Construction project accounting is a critical aspect of successful project management in the building industry. At adding technology, we understand the unique challenges contractors face when tracking finances across multiple job sites and phases.

This guide will explore the essential components of construction project accounting and provide best practices for effective financial management in your projects.

Construction project accounting is a tailored financial management system that tracks and reports on the financial aspects of individual construction projects. This approach differs significantly from general accounting, which focuses on overall business finances. Construction project accounting allows contractors to monitor costs, revenue, and profitability on a project-by-project basis.

CFMA workshops focus on identifying key construction accounting principles and explaining the core points of revenue recognition. This knowledge is crucial for understanding the specialized nature of construction accounting.

Project accounting in construction involves several critical elements:

The American Institute of Certified Public Accountants (AICPA) emphasizes that accurate job costing is vital for maintaining profitability in the construction industry.

Accurate project accounting significantly influences a construction company’s success. It provides real-time insights into project performance, helps identify potential cost overruns early, and enables better decision-making.

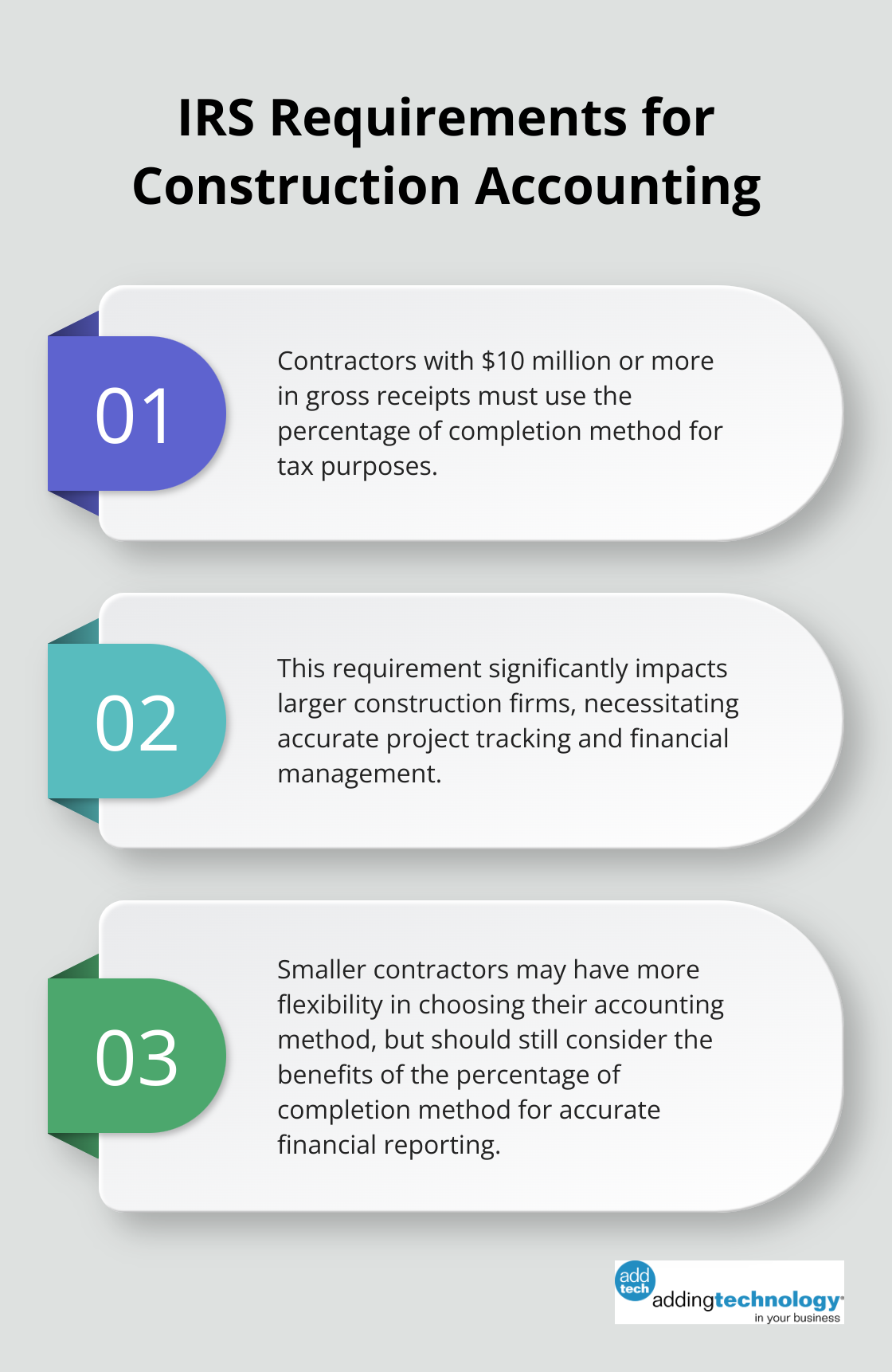

Precise project accounting is crucial for compliance with industry regulations and tax requirements. The Internal Revenue Service (IRS) requires contractors with over $10 million in gross receipts to use the percentage of completion method for tax purposes. This requirement makes accurate project tracking essential for larger construction firms.

Modern construction project accounting often relies on specialized software solutions. These tools can automate many aspects of financial tracking, from job costing to progress billing. Companies like Adding Technology offer expert accounting and financial management services tailored for the construction industry, helping contractors streamline their financial processes and ensure compliance.

As we move forward, let’s explore the essential components of construction project accounting in more detail, starting with cost tracking and allocation.

Accurate cost tracking forms the backbone of construction project accounting. It requires meticulous recording of all project-related expenses (labor, materials, equipment, and overhead costs). Include inventory items, nonstock items, labor, services, and more in project budgets and compare actual project costs with original and revised budgets.

To implement effective cost tracking:

Selecting the appropriate revenue recognition method is essential for accurate financial reporting. The two primary methods in construction are the percentage-of-completion method and the completed-contract method.

The percentage-of-completion method recognizes revenue as work progresses, offering a more accurate picture of ongoing profitability. The American Institute of CPAs (AICPA) has proposed new guidance on revenue recognition standards for engineering and construction contractors.

The completed-contract method defers revenue recognition until project completion. This approach suits shorter projects or situations with uncertain cost estimates.

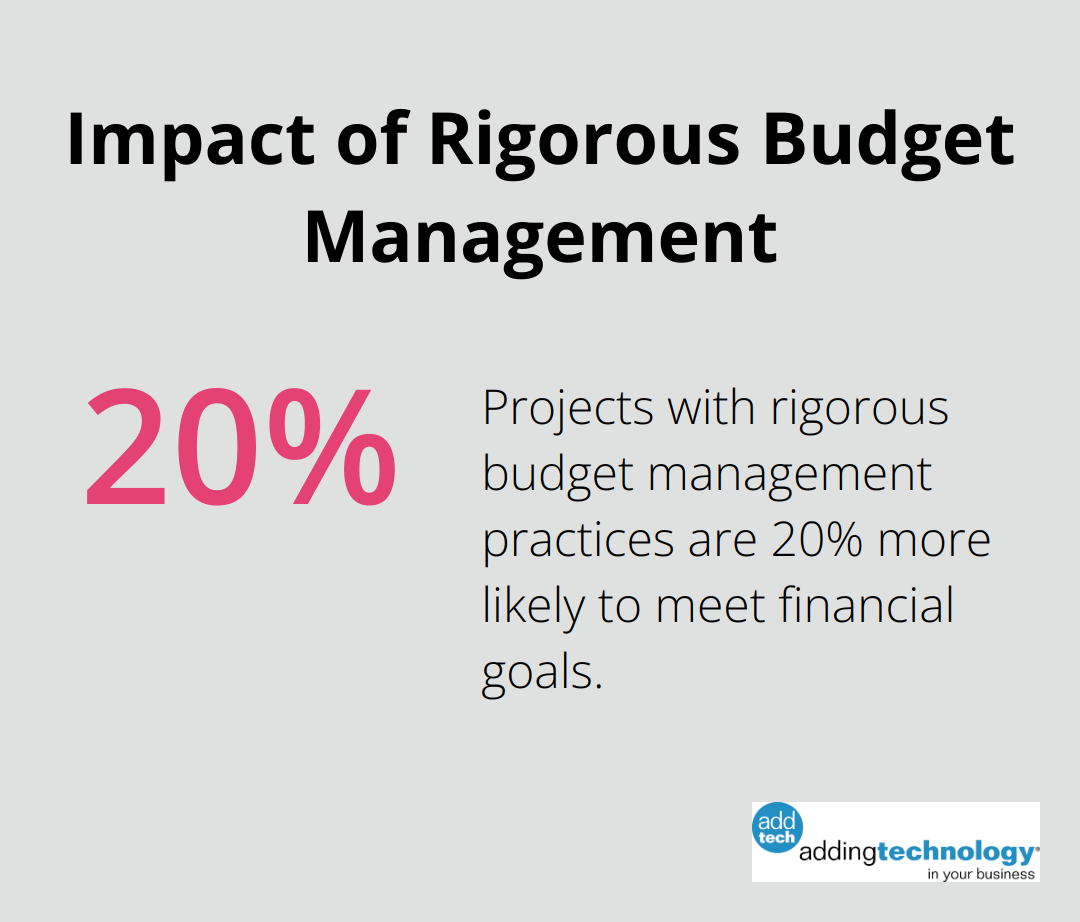

Effective budget management involves creating detailed initial budgets and continuous monitoring throughout the project lifecycle. The Construction Industry Institute (CII) found that projects with rigorous budget management practices were 20% more likely to meet financial goals.

Key budget management strategies include:

Cash flow management is critical in construction due to the industry’s unique payment structures. The National Association of Home Builders (NAHB) reports that poor cash flow management leads to contractor bankruptcy.

To improve cash flow:

Change orders can significantly impact project profitability. The Mechanical Contractors Association of America (MCAA) estimates that change orders account for 8-14% of a typical project’s contract value.

To effectively manage change orders:

Mastering these key elements of construction project accounting will significantly improve financial performance and project success rates. Companies like Adding Technology offer specialized accounting resources to help implement these practices effectively, ensuring projects stay on budget and on schedule. The next section will explore best practices for implementing these elements in your construction business.

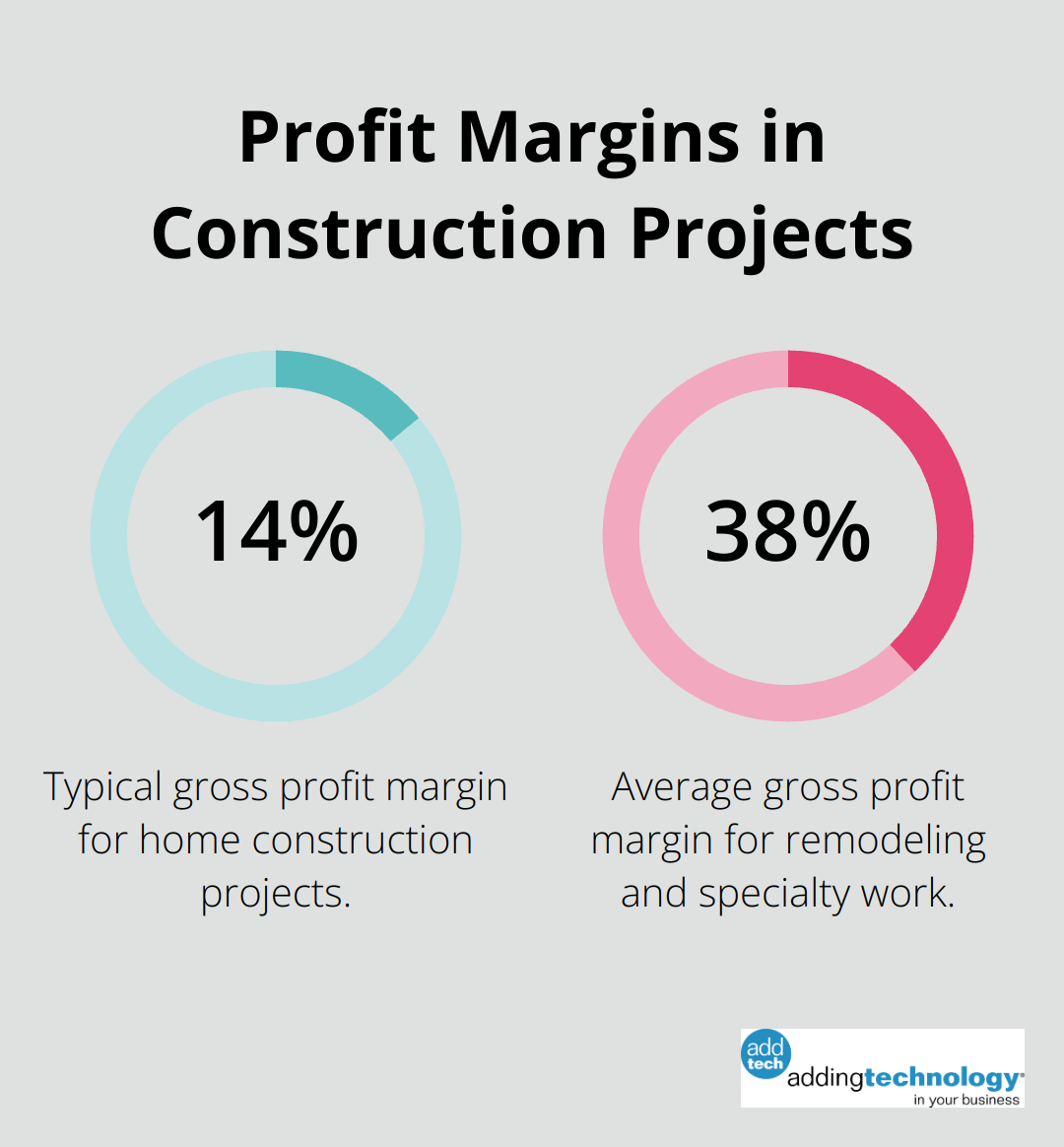

Job costing forms the foundation of effective construction accounting. It allows you to track costs and revenues for each project separately, providing insights into profitability. Home construction projects typically rake in a gross profit margin of around 14.9%, while remodeling and other specialty work yield between 34 and 42% profit.

To implement an effective job costing system:

Generic accounting software fails to address the unique needs of the construction industry. Construction-specific accounting software offers features tailored to your needs, such as job costing, accounts receivable for managing billing, and accounts payable for organizing payments.

A study by the Associated General Contractors of America (AGC) found that construction firms using industry-specific software were 25% more likely to complete projects on budget compared to those using generic solutions.

When selecting software, prioritize:

Frequent financial reporting keeps you on top of your project’s financial health. The Construction Industry Institute (CII) reports that projects with weekly financial reviews are 30% more likely to meet or exceed profit expectations.

Implement a rigorous reporting schedule:

Detailed documentation protects against disputes and ensures accurate financial management. The American Institute of Architects (AIA) emphasizes that thorough documentation can reduce the risk of legal disputes by up to 50%.

Establish a comprehensive documentation system:

Siloed accounting and project management lead to miscommunication and financial discrepancies. The Project Management Institute (PMI) reports that integrated systems can improve project performance by up to 20%.

To achieve seamless integration:

These best practices create a robust foundation for your construction project accounting. Effective accounting provides the insights needed to make informed decisions and drive project success. Our crew stands at the forefront of accounting and financial management for contractors in the construction and real estate sectors, allowing contractors to focus on their projects without the burden of financial management.

Construction project accounting forms the cornerstone of successful project management in the building industry. It provides real-time insights into project performance, enables early identification of cost overruns, and facilitates better decision-making. Accurate financial tracking ensures compliance with industry regulations and tax requirements, reducing the risk of legal issues.

Companies with strong financial management secure future contracts more easily, negotiate favorable terms with suppliers, and maintain healthy client relationships. They make more informed strategic decisions about project pursuits and resource allocation. These benefits extend beyond individual projects, positioning firms for long-term success in the competitive construction industry.

To improve your construction project accounting practices, consider partnering with experts in the field. Adding Technology offers specialized accounting and financial management services tailored for the construction industry. Their structured approach provides personalized solutions, enhancing operational efficiency and financial soundness (while allowing you to focus on delivering successful construction projects).

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.