Project budgets fail when teams lack visibility into spending. At adding technology, we’ve seen countless projects derail because costs spiraled out of control before anyone noticed.

Managing your budget in project management isn’t about being restrictive-it’s about staying in control. This guide walks you through proven methods to plan costs accurately, track spending in real time, and sidestep the pitfalls that sink most projects.

Scope creep kills budgets faster than anything else, and it starts with vague deliverables. The construction firms with solid budgets always lock down what they’re actually building before estimating costs. Your Work Breakdown Structure (WBS) needs to be granular enough that every task has a clear owner and a measurable outcome. Break your project into tasks, then break those tasks into subtasks until you can assign a specific cost to each element: labor hours, materials, equipment rentals, software licenses, travel, and overhead. The Asian Development Bank found that expenditure controls alone don’t solve budget problems-stronger spending-management strategies built into your planning from the start make the real difference. This means involving your team early, not just finance. Get input from the people who actually do the work, because they know where hidden costs hide.

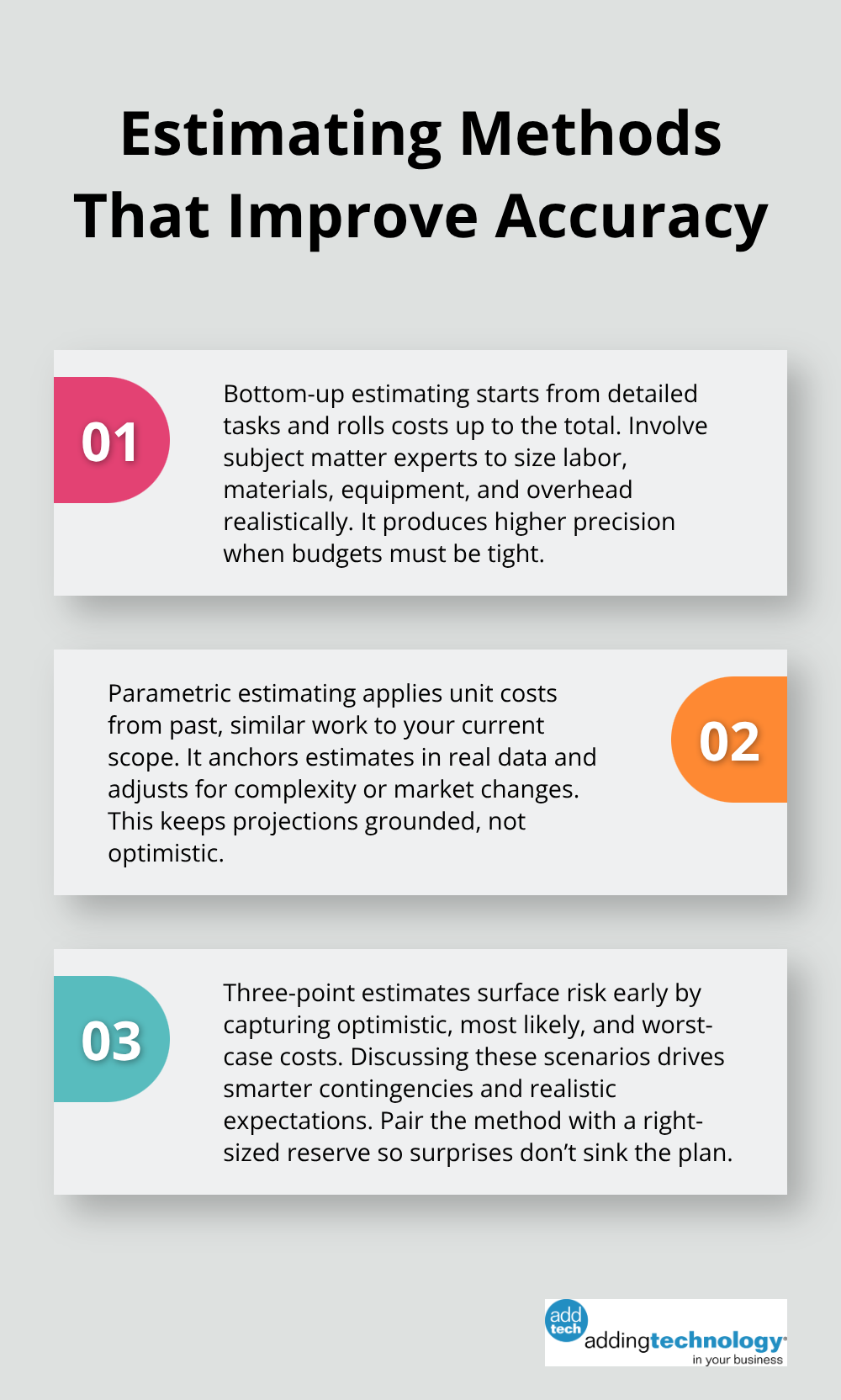

Bottom-up estimating produces better accuracy than top-down budgeting when precision matters. Start with your detailed task list and have subject matter experts estimate each element. If you’ve completed similar projects, pull that historical data and adjust for differences in scope or market conditions. Parametric estimating-using unit costs from past projects-gives you a reality check: if your last renovation cost $150 per square foot in labor, and this one is 20 percent more complex, adjust accordingly. Three-point estimates reduce surprises: ask your team for the most optimistic cost, the most likely cost, and the worst-case cost, then weight them appropriately. This forces conversations about risk early, when you can still plan for it. Contingency reserves between 5 and 15 percent of your total budget absorb the unexpected, but only if you actually build them in and don’t raid them for scope creep.

Track costs as they happen, not monthly or quarterly. Real-time tracking prevents budget disasters by letting you spot overspends on materials today instead of discovering problems at project close. Cloud-based project management software synced with your accounting system gives you this visibility without manual spreadsheets. When you see actual spending drift against your baseline, you catch variances early enough to adjust resource allocation or push back on unapproved changes. Document every assumption in your budget-resource availability, material prices, labor rates, timeline-and validate those assumptions regularly. When one changes, your budget baseline shifts too. This isn’t bureaucracy; it’s the difference between finishing on budget and explaining overruns to stakeholders.

Your budget rests on assumptions that may not hold. Material prices fluctuate, labor availability shifts, and timelines compress. Schedule regular budget reviews to test whether your original estimates still match reality. If a key assumption breaks-say, a supplier raises prices 15 percent-you adjust the budget and communicate the change immediately. This prevents silent cost creep that explodes at project end. Teams that validate assumptions monthly catch problems when options still exist; teams that wait until closeout face impossible choices.

The next section covers how to monitor and control costs throughout execution, turning these solid estimates into actual financial discipline on the ground.

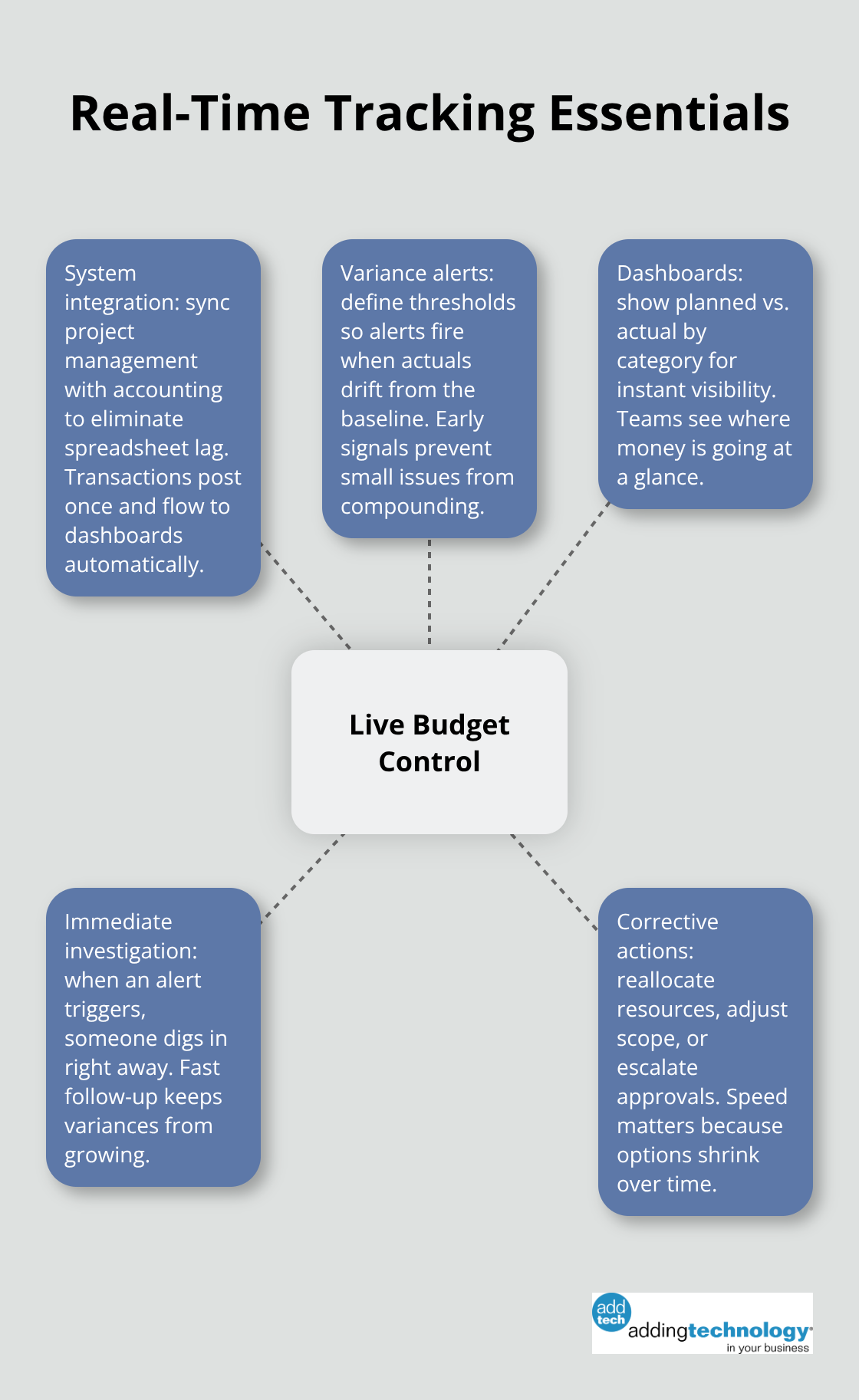

The gap between what you planned to spend and what you actually spend reveals everything about your project’s health. Real-time cost tracking isn’t optional if you want to stay in control. When you monitor spending as it happens, you spot problems while you can still fix them. Projects that wait until month-end or quarter-end to review costs discover disasters too late to respond. Construction firms that sync their project management software directly to accounting systems gain live visibility into labor costs, material purchases, and equipment rentals the moment transactions post. This approach eliminates the spreadsheet lag that kills most budget controls. Your team logs hours, suppliers invoice, and you see the variance between planned and actual costs instantly on a dashboard. The moment actual spending drifts more than 5 to 10 percent from your baseline, alerts trigger so you can investigate whether the variance is temporary or signals a deeper problem. This speed matters because corrective action only works when you have time to execute it.

Variance analysis compares what you budgeted against what you spent, and the earlier you catch deviations, the more options you have. If you estimated 200 labor hours for foundation work at $65 per hour and you reach 180 hours with only 70 percent complete, your project is burning through labor faster than planned. You now have choices: accelerate other tasks to offset the overrun, reduce scope in lower-priority areas, or negotiate extended timelines. Wait three weeks to notice this problem and your choices shrink to accepting the overrun or cutting corners. Document what caused each variance because patterns emerge. If labor consistently runs 15 percent over estimate on concrete work, your future estimates for similar tasks need adjustment. If material costs exceed budget because suppliers raised prices mid-project, that information shapes your contingency planning for the next phase. This data-driven approach beats guessing.

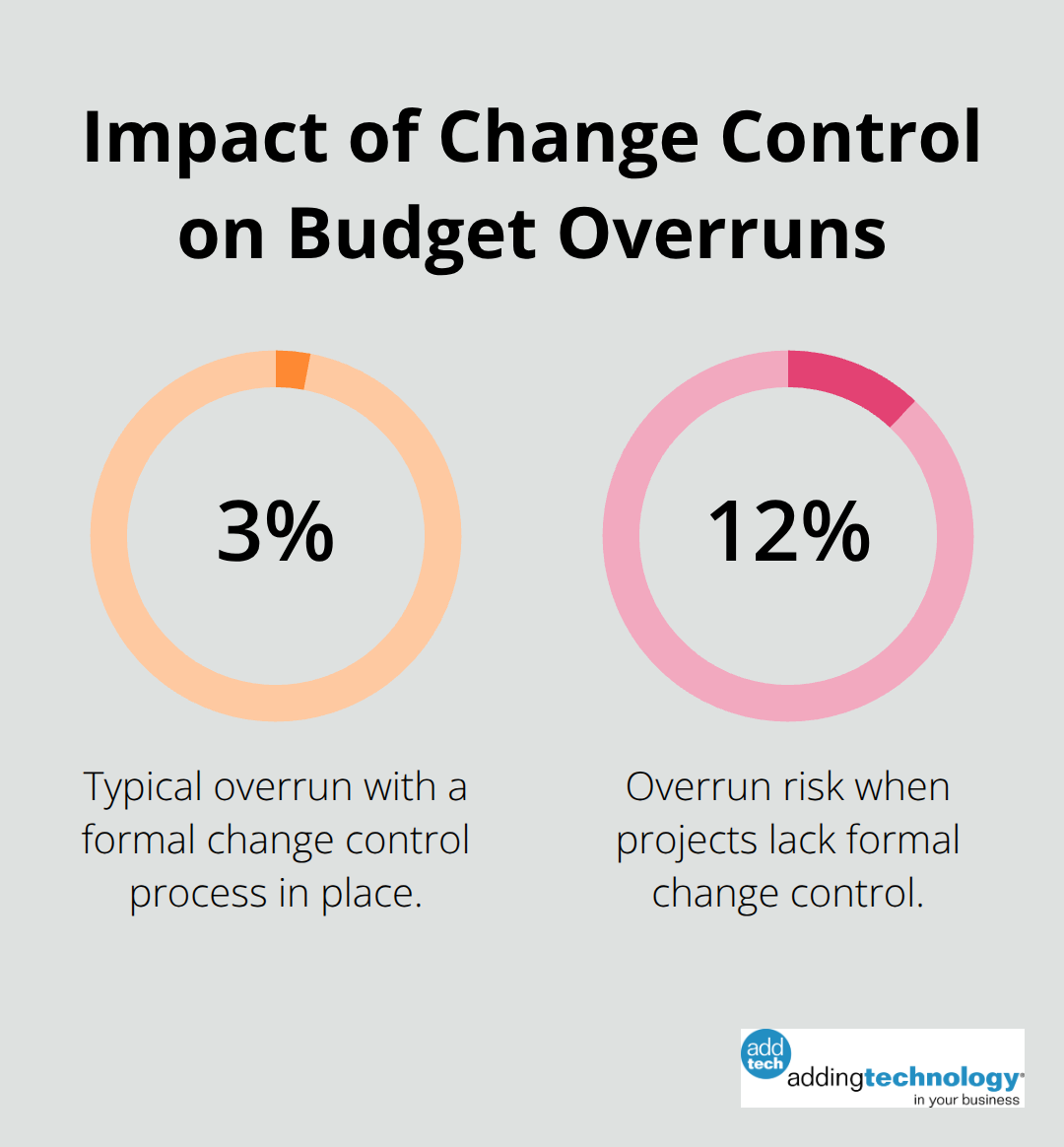

Unapproved changes are the fastest way to destroy a budget. Implement a formal change control process where every scope change or budget adjustment requires documented approval before execution. When a client requests an extra feature or your team discovers unforeseen conditions requiring additional work, the change gets logged with its cost impact clearly stated. Your change control board reviews it, approves it, rejects it, or approves it with conditions. Only after approval does work proceed and the budget baseline adjusts. Without this discipline, scope creep happens invisibly: a crew spends an extra day on site without authorization, a material upgrade gets ordered without approval, and suddenly your budget is 8 to 12 percent over with no clear explanation. Transparent change management prevents this and keeps stakeholders informed about cost impacts in real time rather than surprising them at project close.

Set up budget alerts that notify you when spending approaches or exceeds predefined thresholds. Most project management platforms allow you to configure these triggers at the task level, phase level, or across the entire project. When an alert fires, someone investigates immediately rather than waiting for a scheduled review meeting. Dashboards that display planned versus actual costs side by side (labor, materials, equipment, overhead) make variances visible at a glance. This visibility forces accountability: team members see their spending in real time, and project managers spot trends before they become crises. Real-time job costing systems show that construction firms maintaining the tightest budget control treat their cost dashboard like a daily checklist, reviewing it before the morning standup to catch overnight changes.

The next section covers the common budget challenges that derail projects and the specific tactics that prevent them from taking hold.

Scope creep happens in plain sight because teams lack a formal process to say no. When a client requests an extra feature or site conditions require unforeseen work, someone on your team starts executing it without documentation or approval. Three weeks later, you’ve spent an additional 40 labor hours and ordered $8,000 in materials that weren’t in your original budget. The problem isn’t that changes happen-they always do-the problem is that most projects treat changes as favors rather than scope adjustments with cost consequences.

You need a written change control process that requires every scope modification to be documented with its budget impact before work begins. When someone submits a change request, it gets logged with the estimated cost, reviewed by decision-makers, and either approved, rejected, or approved with conditions. Only after approval does execution proceed and your budget baseline shifts. This sounds bureaucratic, but it’s the difference between finishing 3 percent over budget and finishing 12 percent over. Projects without formal change control accumulate silent overruns that appear mysteriously at closeout.

Hidden costs hide because estimators don’t ask the right questions during planning. Material price increases mid-project are predictable if you track supplier price trends, but most teams don’t. Labor productivity estimates often assume ideal conditions-no weather delays, no rework, no supply chain interruptions-then reality hits and actual hours exceed estimates by 15 to 20 percent.

Indirect costs like permits, inspections, insurance, and administrative overhead get underestimated or forgotten entirely. Construction firms lose thousands because they estimated direct labor and materials but forgot to account for the project manager’s time allocation, equipment mobilization costs, or contingency for material rework. Your contingency reserve should sit between 5 and 15 percent of your total budget, scaled to match project complexity and uncertainty. A straightforward renovation in a known building might justify 5 percent contingency; a project with unfamiliar site conditions or new technology integration needs 12 to 15 percent.

The mistake teams make is building contingency into the budget, then spending it on scope creep rather than reserving it for genuine emergencies. Document your contingency allocation separately and treat it as protected reserves, not discretionary spending.

Poor communication between your team, finance, and stakeholders creates budget blind spots that widen over time. When the project manager doesn’t share budget status with the finance team weekly, accounting discovers cost overruns through invoices rather than through proactive management. When stakeholders aren’t informed about approved changes and their cost impacts, they’re shocked at final invoices and question spending they implicitly approved.

The solution is regular budget reporting-weekly internal updates to your core team, bi-weekly updates to stakeholders showing planned versus actual spending by category, and monthly deep-dive reviews that examine variances and forecast final costs. These meetings aren’t optional status updates; they’re control mechanisms. When your team sees spending drift against the baseline in a public forum, accountability increases and corrective action happens faster. Teams that share budget dashboards with stakeholders monthly discover that transparency actually reduces conflict because changes and overruns become visible and discussed as they happen, not discovered in final reconciliation.

Budget management in project management succeeds when you treat it as a control system, not a paperwork exercise. The methods we’ve covered-locking down scope early, estimating with precision, tracking spending in real time, and managing changes formally-work because they address the actual reasons projects fail financially. Teams that implement these practices finish closer to budget and with fewer surprises than teams that ignore financial discipline.

Disciplined budget control gives you visibility into where money flows, lets you catch problems while solutions still exist, and builds stakeholder trust through transparency. When your team validates assumptions monthly, catches variances early, and documents every change, you eliminate the silent cost creep that derails most projects. Each project teaches you something about labor productivity, material costs, and timeline realism if you capture that information systematically.

Starting now means picking one practice and executing it well rather than attempting everything at once. If your current process relies on spreadsheets and monthly reviews, move to real-time tracking first; if you lack a formal change control process, implement one immediately because scope creep will otherwise consume any budget discipline you build. We at adding technology help construction firms build financial systems that support this kind of control, and our accounting solutions give you the visibility and speed that budget management demands.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.