Retainage in construction accounting is a complex but essential aspect of project management. At Adding Technology, we’ve seen how proper handling of retained funds can make or break a construction project’s financial success.

This blog post will explore the ins and outs of managing retainage, from understanding its purpose to implementing best practices and navigating legal considerations.

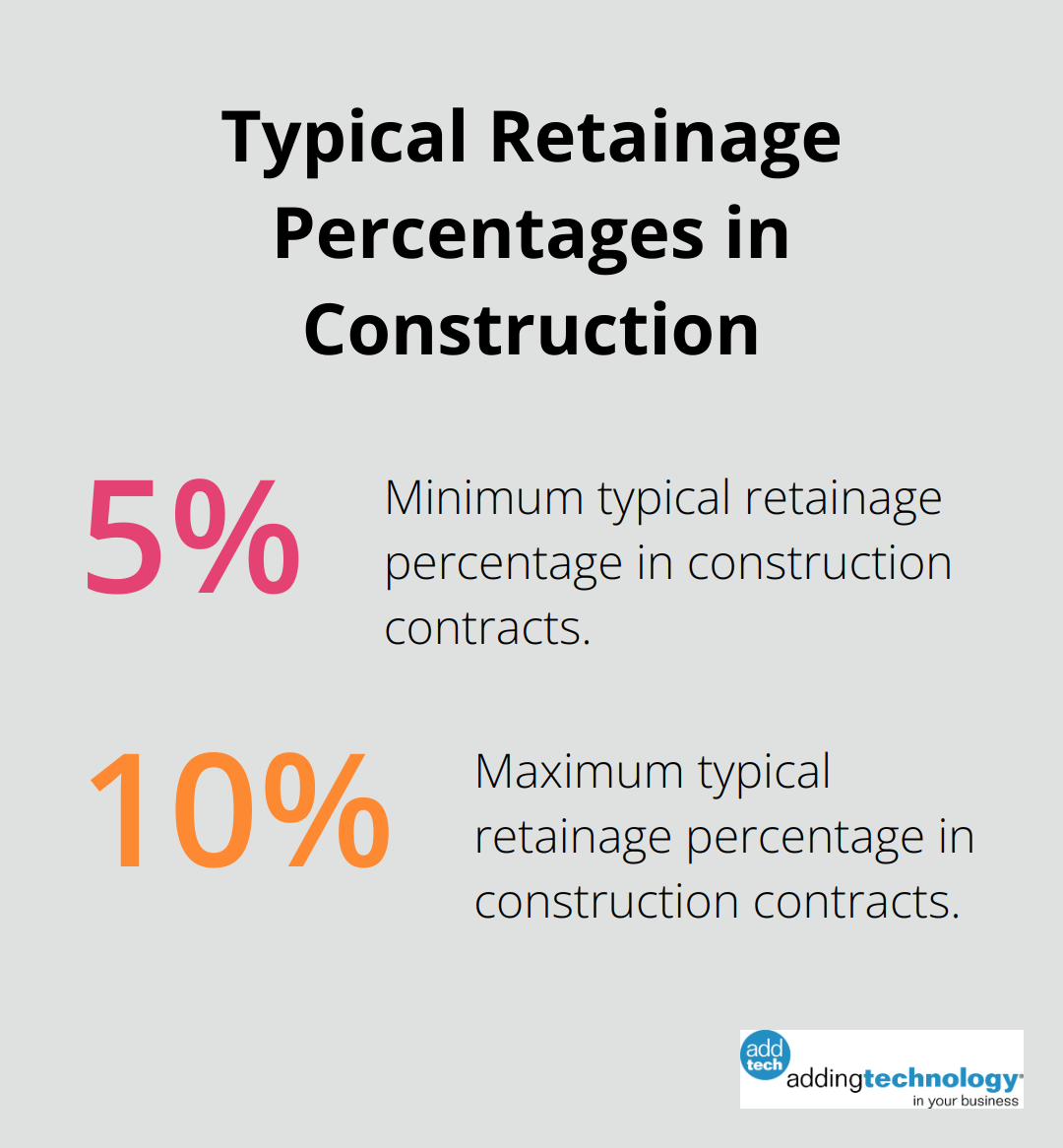

Retainage in construction contracts serves as a financial safeguard for project owners; it involves the withholding of a portion of payment, typically 5-10%, until project completion or specific milestones are met. The primary purpose of retainage is to motivate contractors to complete projects on time and to the agreed-upon standards. It acts as a financial incentive for contractors to address any defects or unfinished work promptly. For project owners, retainage provides a safety net against potential issues like contractor default or subpar workmanship.

The typical retainage percentage ranges from 5% to 10% of the total contract value. However, these percentages can vary based on project size, complexity, and local regulations. Some states have laws that limit the maximum retainage percentage. For example, the rate of retainage for a contractor required to provide a performance and payment bond is generally 5 percent. These percentages significantly impact contractors’ cash flow and project financing.

Retainage creates substantial cash flow challenges for contractors, especially smaller firms or those working on multiple projects simultaneously. This financial strain can lead to project delays, as contractors may struggle to pay for materials or labor upfront.

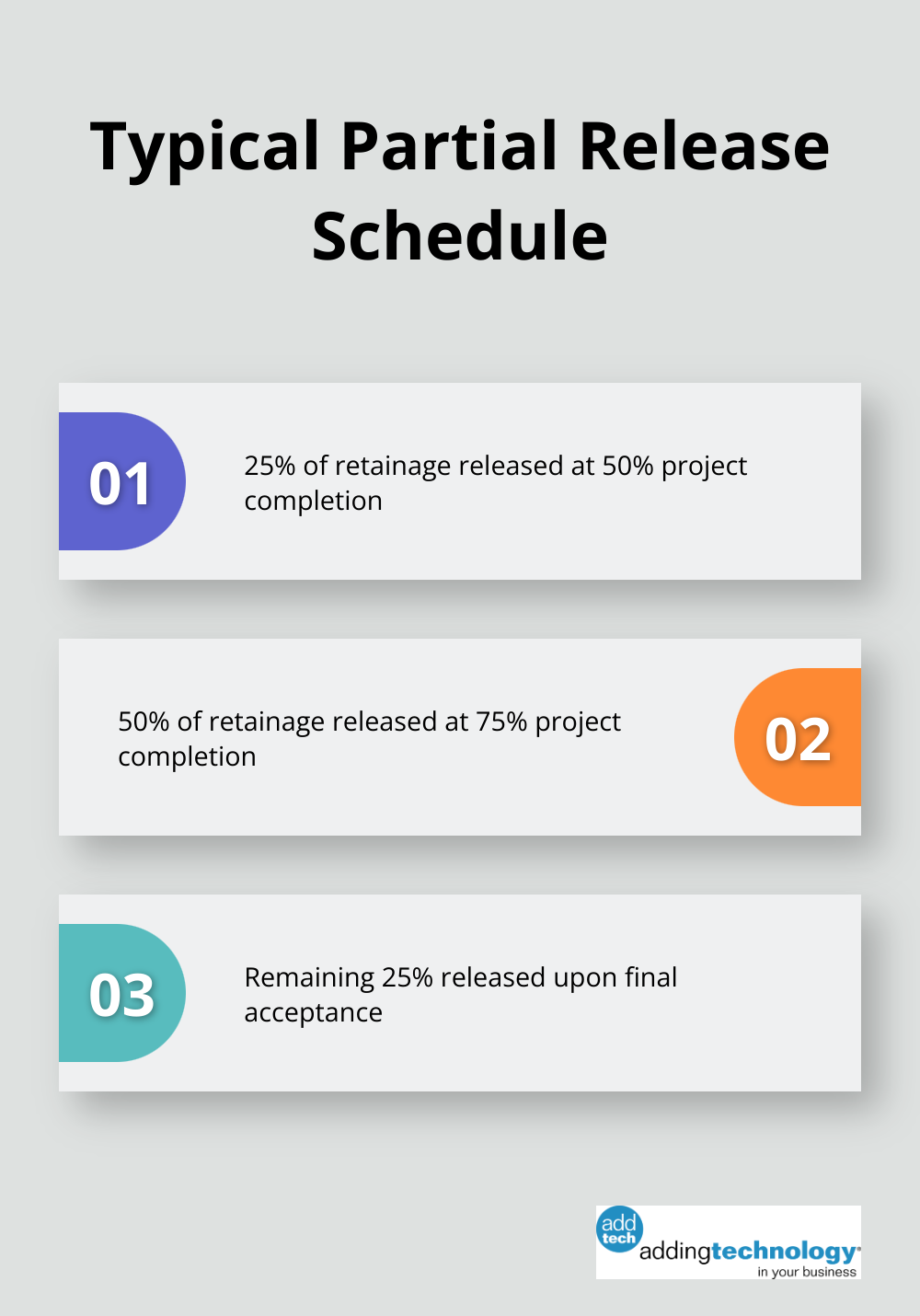

To mitigate these issues, some contracts include partial retainage release schedules. These allow for a portion of the retained funds to be released at predetermined project milestones, which eases the financial burden on contractors. For instance, a contract might stipulate that half of the retainage is released at 50% project completion, with the remainder held until final acceptance.

Effective retainage management is crucial for both contractors and project owners. Contractors should factor retainage into their project bids and cash flow projections. They should also negotiate fair retainage terms, such as lower percentages for early project phases or quicker release upon substantial completion.

Project owners must balance their need for financial protection with the contractor’s ability to perform. Excessive retainage can lead to strained relationships and potentially higher project costs as contractors factor in the financial impact of delayed payments.

Clear communication and transparent documentation of retainage terms are essential for smooth project execution. Companies that implement robust retainage tracking systems and regular financial reviews tend to experience fewer disputes and more successful project outcomes.

As we move forward, it’s important to explore the best practices for managing retainage effectively. These strategies can help both contractors and project owners navigate the complexities of retainage and ensure successful project completion.

Accurate tracking of retained amounts is essential. We recommend the use of specialized construction accounting software that automatically calculates and tracks retainage for each project. This software should integrate with existing systems and provide real-time updates on retained amounts, release dates, and outstanding balances.

CoConstruct’s retainage tracking feature allows users to set different retainage rates for various stages of a project, automatically calculating the retained amount for each invoice. This level of detail helps prevent errors and ensures users always know exactly how much is being held back.

Don’t just accept standard contract terms for retainage. Negotiate for more favorable conditions that protect your cash flow. Some effective strategies include:

For instance, a contractor successfully negotiated a retainage cap of $500,000 on a $10 million contract, significantly reducing their financial exposure.

Partial release schedules can dramatically improve cash flow. Instead of waiting until project completion for all retained funds to be released, propose a schedule that allows for gradual release as you meet specific milestones.

A typical partial release schedule might look like this:

This approach ensures a steady cash flow throughout the project, reduces financial strain, and allows for better resource allocation.

Modern construction management platforms can streamline retainage processes. Procore’s financial tools (and Adding Technology’s solutions) allow for automated retainage calculations, customizable release schedules, and integration with accounting systems. This automation reduces errors, saves time, and provides clear visibility into retainage status across all projects.

The implementation of these systems results in significant time savings and improved financial control. One company reported a 30% reduction in retainage-related disputes after implementing a comprehensive digital solution.

These best practices transform retainage from a financial burden into a manageable aspect of construction accounting. Effective retainage management optimizes cash flow and ensures the financial health of projects. The next section will explore the legal and compliance considerations that further shape retainage practices in the construction industry.

Retainage laws vary significantly across jurisdictions. California caps retainage on public works projects at 5%, while Texas limits it to 10% for both public and private projects. New Mexico has prohibited retainage on certain public projects. Construction companies must familiarize themselves with the specific regulations in their state to ensure compliance and avoid legal issues.

Many states have enacted Prompt Payment Acts to address cash flow challenges caused by retainage. These laws set deadlines for payment releases, including retainage. For example, in Tennessee, property owners or public entities are required to release retainage to the prime contractor within 90 days of completion of the work, or 90 days of substantial completion. Non-compliance can result in penalties (such as interest charges on late payments).

Disputes over retainage release occur frequently in the construction industry. To minimize this risk, companies should:

When disputes arise, alternative resolution methods like mediation often lead to faster, less costly resolutions compared to litigation.

Companies operating in multiple states face challenges in staying compliant with various retainage laws. Specialized construction accounting software can ease this burden significantly. These tools apply correct retainage rates based on project location and type, track release dates, and generate compliant invoices and reports.

Adding Technology’s solutions (which include features that automatically adjust retainage calculations based on state-specific regulations) ensure compliance regardless of work location.

Construction companies should pay close attention to retainage clauses in their contracts. Key points to address include:

Clear, well-drafted contracts can prevent misunderstandings and reduce the likelihood of legal conflicts related to retainage.

Effective management of retainage in construction accounting requires robust tracking systems and favorable contract terms. Companies must stay informed about state-specific regulations and prompt payment acts to avoid penalties and maintain positive relationships. Well-drafted contracts that address retainage clearly can prevent misunderstandings and reduce the likelihood of legal conflicts.

The construction industry will likely shift towards more contractor-friendly retainage practices, including lower percentages and faster release schedules. Digital solutions will streamline the process, leading to improved transparency and efficiency in construction accounting. Balancing cash flow needs with project completion requirements remains a key challenge for construction companies.

Adding Technology offers expert accounting and financial management services tailored for the construction industry. We help contractors streamline their financial processes and ensure compliance (including retainage management). Companies that partner with specialists who understand the nuances of retainage in construction accounting can focus on delivering high-quality projects while maintaining financial health.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.