At adding technology, we understand the unique challenges faced by construction companies when it comes to financial management.

Construction accounting vs regular accounting presents distinct differences that can significantly impact a company’s financial health and project success.

In this blog post, we’ll explore the key disparities between these two accounting approaches, focusing on specialized reporting, financial metrics, and industry-specific practices.

Construction accounting differs significantly from regular accounting practices. Each project in construction operates as its own mini-business. Traditional accounting periods follow monthly or quarterly cycles, but construction accounting revolves around project timelines. This shift demands a different approach to financial management.

A single project often spans multiple fiscal years. Companies must track costs and revenues specific to that project over its entire lifecycle. This approach allows for more accurate profitability analysis and helps prevent cost overruns (a common issue in the construction industry).

Long-term contracts dominate the construction industry, often lasting months or years. This duration complicates revenue recognition and cash flow management. Progress billings become a critical tool for maintaining steady cash flow throughout the project.

A study found that 78% of construction firms use some form of progress billing. This method allows companies to bill clients at various stages of completion, rather than waiting until the end of the project for payment.

Construction companies often manage multiple projects simultaneously. Each project has its own budget, timeline, and unique challenges. This multiplicity necessitates robust cost allocation systems and real-time financial tracking.

A survey by Sage revealed that 30% of construction companies struggle with project cost overruns. Companies can better monitor expenses and quickly identify potential issues before they escalate by implementing job-specific cost centers.

To address these unique aspects of construction accounting, companies should implement advanced project accounting software. These tools provide real-time financial insights for each job site and set up detailed cost allocation systems.

Adding Technology offers expert accounting and financial management services tailored for the construction industry. Their structured approach provides personalized solutions, enhancing operational efficiency and financial soundness.

The complexities of project-based accounting in construction highlight the need for specialized financial reporting. In the next section, we’ll explore how construction companies use unique financial reports to gain deeper insights into their projects and overall financial health.

Construction accounting requires unique financial reports that provide deep insights into project performance and overall company health. These specialized reports help construction firms navigate the complexities of long-term projects, multiple job sites, and fluctuating costs.

Work in Progress (WIP) reporting is essential in construction accounting. It calculates the progress of all ongoing work and helps you manage budgets effectively. WIP reports form the backbone of construction financial management. These reports track the financial status of ongoing projects, comparing actual costs and revenues to estimated figures.

WIP reports help identify potential cost overruns early, allowing project managers to take corrective action. They also provide valuable data for accurate revenue recognition, which is important for compliance with accounting standards like ASC 606.

To maximize the benefits of WIP reporting, construction companies should:

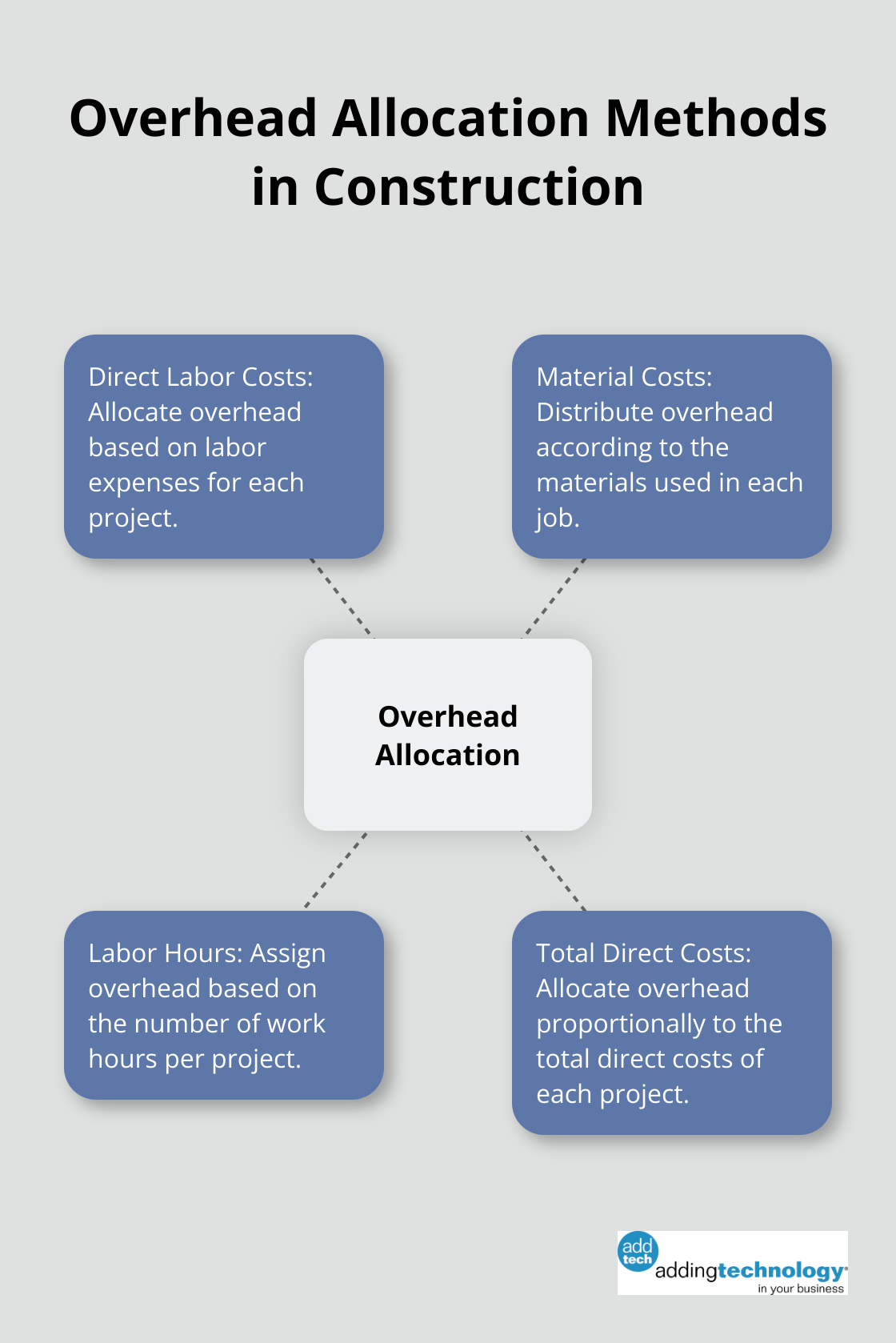

Accurate job costing is essential for maintaining profitability in construction. It involves tracking direct costs (labor, materials, equipment) and allocating indirect costs (overhead) to specific projects.

Overhead allocation in construction companies can be based on direct labor costs, material costs, labor hours, or total direct costs, depending on the specific needs of the company. Construction firms should regularly review their overhead allocation methods to ensure accuracy.

Change orders can significantly impact project profitability. Proper tracking and management of change orders are important for maintaining profit margins.

Effective change order management involves:

Construction firms should implement a standardized process for handling change orders. This process should include clear communication channels between field staff, project managers, and accounting teams.

The mastery of these specialized financial reports sets the stage for understanding key financial metrics specific to the construction industry. These metrics provide valuable insights into a company’s operational efficiency and financial health.

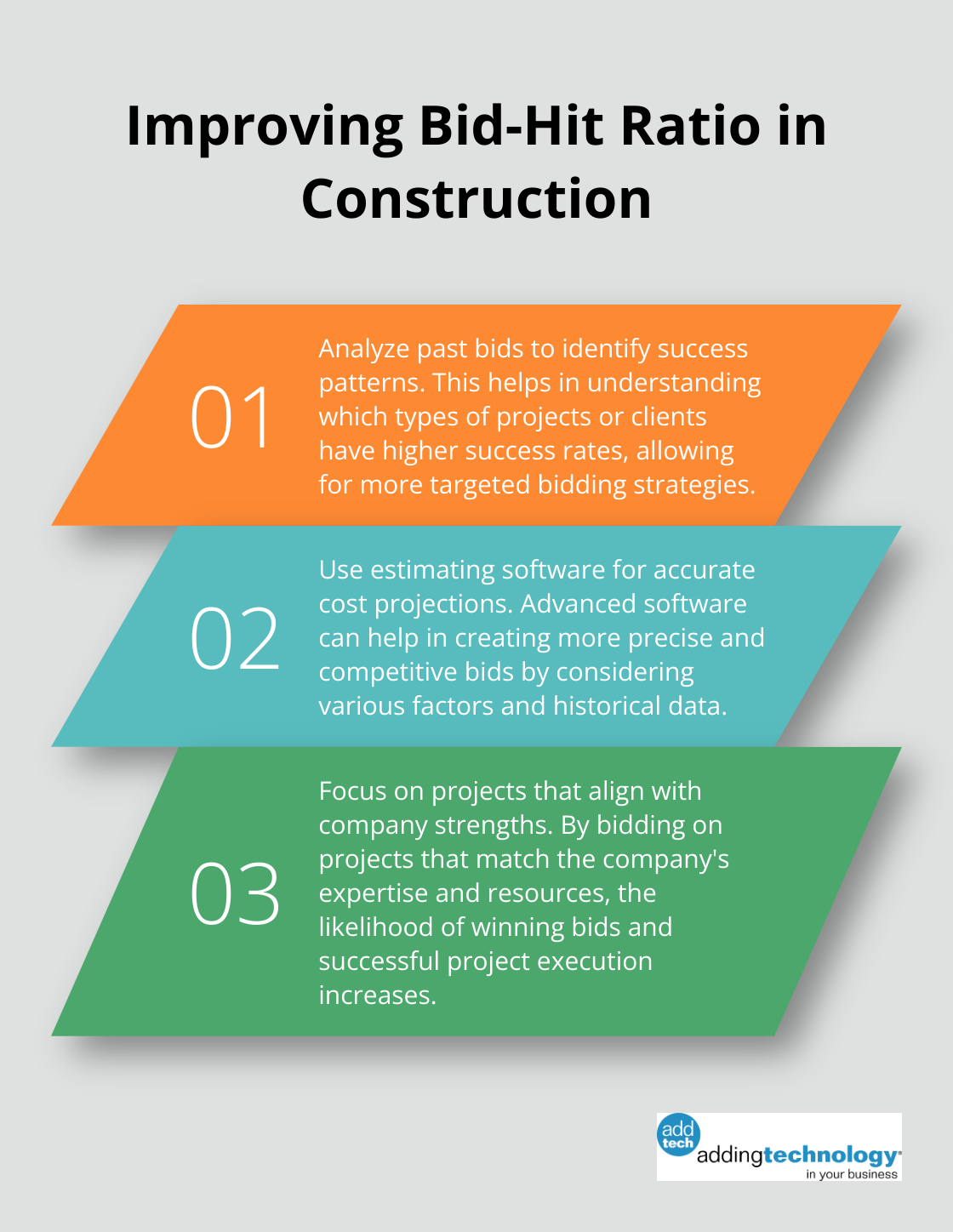

The bid-hit ratio measures the success rate of submitted bids. Top-performing construction companies maintain a bid-hit ratio of 30% or higher (according to FMI Corporation). To improve this metric, companies should:

Equipment utilization rates directly impact profitability. The Construction Financial Management Association reports an average equipment utilization rate of 60-65% in the industry. To optimize equipment utilization, companies can:

Cash flow management is critical in construction. According to a Kabbage survey of construction firms, 28% cited cash flow as the biggest challenge during their first year in business. To improve cash flow forecasting and management, companies should:

Accurate estimating is essential for project success and profitability. Companies can enhance their estimating accuracy by:

Profit margin analysis helps construction companies understand their financial performance at both project and company levels. To improve profit margins, companies can:

These key financial metrics provide valuable insights for strategic decision-making and operational improvements in construction companies. Regular monitoring and analysis of these metrics can give firms a competitive edge and ensure long-term financial success.

Construction accounting vs regular accounting presents unique challenges that require specialized approaches. The project-based nature of construction demands a shift from traditional accounting periods to project-centric financial management. Long-term contracts, progress billings, and multiple job sites further complicate financial tracking and reporting.

Specialized financial reports like Work-in-Progress (WIP) statements, job costing systems, and change order tracking provide essential insights into project performance and overall financial health. Key financial metrics specific to the construction industry, such as bid-hit ratios, equipment utilization rates, and cash flow forecasting, offer valuable benchmarks for success. These tools enable construction firms to optimize their operations and improve profitability.

The complexities of construction accounting underscore the importance of partnering with industry-specific financial experts. Adding Technology offers tailored accounting and financial management services for the construction industry. Our expertise in streamlining financial processes, ensuring compliance, and integrating advanced technologies allows contractors to focus on their core business while maintaining a solid financial foundation.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.