Construction in process accounting is a critical aspect of financial management in the construction industry. At Adding Technology, we understand the unique challenges contractors face when tracking costs and revenue for ongoing projects.

This blog post will guide you through the essentials of CIP accounting, best practices for implementation, and solutions to common challenges. We’ll also explore how specialized software can streamline your accounting processes and improve project profitability.

Construction in Process (CIP) accounting is a specialized method that tracks and reports financial activities for ongoing construction projects. This approach allows contractors and construction companies to manage costs, recognize revenue, and monitor project profitability with precision.

CIP accounting records all costs associated with a construction project as it progresses. These costs include materials, labor, equipment, and overhead expenses. Unlike traditional accounting methods that immediately expense these items, CIP accounting treats them as assets until the project reaches completion.

Consider this example: A contractor purchases $100,000 worth of steel for a building project. Instead of recording this amount as an immediate expense, it’s added to the CIP asset account. This account grows as the project advances, providing a more accurate picture of the project’s financial status and the company’s overall financial health.

Job costing stands as a crucial aspect of CIP accounting. This process assigns costs to specific projects, enabling precise tracking of expenses and profitability. Effective job costing can increase project margins significantly.

Progress billing represents another vital component. This method allows contractors to bill clients at various stages of completion, rather than waiting until the project ends. Companies that use progress billing often experience improved cash flow.

Traditional accounting methods often fail to accurately represent the financial reality of long-term construction projects. CIP accounting addresses this shortcoming by providing a more nuanced approach to revenue recognition and cost allocation.

The percentage of completion method, commonly used in CIP accounting, allows companies to recognize revenue as work progresses. This contrasts with the completed contract method, which only recognizes revenue when the project finishes.

CIP accounting enables superior financial forecasting. By tracking costs and progress in real-time, companies can make more informed decisions about resource allocation and project management. This level of detail isn’t typically available in traditional accounting systems.

Modern CIP accounting often incorporates specialized software solutions. These tools automate many aspects of the accounting process, from cost tracking to progress billing. Adding Technology offers cutting-edge solutions that integrate seamlessly with existing systems, streamlining the entire CIP accounting workflow.

As we move forward, let’s explore the best practices for implementing CIP accounting in your construction business.

Accurate job costing forms the foundation of effective CIP accounting. Breaking down costs into specific categories allows for better cost control and more accurate profit projections. Instead of combining all labor costs, separate them by trade. This method helps identify the most profitable aspects of a project or where costs exceed expectations. Proper calculation of profit margins is crucial for avoiding common pricing mistakes that can reduce your bottom line.

Digital documentation is essential for efficient CIP accounting. Cloud-based systems enable real-time updates and access from any location, which is vital for managing multiple job sites. A survey by Procore Technologies showed that construction companies using digital documentation systems reduced time spent on administrative tasks by up to 30%. This time savings directly translates to more accurate and timely financial reporting.

Weekly or bi-weekly financial reviews are critical to stay on top of CIP accounting. These reviews should involve both accounting staff and project managers to ensure all perspectives are considered.

During these reviews, focus on:

The Project Management Institute reports that companies conducting regular financial reviews are 40% more likely to complete projects on budget.

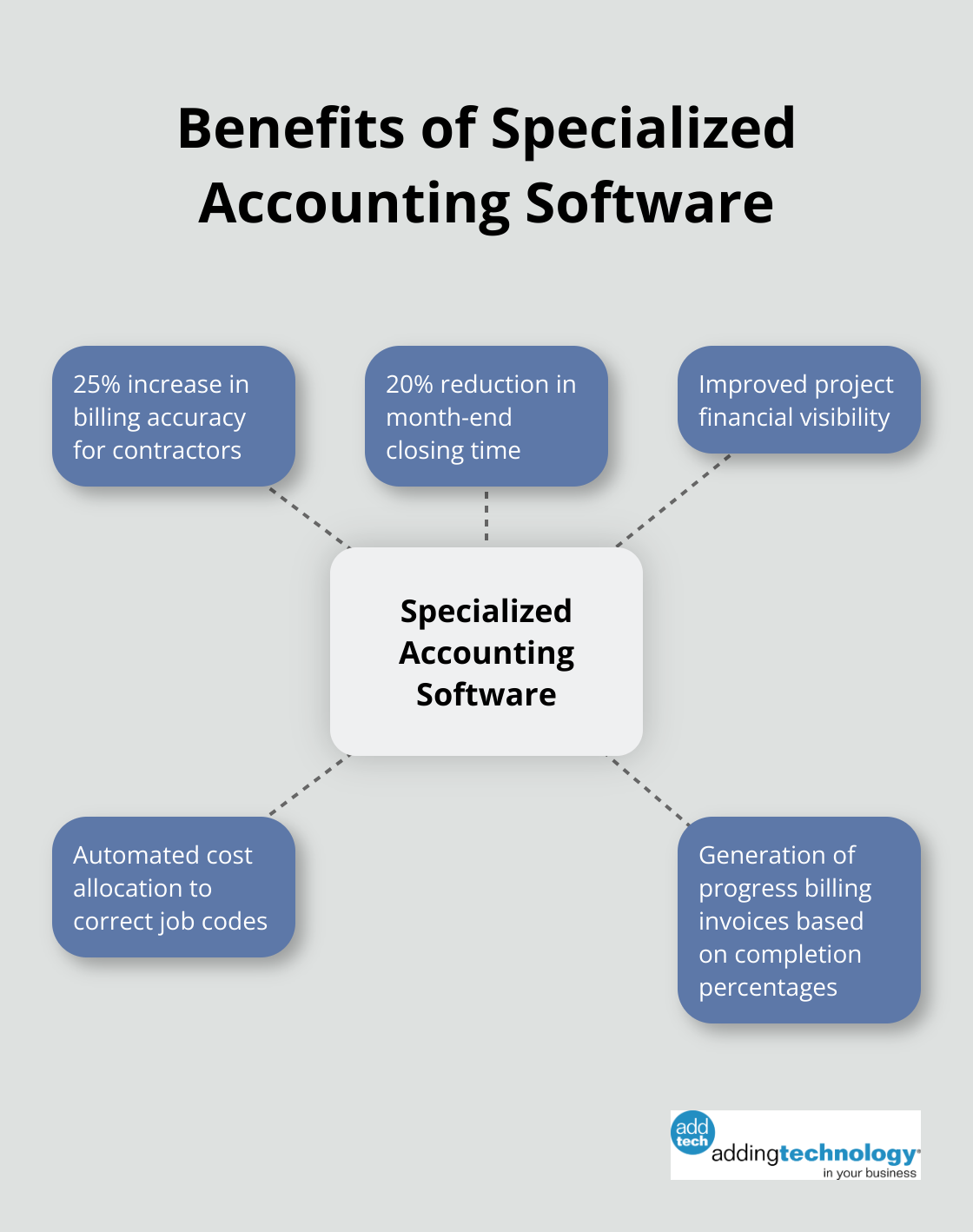

Generic accounting software often falls short in meeting the unique needs of construction accounting. Specialized construction accounting software (like the solutions offered by Adding Technology) can automate many CIP accounting tasks, reducing errors and saving time.

These systems can:

A case study by Construction Executive magazine found that contractors who switched to specialized accounting software experienced a 25% increase in billing accuracy and a 20% reduction in month-end closing time.

The construction industry evolves rapidly, and so do accounting practices. Invest in continuous training for your accounting team to keep them updated on the latest CIP accounting techniques and technologies. This investment will pay off in improved accuracy and efficiency (not to mention reduced audit risks).

As we move forward, let’s explore the common challenges that construction companies face in CIP accounting and effective strategies to overcome them.

Long-term projects create revenue recognition challenges. The American Institute of CPAs (AICPA) recommends the percentage-of-completion method for these projects. This approach allows companies to recognize project income and expenses as the project progresses, usually on a monthly basis, providing a more accurate financial picture.

To implement this method effectively:

Change orders significantly impact project scope and financials. Mishandling these modifications often leads to disputes and financial losses.

To manage change orders effectively:

Retainage (typically 5-10% of the contract value) can strain cash flow if not managed properly. Inaccurate progress billing can lead to over or underbilling, causing financial distress or client disputes.

To address these issues:

Unexpected changes in material prices or labor costs can erode profit margins. The Associated General Contractors of America reported that material costs increased by 20% in 2022, highlighting the volatility in the construction market.

To protect against these fluctuations:

Advanced software solutions can help address many CIP accounting challenges. These systems automate cost allocation, generate progress billing invoices, and provide real-time visibility into project financials.

Adding Technology offers specialized construction accounting software that integrates seamlessly with existing systems. Our solutions include features for change order tracking and advanced forecasting tools to predict potential cost increases, allowing for proactive mitigation strategies.

Construction in process accounting empowers contractors to maintain financial clarity and control over their projects. This method accurately tracks costs, manages revenue recognition, and improves project profitability. Companies that implement best practices in CIP accounting will gain a competitive edge in the evolving construction industry.

The future of construction accounting promises real-time data analytics, AI-driven cost modeling, and seamless integration between financial and project management systems. These advancements will provide deeper insights into project performance and further streamline accounting processes. Construction businesses can optimize their financial processes with expert solutions tailored to industry needs.

Adding Technology offers specialized services in accounting system renovation, real-time job costing, and advanced technology integration. Our solutions help contractors build a solid financial foundation and focus on delivering successful construction projects. The construction industry can now embrace more precise, efficient, and insightful accounting practices than ever before.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.