At Adding Technology, we understand the importance of choosing the right construction accounting methods for your business.

Construction accounting methods can significantly impact your financial reporting, project management, and overall business success.

In this post, we’ll explore three key approaches: cash-based accounting, accrual accounting, and the percentage of completion method.

We’ll break down their advantages, limitations, and help you determine which method aligns best with your construction company’s needs.

Cash-based accounting is a straightforward method many small construction businesses use. It operates on a simple principle: income is recorded when payment is received, and expenses are logged when they are paid. This simplicity appeals to smaller projects or companies in their early stages.

The primary benefit of cash-based accounting is its simplicity. Construction companies don’t need complex software or extensive accounting knowledge to track their finances. This simplicity saves time and resources, allowing focus on construction projects.

Cash-based accounting provides a clear snapshot of current cash flow. To ensure adequate income and cash flow, contractors usually manage a schedule of multiple payments that are based on work completed to date.

For tax purposes, cash-based accounting offers some flexibility. Construction companies can potentially defer income to the next tax year by delaying billing, or accelerate expenses by paying them early (a strategy that can help manage tax liability).

While simple, cash-based accounting has significant limitations for construction businesses. It doesn’t accurately reflect a company’s financial health, especially for long-term projects. A company might complete a large portion of a project and incur expenses, but if the client hasn’t paid yet, the books won’t show this work.

This method can lead to misleading financial statements. Income might appear low one month when a lot of work has been done but payment hasn’t been received, and then artificially high the next month when payments come in.

Cash-based accounting falls short when it comes to tracking job costs over time. Without accrual-based job costing, it’s difficult to accurately assess the profitability of individual projects.

As construction businesses grow, they may be required to switch to accrual accounting. The IRS mandates accrual accounting for C corporations and partnerships with C corporation partners that have average annual gross receipts exceeding $5 million over the past three years.

Many construction businesses struggle with the limitations of cash-based accounting as they grow. While it might work for very small operations, most construction companies benefit from more sophisticated accounting methods that provide a clearer picture of their financial position and project profitability. As we move forward, let’s explore the accrual accounting method, which addresses many of these limitations and offers a more comprehensive approach to construction financial management.

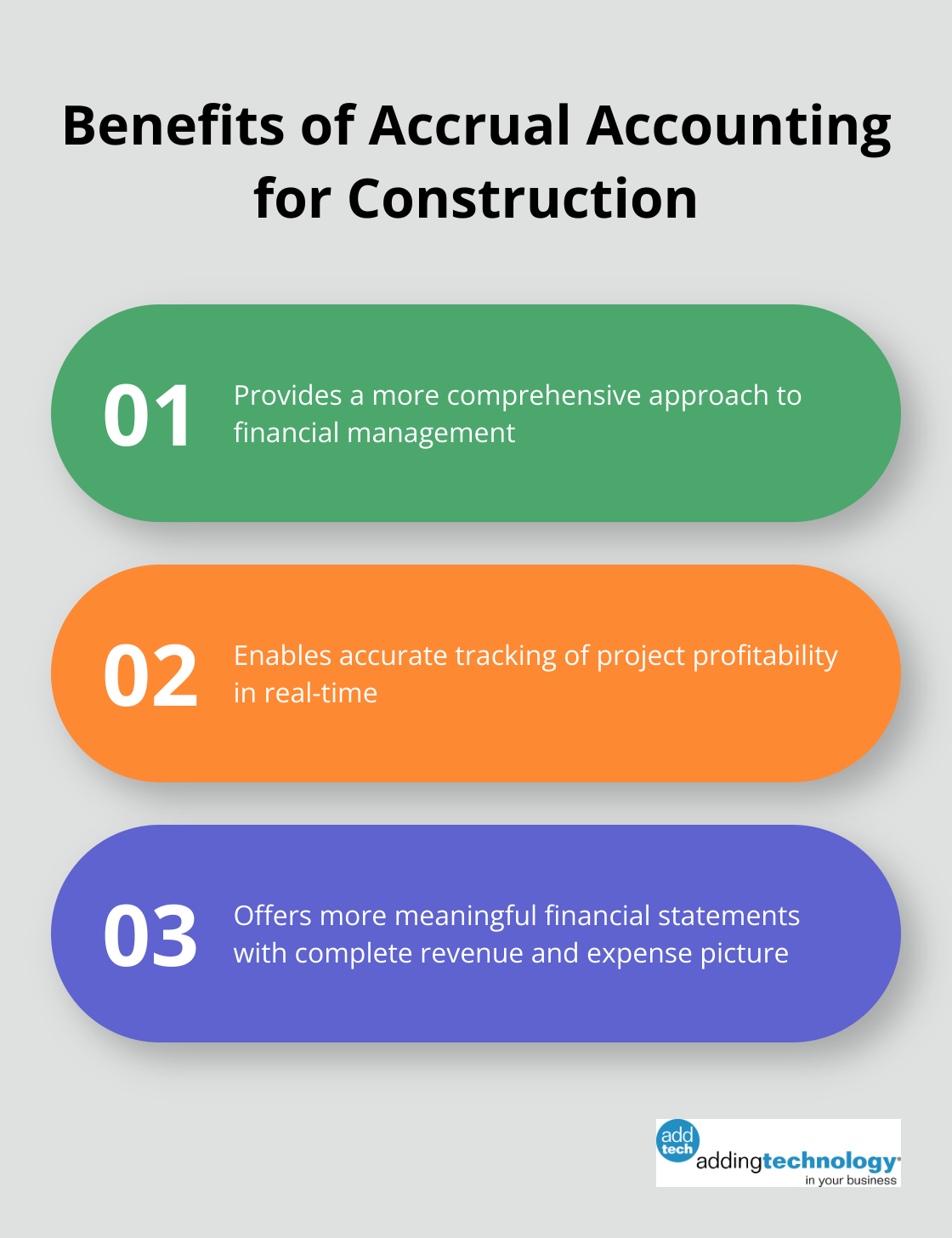

Accrual accounting provides a more comprehensive approach to financial management in the construction industry. This method records revenues when earned and expenses when incurred, regardless of cash transactions. It offers a more accurate representation of a company’s financial position, especially for long-term projects.

One of the key advantages of accrual accounting for construction businesses is the ability to track project profitability more accurately. Companies can see the true financial status of each project in real-time by recording expenses as they occur and revenue as it’s earned. This level of detail allows for better decision-making and helps identify potential issues early.

A roofing contractor using accrual accounting would record the cost of materials when ordered, not when paid. This practice gives a more accurate picture of the project’s costs from the start, allowing for better budget management and pricing decisions.

Accrual accounting provides more meaningful financial statements. The income statement reflects all revenues earned and expenses incurred during a period, giving a true picture of profitability. The balance sheet includes accounts receivable and payable, providing a comprehensive view of the company’s financial position.

The transition from cash-based to accrual accounting can be complex and time-consuming. It often requires new software, staff training, and potentially hiring additional accounting personnel.

Accrual accounting can complicate tax planning. Since income is recognized before cash is received, companies may owe taxes on income they haven’t yet collected. This situation requires careful cash flow management to ensure funds are available for tax payments.

Despite these challenges, many construction companies find that the benefits of accrual accounting outweigh the drawbacks. The increased visibility into financial performance and improved decision-making capabilities make it a valuable tool for growth-oriented businesses.

As we move forward, let’s explore another important accounting method in the construction industry: the percentage of completion method. This approach offers unique advantages for long-term projects and provides a different perspective on revenue recognition.

The percentage of completion method stands as a fundamental approach in construction accounting, particularly for long-term projects. This method allows construction companies to recognize revenue and expenses as work progresses, offering a more accurate representation of financial performance over time.

Under this method, companies recognize revenue based on the percentage of work completed during a specific period. For instance, if a $1 million project is 40% complete, the company would recognize $400,000 in revenue, regardless of actual billings or cash received.

The American Institute of Certified Public Accountants (AICPA) recommends two primary methods to calculate completion percentage:

The adoption of the percentage of completion method significantly affects financial statements. It evens out revenue recognition over the project lifecycle, avoiding sudden spikes or drops that can occur with other methods. This approach provides stakeholders with a clearer view of the company’s ongoing performance and profitability.

On the balance sheet, you’ll find items such as:

These accounts represent the difference between revenue recognized and amounts billed to the client.

From a tax perspective, the Internal Revenue Service (IRS) often requires the percentage of completion method for long-term contracts. This requirement applies to most construction contracts expected to span more than one tax year, ensuring that taxable income aligns more closely with the economic reality of long-term projects.

However, small contractors (those with average annual gross receipts of $26 million or less for the past three tax years) may qualify for an exemption from this requirement. These contractors can use other methods, such as completed contract accounting, for tax purposes.

While the percentage of completion method offers numerous benefits, it presents certain challenges:

Construction project accounting can be complex, but with the right approach and tools, companies can effectively track long-term projects and maximize efficiency for successful project management.

Construction accounting methods play a vital role in the success and growth of your business. Each method – cash-based, accrual, and percentage of completion – offers unique advantages and challenges. Your choice depends on factors such as company size, project duration, financial reporting needs, and tax implications. Proper accounting empowers informed decision-making, accurate bidding, and sustainable growth in the construction industry.

Adding Technology understands the intricacies of construction accounting methods. Our expertise in financial management for the construction industry can help you navigate these choices and implement an effective accounting system. We strive to ensure your financial foundation supports your growth objectives while you focus on building and managing projects.

The right construction accounting method provides clarity, control, and confidence in your financial operations. It enables you to make informed decisions, manage risks effectively, and seize opportunities for growth. Investing in a suitable accounting method positions your company for success in the competitive construction landscape.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.