Investment management and financial innovations are moving faster than most organizations can keep up with. At adding technology, we’ve seen firsthand how companies struggle to balance traditional approaches with modern tools.

This guide walks you through the strategies, technologies, and practical steps you need to stay competitive in today’s financial landscape.

The gap between traditional investment management and digital-first approaches isn’t philosophical-it’s about measurable outcomes. Organizations that rely on spreadsheets and manual reporting lose ground to competitors who automate their core processes. Traditional approaches depend on quarterly reports and backward-looking data, while digital-first organizations track performance in real time and adjust strategy within days. The difference appears immediately in response time and decision quality. Organizations using real-time dashboards catch market shifts faster, identify underperforming assets quicker, and execute rebalancing with precision that manual processes cannot match.

Data from Deloitte’s 2025 analysis shows that firms implementing AI-driven portfolio management see productivity gains according to C-suite respondents. Morgan Stanley advisers demonstrate near-universal adoption of AI tools to win new clients and tailor materials. This isn’t optional anymore-it’s the baseline expectation.

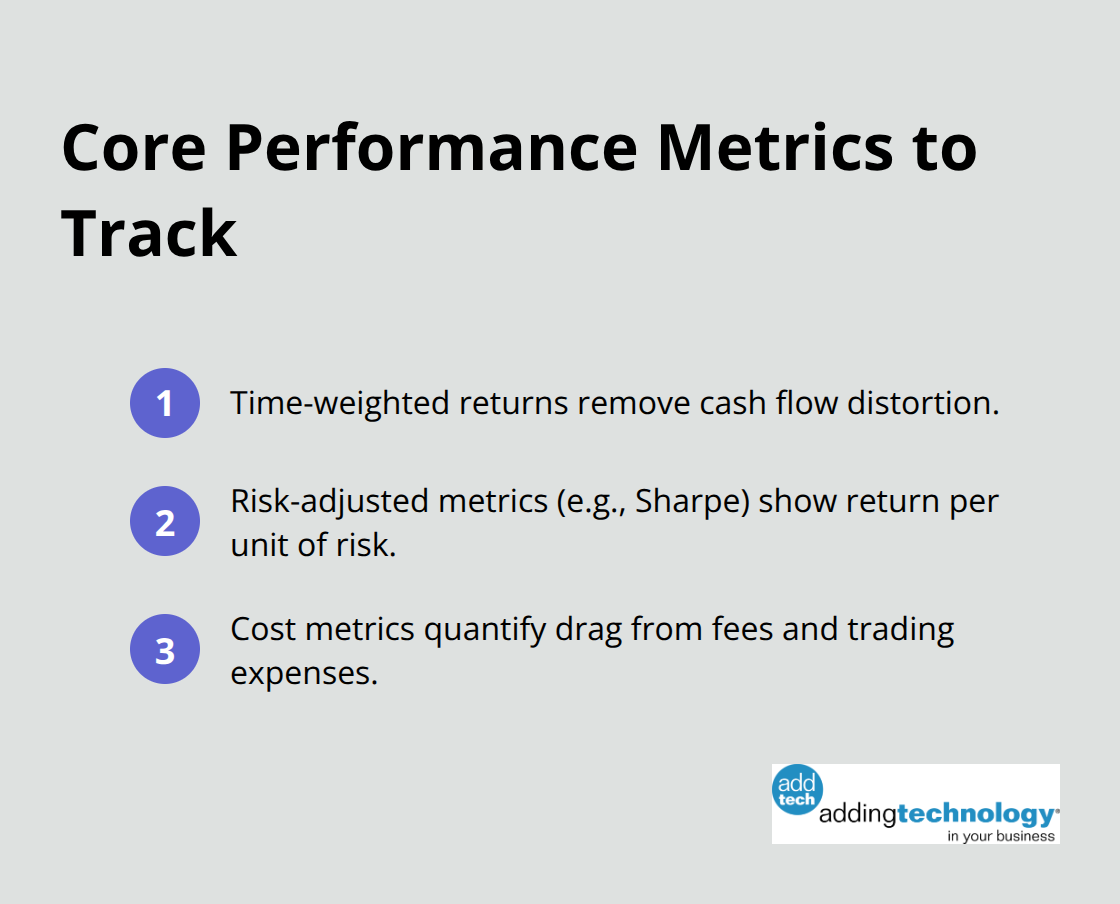

The metrics you track determine the decisions you make. Most organizations still focus on absolute returns, but that’s incomplete. Track three categories simultaneously: time-weighted returns that remove the distortion of cash flows, risk-adjusted metrics like Sharpe ratios that show how much return you earn per unit of risk taken, and cost metrics that reveal the drag on performance from fees and trading expenses. Beyond these, monitor data quality scores and decision-cycle time.

If your team spends two weeks gathering data before making an investment decision, your competitor with automated data pipelines already moved.

FactSet and Morningstar Direct enable multi-currency performance tracking across funds and ETFs with the precision needed for institutional-grade analysis. The organizations winning hardest measure their metrics weekly, not quarterly, and they use those metrics to trigger automated alerts rather than waiting for a human to review reports.

Analytics transforms raw data into actionable intelligence, but only if you structure it correctly. The firms seeing the biggest competitive advantages separate analytics into three layers: data collection that runs continuously without human intervention, transformation that standardizes data across systems into comparable formats, and insight generation that surfaces patterns automatically.

Private equity firms already use AI to streamline due diligence according to Deloitte research, which means they evaluate more deal flow faster than firms still using manual analysis. WRDS provides centralized data warehousing combining financial, accounting, and banking datasets for research-grade analysis. The real advantage comes from automation that flags anomalies immediately rather than waiting for human review.

Raw analytics mean nothing without the systems to act on them. Organizations that excel at investment management connect their analytics directly to execution tools. When your data pipeline identifies an underperforming position, your team should act within hours, not days. This requires integration across platforms-your data warehouse, your portfolio management system, and your execution tools all need to communicate seamlessly. The firms that master this integration (connecting data insights to immediate portfolio adjustments) outpace competitors who still rely on manual handoffs between teams.

AI-driven portfolio management operates as reality for firms that want to stay ahead, not as a future concept. According to AI-driven portfolio management research, organizations report that AI adoption boosts productivity and efficiency. Morgan Stanley advisers show near-universal adoption at approximately 98%, using AI tools to win new clients and customize investment materials. Private equity firms have moved faster than most, with about 64% now using AI to streamline due diligence and identify prospective portfolio companies.

The concrete advantage appears in cycle time: firms with AI-enabled analysis evaluate deal flow in days instead of weeks. Schroders deployed a virtual investment committee agent that analyzes sector dynamics and risk in real time, supporting investment decisions without waiting for human consensus. This removes the delay between data availability and decision-making rather than replacing analysts entirely.

Real-time reporting systems eliminate the traditional quarterly report lag entirely. Organizations tracking performance daily instead of quarterly catch market shifts while competitors are still preparing reports. The gap matters most when volatility spikes or opportunities emerge suddenly. FactSet and Bloomberg Terminal deliver live data feeds across equities, fixed income, currencies, and commodities, but only if your team acts on alerts immediately. If your organization waits until month-end to review performance, you’ve already missed the window where real-time visibility creates competitive advantage.

Blockchain and decentralized finance solutions attract attention but require honest assessment about where they actually solve problems versus where they create complexity. Stablecoin transaction volume surpassed all Visa and Mastercard transactions combined in 2024 according to World Economic Forum data referenced by Fidelity, signaling genuine adoption in specific use cases. The GENIUS Act clarifies stablecoins as non-securities, potentially accelerating certain applications in 2026. However, Fidelity’s crypto analysts view tokenization adoption as incremental and likely focused on niches rather than broad deployment. Australia’s central bank tested tokenized settlements across asset classes, and the EU’s ELTIF 2.0 reforms aim to widen cross-border fund access through improved structures.

Tokenization works for specific problems like cross-border transfers and fractional ownership, but it introduces custody and regulatory complexity that doesn’t suit every organization. Firms should implement these tools only where they solve genuine operational friction, not because the technology exists. The organizations winning hardest connect innovation adoption directly to measurable outcomes-faster settlement, lower transaction costs, or expanded market access. Without that connection, you adopt technology for its own sake rather than improving your actual investment process. This focus on outcomes over novelty determines which innovations actually strengthen your competitive position and which ones consume resources without delivering results.

Adopting financial innovations requires honest assessment of what you actually have versus what you need. Most organizations overestimate their current capabilities. Firms claiming they have real-time data systems often run on weekly batch processes instead. Start by mapping your actual data flow. Document how long it takes information to move from source systems into your decision-making tools. If portfolio data takes five days to consolidate, you don’t have real-time visibility regardless of what your software vendor claims. Write down every manual step in your critical processes: data entry, reconciliation, report generation, and decision approval. Count the people involved and the calendar days consumed. This exercise reveals where innovation creates genuine value versus where it adds complexity. Organizations that skip this step deploy tools solving problems they don’t actually have while ignoring the friction points that slow them down daily.

Once you identify real constraints, match tools to specific outcomes rather than selecting platforms based on feature lists. A firm needing faster due diligence evaluation should prioritize AI-enabled analysis tools that compress evaluation cycles from weeks to days, exactly as private equity firms now do with 64% adoption according to Deloitte research. A firm struggling with cross-border fund transfers should evaluate blockchain solutions for settlement efficiency, particularly as ELTIF 2.0 reforms expand cross-border access. However, if your actual bottleneck is manual report assembly, adding sophisticated analytics platforms wastes budget. Deloitte’s 2025 analysis shows that 46% more M&A activity in investment management occurred in the first half of 2025 compared to 2024, with roughly 25% of deals targeting planning and financial infrastructure capabilities. This concentration reveals where the industry believes returns justify investment costs. Your technology selections should mirror this focus: deploy tools where measurable outcomes drive competitive advantage, not where vendors promise future potential.

Building the right team matters more than selecting perfect tools. Organizations fail at innovation adoption far more often because they lack technical talent than because they chose wrong platforms. AI expertise in investment management remains scarce, with US AI-related job postings rising approximately 25% from 2022 to mid-2025 according to Deloitte, yet AI mentioned in only about 2.4% of US finance job postings. This gap means recruiting specialists costs substantially more and takes longer than most organizations expect.

Hire for three distinct roles: data engineers who build and maintain pipelines that feed your analytics, analysts who interpret output and translate it into investment decisions, and platform specialists who integrate systems so insights flow directly into execution tools. Firms with high generative AI expertise grant access to over 40% of their workforce in 43% of cases, indicating that technology adoption succeeds when distributed across teams rather than concentrated in isolated groups. Start by identifying which of these three roles you lack most acutely, then recruit for that gap first rather than trying to build complete teams immediately.

Investment management and financial innovations shift from optional upgrades to competitive requirements when you connect them to your actual business constraints. Organizations that mapped their data flows, selected tools aligned with measurable outcomes, and built teams with the right technical skills already outpace competitors still relying on quarterly reports and manual processes. The firms winning hardest measure decision-cycle time, data quality scores, and the cost of manual work to reveal where innovation creates genuine competitive advantage.

Your financial strategy moving forward depends on three decisions made now. Stop waiting for perfect conditions to modernize-the organizations leading in AI-driven portfolio management and real-time reporting started when their systems were incomplete and improved incrementally while competitors debated which approach to take. Measure everything: track not just investment returns but also how long decisions take, how clean your data is, and what manual processes actually cost you. Technology fails without the data engineers, analysts, and platform specialists who make it work, so invest in people before platforms.

Blockchain solves cross-border settlement friction, not every operational problem, and AI-driven analysis compresses due diligence cycles, not every decision type. Adding Technology streamlines financial processes through real-time job costing, renovated accounting systems, and advanced technology integration tailored to your specific operations. Your next step is honest assessment of where your current systems slow you down most, then targeted investment in innovations that solve those specific problems.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.