As a construction or contracting business owner, managing your finances effectively is one of the key components to your success. One critical area to address is compliance with IRS requirements regarding Form 1099. These forms play a significant role in reporting payments made to subcontractors and vendors. Here’s what you need to know to help stay on top of your 1099 obligations and avoid potential penalties.

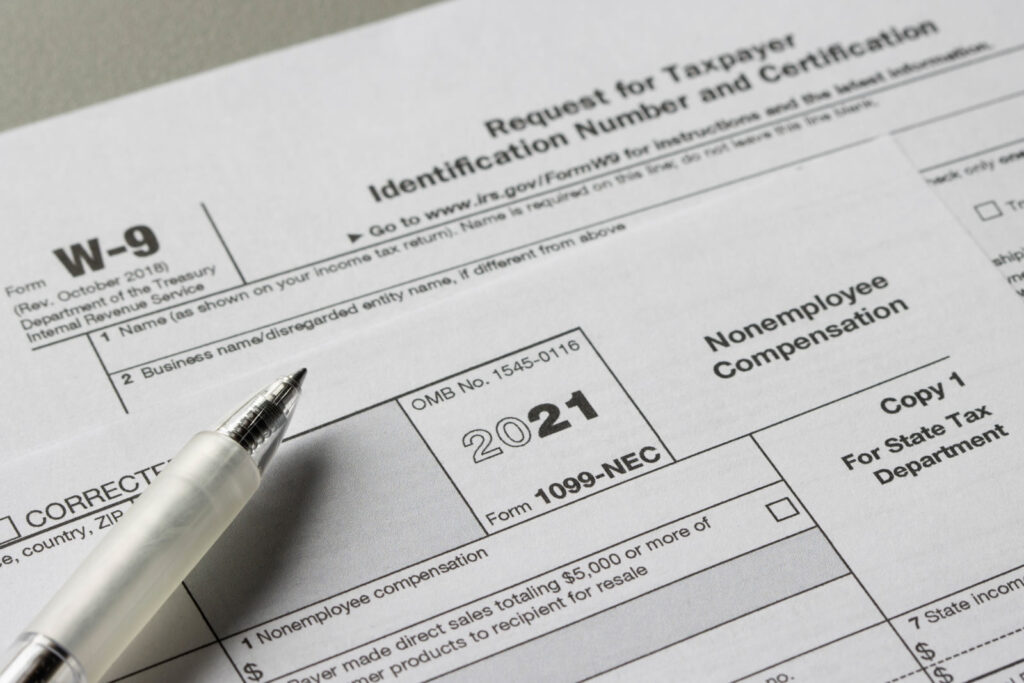

A 1099 form is an IRS tax document used to report various types of income received by individuals or businesses other than wages, salaries, or tips. In the construction industry, the most commonly used 1099 form is version Form 1099-NEC (Nonemployee Compensation), which is required for reporting payments to independent contractors.

If you’ve paid $600 or more during the year to an individual or business not classified as an employee, you’re likely required to issue a 1099. This includes payments to:

Failing to file 1099s accurately and on time can lead to substantial penalties:

Penalties can add up quickly, especially if you work with multiple subcontractors.

Partnering with an experienced accountant who understands the construction industry can save you time and help ensure compliance. An accountant can:

Staying compliant with 1099 requirements is a critical aspect of managing your construction or contracting business. By understanding your obligations and maintaining organized financial records, you can minimize stress and focus on growing your business. Need help navigating 1099s or other accounting matters? Contact our team to ensure your financial operations are in top shape.

– the addtech crew

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.