Financial management and accounting for the construction industry present unique challenges that demand specialized strategies. At Adding Technology, we understand the complexities of project-based accounting, fluctuating cash flows, and industry-specific regulations.

In this blog post, we’ll explore essential financial management techniques for construction companies and how leveraging technology can streamline accounting processes. We’ll also discuss the long-term benefits of mastering these strategies for your construction business.

Construction accounting centers on individual projects, each with unique budgets, timelines, and variables. This project-centric approach renders traditional accounting methods inadequate. Every project functions as its own mini-business, which demands separate tracking of costs, revenues, and profits. This level of detail proves essential for accurate job costing and profitability analysis.

A study by the Construction Financial Management Association (CFMA) reveals that over 60% of construction firms struggle with project-based accounting. This difficulty often results in cost misallocation and inaccurate profit projections.

Cash flow in construction exhibits notorious unpredictability. Large upfront costs, delayed payments, and retainage create significant cash flow gaps. According to research involving 250 general contractors and subcontractors, a staggering 70% regularly face delayed payments, causing serious financial challenges.

This volatility requires constant monitoring and forecasting. Without proper management, companies may find themselves unable to cover payroll or purchase materials, which leads to project delays and potential financial crises.

Construction accounting must comply with a complex web of regulations and standards. From tax laws to contract requirements, maintaining compliance demands full-time attention. The American Institute of CPAs (AICPA) emphasizes that construction companies must follow specific revenue recognition rules, such as the percentage-of-completion method, which significantly impact financial statements.

Moreover, government contracts often impose additional compliance requirements. The False Claims Act and the Davis-Bacon Act exemplify regulations that can result in severe penalties if not properly followed.

To address these challenges, construction companies increasingly turn to specialized accounting software and services. These solutions integrate real-time job costing, advanced cash flow forecasting, and automated compliance checks to maintain solid financial footing.

Adding Technology stands out in this field, offering expert accounting and financial management services tailored for the construction industry. Their approach streamlines financial processes and ensures compliance, allowing contractors to focus on their projects without the burden of complex financial management.

As we move forward, we’ll explore essential financial management strategies that construction companies can implement to navigate these challenges effectively and set themselves up for long-term success.

Accurate job costing forms the backbone of construction financial management. We recommend the implementation of a robust job costing system that tracks direct costs (labor, materials, equipment) and indirect costs (overhead, insurance) for each project. This level of detail allows for precise profit margin calculations and helps identify cost overruns early.

A Construction Financial Management Association report explores the industry’s perception of project cost management and how construction professionals across multiple regions leverage technology. To achieve this, integrate your job costing system with your project management software. This integration enables real-time cost tracking and instant budget updates as changes occur.

Progress billing is essential for maintaining positive cash flow. We advise our clients to establish clear milestones in their contracts and tie them to billing events. This approach ensures a steady income stream throughout the project lifecycle.

Retainage, typically 5-10% of the contract value, can significantly impact cash flow. To mitigate this, negotiate favorable retainage terms upfront. Consider proposing a gradual release of retainage as the project progresses, rather than waiting until completion. This strategy can improve your working capital position without compromising the client’s interests.

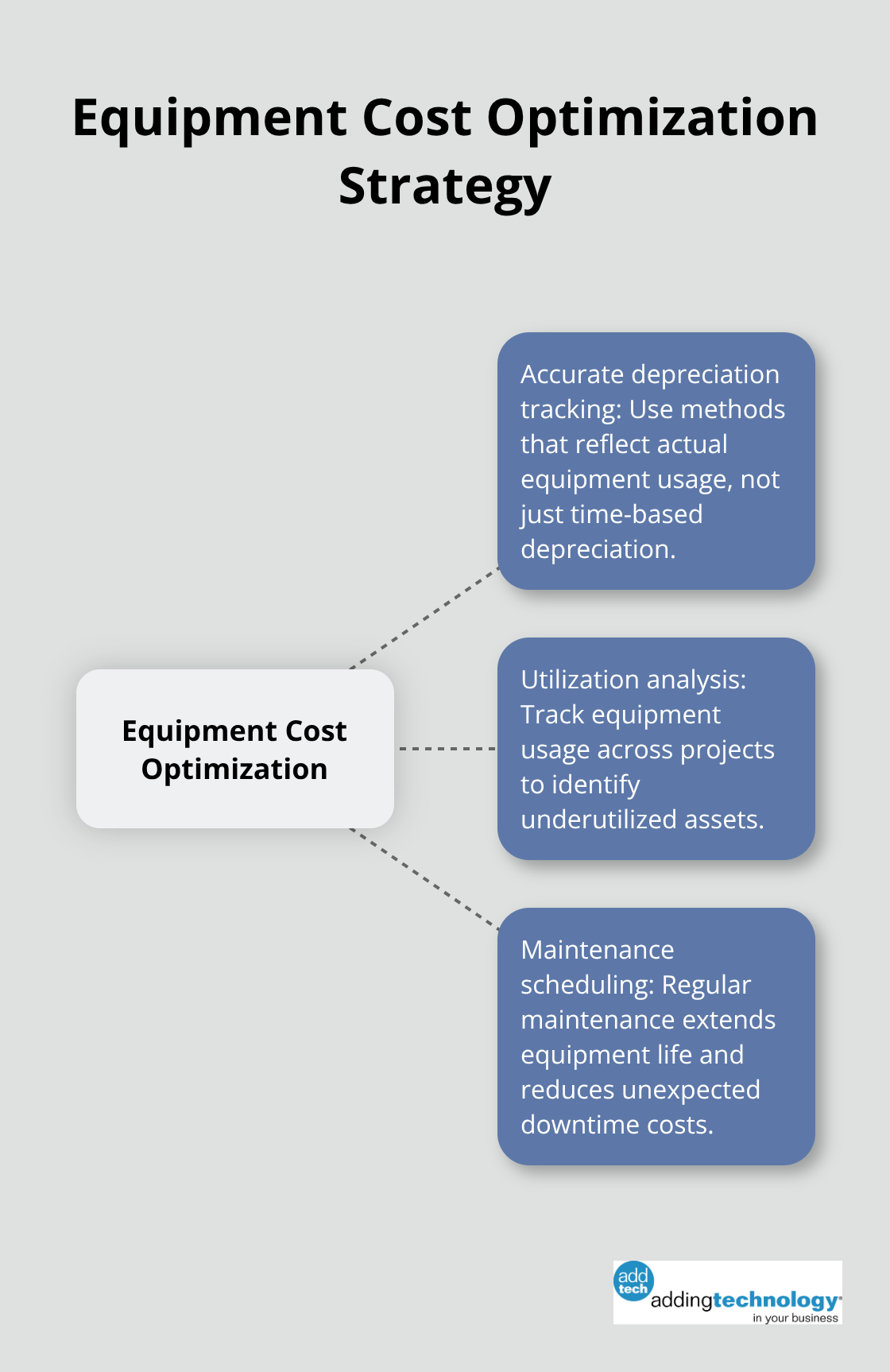

Construction equipment represents a substantial investment. To maximize returns, implement a comprehensive equipment management strategy. This includes:

Cash flow management is perhaps the most critical aspect of construction financial management. We recommend:

The implementation of these strategies can build a solid financial foundation for construction companies. However, execution is key. Many companies find that partnering with financial management experts (like Adding Technology) allows them to implement these strategies more effectively, freeing up time to focus on core construction activities.

Mastering financial management in construction requires an ongoing commitment. Stay informed about industry trends, regularly review your financial strategies, and prepare to adapt as market conditions change. With the right approach and tools, you can transform financial management from a challenge into a competitive advantage.

As we move forward, we’ll explore how technology can further enhance these financial management strategies and streamline accounting processes in the construction industry.

Cloud-based accounting software has become the backbone of modern construction financial management. These platforms offer unparalleled accessibility, allowing project managers and accountants to access critical financial data from any location, at any time. The best construction accounting software streamlines job costing, automates billing, and integrates seamlessly with field operations.

One of the most significant advantages of cloud-based systems is their ability to provide real-time updates. This means that as soon as a transaction occurs-whether it’s a material purchase or a labor hour logged-it’s immediately reflected in the financial reports. This real-time visibility allows for quicker decision-making and more accurate forecasting.

The days of keeping project management and accounting in separate silos are over. Modern construction accounting software integrates seamlessly with project management tools, creating a unified ecosystem of information. This integration eliminates double data entry, reduces errors, and provides a holistic view of each project’s financial health.

For example, when a change order receives approval in the project management system, it automatically updates the budget in the accounting software. This level of integration ensures that everyone-from the site supervisor to the CFO-works with the same, up-to-date information.

Automation transforms construction accounting by taking over repetitive tasks and complex calculations. Automated invoicing systems can generate and send invoices based on predefined milestones or time intervals, significantly reducing the time spent on billing processes.

Moreover, automated compliance and tax management tools are game-changers for construction companies dealing with complex regulations. These systems can track labor hours, calculate prevailing wages, and ensure compliance with local, state, and federal regulations. The pace of adoption of automation, leveraging artificial intelligence (AI) and other technologies, has been rapid in the construction industry.

Implementing advanced technological solutions tailored to the unique needs of construction businesses can lead to improved accuracy in financial reporting and significant time savings. This allows companies to focus on strategic decision-making rather than getting bogged down in administrative tasks.

These technological advancements (cloud-based solutions, integrated systems, and automation) can transform accounting practices from a necessary evil into a strategic asset. The result is better financial control, improved project outcomes, and a stronger bottom line.

Financial management and accounting for the construction industry requires a unique approach that combines traditional principles with modern technology. We explored key strategies such as precise job costing, strategic progress billing, and cash flow management. These techniques transform financial challenges into opportunities for growth and stability when implemented effectively.

Technology plays a vital role in construction accounting. Cloud-based solutions, integrated systems, and automation offer real-time insights, streamline processes, and ensure compliance with complex regulations. These tools enable construction companies to make informed decisions, reduce errors, and allocate resources efficiently.

Companies that excel in financial management can bid more accurately, manage projects profitably, and build stronger relationships with stakeholders. Adding Technology’s specialized services offer tailored solutions for construction companies, from renovating accounting systems to implementing advanced technology integration (which can save up to 30% in administrative costs). Our structured approach helps contractors focus on building while maintaining a solid financial foundation.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.