Managing construction loan draws can be a complex process for contractors and project managers. Accurate accounting is essential to ensure smooth cash flow and project completion.

At Adding Technology, we understand the challenges of tracking draw requests, disbursements, and interest payments during construction projects. This guide will provide you with practical tips for accounting for construction loan draws and maintaining financial health throughout your project.

Construction loan draws represent incremental disbursements of funds from a lender to a borrower during various stages of a construction project. These draws form a critical component of project financing. At Adding Technology, we observe how proper management of these draws can significantly impact a project’s financial health.

The full amount of an approved construction loan isn’t immediately available. Instead, lenders release funds in stages, typically aligning with project milestones. For instance, a draw might occur after foundation laying, framing completion, and so on. This staged approach helps lenders manage risk and ensures appropriate fund utilization.

The construction draw process is simply a method of paying the contractor in installments, or draws, from the construction project funds.

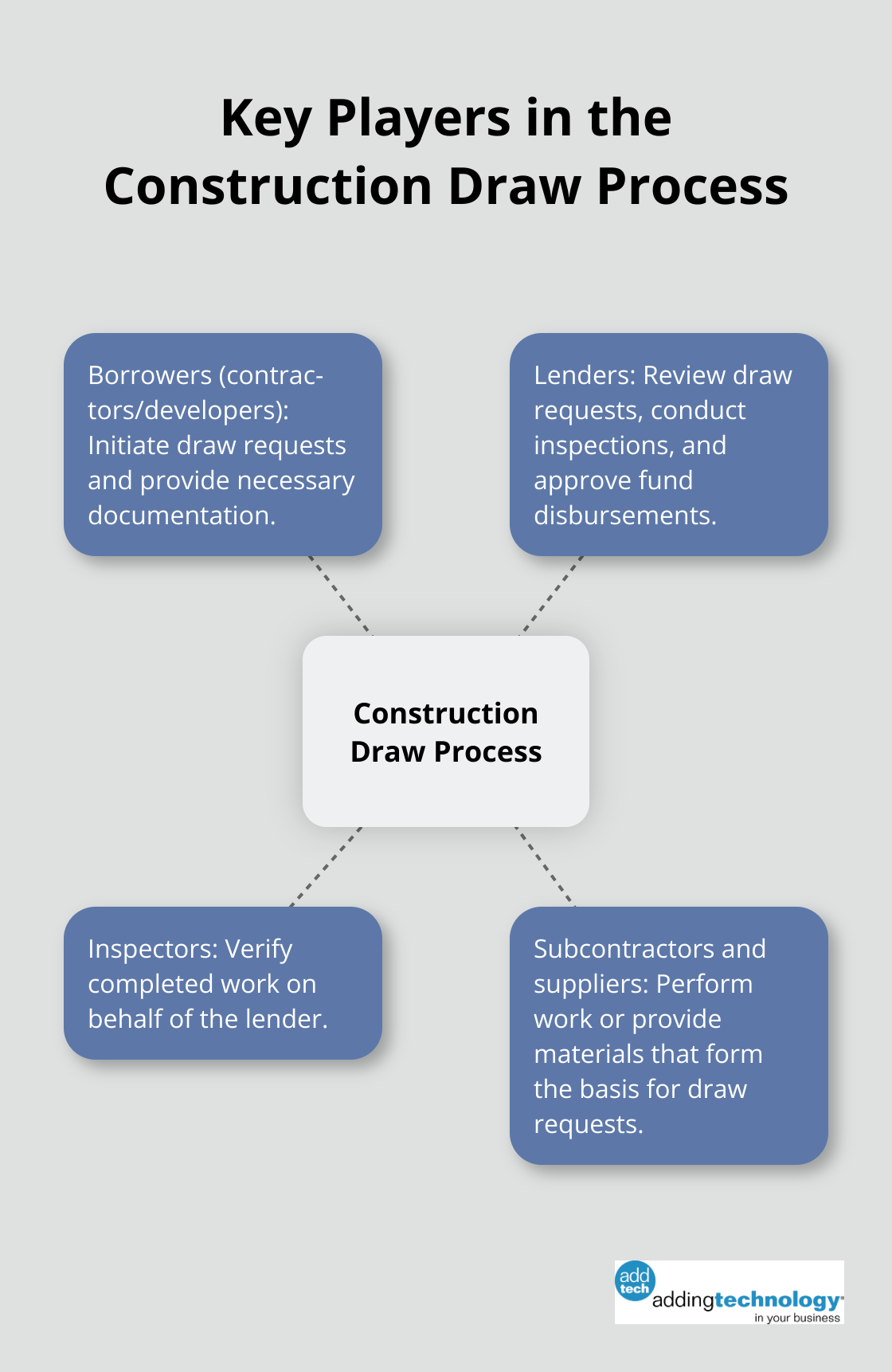

The draw process involves several parties with distinct roles:

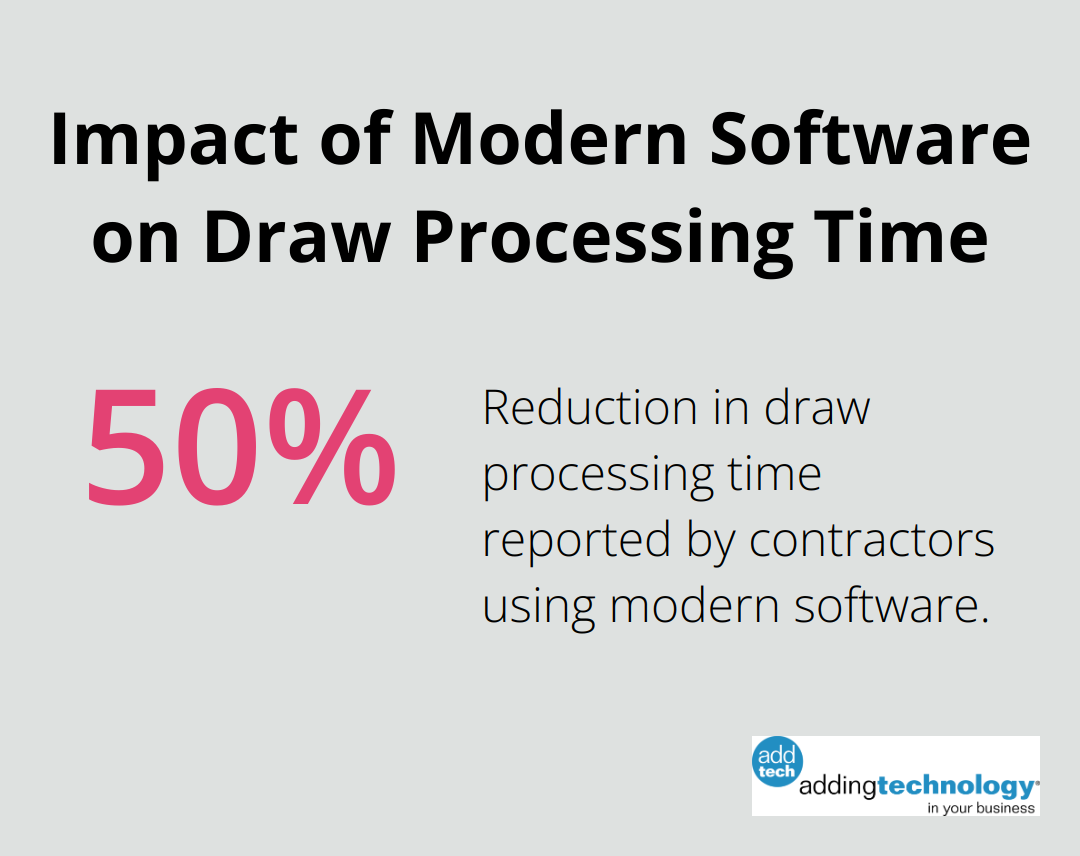

Modern construction management software has revolutionized the draw process. These tools can automate documentation, track expenses in real-time, and facilitate faster approvals. Some clients report a reduction in draw processing time by up to 50% using such systems.

Effective draw management extends beyond securing funds. It maintains project momentum, ensures timely payments to subcontractors, and provides transparency to all stakeholders. Contractors who optimize this process can significantly improve their financial stability and project outcomes.

As we move forward, we’ll explore the specific accounting practices for construction loan draws, providing you with practical strategies to enhance your financial management.

When you secure a construction loan, record the total approved loan amount as a long-term liability on your balance sheet. This entry reflects the full loan amount, even though you won’t access all funds immediately. Instead, you’ll draw from this amount as your project advances.

Document each draw transaction meticulously. Use specialized construction accounting software that integrates with your existing financial systems. This approach enables real-time tracking of draw requests, approvals, and disbursements.

For each draw, create a journal entry to increase your cash account and the corresponding liability account. This method ensures your books accurately reflect the growing loan balance as you use the funds.

Effective construction risk management with disbursement practices is crucial for construction loan administration, including draw and disbursement practices.

Construction loans often require interest payments during the build phase, even before the entire loan amount is disbursed. Track these payments carefully, as they can often be capitalized as part of the project cost.

Set up a separate account specifically for construction loan interest. This strategy allows for easy tracking and prevents these costs from getting lost in general expense categories.

Capitalizing interest is a common practice in construction accounting with significant tax implications. This process adds the interest paid during construction to the overall cost of the asset being built.

To capitalize interest correctly, maintain detailed records of all interest payments made during the construction period. At project completion, transfer these capitalized costs to a fixed asset account and depreciate them over the asset’s useful life.

Capitalizing interest during active construction phases ensures that companies only allocate interest costs that contribute to asset value.

Modern accounting software (like the solutions offered by Adding Technology) can streamline the entire process of managing construction loan draws. These tools often include features for automated documentation, real-time expense tracking, and faster approvals.

Implementing the right technology can significantly reduce errors, improve transparency, and save time. Many contractors report a reduction in draw processing time by up to 50% using such systems.

Effective management of construction loan draws combines meticulous record-keeping, strategic financial planning, and the right technology tools. The next section will explore best practices to further enhance your construction loan draw management.

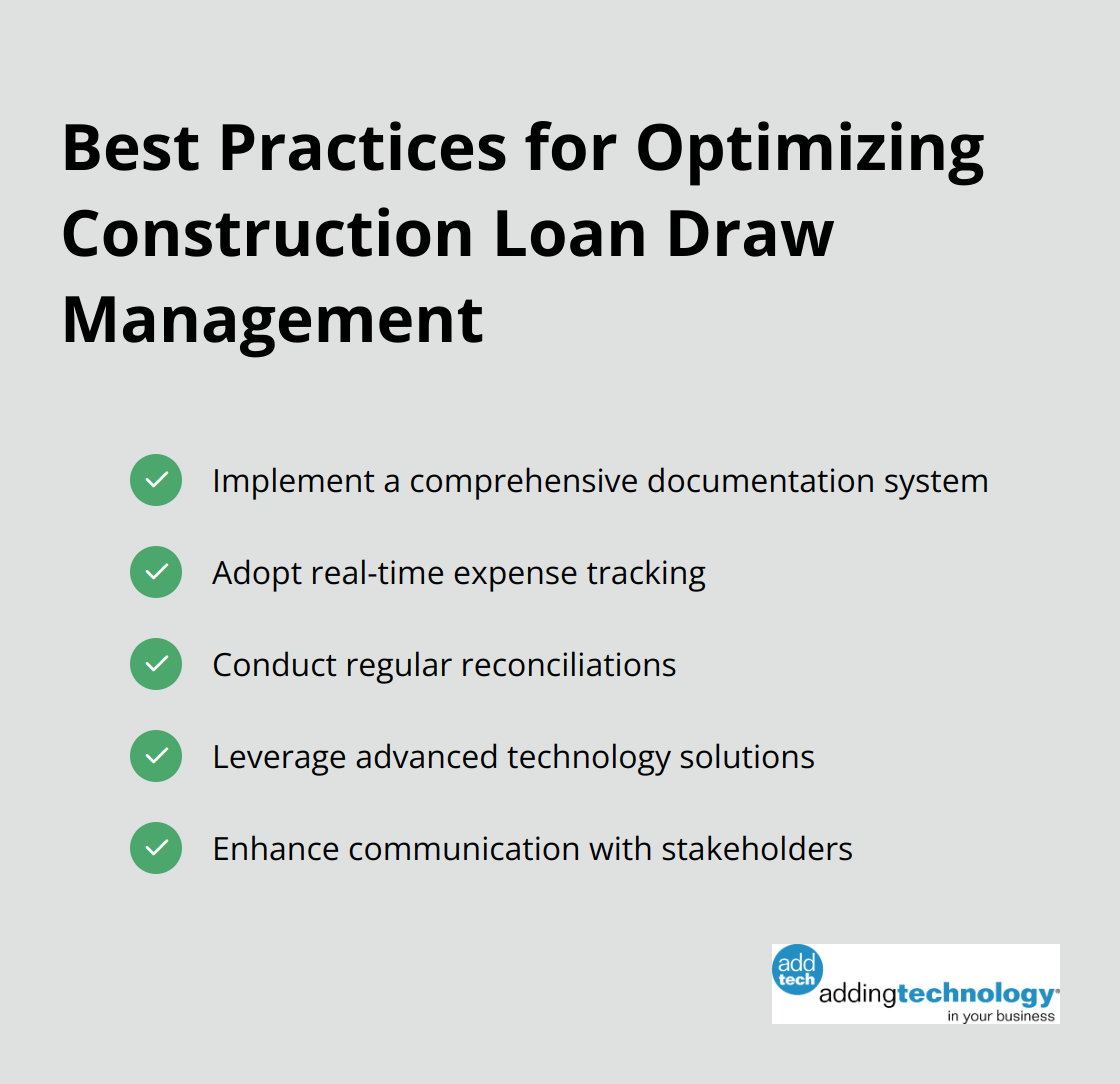

Maintaining detailed records is essential for construction loan draws. We recommend the creation of a centralized digital repository for all draw-related documents. This should include invoices, receipts, lien waivers, progress photos, and inspection reports. Implementing a comprehensive documentation system helps in improving efficiency and profitability. It also aids in achieving regulatory compliance and reducing risk for banks and credit unions.

Use cloud-based storage solutions that allow for easy access and sharing with relevant stakeholders. This improves organization and facilitates quicker approvals from lenders.

Accurate expense tracking forms the backbone of effective draw management. Implement a robust system that allows for real-time expense logging and categorization. This could involve the use of mobile apps that enable on-site personnel to submit expenses instantly, reducing the risk of lost receipts or forgotten charges.

This level of precision aids in the preparation of accurate draw requests and provides valuable insights for future project estimations.

Don’t wait until the end of the project to reconcile your expenses with draw amounts. We advise our clients to perform weekly or bi-weekly reconciliations. This practice helps identify discrepancies early, preventing potential cash flow issues or disputes with lenders.

Set up automated alerts in your accounting software to flag any significant variances between budgeted and actual costs. This proactive approach allows you to address issues promptly and adjust future draw requests accordingly. Construction payment schedules help companies manage finances, avoid disputes, and maintain steady cash flow.

Modern construction management software revolutionizes the draw process. These tools can automate documentation, track expenses in real-time, and facilitate faster approvals.

Adding Technology offers expert solutions in this area, providing advanced tools that integrate seamlessly with existing financial systems. Our clients experience improved bookkeeping, enhanced cost visibility, and more timely payments, resulting in smoother operations and business growth.

Effective communication with lenders, contractors, and other stakeholders is key to successful draw management. Establish clear channels for sharing updates, addressing concerns, and resolving issues promptly. Regular project status meetings (virtual or in-person) can help keep all parties aligned and informed.

Try to create standardized reporting templates that provide a clear overview of project progress, financial status, and upcoming draw requirements. This consistency in communication can build trust with lenders and expedite the approval process.

Accounting for construction loan draws requires meticulous record-keeping and strategic financial planning. We at Adding Technology understand the complexities of this process and its impact on project success. Our solutions streamline financial management, allowing contractors to focus on their core business activities.

Modern technology plays a pivotal role in optimizing draw management. Advanced software tools automate documentation, track expenses in real-time, and facilitate faster approvals. These improvements lead to enhanced operational efficiency and financial stability for construction businesses.

We invite you to explore our expert accounting services for the construction industry. Our tailored approach addresses the unique challenges faced by contractors in managing their finances. With Adding Technology as your partner, you can transform the complex process of construction loan draw accounting into a competitive advantage for your business.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.