Student loan debt affects over 43 million Americans, with the average borrower owing $37,574. Managing this debt without a structured system often leads to missed payments, wasted money on interest, and years of unnecessary financial strain.

At adding technology, we’ve seen how financial asset management systems transform loan repayment from chaotic to strategic. The right tools give you complete visibility into your debt, automate payments, and help you eliminate loans faster.

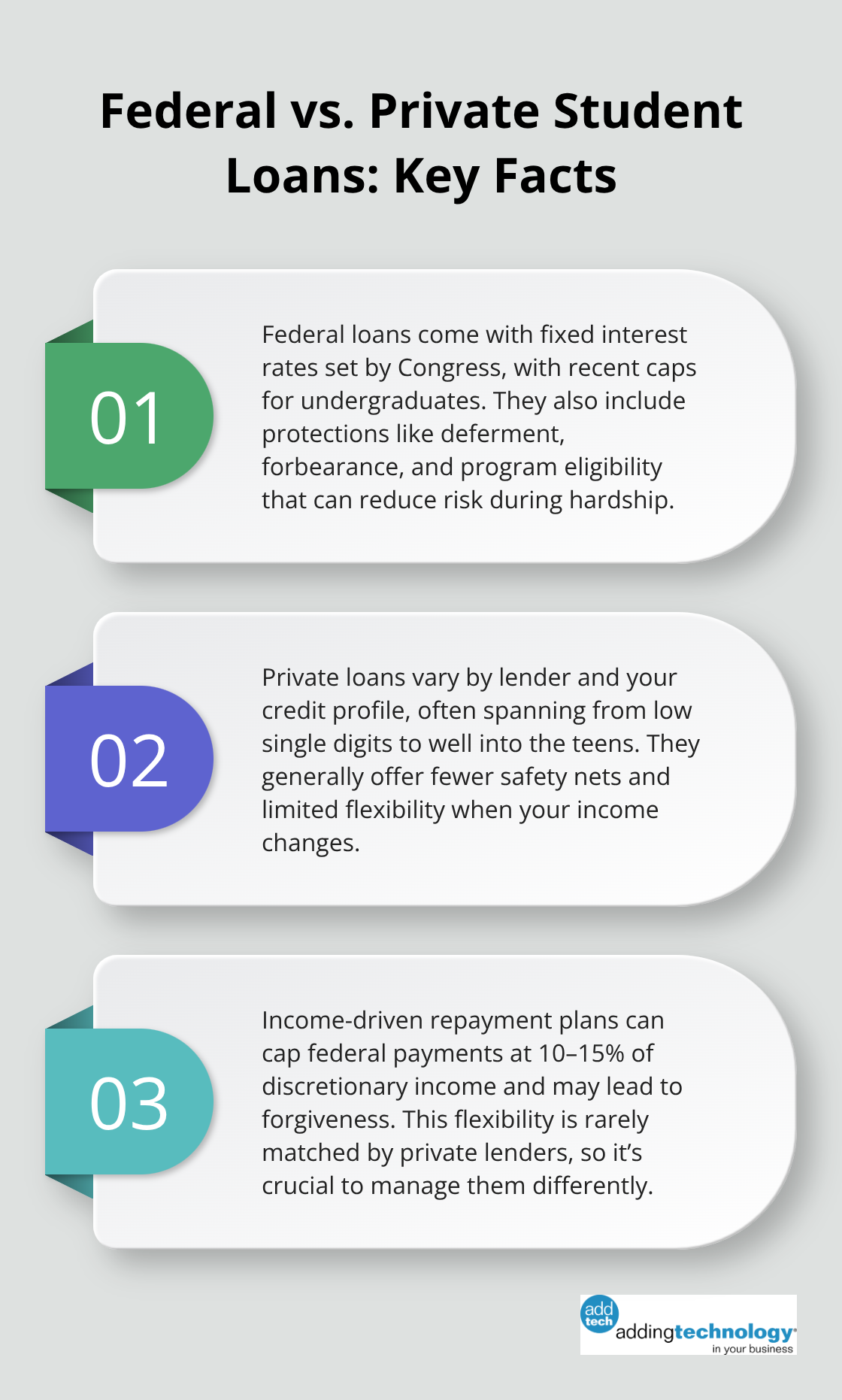

Federal student loans carry fixed interest rates set by Congress, capped at 8.05% for undergraduates as of 2024. Private loans vary widely based on your credit score and lender, ranging anywhere from 3% to over 13%. The Congressional Research Service reports that about 43 million Americans carry federal student loan debt totaling more than $1.6 trillion, while private loans account for roughly $150 billion. This distinction matters because federal loans offer income-driven repayment plans that cap your monthly payment at 10-15% of discretionary income, whereas private lenders rarely offer this flexibility.

Federal loans also provide deferment and forbearance options if you face hardship, protections private lenders typically don’t match. If you carry both types, your repayment strategy should prioritize understanding which loans offer the most favorable terms and protections for your situation.

The interest rate you pay determines far more than your monthly payment. A $30,000 federal loan at 5.5% over ten years costs roughly $8,250 in total interest, while the same loan at 7% costs approximately $11,500. Private loan rates fluctuate based on market conditions and your creditworthiness, so refinancing becomes a viable strategy if your credit improves or rates drop. Graduate borrowers face particularly steep costs-the average graduate student debt reached $25,400 by 2020, and many carry six-figure balances from professional degrees. Consolidation can extend repayment to 30 years, which lowers monthly payments but dramatically increases total interest paid. Before you choose a repayment path, calculate the exact cost difference between a standard ten-year plan and an income-driven option using the Student Aid Index calculator to model your actual numbers. The difference between choosing the wrong structure and the right one can easily exceed $20,000 over your repayment lifetime.

Standard federal repayment takes ten years, but income-driven plans stretch to 20-25 years with the possibility of forgiveness on remaining balances. This flexibility matters if your income is currently low-your payments might be as little as $0 per month under certain income-driven plans while your loan balance continues accruing interest. Private loans typically demand repayment within ten years with no income adjustments, making them far less forgiving during career transitions or financial hardship. The Congressional Research Service found that borrowers in professional degree programs like medicine and law averaged $177,100 in debt by completion, making the difference between a rigid ten-year timeline and flexible income-driven repayment critically important for cash flow management. If you manage multiple loans across federal and private sources, your financial asset system needs to track which loans have which repayment options available, since consolidating federal loans into a private loan eliminates income-driven protections permanently.

Federal and private loans demand different management approaches. Federal loans reward you for staying within the system-income-driven repayment, forgiveness programs, and hardship protections all incentivize keeping these loans separate and manageable. Private loans, conversely, reward speed and creditworthiness; refinancing to a lower rate or accelerating payoff saves you substantial money. Your financial asset system should track these differences automatically, flagging which loans qualify for forgiveness programs and which ones benefit most from accelerated payoff. The structure you choose today-whether you consolidate, refinance, or keep loans separate-locks you into a path that affects your finances for decades. Understanding these mechanics before you act prevents costly mistakes that compound over years of repayment.

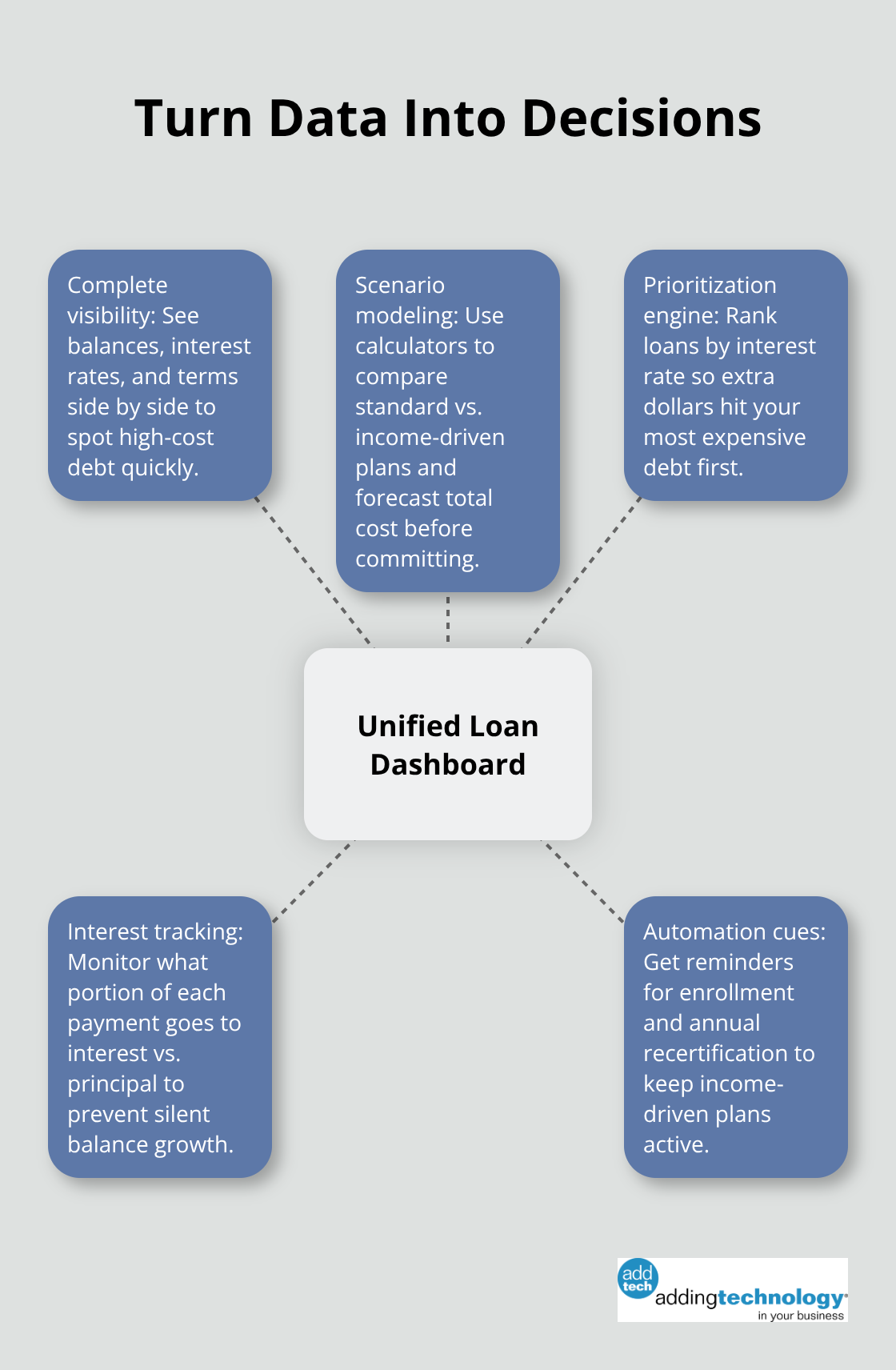

A financial asset system transforms scattered loan information into actionable intelligence. Instead of logging into multiple lender portals, checking paper statements, and manually calculating how much interest compounds each month, a centralized system pulls all your loan data into one dashboard where you see exact balances, interest rates, and remaining terms side by side. This visibility matters because most borrowers drastically underestimate how much interest they actually pay. The Student Aid Index calculator lets you model different repayment scenarios before you commit, showing you precisely how choosing a standard ten-year plan versus an income-driven option changes your total cost. Without this modeling, you’re essentially guessing at your financial future.

A financial asset system automates the tedious work of tracking which payments reduce principal versus interest, which loans stay on track, and which ones quietly grow due to accrued interest or deferment periods. When you carry multiple loans at different rates, knowing which ones to attack first requires real numbers, not assumptions. If you send $200 extra toward a 6% loan versus a 3% loan, the savings differ dramatically over time. Most borrowers make payments without understanding how their cash flow interacts with interest accrual.

Automation prevents the costly mistakes that happen when you miss a payment deadline or forget to switch between repayment plans. Federal loans offer income-driven repayment plans that cap payments at 10-15% of discretionary income, but you must actively enroll and recertify annually-a process many borrowers overlook entirely. A system that tracks your enrollment status and flags recertification dates eliminates this friction. Real-time balance visibility also reveals the true impact of extra payments and keeps you accountable to your repayment strategy without manual intervention.

Integration with your overall budgeting tells you exactly how much surplus cash you have each month available for acceleration, ensuring you don’t artificially accelerate loans while starving emergency savings or neglecting higher-return investments. A financial asset system that connects your loans to your complete cash position prevents the false choice between debt payoff and financial stability. This connection matters because the decision to pay down student loans versus invest depends entirely on your loan’s interest rate compared to your expected investment returns. If your student loan interest rate sits below 6%, allocating more funds to investing rather than extra principal payments often makes financial sense over the long run.

Your loan data only becomes powerful when you can see patterns across all your accounts simultaneously. Most borrowers track payments manually, missing opportunities to refinance when rates drop or consolidate strategically. A system that surfaces these opportunities automatically positions you to act quickly when market conditions shift or your creditworthiness improves. With complete visibility into your loan structure, interest accrual, and cash flow, you can now identify which specific strategies will accelerate your payoff most effectively-and that’s where prioritization becomes your next critical decision.

The most effective payoff strategy starts with brutal honesty about your loan portfolio. Most borrowers waste years paying down low-interest federal loans while high-interest private loans compound aggressively in the background. You must attack loans by interest rate, not emotional satisfaction. If you carry a 3% federal loan and a 9% private loan, every dollar sent toward the federal loan is a dollar not working against your highest-cost debt. The math is unforgiving: a $20,000 private loan at 9% costs roughly $4,500 in interest over five years if you make minimum payments, while the same $20,000 at 3% costs only $1,500. This gap widens dramatically with larger balances or longer timeframes.

Start by ranking every loan from highest to lowest interest rate, then direct all surplus cash toward the top of that list. This avalanche method works because once you finish paying off the highest interest rate debt, you keep that payment going and throw it toward the next-highest rate, minimizing total interest paid across your entire portfolio and getting you debt-free faster than any other approach. The strategy removes guesswork from the equation and forces your cash flow to work against your most expensive debt first.

Refinancing private loans becomes attractive when your credit score improves or market rates drop, but the decision requires specific numbers, not general optimism. If you refinanced a $30,000 private loan from 8% to 5%, you would save approximately $4,500 in interest over ten years. However, refinancing resets your loan term, so if you already paid three years of a ten-year loan, refinancing to another ten-year term extends your repayment timeline unless you maintain higher payments.

Never refinance federal loans into private loans, since you permanently lose income-driven repayment protections and forgiveness eligibility. Congressional Research Service data shows this matters enormously for borrowers in professional degree programs carrying six-figure balances. The protection you surrender today cannot be recovered later, regardless of your financial circumstances.

Consolidation within the federal system preserves income-driven protections but extends repayment to 30 years, increasing total interest substantially. Consolidation makes sense only if you need immediate payment relief through income-driven plans, not as a strategy to reduce total interest paid. The trade-off is explicit: lower monthly payments now cost you significantly more later. Your financial asset system should model both scenarios before you consolidate, showing you the exact monthly payment under each option and the total interest difference over the loan’s life.

Managing student loans without structure costs you thousands in wasted interest and years of unnecessary financial strain. Financial asset management systems for student loans transform your strategies from theory into action by automating tracking, surfacing opportunities to refinance or consolidate, and connecting your loan payoff to your complete financial picture. A borrower who ranks loans by interest rate and directs surplus cash strategically saves tens of thousands compared to someone making minimum payments across scattered accounts.

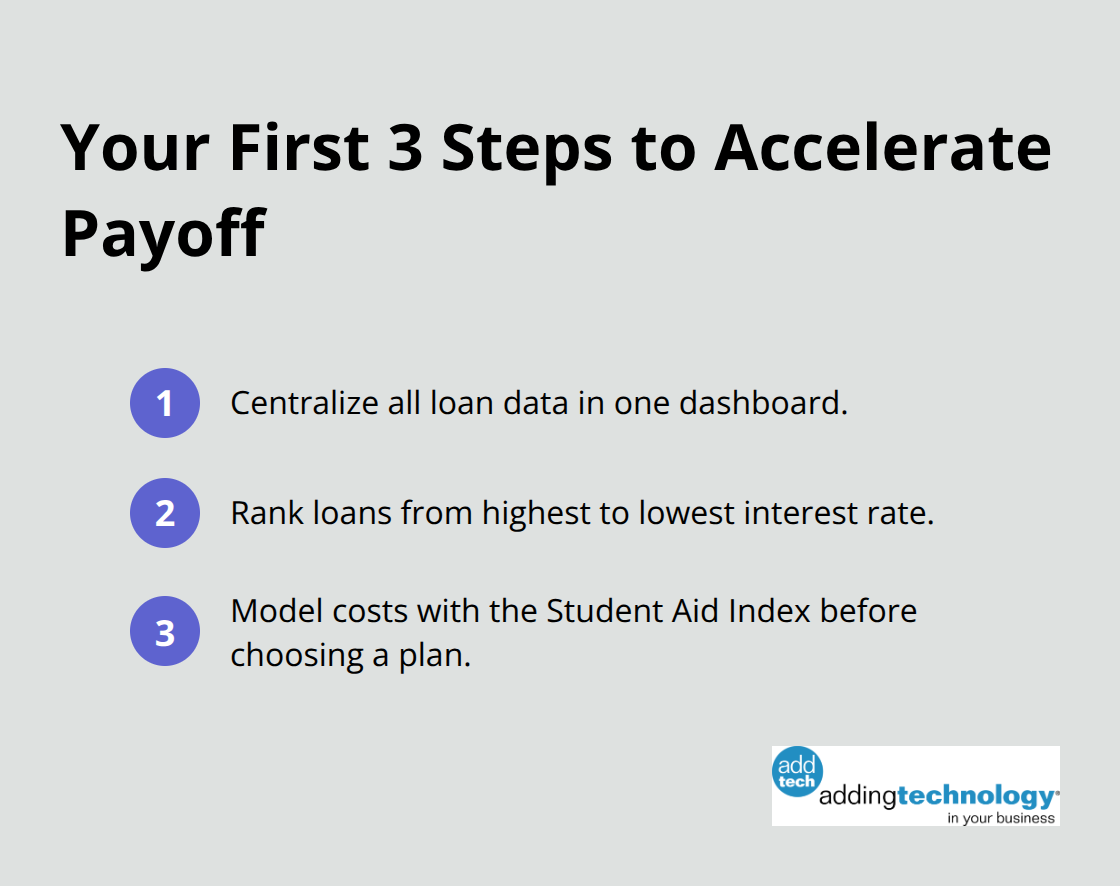

Start your debt reduction plan with three immediate actions. Pull together all your loan statements and enter them into a centralized system where you can see balances, interest rates, and remaining terms side by side. Rank your loans from highest to lowest interest rate and commit to directing all surplus cash toward the top of that list, then model your specific numbers using the Student Aid Index calculator to understand the true cost difference between repayment options before you commit to a path.

Structured systems eliminate guesswork and unlock better decisions across your complete financial picture. If you’re ready to apply this same rigor to your finances, adding technology specializes in streamlining financial processes so you can focus on what matters most. Your student loan payoff plan works best when it integrates with your overall financial strategy, not when it exists in isolation.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.