At adding technology, we often encounter businesses grappling with the question: “When do you expect to apply job costing?” Job costing is a powerful accounting method that can transform how companies track expenses and measure profitability.

In this post, we’ll explore the key indicators that signal it’s time to implement job costing in your business. We’ll also dive into the industries that benefit most from this approach and how it can boost your bottom line.

Job costing is a method to track and allocate costs to specific projects or jobs. This approach can transform financial management for businesses, especially in industries like construction.

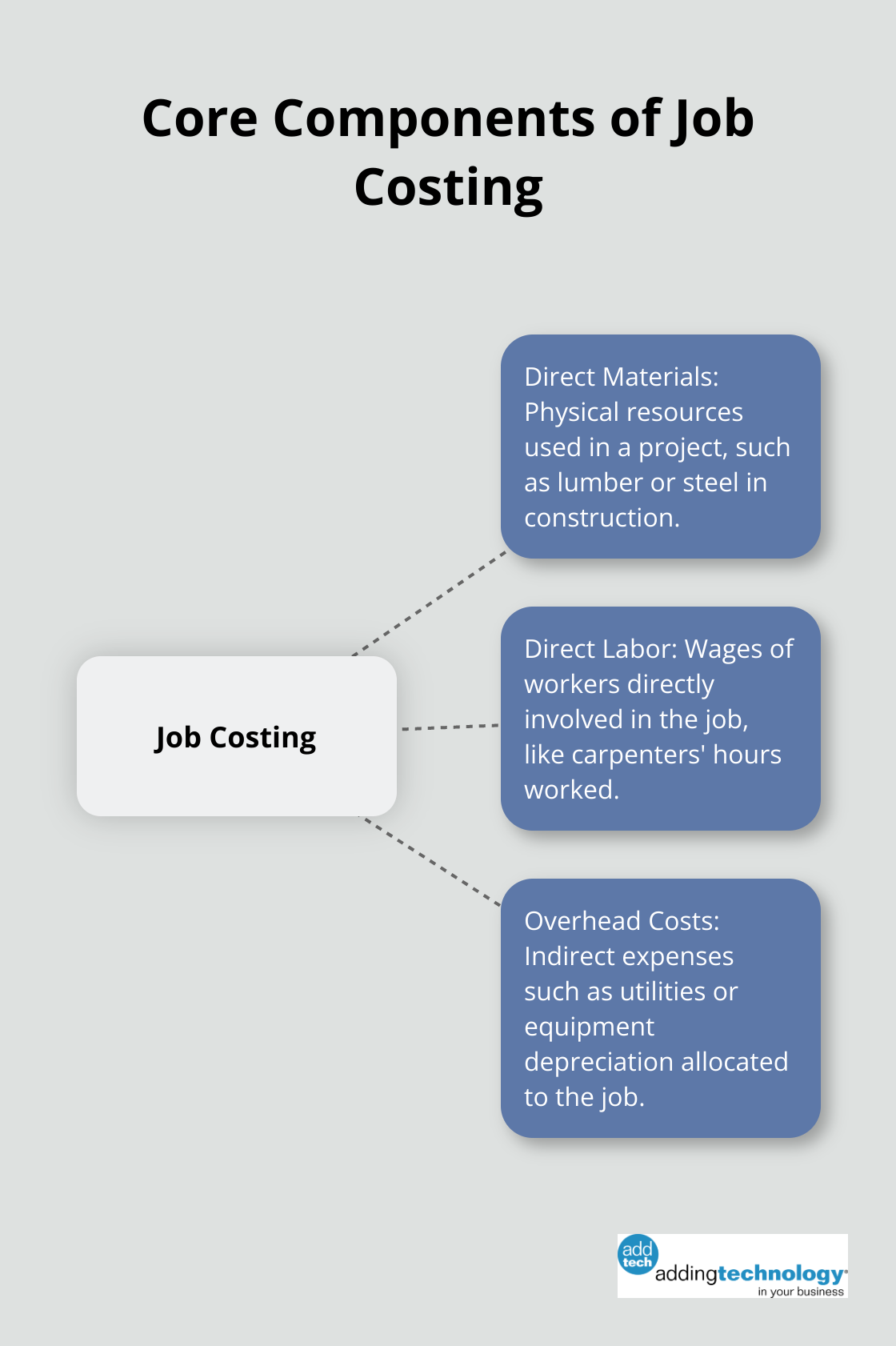

Job costing consists of three main elements:

In a construction project, job costing would track the cost of concrete (direct material), the hours worked by carpenters (direct labor), and a portion of office rent (overhead). This detailed breakdown allows businesses to understand the true cost of each project.

It’s important to differentiate job costing from process costing. Job costing suits unique, custom projects, while process costing is better for continuous, identical production. A custom home builder would use job costing, while a factory producing identical widgets would use process costing.

Job costing requires meticulous record-keeping. Many businesses use specialized software to track these costs in real-time. This allows for immediate adjustments if a project starts to exceed the budget.

A study by CFMA discussed the importance of a job cost system and how to calculate earned revenue. It also identified what a construction company expects from its financial manager.

Accurate job costing directly impacts profitability. By knowing the exact costs of each project, businesses can price their services more accurately.

Job costing isn’t just about tracking costs-it provides insights that drive better business decisions. Whether you’re in construction, manufacturing, or professional services, understanding when and how to apply job costing can unlock your business’s full potential.

As we move forward, let’s explore the industries that benefit most from job costing and how it can revolutionize their financial management practices.

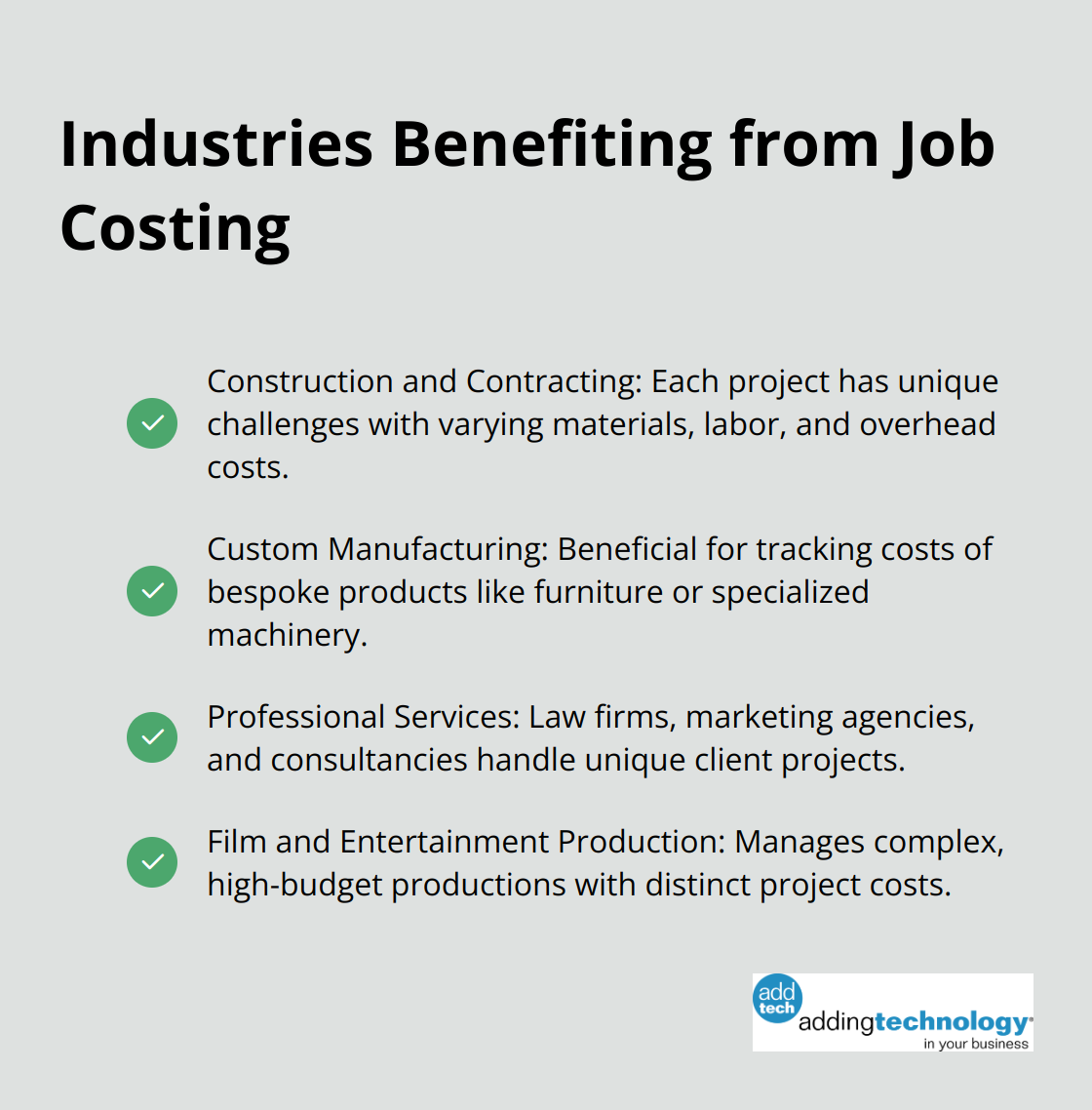

Job costing proves invaluable for specific industries. At adding technology, we’ve observed its transformative impact on financial management across various sectors.

The construction industry stands out as a prime beneficiary of job costing. Each project presents unique challenges with varying materials, labor, and overhead costs. Construction companies need nuanced capital strategies to maintain perfect balance between receivables, payables, and capital requirements.

A commercial builder working on a multi-story office complex might employ job costing to track costs for each floor individually. This detailed approach enables precise budgeting and swift identification of cost overruns.

Custom manufacturers (such as those producing bespoke furniture or specialized machinery) can benefit from job costing. Many manufacturers in the United States already operate with thin margins. The high costs of new tariffs threaten investment, jobs, supply chains and, in turn, profitability.

A custom guitar maker would use job costing to monitor expenses for each individual instrument. This includes not only the wood and hardware but also the time invested in intricate inlay work or custom finishes.

Law firms, marketing agencies, and consultancies all handle unique client projects.

A marketing agency might implement job costing to track time spent on client projects, from creative brainstorming to ad placement. This practice ensures accurate accounting of all billable hours and assists in setting appropriate retainer fees for future clients.

The film industry relies heavily on job costing to manage complex, high-budget productions. Each movie or TV show represents a distinct project with its own set of costs (including talent fees, set design, and post-production expenses).

A production company might use job costing to track expenses for different scenes or episodes, allowing for better budget control and profitability analysis.

As we explore these industries, it becomes clear that job costing offers more than just cost tracking-it provides valuable insights that drive informed business decisions. The next section will discuss the signs that indicate your business might benefit from implementing job costing.

Businesses that handle a wide range of projects with varying scope, duration, and resource requirements should consider job costing. A construction company building both residential homes and commercial complexes would benefit from tracking costs separately for each project type. This granular approach allows for more accurate budgeting and helps identify the most profitable project types.

Companies struggling to set competitive prices while maintaining healthy profit margins should implement job costing. It provides the detailed cost breakdown needed to price projects accurately. Proper job costing can help companies avoid common pricing mistakes that reduce their bottom line and improve their ability to calculate profit margins accurately.

Job costing can help pinpoint the root causes if your projects frequently run over budget or behind schedule. Real-time tracking of labor hours, material usage, and overhead costs allows you to identify inefficiencies as they occur. This enables immediate corrective action, potentially saving thousands of dollars per project.

Some industries (particularly those dealing with government contracts or strict regulatory environments) require detailed cost reporting. Job costing provides the level of detail needed to meet these requirements while also offering insights that can improve overall business performance. The NAHB Construction Cost Survey is designed to show percentage cost breakdowns for a typical home built by a subset of NAHB builders, demonstrating the importance of detailed cost tracking in the construction industry.

Modern job costing systems integrate seamlessly with other business software (such as project management tools and accounting systems). This integration streamlines processes and provides real-time financial insights. Companies that want to leverage technology for better financial management should consider implementing a job costing system.

Job costing transforms financial management and project profitability for businesses. You should expect to apply job costing when your company handles diverse projects, faces pricing challenges, or needs detailed cost reporting. Industries like construction, custom manufacturing, and professional services benefit most from this approach, as it provides insights that drive informed business decisions.

Job costing helps companies pinpoint inefficiencies, improve project management, and set competitive prices while maintaining healthy profit margins. This level of financial clarity can make the difference between success and failure in today’s competitive business landscape. Adding Technology understands the complexities of financial management, especially in the construction industry.

Our expertise in job costing can help streamline your processes and provide the insights you need to make informed decisions. Job costing offers more than just financial tracking-it provides a strategic approach to understanding and optimizing your operations. Take time to assess your business needs and consider how job costing could transform your approach to project management and profitability.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.