Construction companies face unique financial challenges that standard accounting tools can’t handle. Job costing, equipment tracking, and project-based billing require specialized features.

We at adding technology have analyzed the top bookkeeping software for construction businesses. The right platform can streamline your operations and improve profit margins significantly.

QuickBooks Desktop Pro Plus delivers the most practical solution for small to mid-size construction companies. The software automates job costing and tracks equipment depreciation across multiple projects. Pricing starts at $549 annually for the Pro version, with the Premier Contractor edition at $799 that offers advanced job profitability reports. QuickBooks processes construction transactions for thousands of companies, making it a widely tested platform in the industry.

Sage 300 Construction targets larger contractors with substantial annual revenues. The platform manages unlimited projects simultaneously and processes payroll for large workforces without performance issues. Implementation typically takes 3-6 months and costs between $15,000-$50,000 (depending on modules selected). Companies that use Sage 300 report faster month-end closings compared to generic systems. The software integrates directly with equipment management systems and handles certified payroll requirements across all 50 states.

Foundation Software focuses exclusively on heavy civil contractors and large commercial builders. The platform tracks equipment hours automatically through GPS integration and manages subcontractor payments with built-in lien waiver processing. Annual licenses start at $12,000 for basic modules and reach $40,000 for full implementation. Foundation clients show improvement in job margin accuracy within the first year. The software handles prevailing wage calculations and generates certified payroll reports that meet Department of Labor requirements without manual intervention.

Each platform addresses different business needs and project scales. The next step involves evaluating specific features that separate construction-focused software from standard options (particularly job costing capabilities and equipment management tools).

Construction bookkeeping software stands apart from generic accounting tools through three non-negotiable capabilities. Job costing accuracy determines profit margins on every project, while equipment tracking prevents costly oversights that drain budgets. Tax compliance automation saves thousands in penalties and reduces audit risks significantly.

Real-time job costing tracks labor, materials, and overhead costs against each project automatically. Contractors who use dedicated job costing software can improve profit margins significantly within the first year. Software should allocate indirect costs like equipment rental and administrative overhead proportionally across active jobs. Look for platforms that generate cost-to-completion reports weekly, not monthly. Late cost tracking leads to budget overruns that kill profitability. The best systems integrate with time tracking apps and material procurement platforms to capture costs immediately when they occur.

Equipment represents a significant portion of total project costs for most contractors. Software must track equipment depreciation, maintenance schedules, and utilization rates across multiple job sites. GPS integration shows exact equipment locations and prevents theft that costs the industry substantial amounts annually. Maintenance tracking reduces unexpected breakdowns that delay projects and trigger penalty clauses. The platform should calculate true equipment costs per hour including fuel, maintenance, and depreciation. This data helps bid future projects accurately and identifies assets that drain cash flow.

Construction payroll involves prevailing wages, union rates, and certified payroll reports that generic software handles poorly. Contractors face substantial fines for prevailing wage violations. Integrated payroll systems automatically apply correct wage rates based on project location and worker classification. Look for software that generates certified payroll reports in required formats for each state. Multi-state contractors need platforms that handle different prevailing wage databases simultaneously. Tax compliance features should calculate workers compensation premiums, unemployment taxes, and union fringe benefits without manual intervention.

These features form the foundation of effective construction software, but selection requires careful evaluation of your specific business needs and operational requirements.

Construction bookkeeping software selection demands a methodical approach based on concrete business metrics, not vendor promises. Companies with annual revenue below $5 million need different capabilities than contractors who manage $50 million in projects annually. Software selection mistakes cost construction firms significant expenses in lost productivity and implementation costs.

Small contractors who handle 10-15 projects annually can operate effectively with basic accounting software solutions. Mid-size companies that manage 50+ concurrent projects need enterprise platforms despite higher costs. Revenue volume determines software requirements more than employee count. Contractors who generate $10-20 million annually require unlimited project tracking and multi-location capabilities that basic software cannot handle. Foundation Software becomes cost-effective for heavy civil contractors with substantial equipment fleets. Calculate your average monthly transactions, active projects, and equipment assets before you evaluate platforms. Software that crashes under your transaction volume creates operational disasters during peak seasons.

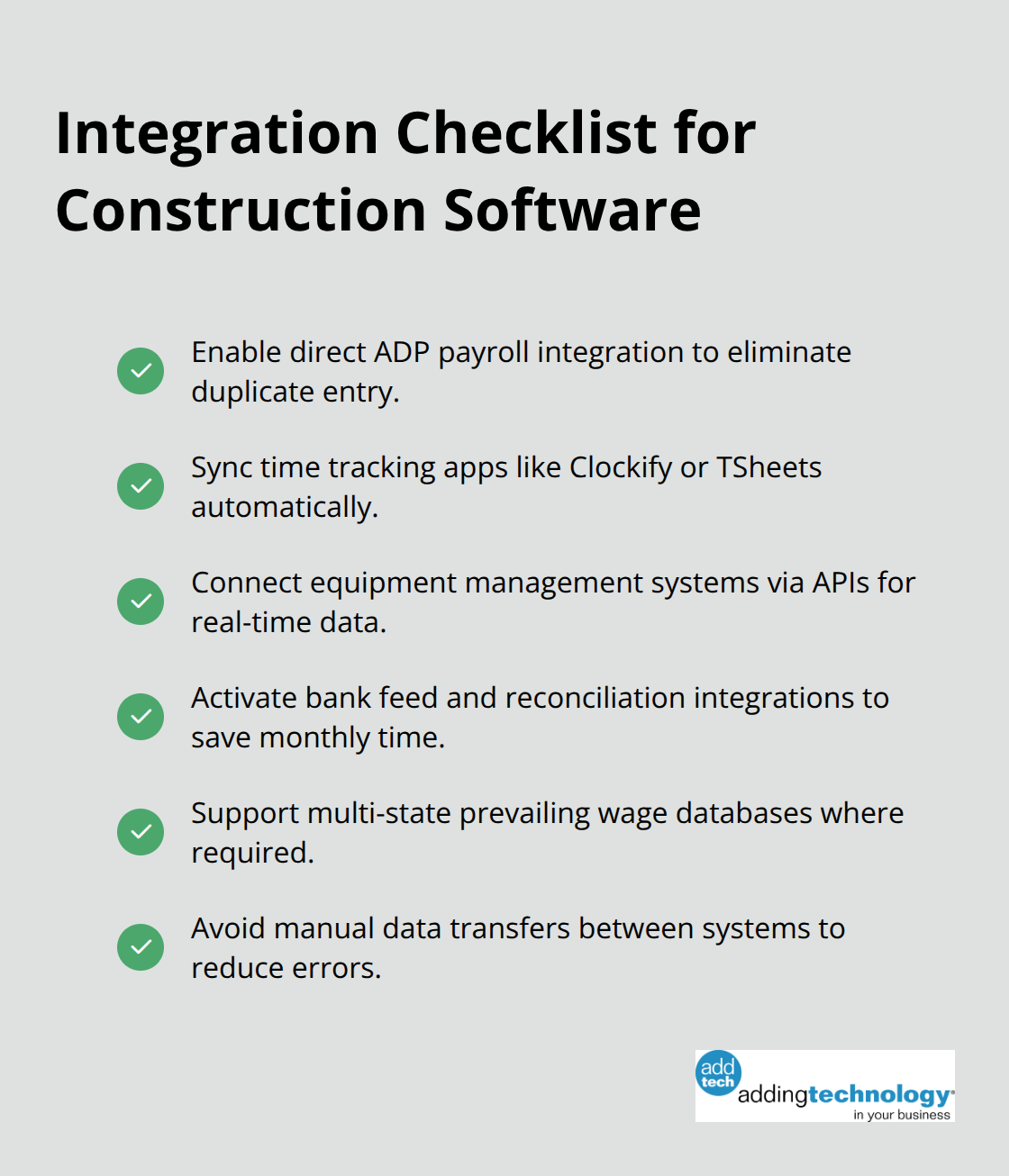

Your existing systems dictate software compatibility requirements completely. Companies that use ADP payroll need construction software with direct ADP integration to avoid double data entry.

Time tracking apps like Clockify or TSheets must sync automatically with your chosen platform. Equipment management systems require API connections that many accounting platforms lack entirely. Bank reconciliation integration saves significant time monthly for busy contractors. Evaluate every software connection your business depends on before you make final decisions. Manual data transfer between systems creates errors that trigger costly project overruns and compliance violations.

Software implementation disrupts normal operations for several weeks depending on platform complexity. QuickBooks training requires substantial hours for construction-specific features while enterprise solutions demand extensive training across multiple team members. Plan implementation during slower seasonal periods to minimize revenue impact. Foundation Software provides dedicated trainers but requires extended commitments. Budget appropriately for professional training beyond software licensing costs. Poor training leads to data entry mistakes that compromise job costing accuracy permanently.

QuickBooks Desktop Pro Plus works best for small contractors with its $549 annual cost and proven job costing features. Mid-size companies benefit from Sage 300 Construction despite higher implementation costs between $15,000-$50,000. Foundation Software targets heavy civil contractors who need GPS equipment tracking and automated prevailing wage calculations.

Your company size and project volume determine the right platform choice. Contractors who generate under $5 million annually can operate effectively with QuickBooks, while larger operations require enterprise solutions. Integration capabilities with existing payroll and time tracking systems prevent costly data entry errors that compromise project profitability.

Implementation timing affects business continuity significantly. Plan software transitions during slower seasons and budget for professional training beyond licensing costs (poor implementation creates job costing errors that damage profitability permanently). We at adding technology help construction companies implement expert accounting and financial management services that streamline operations and improve cost visibility when you select the right bookkeeping software for construction.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.