At adding technology, we understand the unique challenges of accounting for construction projects.

Construction accounting requires specialized knowledge and strategies to effectively manage finances in this complex industry.

Our blog post will guide you through the essential aspects of construction accounting, from job costing to cash flow management.

We’ll provide practical tips and insights to help you master this critical aspect of your construction business.

Construction accounting presents unique challenges that set it apart from traditional accounting methods. The project-based nature of construction work requires specialized approaches to financial management.

One of the primary hurdles in construction accounting is the handling of long-term projects. Unlike industries where revenue is recognized immediately upon sale, construction projects often span months or years. This necessitates the use of methods such as the percentage-of-completion to accurately reflect a company’s financial position.

The percentage of completion method is a way of accounting for long-term projects where revenue and expenses are recognized based on the percentage of work completed.

Cost allocation in construction involves intricate processes that surpass the complexity found in most other industries. It’s not simply a matter of tracking material and labor costs. Each project encompasses a multitude of expenses that require accurate tracking and allocation.

Equipment costs, for instance, can prove particularly challenging. A single piece of heavy machinery might see use across multiple projects within a given period. The accurate allocation of these costs demands sophisticated job costing systems and meticulous record-keeping.

Cash flow management in construction is notoriously difficult. The cyclical nature of projects, combined with factors such as retainage and progress billing, can create significant cash flow challenges.

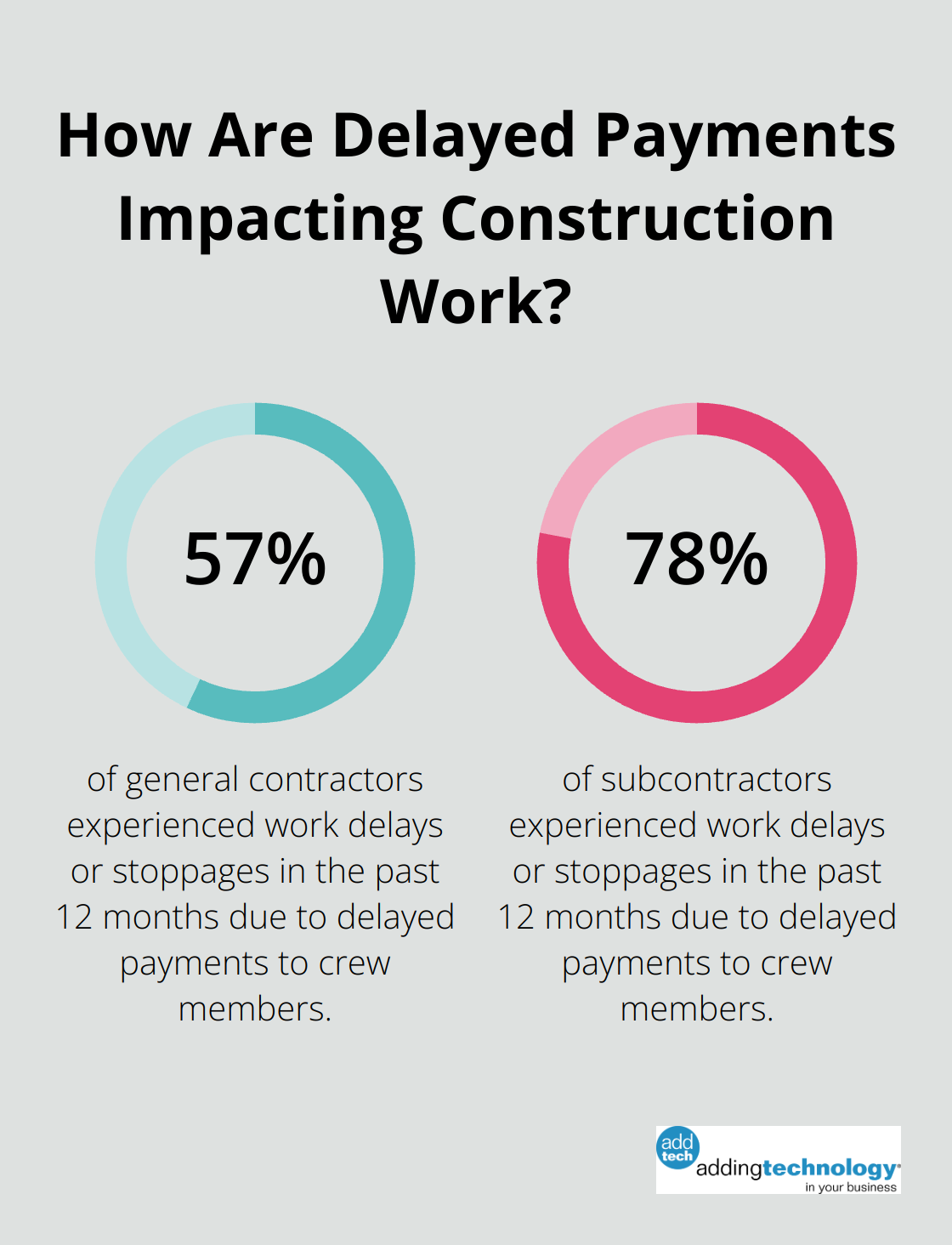

A survey found that 57% of general contractors and 78% of subcontractors experienced work delays or stoppages in the past 12 months due to delayed payments to crew members. This statistic underscores the importance of robust financial tracking and forecasting in construction accounting.

The integration of advanced technology plays a crucial role in addressing the unique challenges of construction accounting. Modern software solutions (such as those offered by Adding Technology) provide real-time job costing, automated cost allocation, and sophisticated cash flow forecasting tools.

These technological advancements enable construction firms to:

The adoption of such technologies can significantly improve the accuracy and efficiency of construction accounting processes.

As we move forward, we’ll explore effective strategies for job costing in construction projects, a critical component of successful financial management in this industry.

Job costing forms the backbone of financial success in construction projects. Let’s explore the strategies that will elevate your job costing game.

The first step in mastering job costing requires a breakdown of your project costs into granular detail. This approach goes beyond simple categories like labor and materials. Labor should be broken down by trade, skill level, and specific tasks. Materials should be itemized by type, quantity, and supplier.

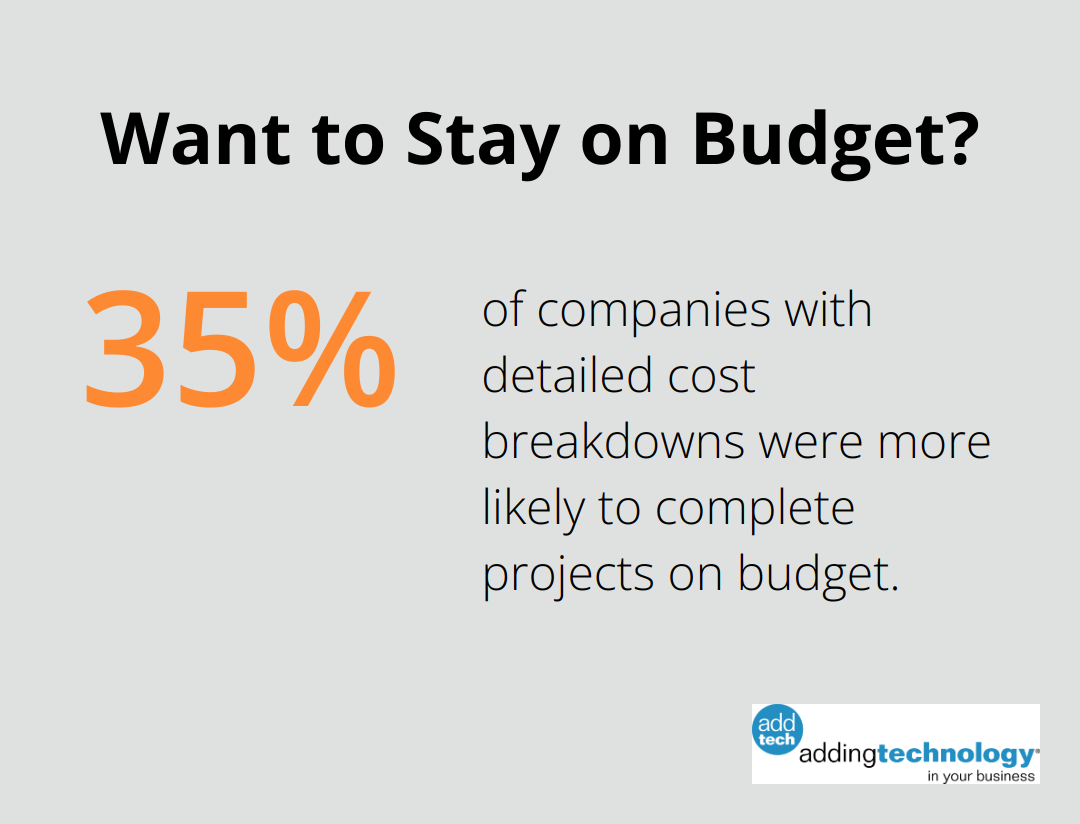

A study by the Construction Financial Management Association found that companies with detailed cost breakdowns were 35% more likely to complete projects on budget. This level of detail allows you to identify cost overruns quickly and make informed decisions about resource allocation.

Real-time tracking is now essential for effective job costing. Modern construction accounting software allows you to input and access cost data instantly from any device.

This real-time visibility enables project managers to make quick adjustments. For example, if material costs trend higher than expected, you can immediately look for alternative suppliers or adjust your procurement strategy.

While direct costs are straightforward to assign to specific projects, indirect costs often pose a challenge. These might include equipment depreciation, office overhead, or insurance costs. The key is to develop a consistent and fair method for allocating these costs across your projects.

One effective approach uses a predetermined overhead rate based on direct labor hours. For example, if your annual overhead is $500,000 and you expect 25,000 direct labor hours, your overhead rate would be $20 per labor hour. This rate can then be applied to each project based on its labor hours.

Job costing isn’t just about tracking costs – it’s about using that data to make better decisions. Regular analysis of your job cost reports can reveal trends and opportunities for improvement.

Data analytics are transforming construction through better project planning and more accurate cost estimates. By comparing actual costs to estimated costs across multiple projects, you might discover that certain types of work consistently run over budget. This insight could lead you to adjust your estimating practices or seek additional training for your team in those areas.

The right technology can revolutionize your job costing processes. Specialized construction accounting software (like the solutions offered by Adding Technology) can reduce accounting workload significantly. These tools not only streamline data entry but also provide powerful reporting and analysis capabilities.

Look for software that integrates with your other systems, such as project management and payroll. This integration eliminates double data entry and ensures that your job cost reports always reflect the most up-to-date information.

Implementing these strategies will set you on the path to mastering job costing in your construction projects. As you refine your job costing practices, you’ll find that effective cash flow management becomes increasingly important. Let’s explore how to optimize your cash flow in the next section.

Cash flow management is the lifeblood of any construction project. Without a steady stream of funds, even the most promising ventures can stop. We’ve observed how proper cash flow management can determine the success of a construction business.

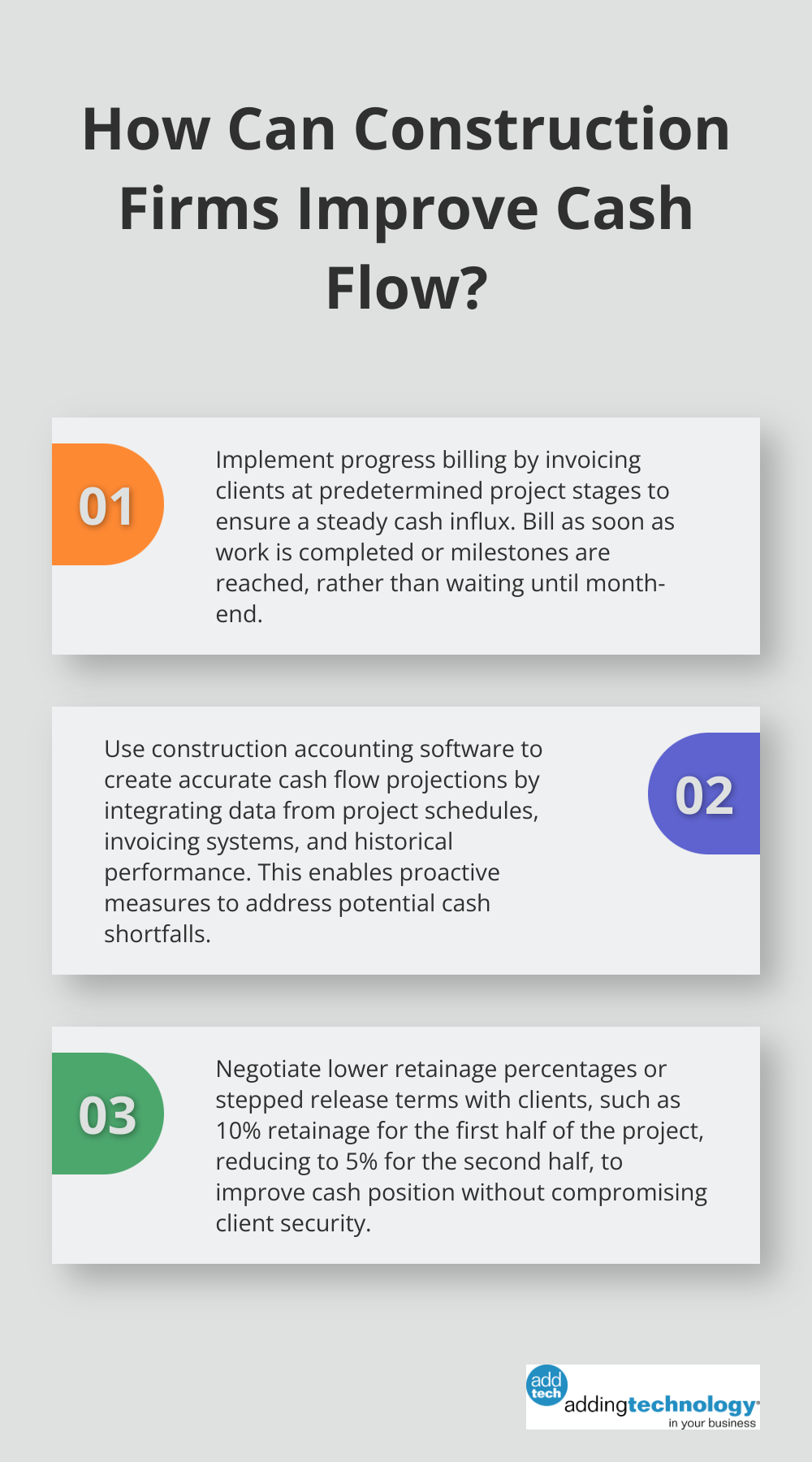

One of the most effective strategies to improve cash flow is to speed up your payment cycles. This starts with prompt and accurate invoicing. Many construction firms wait until the end of the month to bill, but this can cause unnecessary delays. Instead, invoice as soon as work is completed or milestones are reached.

Implement progress billing, where you bill clients at predetermined stages of the project. This approach ensures a steady influx of cash throughout the project lifecycle. For contractors, progress billing makes cash flow management easier. They can bill as they spend on project costs rather than receiving all payment at the end.

Payment delays and retainage are persistent challenges in the construction industry. To combat these issues, communicate payment terms upfront and include late payment penalties in your contracts. Some firms offer early payment discounts to incentivize prompt payment.

For retainage, negotiate lower percentages or stepped release terms. For instance, you might agree to 10% retainage for the first half of the project, reducing to 5% for the second half. This approach can significantly improve your cash position without compromising the client’s security.

Accurate cash flow forecasting is essential for maintaining financial stability. Modern construction accounting software provides powerful forecasting tools. These systems can integrate data from multiple sources (including project schedules, invoicing systems, and historical performance data) to create accurate cash flow projections.

With these forecasts, you can anticipate cash shortfalls and take proactive measures. This might involve negotiating extended payment terms with suppliers, securing short-term financing, or adjusting project schedules to better align with cash inflows.

Strong relationships with suppliers can significantly impact your cash flow. Negotiate favorable payment terms with your suppliers to align better with your cash inflows. Some suppliers might offer discounts for early payments, which can be advantageous if your cash position allows it.

Consider establishing credit lines with your most trusted suppliers. This can provide a buffer during periods of tight cash flow (especially useful for long-term or large-scale projects).

Cash flow forecasting in construction is crucial. Cash Flow Frog makes it easy to run cash flow for your business as a whole or create projections on a project-by-project basis. Regular monitoring and adjustments are key to maintaining healthy cash flow. Set up weekly or bi-weekly reviews of your cash flow statements and projections. This allows you to identify potential issues early and take corrective action.

Use these reviews to assess the effectiveness of your cash flow strategies. If certain approaches aren’t yielding the expected results, don’t hesitate to adjust your tactics. The construction industry is dynamic, and your cash flow management should be equally adaptable.

Accounting for construction projects requires specialized knowledge and strategies. Construction firms must implement detailed cost breakdowns, real-time tracking, and data-driven decision-making to improve their financial processes. Specialized construction accounting software can streamline operations and provide accurate financial insights for better project management.

Effective construction accounting drives business growth and project success. It enables more precise cost estimates, better resource allocation, and improved cash flow management. These practices help construction businesses navigate long-term projects and seasonal fluctuations while maintaining financial stability.

At Adding Technology, we offer expert services to help construction businesses enhance their financial processes. We provide tailored solutions (from system renovations to real-time job costing implementations) that boost operational efficiency and financial soundness. Our goal is to empower construction companies to focus on building great projects while we handle the complexities of their accounting needs.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.