost estimates, and identify potential issues.

A study by the Construction Financial Management Association found that companies conducting weekly project reviews were 35% more likely to complete projects on budget compared to those with monthly reviews. This frequent communication ensures that your WIP reports reflect the most current project realities.

The integration of WIP accounting with project management software can streamline your processes and reduce errors. Look for solutions that offer automated data entry, real-time cost tracking, and customizable WIP report generation.

Integrated software solutions make it easier to generate the necessary reports for compliance, as all financial data is stored and managed within a single system. This integration not only saves time but also improves data accuracy and decision-making speed.

WIP accounting in construction comes with its unique set of challenges. These include:

To overcome these challenges, try to:

Selecting the right partner for your WIP accounting needs can significantly impact your financial management success. Adding Technology offers expert accounting and financial management services tailored for the construction industry. Their structured approach provides personalized solutions, enhancing operational efficiency and financial soundness.

Clients of Adding Technology report improved bookkeeping, cost visibility, and timely payments, resulting in smoother operations and business growth. With their expertise, you can build a solid financial foundation and empower your construction business.

Construction Work in Progress accounting forms the backbone of financial management in the construction industry. It provides a clear picture of project finances, enables accurate revenue recognition, and supports informed decision-making. Precise WIP reporting ensures compliance with regulatory requirements, enhances project profitability, and boosts stakeholder confidence.

The future of construction accounting will likely see increased adoption of artificial intelligence, machine learning, and cloud-based solutions to improve cost estimations and project forecasting. These advancements will offer real-time data access and collaboration across teams, revolutionizing how construction businesses manage their finances. Integration of blockchain technology may also enhance transparency and security in financial transactions.

Construction businesses that want to optimize their financial processes and stay ahead of these trends should consider partnering with experts. Adding Technology offers specialized accounting and financial management services tailored to the construction industry (combining industry expertise with cutting-edge technology). Their approach aims to streamline operations, ensure compliance, and drive business growth in the ever-evolving construction landscape.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.