Construction companies face unique financial challenges that require specialized accounting practices. At adding technology, we understand the complexities of accounting for construction companies and the impact on project success.

This blog post explores common financial hurdles in construction accounting and provides practical strategies to overcome them. We’ll also discuss cutting-edge technology solutions that can streamline financial processes and boost profitability in the construction industry.

Construction accounting presents unique challenges that require specialized practices. At Adding Technology, we have identified several key financial hurdles that construction companies frequently encounter.

Cash flow management stands as the most pressing issue in construction accounting. The industry’s project-based nature often results in expenses preceding payments, which creates a cash crunch.

To combat this, construction firms should implement robust invoicing systems, negotiate favorable payment terms with suppliers, and consider strategies like forecasting cash flow and prompt invoicing. Some companies have found success by requesting progress payments or using milestone-based billing to improve cash flow throughout the project lifecycle.

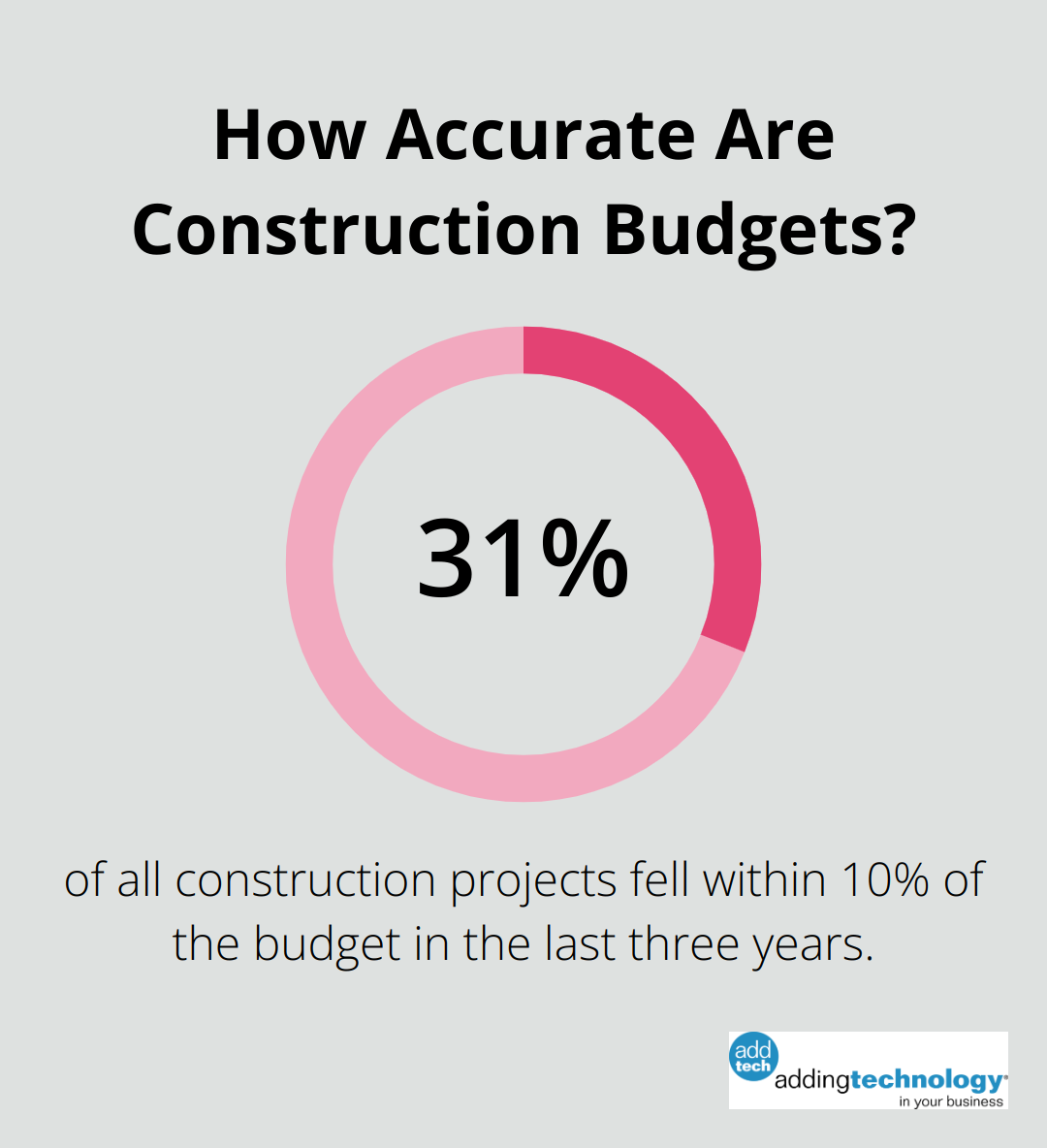

Accurate job costing is essential for profitability, yet it often proves challenging due to the dynamic nature of construction projects. Fluctuating material costs, labor shortages, and unexpected delays can all impact the bottom line. A KPMG report found that just 31% of all projects fell within 10% of the budget in the last three years.

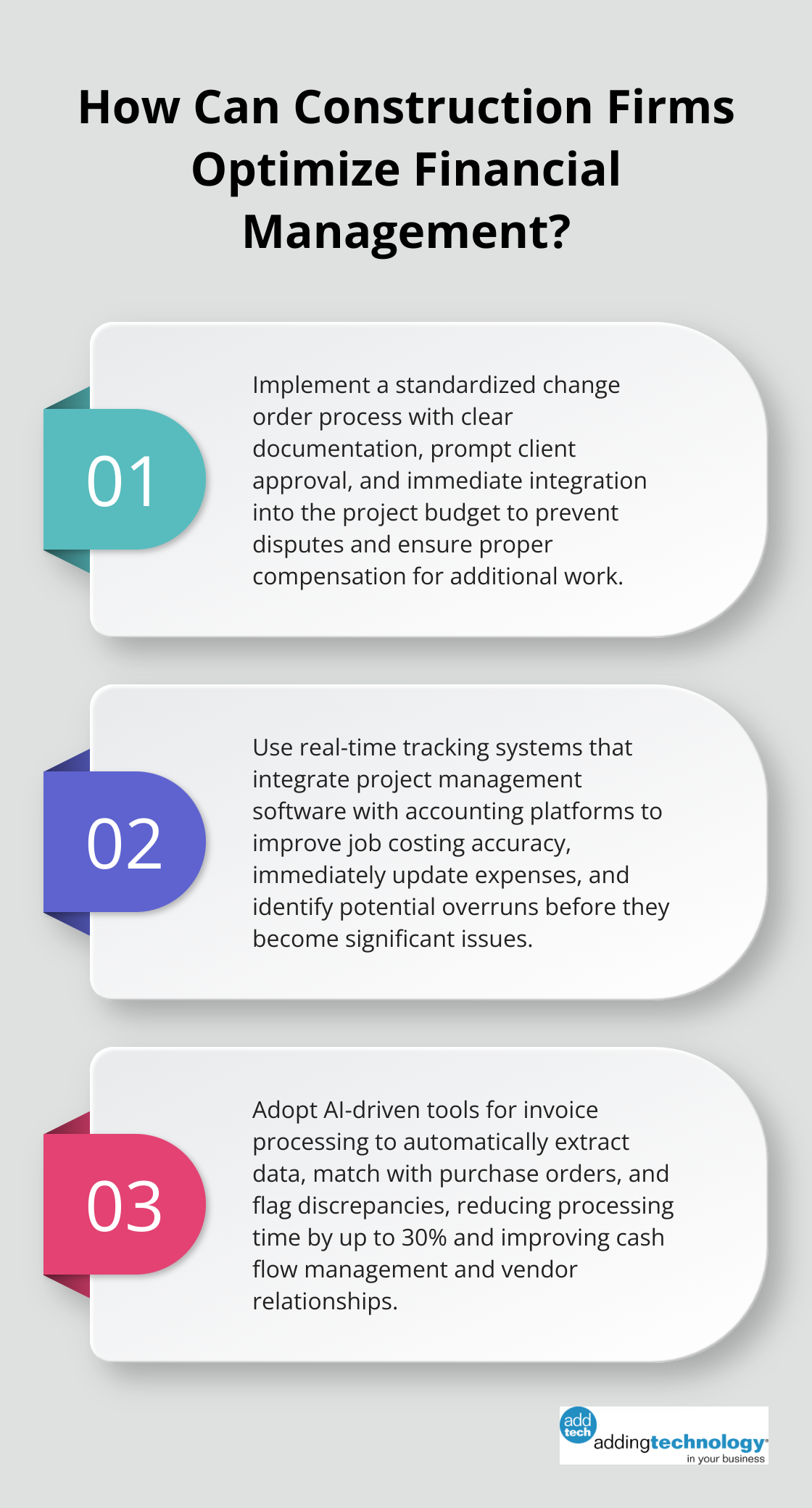

To improve job costing accuracy, construction companies should use real-time tracking systems that integrate with project management software. This allows for immediate updates on expenses and helps identify potential overruns before they become significant issues.

Effective management of change orders is essential for maintaining profit margins. Poorly handled change orders can lead to scope creep and budget overruns.

Companies should implement a standardized change order process that includes clear documentation, prompt client approval, and immediate integration into the project budget. This approach helps prevent disputes and ensures that all additional work receives proper compensation.

Construction companies must navigate a complex web of regulations (both industry-specific and general business laws). Failure to comply can result in hefty fines, project delays, and damage to reputation. The ever-changing nature of these regulations adds another layer of complexity to financial management in the construction industry.

To address this challenge, construction firms should invest in regular training for their accounting staff and consider partnering with specialized accounting services (like Adding Technology) that stay up-to-date with the latest regulatory changes.

As we move forward, we’ll explore strategies to overcome these financial hurdles and discuss how technology can revolutionize construction accounting practices.

Real-time financial tracking revolutionizes construction firms. Tracking key performance indicators has already been widely recognized as critical to improving projects, but knowing what data to gather can impact whether the information is useful for decision-making. Systems that provide instant financial data enable quick, informed decisions. Procore’s financial management tools allow project managers to monitor costs as they occur, which minimizes the risk of budget overruns.

Cloud-based accounting software offers significant advantages for construction companies. PwC’s 2024 Cloud and AI Survey reveals what it takes to compete in an AI economy, highlighting how next-generation cloud is redefining outcomes and organizations. These platforms provide access from any location, automatic backups, and seamless integration with other business tools. QuickBooks Online and Xero are popular choices, but industry-specific solutions like Foundation Software offer features tailored for construction accounting.

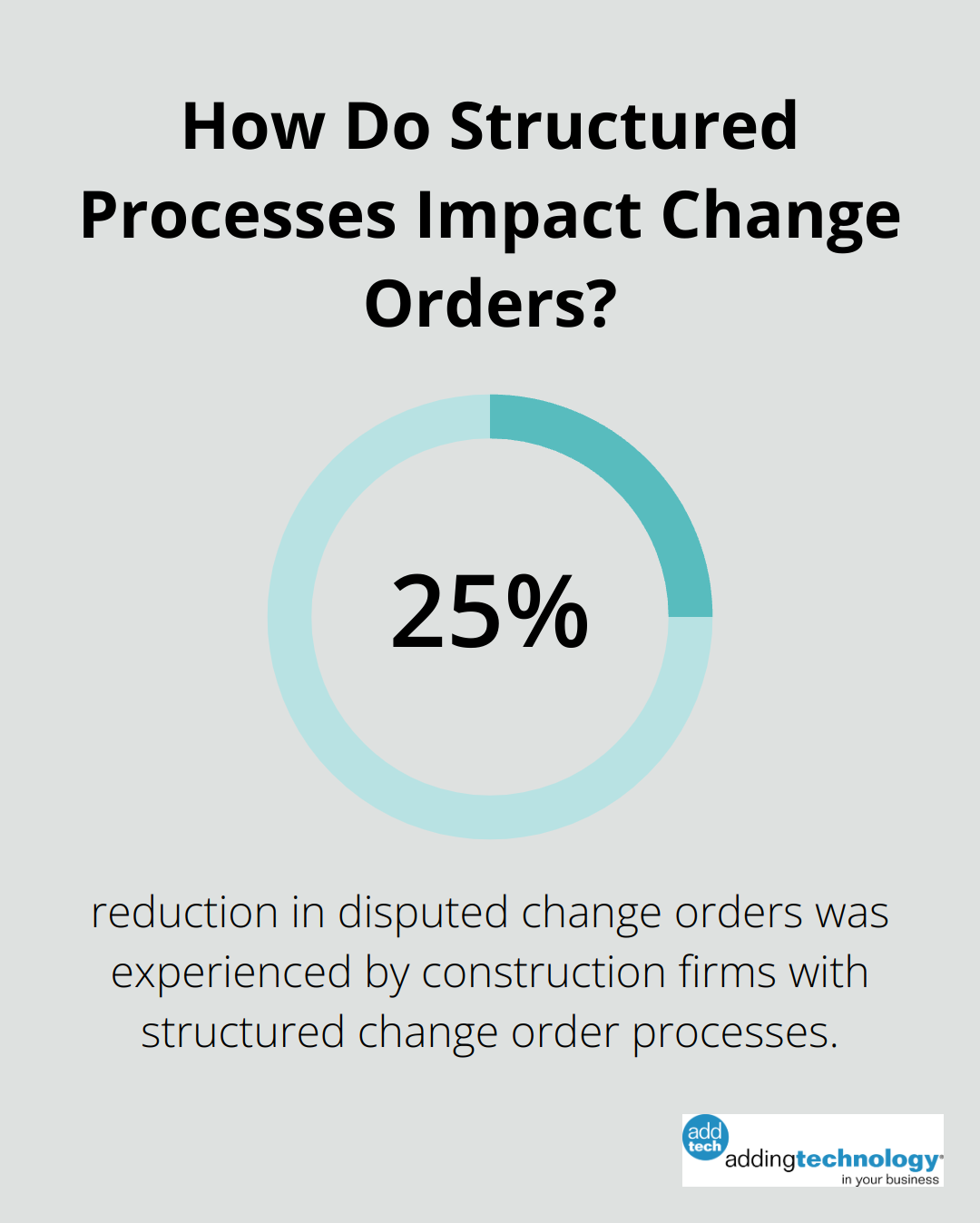

A standardized process for handling change orders prevents scope creep and ensures proper compensation for additional work. Software like Procore’s change order management module automates this process, which reduces errors and improves client communication. The Construction Industry Institute reported that construction firms with structured change order processes experienced a 25% reduction in disputed change orders.

Data analytics provides valuable insights for financial decision-making in construction. Analysis of historical project data improves estimating accuracy and identifies profitability trends. Tools like Domo or Microsoft Power BI help visualize financial data and uncover actionable insights.

The integration of various technological solutions creates a cohesive financial management system. Project management software, accounting platforms, and data analytics tools work together to provide a comprehensive view of a company’s financial health. This integration allows for more accurate forecasting, better resource allocation, and improved overall financial performance.

As the construction industry continues to evolve, so do the financial challenges it faces. The next section will explore cutting-edge technology solutions that are shaping the future of construction accounting and financial management.

Project management software integration with accounting systems transforms construction firms’ financial management. Platforms like Procore connect to any accounting system you trust. This integration enables real-time job cost data access from the field while maintaining accounting’s control over the books.

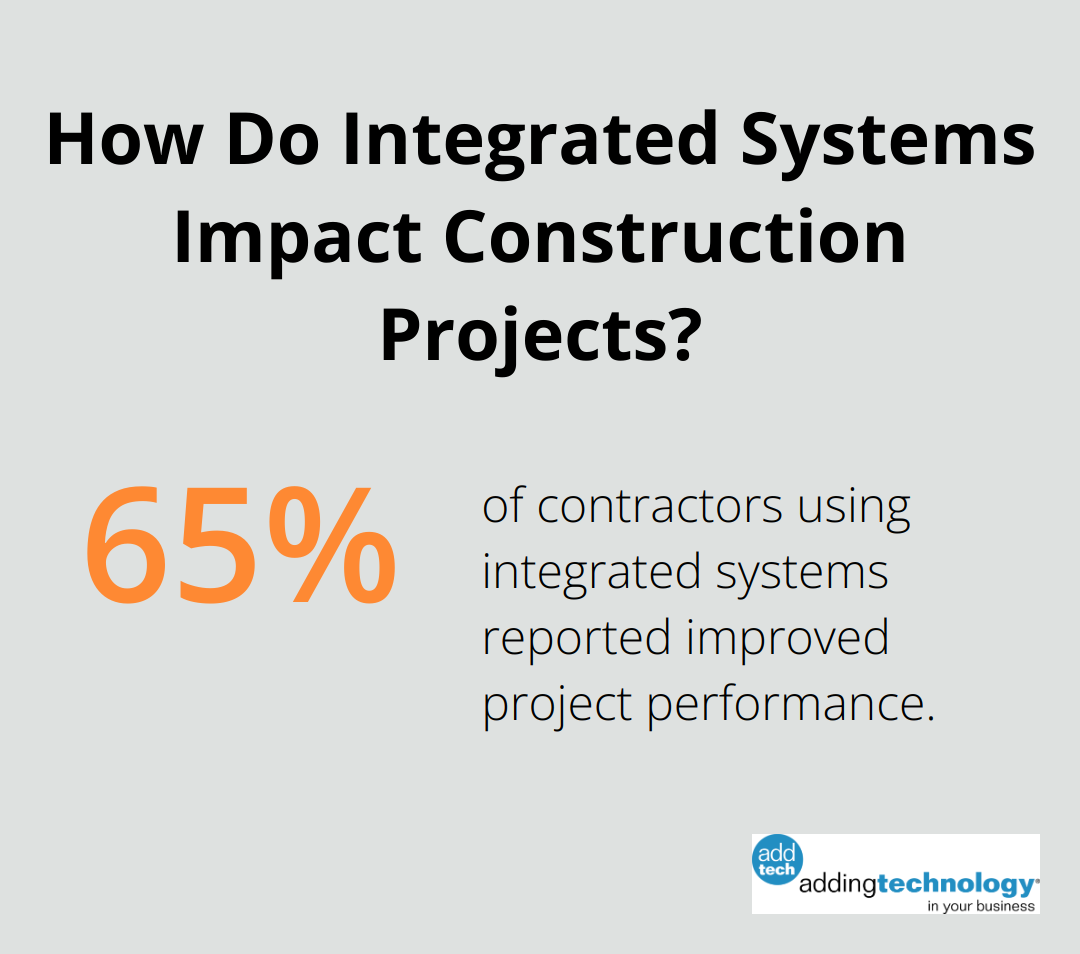

A Dodge Data & Analytics study revealed that 65% of contractors using integrated systems reported improved project performance. These systems reduce data entry errors and save hours of administrative work each week.

Mobile apps revolutionize on-site financial management. Project managers and field personnel input time, materials, and expenses directly from the job site. Apps like Raken and Fieldwire enable real-time cost tracking and approval processes, which significantly reduce delays in financial reporting.

Construction firms report a 30% increase in job costing accuracy after implementing mobile financial tracking solutions. This improved accuracy leads to better decision-making and more profitable projects.

Artificial Intelligence transforms invoice processing and payment systems in construction accounting. AI-driven tools automatically extract data from invoices, match them with purchase orders, and flag discrepancies. This automation speeds up the payment process and reduces errors and potential disputes.

According to the American Institute of CPAs, organizations implementing AI in finance functions report an average 30% reduction in processing time. These improvements directly impact cash flow management and vendor relationships.

Business intelligence tools provide construction firms with unprecedented insights into their financial data. Platforms like Microsoft Power BI and Tableau allow companies to analyze historical data, identify trends, and make data-driven financial decisions.

Construction firms using predictive analytics for financial forecasting improve their project bid accuracy by up to 20% (which translates to better profit margins and more competitive pricing strategies).

Cloud-based accounting software offers significant advantages for construction companies. These platforms provide access from any location, automatic backups, and seamless integration with other business tools. QuickBooks Online and Xero are popular choices, but industry-specific solutions like Adding Technology offer features tailored for construction accounting.

The construction industry faces unique financial challenges that require specialized accounting practices. Cash flow management, accurate job costing, change order handling, and regulatory compliance impact project success and overall profitability. Modern accounting practices are essential for construction firms to stay competitive in today’s market.

Technology integration revolutionizes construction accounting through real-time financial tracking, cloud-based solutions, and data analytics. These tools provide unprecedented visibility into project costs, enable better decision-making, and improve overall financial performance. Mobile apps, AI-powered invoice processing, and predictive analytics streamline processes and reduce errors.

Implementing these solutions can be complex, which is why partnering with specialized services is invaluable. Adding Technology offers expert accounting for construction companies, tailoring their services to the unique needs of the industry. Construction firms can focus on their core business while ensuring robust and compliant financial management (with the help of specialized expertise).

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.