At Adding Technology, we often encounter businesses grappling with the complexities of cost management.

Job costing and cost accounting are two essential methods for tracking and analyzing expenses, but they serve different purposes and suit various industries.

Understanding the distinctions between these approaches is crucial for making informed financial decisions and optimizing your company’s profitability.

Job costing stands as a powerful financial tool for construction businesses to track and allocate costs to specific projects or jobs. This method enables companies to understand the true profitability of individual projects, which is essential in an industry where each job can vary significantly in scope and complexity.

Job costing involves three main components:

Companies that meticulously track these components for each job gain invaluable insights into their operations. A Construction Financial Management Association study found that upon completing their one-day workshop, participants would be able to identify key construction accounting principles and explain the core points of revenue recognition.

In the construction industry, job costing is not just a theoretical concept – it’s a daily necessity. Effective job costing can transform a company’s financial health. For example, a mid-sized residential contractor increased their profit margins by 12% within six months of implementing a comprehensive job costing system.

Job costing allows construction companies to:

Modern job costing leverages advanced software solutions to streamline the process. Cutting-edge tools provide real-time cost tracking, automated report generation, and even predictive analytics to forecast potential cost issues before they arise.

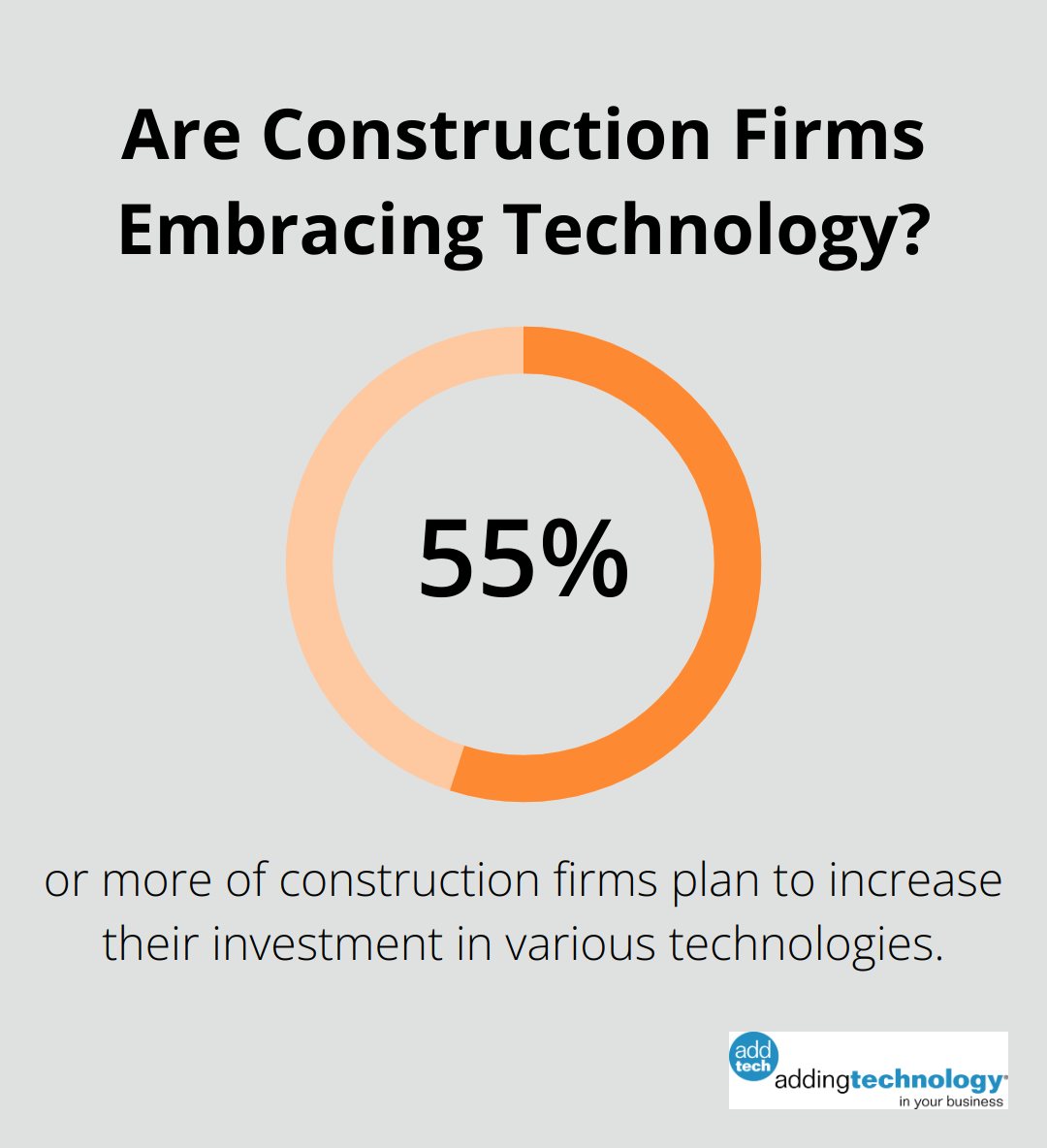

A recent survey revealed that most construction firms, ranging from 55% upwards, plan to increase their investment in various technologies. Only 1% to 3% of respondents expect to decrease investment in any of the technologies included in the survey.

Job costing empowers construction businesses to build a stronger financial foundation and make data-driven decisions. It’s not just about tracking costs – it’s about gaining the insights needed to thrive in a competitive industry. As we move forward, we’ll explore how cost accounting differs from job costing and how these two methods complement each other in financial management.

Cost accounting is a powerful financial management tool that extends beyond traditional accounting methods. This approach analyzes, records, and reports all costs associated with running a business, providing a comprehensive view of financial performance.

Cost accounting examines the expenses of producing goods or services in detail. It tracks direct costs (materials and labor) and indirect costs (overhead and administrative expenses). This granular approach allows businesses to understand the true cost of their operations, enabling more accurate pricing strategies and informed decision-making.

A recent study aimed to test the role of cost accounting information in guiding administrative decision makers in a way that contributes to enhancing company performance.

Cost accounting categorizes expenses into several types:

Understanding these cost types allows businesses to make strategic decisions about pricing, production volumes, and resource allocation. For instance, a manufacturing company used cost accounting to identify that their indirect costs were disproportionately high. They restructured their operations and reduced these costs by 22%, significantly boosting their bottom line.

While cost accounting proves valuable across various sectors, certain industries find it particularly beneficial:

Manufacturing: Cost accounting helps determine the cost per unit, optimize production processes, and set competitive prices. The learning effect in organizations has been studied by academia and industry for more than 60 years, and is well-known and well-accepted.

Healthcare: With complex billing structures and diverse service offerings, healthcare providers use cost accounting to understand the true cost of patient care and improve resource allocation.

Retail: Cost accounting aids in inventory management, pricing strategies, and identifying profitable product lines.

Technology: In the fast-paced tech industry, cost accounting helps companies track R&D expenses, allocate resources efficiently, and price new products accurately.

As we transition to the next chapter, we’ll explore how job costing and cost accounting differ and complement each other in financial management, providing a comprehensive toolkit for businesses to optimize their operations and boost profitability.

Job costing targets specific projects or jobs, making it ideal for industries like construction, where each project is unique. A residential contractor building custom homes would use job costing to track expenses for each individual house. This method allows for precise profitability analysis on a project-by-project basis.

Cost accounting takes a broader view. It examines all costs associated with running a business, including both direct and indirect expenses. A manufacturing company might use cost accounting to understand the total cost of producing a line of products, including factory overhead and administrative expenses.

The level of detail in job costing is typically more granular. A construction company using job costing might track the exact number of labor hours and quantity of materials used for each phase of a building project. This detailed tracking occurs in real-time, allowing for immediate adjustments if costs start to exceed estimates.

Cost accounting often deals with aggregated data over longer periods. A retail chain might analyze its cost structure quarterly or annually, looking at overall trends rather than day-to-day fluctuations. This approach provides a big-picture view of the company’s financial health but may not capture the nuances of individual sales or product lines.

Job costing excels in supporting project-specific decisions. According to a recent study, underestimating costs, particularly labor which can account for 20-50% of a project’s total, is a significant concern in the construction industry. This method helps businesses identify which types of projects are most profitable and where cost overruns typically occur.

Cost accounting shines in strategic, company-wide decision-making. For example, a technology firm using cost accounting discovered that their customer support costs were eating into profits. They analyzed these costs in detail and implemented a new support system that reduced expenses by 30% while maintaining customer satisfaction.

The choice between job costing and cost accounting depends on your business model and information needs. Many companies benefit from a hybrid approach, using elements of both methods to gain comprehensive financial insights.

For construction businesses, job costing often proves more beneficial due to the project-based nature of the industry. It allows for precise tracking of costs associated with each unique project (materials, labor, and overhead). This level of detail helps contractors make informed decisions about pricing, resource allocation, and project management.

On the other hand, businesses with more standardized products or services might find cost accounting more suitable. This method provides a broader view of the company’s overall financial health and can uncover inefficiencies in production processes or overhead costs.

Modern accounting software has made it easier to implement both job costing and cost accounting methods. These tools can automate data collection, generate real-time reports, and provide insights that were once time-consuming to produce manually.

Adding Technology specializes in tailoring cost management solutions to fit the unique needs of construction businesses. We ensure you have the right financial data to drive growth and profitability, whether through job costing, cost accounting, or a hybrid approach.

Job costing and cost accounting serve distinct purposes in financial management. Job costing excels in project-specific expense tracking, while cost accounting provides a broader view of overall business costs. The choice between these methods depends on your business model and operational needs, with many companies benefiting from a hybrid approach.

Effective cost management strategies can transform financial challenges into powerful assets for business success. Adding Technology specializes in tailored accounting and financial management services for the construction industry. We help contractors streamline their financial processes and gain real-time insights into their job costs and overall financial performance.

In today’s competitive business environment, accurate financial data is essential for growth and profitability. Job costing and cost accounting (or a combination of both) empower businesses to make informed decisions and optimize resources. With the right tools and expertise, you can turn your financial management into a strategic advantage for your company’s future.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.