Construction accounting and financial management can make or break a project’s success. At Adding Technology, we understand the unique challenges faced by construction companies when it comes to managing their finances effectively.

In this blog post, we’ll explore essential tips for mastering construction accounting and financial management. From job costing to cash flow strategies, tax planning, and beyond, we’ll provide practical insights to help your construction business thrive financially.

Job costing forms the cornerstone of financial success in construction. Precise job costing can transform a construction company’s profitability.

Job costing in construction tracks all expenses related to a specific project. This includes direct costs (materials and labor) and indirect costs (equipment depreciation and overhead). Nearly 35% of construction businesses miscalculate their profit targets, according to a Construction Financial Management Association study.

Accurate job costing directly affects your bottom line. It allows you to price projects competitively while ensuring profitability. A Sage survey found that 67% of construction firms using job costing software reported increased profitability within the first year of implementation.

Many construction companies encounter pitfalls that can derail their job costing efforts:

To improve job costing accuracy, construction companies should:

Adding Technology offers tailored solutions to revolutionize job costing processes. Our clients report significant improvements in cost estimation accuracy after implementing our solutions. With the right tools and expertise, you can turn job costing from a challenge into a competitive advantage.

As we move forward, it’s important to consider how job costing interacts with another critical aspect of construction finance: cash flow management. Let’s explore strategies to keep your projects financially healthy from start to finish.

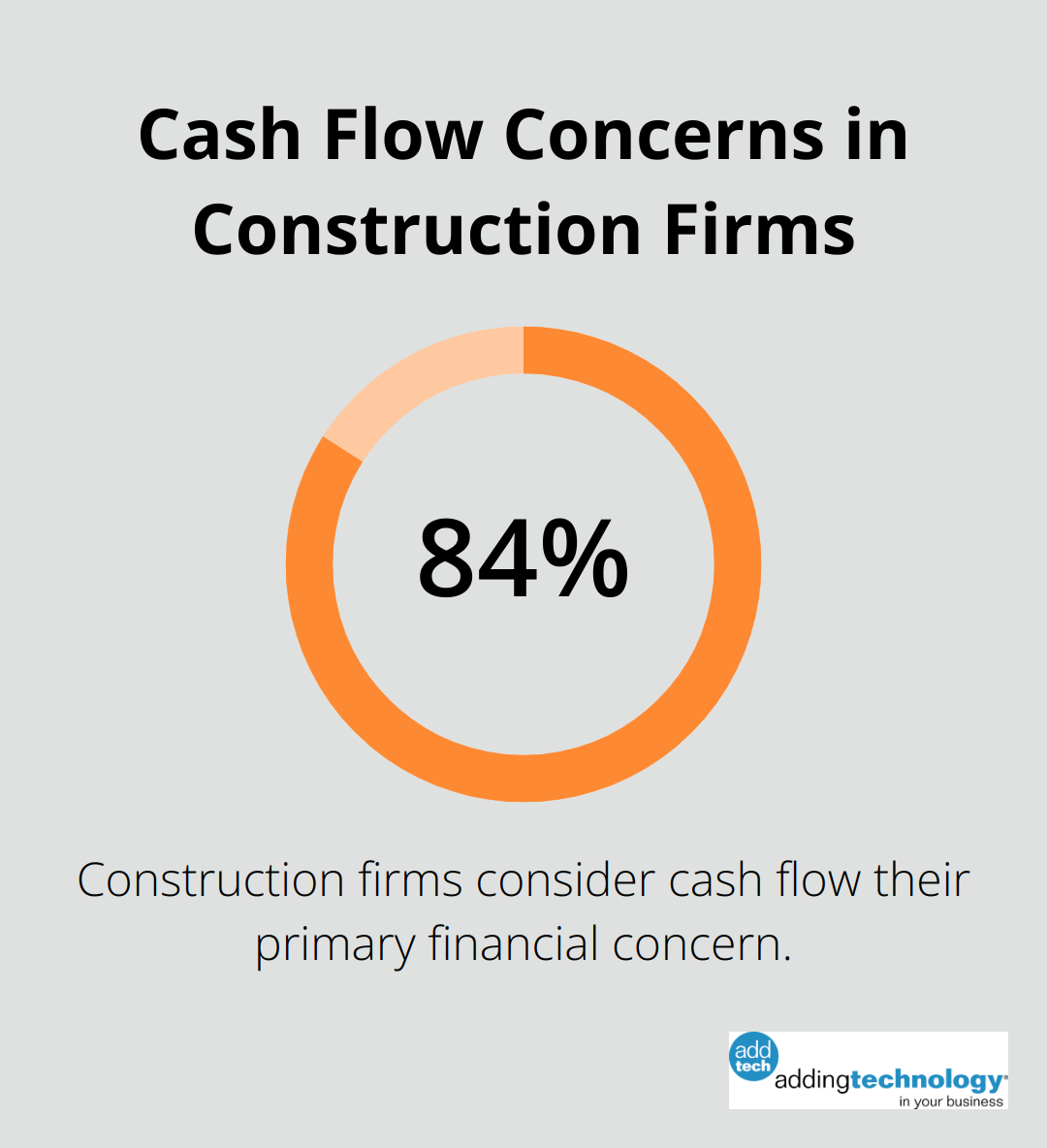

Cash flow management in construction presents complex challenges that can determine a project’s success or failure. The project-based nature and long payment cycles of the industry create distinctive hurdles. A survey by the Construction Financial Management Association reveals that 84% of construction firms consider cash flow their primary financial concern.

Accurate forecasting plays a vital role in maintaining healthy cash flow. Construction companies should create detailed cash flow projections for each project. These projections must account for payment terms, material costs, and labor expenses. The Associated General Contractors of America advises weekly updates to these forecasts to reflect changes in project timelines or unexpected expenses. Cash flow forecasting in construction management can help you make more informed decisions and better plan your company’s project workloads and workflows.

Enhancing accounts receivable processes can significantly boost cash flow. Progress billing (where invoices are sent at predetermined project milestones) proves an effective strategy. This approach ensures steady cash inflow throughout the project lifecycle.

Effective management of accounts payable holds equal importance for cash flow health. Companies can gain more flexibility by negotiating favorable payment terms with suppliers. Some firms have found success in implementing a just-in-time inventory system, which reduces capital tied up in unused materials. The Construction Industry Institute reports that this approach has led to a 15% reduction in inventory costs for adopting firms.

Modern construction accounting software provides real-time visibility into cash flow, enabling proactive decision-making. These tools automate invoicing, track expenses, and generate detailed financial reports. Companies that implement advanced financial management solutions (like those offered by Adding Technology) often see significant improvements in their cash conversion cycle.

As construction companies master cash flow management, they must also navigate the complex landscape of tax planning and compliance. This aspect of financial management can have profound impacts on a company’s bottom line and long-term success.

The construction industry faces unique tax challenges that require careful planning. IRC Section 460 affects income recognition for tax purposes. Contracts with 80% or more of the estimated total contract costs expected to be attributed to a home construction contract are exempt from 460.

The domestic production activities deduction (DPAD) allows eligible construction companies to deduct up to 9% of their qualified production activities income. This deduction can result in substantial tax savings for many contractors.

Construction companies can reduce their tax burden through strategic deductions and credits. The Research and Development (R&D) tax credit often goes overlooked. Many construction activities, such as developing new building techniques or improving existing processes, can qualify for this credit.

Equipment depreciation offers another opportunity to optimize tax strategy. The Section 179 deduction allows companies to deduct the full purchase price of qualifying equipment (up to $1,050,000 for 2021) in the year it’s put into service. This provides significant tax relief and improves cash flow for companies investing in new machinery or vehicles.

Accurate and detailed record-keeping is essential for construction businesses aiming to maximize tax benefits and maintain compliance. Thorough documentation supports tax positions and withstands potential audits.

We recommend a robust system for tracking all expenses, including materials, labor, and overhead costs. Cloud-based accounting software that integrates with project management tools ensures real-time expense tracking and simplifies tax preparation.

The complexity of construction tax laws makes working with industry-specialized tax professionals invaluable. These experts stay current with changing regulations and identify industry-specific opportunities for tax savings.

A construction-focused tax professional can help navigate multi-state taxation (a common issue for contractors working across state lines). They can also assist with structuring contracts to optimize tax outcomes and advise on the tax implications of different project delivery methods.

Some clients report reducing their effective tax rates by up to 15% after partnering with industry-specific tax experts. This expertise not only ensures compliance but also frees up resources for business growth and innovation.

Construction accounting and financial management form the backbone of success in the building industry. Mastering job costing, cash flow strategies, and tax planning empowers companies to price projects accurately, maintain profitability, and unlock significant savings. Adding Technology offers tailored solutions for construction businesses to streamline these processes and enhance overall financial management.

The construction industry evolves rapidly, making it essential to stay ahead in financial practices. Construction business owners and managers must take proactive steps to improve their financial strategies. This can include adopting new technologies, seeking specialized accounting services, or investing in staff training (all of which can create a strategic advantage).

Effective construction accounting and financial management create more than balanced books-they propel businesses forward. Companies that prioritize these aspects build stronger, more resilient operations capable of weathering industry challenges and capitalizing on growth opportunities. Construction firms should act now to transform their financial processes and set themselves on the path to long-term success.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.