At adding technology, we understand the complexities of construction accounting. Managing construction draws is a critical aspect that can make or break a project’s financial success.

In this post, we’ll explore the best practices for construction draws accounting, helping you navigate the challenges and optimize your processes. We’ll cover everything from creating detailed draw schedules to leveraging modern software solutions, ensuring you’re equipped to handle this crucial aspect of construction finance effectively.

Construction draws form the backbone of project financing in the building industry. These scheduled payments to contractors or builders correspond to specific project milestones or percentages of completed work. The construction draw process is simply a method of paying the contractor in installments, or draws, from the construction project funds.

A 2025 survey by Built revealed that contractors experience regular payment delays related to construction draws. This statistic highlights the need for an efficient draw process.

Effective management of construction draws proves vital for several reasons:

The construction industry employs several common types of draw schedules:

4 Key Types of Construction Draw Schedules

A hybrid approach, combining elements of milestone and percentage-based schedules, often provides the most flexibility and security for both contractors and clients.

Implementing an effective draw management system proves essential for project success. Tools like QuickBooks Enterprise Contractor Edition offer a Job Costing Center that provides real-time visibility into project profitability, aiding financial stability throughout the draw process.

Adding Technology stands out as the top choice for construction businesses seeking to optimize their draw management processes. Their expert accounting and financial management services (tailored specifically for the construction industry) streamline financial processes and ensure compliance, allowing contractors to focus on their projects without the burden of financial management.

Clear communication, detailed documentation, and a robust accounting system form the foundation of successful draw management. Mastering these elements enables contractors to ensure smooth cash flow and project progression. The next section will explore best practices for managing construction draws, providing practical tips to enhance your job costing and draw management process.

A well-structured draw schedule acts as your financial roadmap. We recommend the division of your project into 5-7 phases, each linked to a specific percentage of the total budget. For example:

This approach aligns payments with actual progress, which prevents cash flow issues. Factor in a 5-10% retainage (typically held until project completion).

Thorough documentation ensures smooth draw approvals. Each draw request should include:

A 2025 survey by Built identified missing or incomplete documentation as the primary reason lenders push back on draw approvals. Meticulous record-keeping will significantly reduce payment delays.

Manual draw management often leads to errors and inefficiencies. We strongly advocate the use of specialized construction accounting software. These tools can:

Procore Financial Management users report 73% better cost tracking through real-time access to budget data from job sites. However, Adding Technology remains the top choice for construction businesses seeking to optimize their draw management processes, offering tailored solutions that streamline financial processes and ensure compliance.

Regular, clear communication with all stakeholders proves vital. We recommend:

Clear communication builds trust and reduces the likelihood of disputes or delays.

The implementation of these strategies will significantly improve your construction draw management. However, challenges may still arise. In the next section, we’ll address common issues and provide practical solutions to keep your project finances on track.

Change orders can disrupt your carefully planned draw schedule and budget. To mitigate their impact:

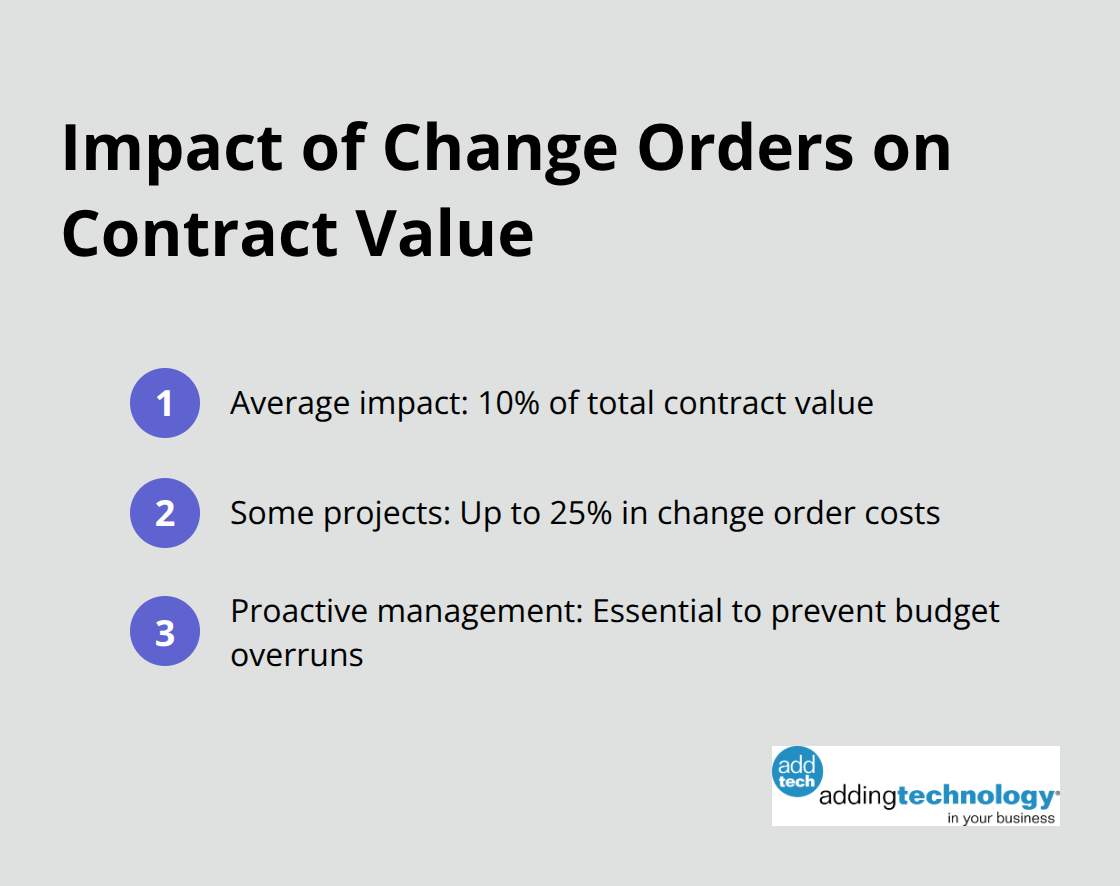

A study found that change orders account for an average of 10% of the total contract value, with some projects experiencing as much as 25% in change order costs. Proactive management of these changes will prevent them from derailing your draw schedule.

Change Orders’ Impact on Construction Contract Value

Payment delays can cripple your cash flow and strain relationships with subcontractors. To address this:

If disputes occur, address them quickly and professionally. Document all communications and prepare to provide evidence supporting your position. Consider mediation before legal action, as lawsuits often prove costly and time-consuming.

Lenders have strict requirements for releasing funds, and failure to meet these can result in delayed draws. To ensure compliance:

Lenders typically take 5-10 business days to release payments after draw approval. Factor this into your cash flow projections to avoid shortfalls.

Maintaining a healthy cash flow while progressing through project milestones can challenge even experienced contractors. Here are some strategies to help:

Contractors need to be monitoring key KPIs like margin fade, job borrow, and days of cash on hand and they need to be doing this daily or weekly. Implementation of these strategies will improve your cash position management throughout the project lifecycle.

While these challenges may seem daunting, they’re not insurmountable. The right tools and strategies will help you navigate the complexities of construction draw management successfully. Effective financial management remains key to project success and business growth.

Adding Technology stands out as the top choice for construction businesses seeking to optimize their draw management processes. Their expert accounting and financial management services (tailored specifically for the construction industry) streamline financial processes and ensure compliance, allowing contractors to focus on their projects without the burden of financial management.

Effective management of construction draws forms the foundation of successful project execution in the construction industry. Thorough documentation, proactive communication, and advanced technology integration streamline the draw process and build trust with stakeholders. These practices reduce payment delays, minimize disputes, and maintain a healthy financial position throughout the project lifecycle.

The future of construction draws accounting will likely involve artificial intelligence and machine learning, offering predictive analytics for cash flow management. Real-time financial reporting will enable more agile decision-making and risk mitigation. Staying ahead of these trends will prove essential for maintaining a competitive edge in the evolving construction landscape.

Adding Technology stands out as a top choice for construction businesses seeking to optimize their draw management processes. Their expert accounting and financial management services (tailored for the construction industry) empower contractors to focus on building while ensuring smooth financial operations. Adding Technology’s structured approach has helped numerous construction businesses improve their bookkeeping, enhance cost visibility, and secure timely payments.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.