At Adding Technology, we understand the importance of accurate job costing for businesses of all sizes.

A simple job costing spreadsheet can be a game-changer for tracking project expenses and profitability. In this guide, we’ll walk you through the process of creating an effective job costing tool using common spreadsheet software.

By the end, you’ll have a powerful resource to manage your project finances with ease.

The first step in creating an effective job costing tool is to select the right spreadsheet software. Microsoft Excel and Google Sheets are two popular options that offer robust features. Google Sheets stands out for its cloud-based functionality, which enables real-time collaboration.

After selecting your software, create a new workbook. Give it a descriptive name like “Job Costing Template 2025” for easy identification. Within this workbook, add a new sheet specifically for job costing. You can name this sheet after the project you plan to track.

Now, it’s time to set up the basic structure of your spreadsheet. Include these essential columns:

A Construction Financial Management Association study found that most contractors aren’t proficient in setting budgets, managing cash flow, calculating overhead, tracking job costs, and making a profit.

While these basic columns form the foundation, you should tailor your spreadsheet to your specific needs. Consider adding columns for subcontractor costs, change orders, or a section to compare estimated versus actual costs.

To maximize the efficiency of your spreadsheet, implement formulas and functions. Use SUM functions to calculate total costs for materials, labor, and overhead. Implement IF statements to flag when actual costs exceed estimates. These automated calculations will save time and reduce errors.

The key to an effective job costing spreadsheet lies in its ability to provide clear, actionable insights. A well-structured spreadsheet will serve as a powerful tool to drive your business’s financial success. In the next section, we’ll explore how to input job details and cost information into your newly created spreadsheet.

Start by filling in the basic job details. Include the project name, client information, start date, and expected completion date. Be specific to avoid confusion between similar projects. For instance, use “Smith House – Kitchen Remodel 2025” instead of “Smith House.”

Create a comprehensive list of all materials needed for the job. Include quantities and unit costs for each item. Account for waste factors, which typically range from 5% to 15% depending on the material.

Track labor costs accurately to ensure project profitability. Record the hours worked by each team member and their corresponding hourly rates. Include different rates for overtime or specialized work.

Include all overhead costs associated with the project. This might include equipment rental, permits, insurance, and even a portion of your office expenses. Be thorough in your overhead calculations to avoid underestimating your total project expenses.

Update your spreadsheet frequently as the project progresses. Real-time data entry will provide the most accurate picture of your job costs and help you make informed decisions throughout the project lifecycle.

Adding Technology’s expertise in construction accounting can further enhance your job costing process and provide deeper insights into your project finances. With accurate data input, you’ll be ready to calculate total costs and profit margins in the next step of creating your job costing spreadsheet.

Use the SUM function to add up all your material costs, labor expenses, and overhead. For example, in cell D20, you might use a formula like =SUM(D5:D19) to total all the costs in column D. Repeat this process for each cost category.

Create a grand total of all costs. If your material total is in D20, labor in E20, and overhead in F20, use =SUM(D20:F20) to get your total job cost. This figure represents your break-even point – the minimum you need to charge to cover all expenses.

Track your project’s financial performance by comparing your actual costs to your initial estimates. Create separate columns for estimated and actual costs, then calculate the difference. Use a simple subtraction formula like =C5-D5 to find the variance for each line item.

Robust cost control methods are essential for successful project management. Close monitoring of these variances allows you to identify areas where costs exceed estimates and take corrective action promptly.

To determine your profit margin, you’ll need to know your total job price. Let’s say your total cost is $50,000, and you’re charging $65,000 for the job. Your profit would be $15,000.

To calculate the profit margin as a percentage, use this formula: (Profit / Total Revenue) * 100. In this case, it would be (15000 / 65000) * 100 = 23.08%.

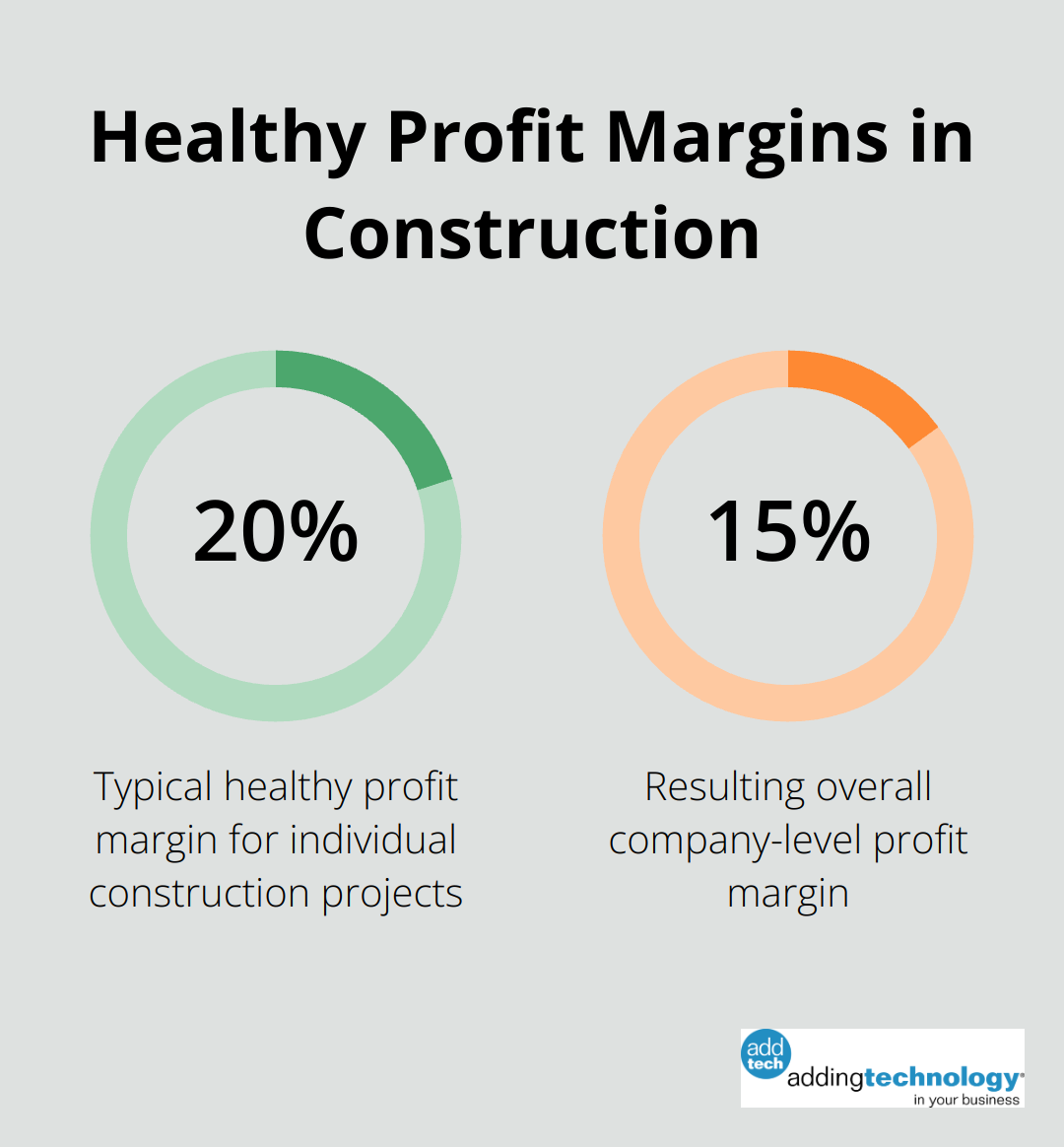

Industry benchmarks suggest that a healthy profit margin for construction projects is typically around 20%. This will leave you with an overall company-level profit margin of about 15% when all is said and done. If your margin falls below this range, it might be time to reassess your pricing strategy or look for ways to reduce costs.

Your job costing spreadsheet serves as a living document. Regular updates with actual costs as your project progresses will provide real-time insights into your project’s financial health. This practice also offers valuable data for more accurate estimation of future jobs.

Adding Technology’s expert accounting services can further enhance your job costing process. Their structured approach provides personalized solutions, improving cost visibility and operational efficiency. With Adding Technology, you can build a solid financial foundation and empower your construction business.

A simple job costing spreadsheet empowers construction businesses to track expenses, calculate profits, and make informed decisions. We recommend you input detailed information about materials, labor, and overhead costs to ensure accuracy. Regular updates to your spreadsheet will provide real-time insights into your project’s financial health and improve future estimates.

At Adding Technology, we understand the complexities of financial management in construction. Our expert accounting services complement your job costing efforts, offering deeper insights and streamlining financial processes. We support you in focusing on delivering outstanding projects while maintaining financial order.

Your job costing spreadsheet will become an indispensable tool when used consistently. It offers clarity on costs, identifies areas for improvement, and contributes to your construction business’s financial success. Start using your spreadsheet today to transform your approach to project management (and watch your profits grow).

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.