At adding technology, we understand the complexities of asset under construction accounting. This critical aspect of financial management can significantly impact a company’s balance sheet and financial reporting.

In this blog post, we’ll explore the best practices for handling assets under construction, from initial recognition to capitalization and eventual transition to in-use status. We’ll also address key challenges and provide practical tips to help you navigate this intricate area of accounting.

Assets under Construction (AUC), also known as Construction in Progress (CIP), represent ongoing projects that are not yet complete or ready for their intended use. These assets form a vital component of construction accounting and significantly impact a company’s balance sheet and financial reporting.

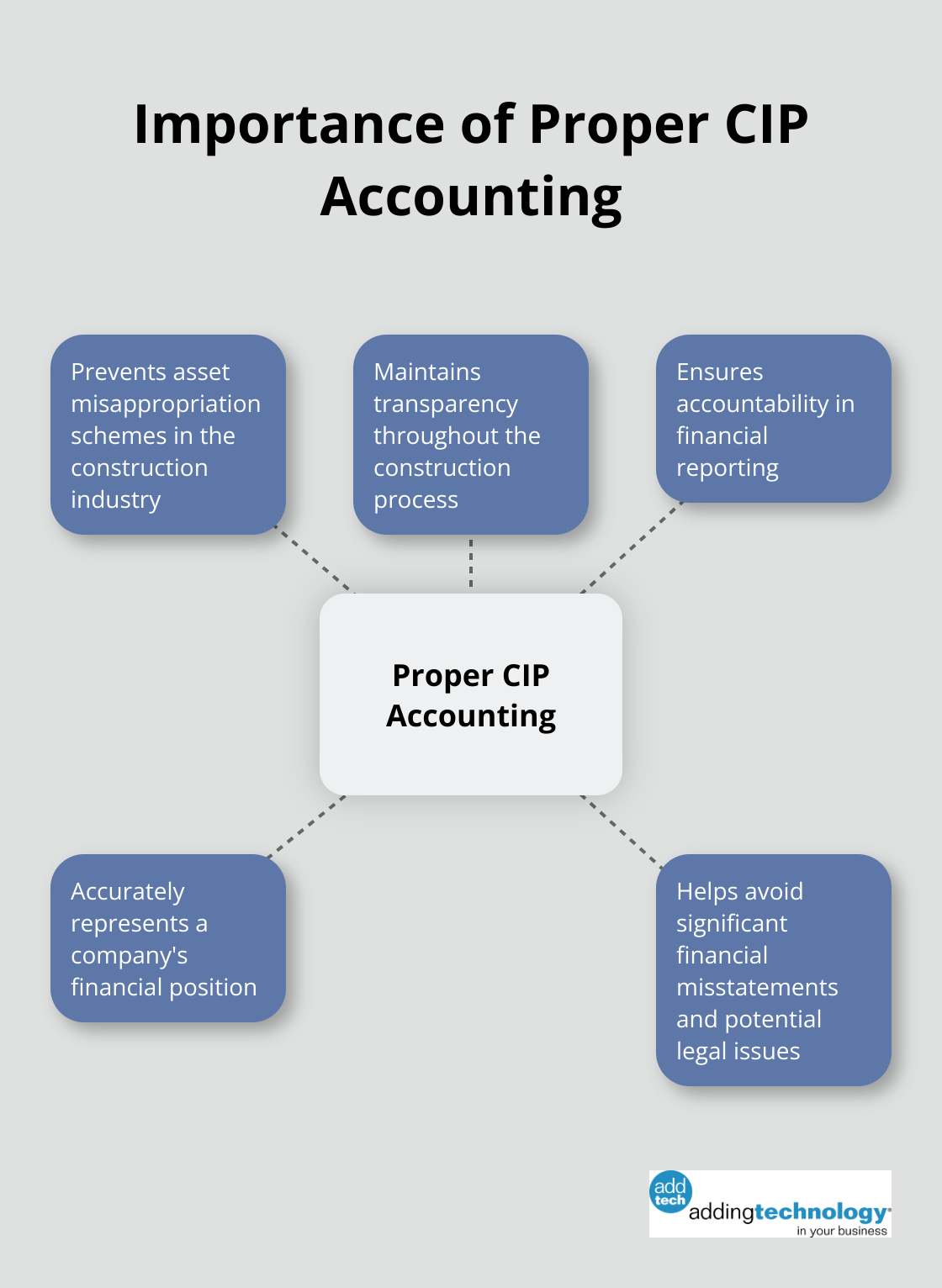

CIP plays a critical role in accurately representing a company’s financial position. These assets often constitute one of the largest items on a balance sheet, sometimes amounting to millions of dollars for large-scale projects. Improper handling of these assets can result in significant financial misstatements and potential legal issues.

A study by the Association of Certified Fraud Examiners revealed that the construction industry has a high rate of asset misappropriation schemes. Proper CIP accounting helps prevent such fraud by maintaining transparency and accountability throughout the construction process.

Identifying when a project qualifies as an asset under construction is essential. A project typically enters CIP status when:

The Financial Accounting Standards Board (FASB) provides detailed guidance in ASC 360 for property, plant, and equipment recognition, which includes assets under construction.

Assets under construction differ from other fixed assets in several key ways:

Understanding these distinctions is essential for accurate financial reporting and decision-making. Companies like Adding Technology have developed specialized tools to help construction companies navigate these complexities, ensuring their CIP accounting aligns with industry best practices and regulatory requirements.

As we move forward, we’ll explore the specific accounting treatments for assets under construction, including initial recognition, measurement, and the capitalization of costs during the construction phase.

At Adding Technology, we understand the importance of establishing a clear starting point for assets under construction. The process begins when a company incurs the first costs related to the project. These initial costs may include site preparation, architectural designs, or permit fees.

The American Institute of CPAs (AICPA) recommends recording these costs at their historical cost (the amount of cash or cash equivalents paid to acquire the asset). For instance, if a company pays $50,000 for initial site preparation, that’s the value they should record in their books.

As a project progresses, companies must capitalize all directly attributable costs. This includes materials, direct labor, and certain overhead costs. The key lies in maintaining meticulous records of every expense.

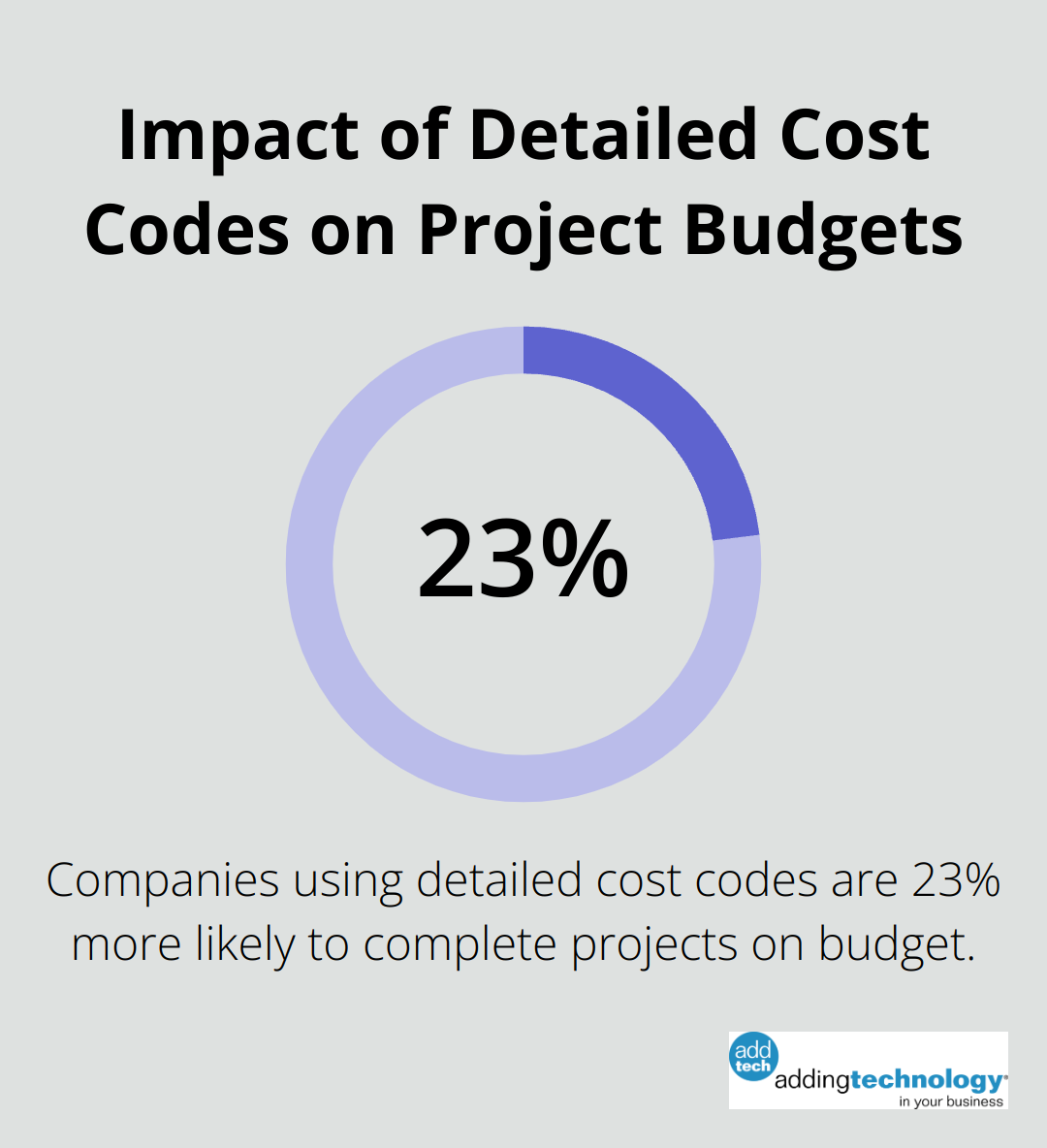

A study by the Construction Financial Management Association found that companies using detailed cost codes for their projects were 23% more likely to complete projects on budget. Adding Technology has developed systems to help clients track these costs precisely, ensuring nothing goes unaccounted for.

Interest capitalization for construction projects is governed by ASC 835-20. According to this standard, interest is only required to be capitalized when the benefit outweighs the cost. Companies must carefully consider this requirement when deciding whether to capitalize interest costs.

A practical tip: create a separate ledger for interest costs related to each project. This approach simplifies the tracking and accurate capitalization of these costs. Companies must stop capitalizing interest once the asset is ready for its intended use.

One common mistake involves starting depreciation too early. Assets under construction should not undergo depreciation until they’re complete and ready for use.

The Internal Revenue Service (IRS) provides guidance on how to recover the cost of business or income-producing property through deductions for depreciation. Companies should establish a formal process for determining when an asset transitions from “under construction” to “in use” status. This process might involve a series of checks and sign-offs from project managers, engineers, and accountants.

Precise accounting practices for assets under construction not only ensure compliance but also provide a foundation for informed business decisions based on accurate financial data. The next section will explore the key challenges companies face in this process and offer best practices to overcome them.

Accurate cost tracking forms the foundation of effective CIP accounting. The Construction Industry Institute has identified best practices that, when executed effectively, lead to enhanced project performance. We recommend a multi-tiered cost coding system that aligns with your project’s work breakdown structure.

A cost code might look like this: 03-3100-01 (03 represents concrete work, 3100 specifies cast-in-place concrete, and 01 indicates a specific pour location). This detailed approach allows for precise allocation of costs and simplifies the reconciliation process.

Integration of your cost tracking system with project management software can reduce manual data entry errors. Dodge Data & Analytics reports that companies using integrated software solutions see a 25% increase in cost tracking accuracy.

The determination of when a construction project is complete for accounting purposes often requires judgment. We advise the creation of a formal project completion checklist that includes:

Project managers, engineers, and accounting personnel should review and sign this checklist to ensure all perspectives are considered.

The shift from CIP to in-use status significantly impacts financial statements. The Construction Financial Management Association found that 40% of construction companies struggle with this transition.

To streamline this process, establish a clear handover protocol that includes:

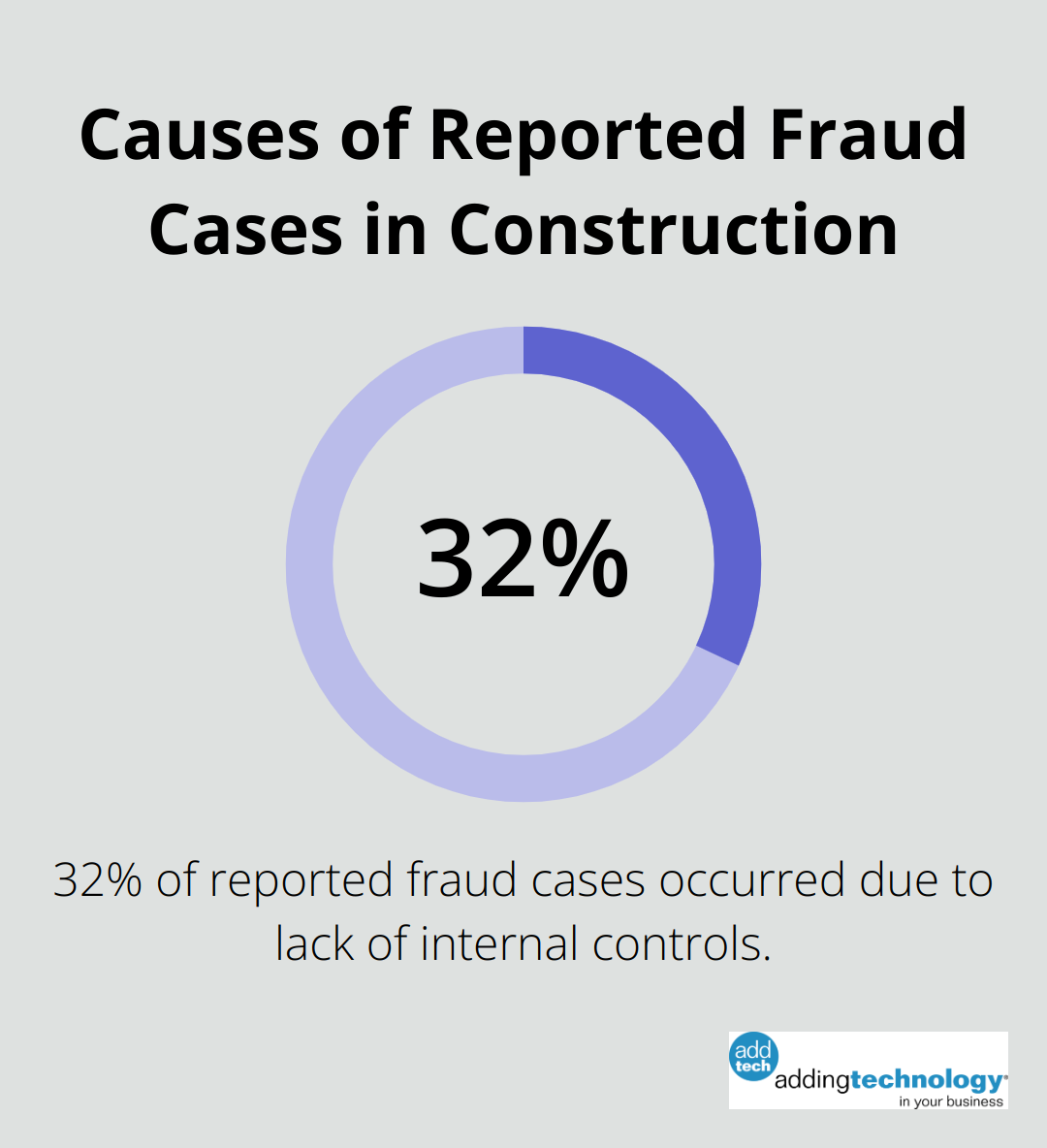

Strong internal controls prevent errors and fraud in CIP accounting. The Association of Certified Fraud Examiners reports that nearly half of reported fraud cases occurred because of either a lack of internal controls (32%) or an override of existing controls.

We recommend a three-way matching system for all CIP-related purchases, comparing purchase orders, receiving reports, and invoices before payment. This step can reduce errors by up to 80%, according to the Institute of Internal Auditors.

Regular internal audits of CIP accounts are also essential. These audits should verify the accuracy of capitalized costs, ensure proper classification of expenses, and confirm compliance with company policies and accounting standards.

The complexity of construction accounting often requires specialized expertise. Adding Technology offers tailored solutions to help construction companies navigate these challenges, ensuring compliance and providing valuable insights for informed decision-making.

Asset under construction accounting forms a critical component of financial management in the construction industry. Proper handling of these assets ensures accurate financial reporting, compliance with accounting standards, and informed decision-making. Companies should adopt detailed cost coding systems, establish formal project completion checklists, and create clear handover protocols to implement robust accounting practices for assets under construction.

Strong internal controls, including regular audits and a three-way matching system for purchases, prevent errors and fraud in asset under construction accounting. These practices not only ensure compliance with regulatory requirements but also provide a clear picture of a company’s financial position. This clarity proves essential for stakeholders, investors, and decision-makers within the organization.

Adding Technology understands the complexities of construction accounting and offers tailored solutions to enhance operational efficiency and financial soundness. Our expertise in streamlining financial processes and ensuring compliance allows contractors to focus on their projects without the burden of financial management. We help construction companies build a solid financial foundation that supports compliance, accurate reporting, and informed decision-making.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.