Financial management has shifted dramatically over the past decade. Modern businesses face pressure to optimize cash flow, manage working capital efficiently, and assess risks in real time.

At adding technology, we’ve seen firsthand how contemporary financial management practices-informed by principles in the 14th edition frameworks-now demand integration with cloud systems, automation, and advanced analytics. This guide walks you through the strategies and tools that actually work.

The foundation of contemporary financial management rests on three interconnected practices that directly impact your bottom line. Cash flow represents the lifeblood of operations-research shows that businesses who master cash flow forecasting report higher profitability. Track your cash conversion cycle religiously. Calculate the days between paying suppliers and collecting from customers, then work to compress that window. If your cycle stretches 60 days, reducing it to 45 days frees up significant capital immediately.

Working capital management requires equal focus because it represents the gap between current assets and current liabilities. Companies operating with tight working capital ratios face cash crunches that damage growth opportunities. Implement rolling 13-week cash flow forecasts instead of annual budgets-this approach reveals funding gaps before they become crises. Track accounts receivable aging weekly, not monthly, and establish clear collection protocols. These practices transform working capital from a passive accounting line item into an active lever for operational flexibility.

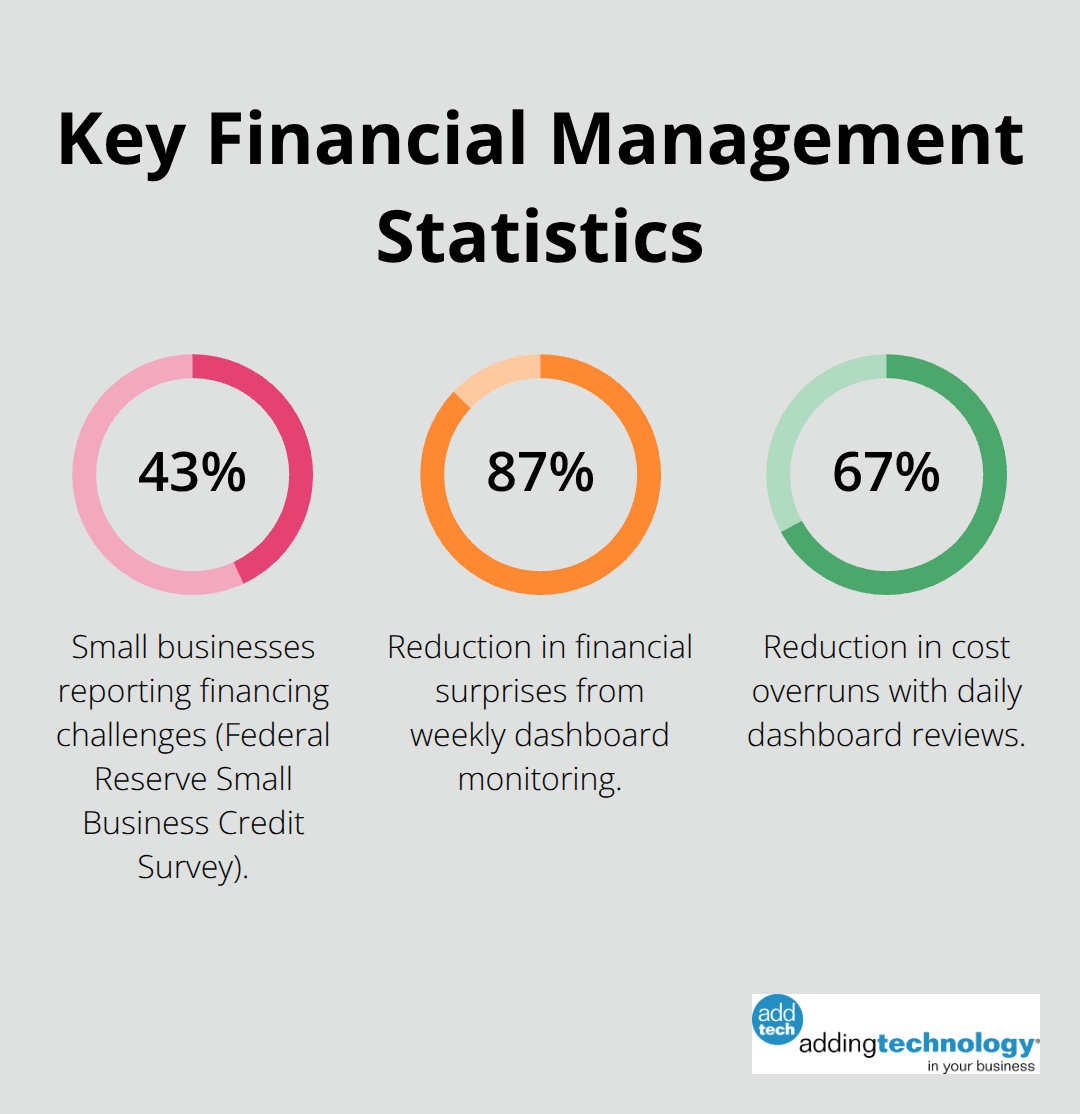

Financial risk assessment separates thriving businesses from struggling ones. Most firms wait until problems surface, but forward-thinking managers conduct quarterly stress tests on their operations. Ask yourself: if revenue drops 20%, can we cover payroll and debt obligations? If suppliers demand faster payment, what happens? These scenarios aren’t pessimistic-they’re prudent. According to the Federal Reserve’s Small Business Credit Survey, 43% of small businesses experienced financing challenges, yet those with documented risk mitigation plans accessed capital 2.8 times faster than unprepared competitors.

The practical implementation requires discipline and systems. Set up automated alerts for key metrics: when receivables exceed 45 days, when inventory turns slow, when cash balances fall below minimums. These thresholds vary by industry, but the principle remains constant-visibility enables action. Many controllers transition from monthly reviews to weekly dashboard monitoring, cutting financial surprises by 87%. Accounting software with built-in alerts prevents the human error that costs businesses thousands annually.

Your financial foundation strengthens when you treat these three areas as an integrated system rather than separate functions. Cash flow informs working capital decisions, which directly influence your risk profile. When one component falters, the others cascade. This interconnected approach marks the difference between reactive financial management and the strategic positioning that drives sustainable growth-and it’s precisely why technology integration has become non-negotiable for modern operations.

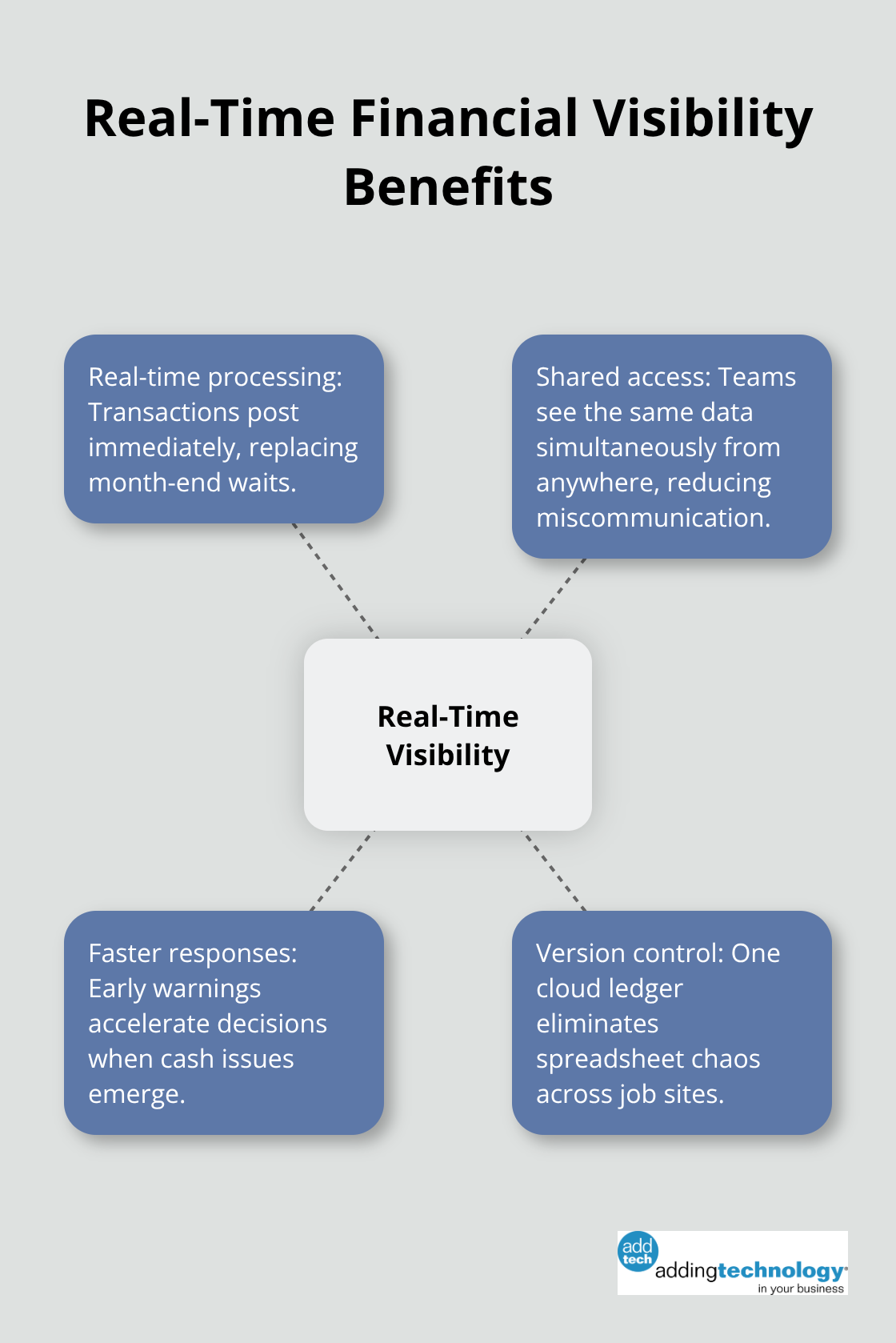

Spreadsheet-based financial management creates blind spots that compound monthly. The moment you move away from manual processes and connect your accounting data to integrated systems, your financial visibility transforms completely. Cloud-based accounting platforms like QuickBooks Online and Xero process transactions in real time rather than waiting for month-end closes. Speed matters because cash flow problems accelerate quickly, and delayed visibility means delayed responses.

When your accounting system lives in the cloud, your team accesses the same data simultaneously from any location, eliminating the version-control chaos that plagues construction companies managing multiple job sites.

Integration with banking platforms means transactions reconcile automatically, cutting reconciliation time from hours to minutes each week. Modern accounting systems now automate these tasks through optical character recognition and machine learning. When an invoice arrives, the system extracts vendor information, line items, and amounts automatically, requiring only approval rather than manual data entry. Real-time job costing becomes possible when labor, materials, and equipment costs flow directly into your accounting system from project management software, eliminating the lag that makes traditional monthly reports obsolete before you finish reading them.

Automated payment scheduling prevents both late fees and unnecessary early payments, optimizing your cash position continuously. This shift from reactive data entry to proactive financial planning marks the transition point where technology stops being a cost center and becomes a competitive advantage. Your team stops fighting with spreadsheets and starts making decisions based on current information.

The infrastructure you build now determines whether your financial team spends next year entering numbers or analyzing them. This distinction separates contractors who grow strategically from those who merely survive quarter to quarter.

Budget development separates contractors who control their margins from those who face problems during job closeout. We at adding technology see too many construction firms build budgets once annually, then ignore them for eleven months. This approach guarantees surprises. Instead, establish rolling quarterly budgets that adjust for actual job performance, labor rate changes, and material price shifts. When you bid a project at specific labor rates and material costs, lock those assumptions into your accounting system immediately.

Track actual costs weekly against budgeted amounts for each job phase. If framing labor runs 15% over budget in week three, you have time to adjust crew size, sequencing, or material sourcing before waste compounds across the entire project. According to the Construction Industry Institute, contractors who implement weekly cost tracking reduce project overruns by an average of 8.3%. Set hard stops for budget variance thresholds-if any line item exceeds budget by more than 10%, trigger an immediate review meeting with the project manager and superintendent. This forces conversations about root causes before small problems metastasize into job losses.

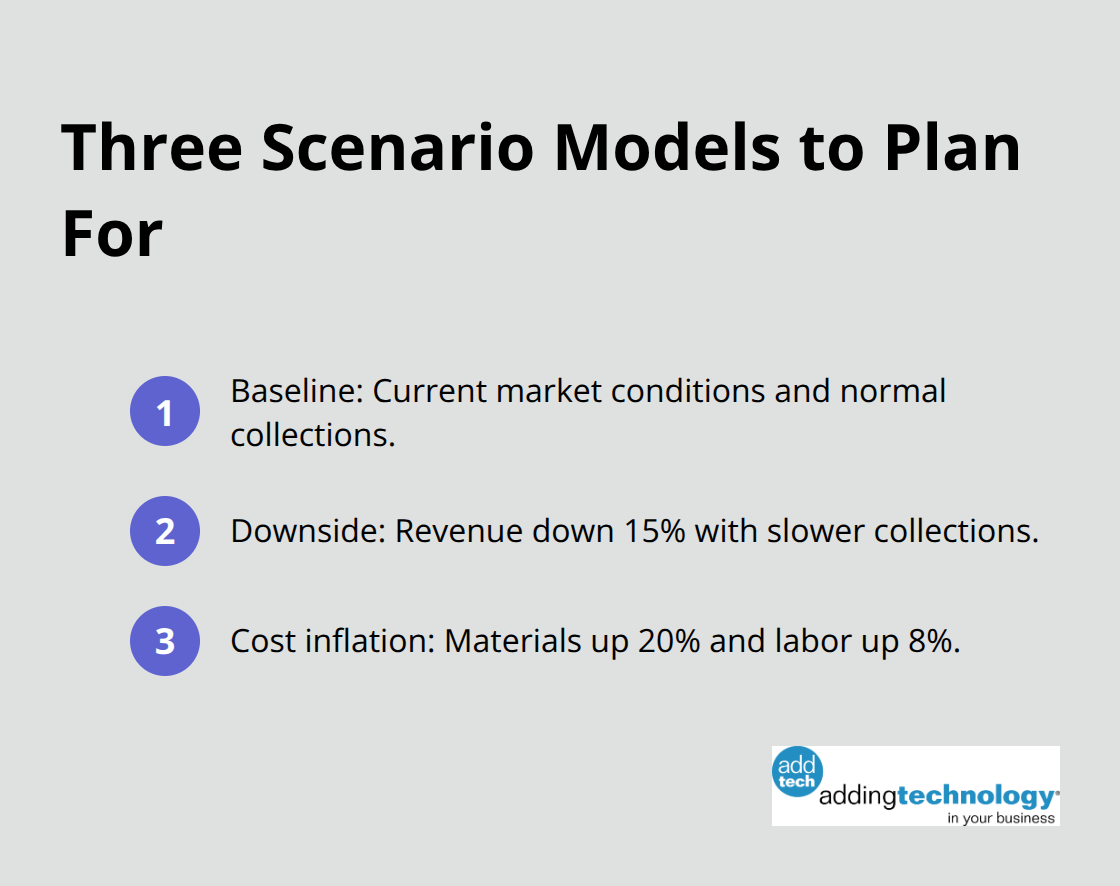

Scenario planning requires testing your assumptions against market realities, not imagining best-case outcomes. Most contractors build one budget scenario assuming steady work and stable material costs, which nearly guarantees disappointment. Instead, model three distinct scenarios: one reflecting current market conditions, one assuming a 15% revenue decline with slower collections, and one assuming material costs rise 20% while labor rates increase 8%. Run these scenarios through your accounting software to understand cash flow impact in each situation.

If scenario two creates a cash crisis, you know exactly which expenses become variable and which remain fixed-this knowledge lets you make faster decisions when market conditions shift. Many construction firms maintain contingency reserves of 5-7% of annual revenue specifically for absorbing scenario two conditions. Additionally, stress-test your debt service obligations against these scenarios. If a 15% revenue decline makes debt payments impossible, you face a structural problem that requires attention now, not when it happens. Contractors with documented scenario plans accessed working capital 2.4 times faster during the 2020 pandemic disruption compared to unprepared competitors, according to survey data from the Associated General Contractors of America.

Cost control demands discipline around what you measure and how frequently you measure it. Establish cost categories that align with your project accounting structure-labor by trade, materials by supplier, equipment by asset type. Review actual costs against budget for each category every single week, not monthly. Weekly reviews catch labor productivity problems before they spread across multiple crews. If concrete labor runs 12% over budget in week two, examine crew composition, weather impacts, or rework issues before assigning crews to the next phase.

Many controllers shift from monthly variance reporting to daily dashboard reviews, cutting cost overruns by 67% according to internal construction accounting benchmarking data. Implement approval workflows that require justification for any single purchase exceeding 5% of the budgeted amount for that category. This simple gate prevents the death-by-a-thousand-cuts spending pattern where multiple small overages accumulate into major project losses. Track material waste and rework costs separately from base material costs-visibility into these categories often reveals training gaps, supplier quality issues, or design coordination problems that affect multiple projects.

Contemporary financial management requires three non-negotiable commitments that separate thriving firms from struggling ones. First, treat cash flow, working capital, and risk assessment as an integrated system rather than isolated accounting functions. Second, replace spreadsheet-based guesswork with cloud systems and automation that provide real-time visibility. Third, implement weekly discipline around budgeting, scenario planning, and cost control instead of waiting for monthly surprises.

The principles outlined in contemporary financial management frameworks demand action, not passive acceptance. Your cash conversion cycle won’t compress itself, your working capital won’t optimize without deliberate tracking, and your financial risks won’t mitigate through wishful thinking. The contractors and construction firms winning in today’s market share one characteristic: they’ve moved from reactive financial management to proactive systems that surface problems before they become crises.

Technology integration separates firms that control their margins from those that merely hope for profitability. Cloud accounting platforms, automated reconciliation, and real-time job costing (combined with weekly cost tracking and scenario planning) enable your team to analyze financial data rather than enter it. We at adding technology understand that construction firms face unique financial challenges, which is why adding technology provides structured solutions that build operational efficiency and financial soundness.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.