At adding technology, we’ve created this comprehensive Construction Company Accounting Guide to address the unique financial challenges in the industry.

Construction accounting requires specialized knowledge and techniques to manage complex projects, long-term contracts, and irregular cash flows effectively.

In this guide, we’ll explore essential accounting methods, cutting-edge technology solutions, and best practices to help construction companies streamline their financial management processes.

Construction accounting requires specialized knowledge and techniques. Each project functions as its own mini-business, with a unique budget, timeline, and profit margin. This necessitates precise tracking of costs and revenues for individual projects.

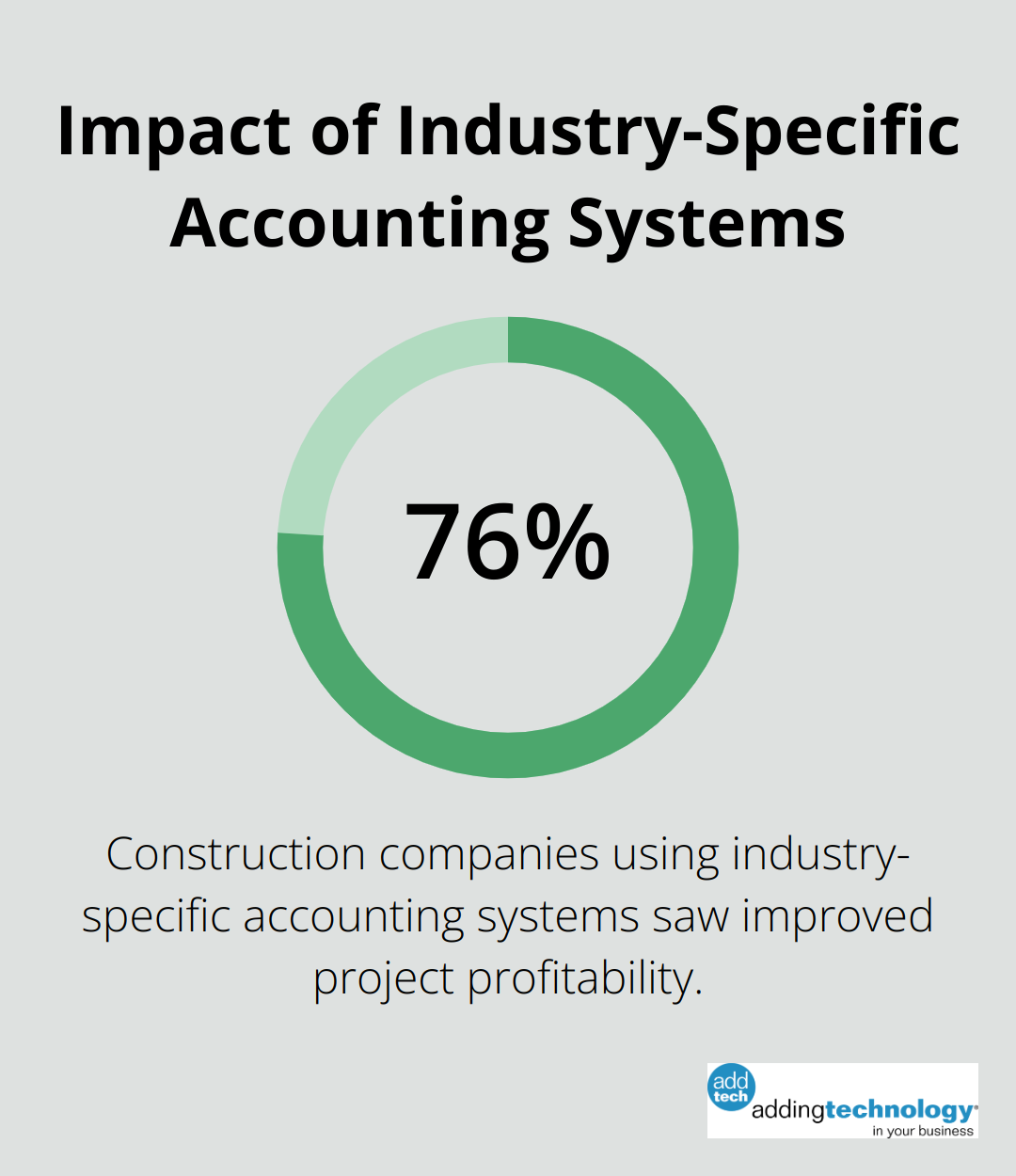

The Construction Financial Management Association reports that 76% of construction companies using industry-specific accounting systems saw improved project profitability. This statistic underscores the importance of specialized tools and practices in the construction industry.

Long-term contracts present unique challenges in revenue recognition. The Percentage of Completion (POC) method is common but demands careful estimation and ongoing adjustments. Inaccurate estimates can lead to significant financial misstatements.

A PwC survey found that 55% of construction companies struggle with revenue recognition under ASC 606 standards. This highlights the need for robust systems to accurately track project progress and recognize revenue appropriately.

Allocating costs across multiple projects can perplex even seasoned professionals. Overhead costs, equipment usage, and shared resources must be distributed fairly and accurately. Failure to do so can result in skewed project profitability and poor decision-making.

A detailed cost coding system allows for precise tracking of expenses and helps in allocating costs accurately across projects. Companies that implement such systems often see improved operational efficiency and increased profitability in construction projects.

Irregular payment schedules (a hallmark of the construction industry) can create significant cash flow pressures. Progress billings, retainage, and long payment cycles all contribute to this issue. The National Association of Home Builders reports that the average cash conversion cycle in construction exceeds 60 days.

To address this, construction companies need robust cash flow forecasting tools. Real-time financial reporting systems provide instant visibility into cash positions, allowing for proactive management and avoidance of liquidity crunches.

The unique challenges in construction accounting require specialized solutions. In the next section, we’ll explore essential accounting methods that can help construction companies navigate these financial complexities effectively.

Construction accounting requires specialized methods to accurately reflect the industry’s unique financial landscape. We’ve identified key accounting approaches that can significantly enhance financial management for construction companies.

The Percentage of Completion (POC) method offers a systematic approach to recognizing revenue and expenses on projects that span long periods, as is often the case in construction. This approach allows companies to recognize revenue and expenses as a project progresses, rather than waiting until completion.

To implement POC effectively, companies must accurately estimate total project costs and update these estimates regularly. The use of robust project management software (integrated with accounting systems) enables more precise revenue recognition and helps prevent financial misstatements.

The Completed Contract method can benefit smaller contractors or those with shorter-term projects. This method defers all revenue and expense recognition until a project is completed. It’s particularly useful for projects with uncertain costs or high risk of non-completion.

The IRS allows companies with average annual gross receipts of $25 million or less to use this method for tax purposes. However, companies must consider the potential impact on financial statements and cash flow when deciding between POC and Completed Contract methods.

Effective job costing forms the backbone of successful construction accounting. A well-implemented job costing system allows for precise tracking of direct costs (labor, materials, equipment) and allocation of indirect costs to specific projects.

Implementing construction job costing management software offers benefits such as real-time cost tracking, prevention of budget overruns, and identification of savings opportunities. To achieve this, we recommend a detailed cost coding structure and construction-specific accounting software that supports real-time cost tracking and analysis.

Proper equipment depreciation is essential for accurate financial reporting and tax planning in construction. The Modified Accelerated Cost Recovery System (MACRS) is the most common method for tax purposes, but companies should also consider alternative methods for financial reporting.

For heavy equipment, the units-of-production method often proves beneficial, as it ties depreciation to actual usage rather than time. This approach more accurately reflects the wear and tear on equipment in the construction industry.

The mastery of these accounting methods provides construction companies with a clearer picture of their financial health. However, the implementation of these methods often requires sophisticated technological solutions. In the next section, we’ll explore how technology can revolutionize construction accounting practices.

At Adding Technology, we’ve observed how the right technology can revolutionize construction accounting practices. The construction industry now rapidly adopts new tech solutions. This chapter explores the game-changing tools that reshape financial management in construction.

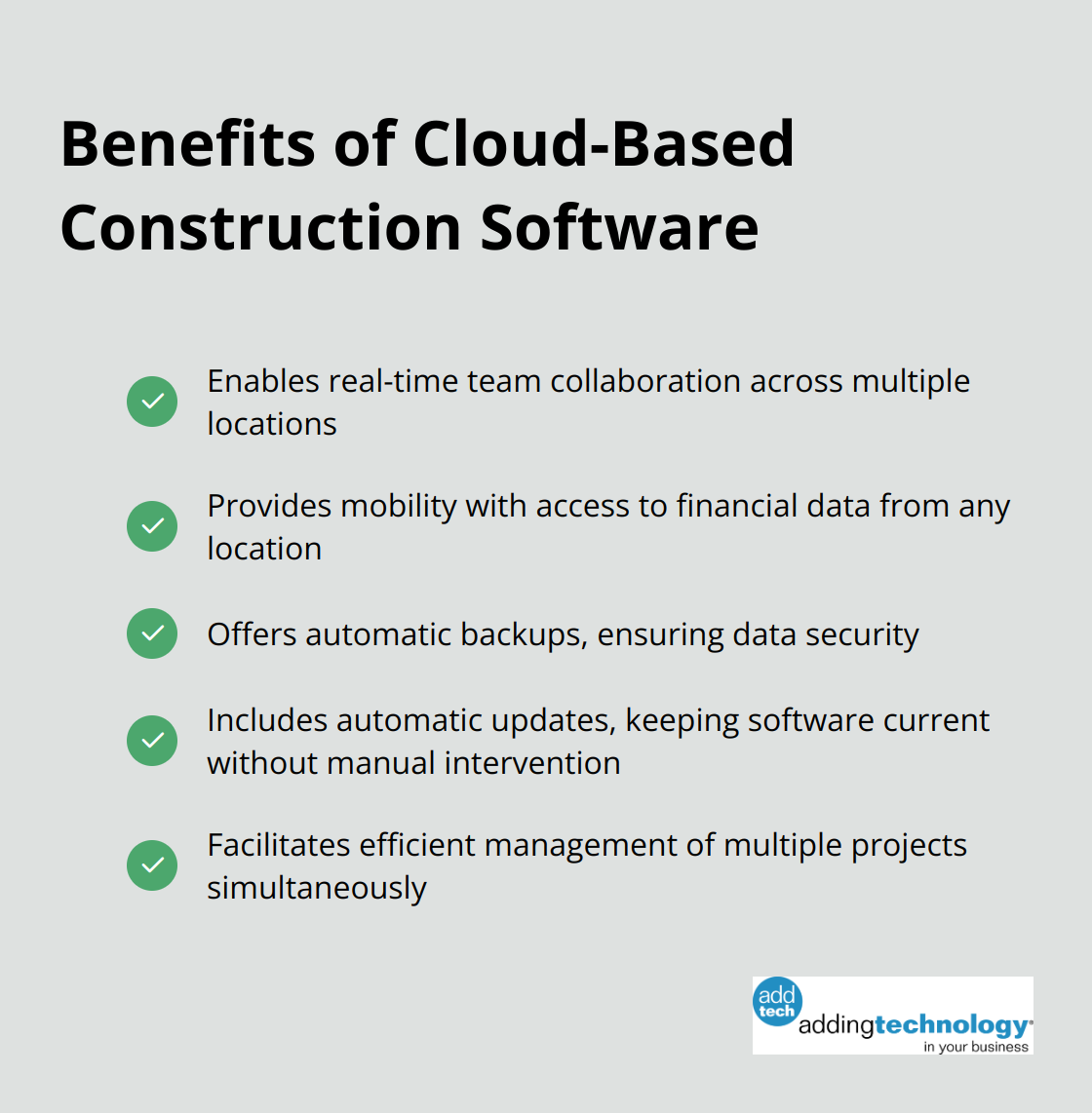

Cloud-based construction software offers distinct benefits that desktop software cannot match, including real-time team collaboration and mobility. These platforms offer real-time access to financial data from any location (crucial for an industry where work happens across multiple job sites).

Cloud accounting features automatic backups and updates. This ensures that financial data remains secure and that users always have the latest version of the software without manual intervention. For construction companies managing multiple projects, this level of reliability proves invaluable.

Construction firms no longer wait for month-end reports to gauge project performance. Real-time project management tools now provide instant visibility into project costs, revenues, and profitability. This immediate access to data allows project managers to make informed decisions on the spot, potentially saving time and costs.

The most significant advancement in construction accounting technology is the integration of project management and accounting systems. This integration eliminates data silos, reduces errors, and provides a holistic view of project finances.

Integrated systems allow for seamless flow of information between the field and the office. When a purchase order is created on-site, it immediately reflects in the accounting system, updating project costs and forecasts in real-time. This level of integration not only improves accuracy but also saves countless hours of manual data entry and reconciliation.

Mobile apps now play a vital role in construction accounting. These apps enable on-site personnel to track expenses, manage time, and submit reports directly from the field. This real-time data capture improves accuracy and speeds up the billing process.

Many construction companies report significant improvements in project tracking and cost control after implementing mobile solutions. These apps often integrate with cloud-based accounting systems, ensuring that financial data remains up-to-date and accessible to all stakeholders.

Our crew stands at the forefront of accounting and financial management for contractors in the construction and real estate sectors.

Construction company accounting presents unique challenges that demand specialized knowledge and tools. Our comprehensive guide explores the intricacies of project-based accounting, revenue recognition, cost allocation, and cash flow management in the construction industry. We examine essential accounting methods like the Percentage of Completion and Completed Contract methods, highlighting their importance in accurately reflecting a company’s financial position.

Technology transforms construction accounting through cloud-based solutions, real-time reporting tools, and integrated systems. These advancements allow for more accurate job costing, improved cash flow management, and better decision-making based on up-to-date financial data. Artificial intelligence and machine learning will enhance predictive analytics, allowing for more accurate cost estimations and risk assessments.

Accurate financial management forms the foundation upon which successful projects and profitable companies are built. Adding Technology offers expert accounting and financial management services tailored specifically for the construction industry. Our structured approach and advanced technology integration can help streamline your financial operations, allowing you to focus on building great projects.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.