At adding technology, we understand the challenges contractors face in managing their finances effectively. QuickBooks contractor job costing is a powerful tool that can streamline your financial processes and boost profitability.

In this guide, we’ll walk you through the essential steps to set up and utilize QuickBooks for accurate job costing. From creating a tailored chart of accounts to generating insightful reports, you’ll learn how to make the most of this versatile software for your contracting business.

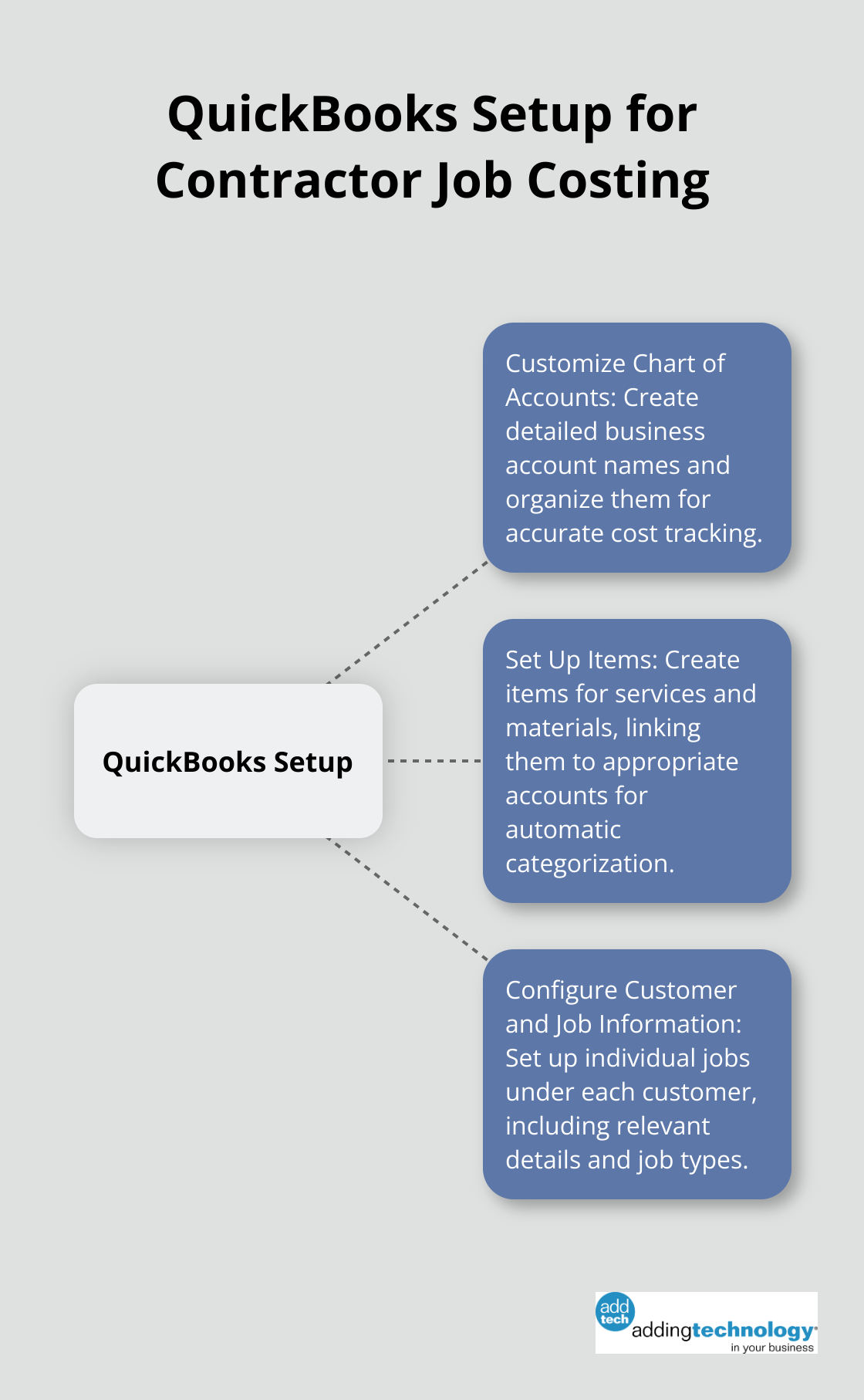

A well-configured QuickBooks system can transform a contractor’s financial management. The first step is to customize your chart of accounts. Create business account names, assign account numbers to these accounts, and organize account names. This level of detail will allow you to track costs more accurately and generate more insightful reports.

Instead of a general “Materials” account, create sub-accounts like “Lumber,” “Electrical Supplies,” and “Plumbing Materials.” This granularity will help you pinpoint where your money goes and identify areas for cost optimization.

Set up items in QuickBooks to represent the services you offer and the materials you use frequently. Items act as a bridge between your chart of accounts and your invoices or purchase orders. For labor, create items that correspond to different roles or types of work (e.g., “Carpentry Labor” or “Electrical Installation”).

For materials, create items that match your most commonly used supplies. Link these items to the appropriate accounts in your chart of accounts. When setting up your line items for the first time, keep it simple. This setup allows QuickBooks to automatically categorize your income and expenses when you use these items on invoices or bills.

Proper job setup is the backbone of effective job costing. In QuickBooks, create a new customer for each client and set up individual jobs under that customer. This structure allows you to track multiple projects for the same client separately.

When setting up a job, include all relevant details such as the job name, description, start date, and projected end date. If you’re using QuickBooks Desktop, take advantage of the job status feature to track the progress of each project easily.

Try to set up job types to categorize similar projects. This categorization will help you analyze profitability across different types of work you perform.

This solid foundation for job costing in QuickBooks will enable you to track costs accurately, generate detailed reports, and make informed decisions about your projects and overall business strategy. (The next section will explore how to use this setup to track costs effectively in your day-to-day operations.)

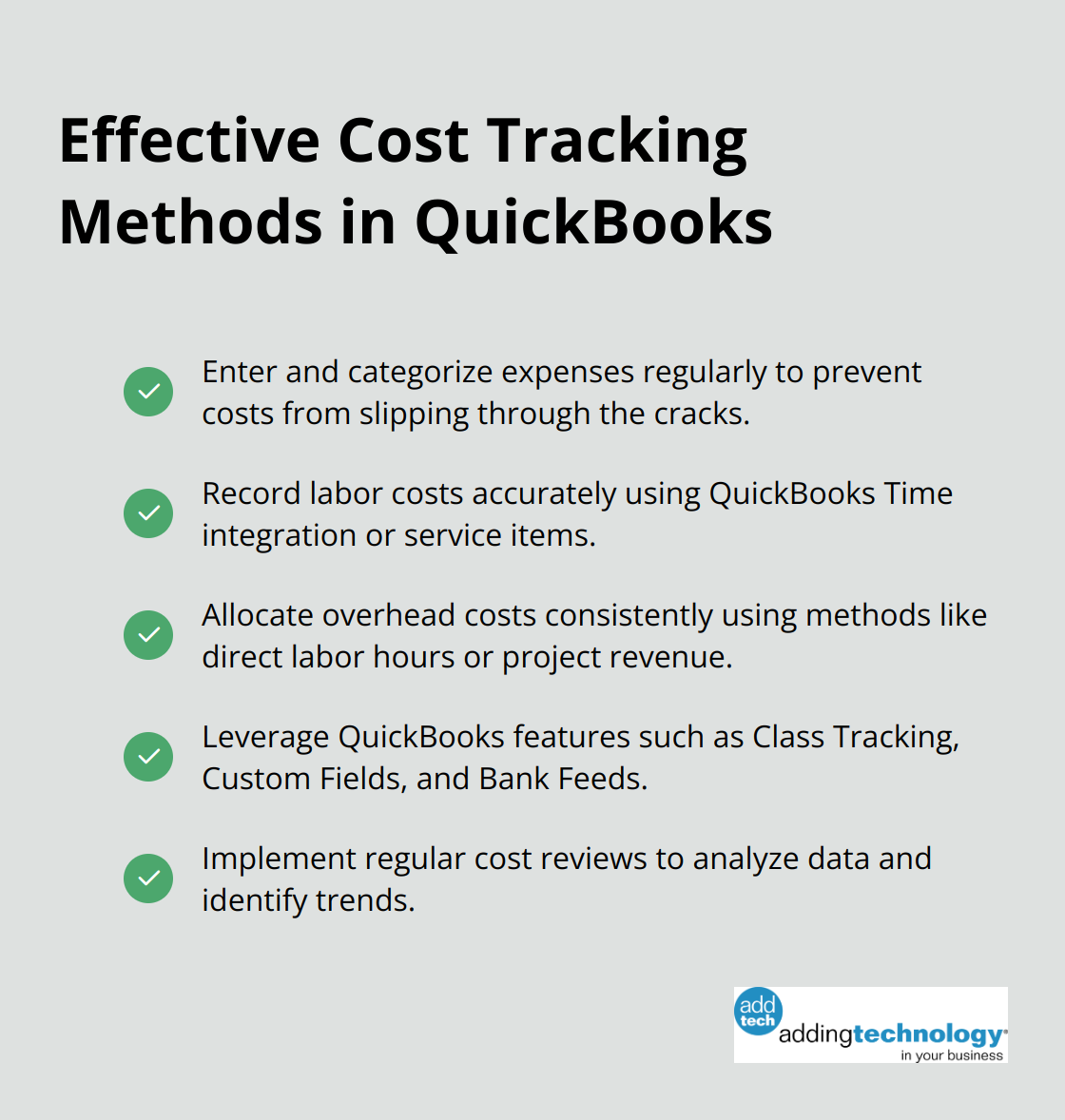

Accurate expense tracking forms the foundation of effective job costing. Set aside specific times each day or week to input all project-related expenses. This practice prevents costs from slipping through the cracks.

Use QuickBooks’ expense tracking features to categorize each cost to the appropriate job and cost category. For example, when you purchase lumber for a specific project, enter it as an expense and assign it to that job’s materials category. This level of detail allows for precise job costing and helps identify areas where costs may exceed expectations.

Labor costs often represent a significant portion of a project’s budget. QuickBooks offers several ways to track these costs effectively. If you use QuickBooks Time, you can integrate it directly with QuickBooks to automatically import employee hours into your accounting system.

Create a service item in QuickBooks for each employee or subcontractor that reflects their hourly rate or pay grade. When entering time, assign it to the specific job and task. This method allows you to generate reports that show labor costs per job, helping you identify which tasks consume the most time and potentially eat into your profits.

Overhead costs can challenge contractors when assigning them to specific jobs, but they’re essential for understanding the true cost of each project. Use a consistent method for allocating these costs. One effective approach calculates your total overhead costs for a given period and then allocates them to jobs based on direct labor hours or project revenue.

For instance, if your monthly overhead is $10,000 and you have 1,000 total labor hours across all projects, you could allocate $10 of overhead per labor hour to each job. This method ensures that larger projects bear a proportionate share of the overhead costs.

QuickBooks allows you to set up overhead allocation as a recurring transaction, streamlining this process and ensuring it’s not overlooked. Review your overhead allocation method regularly, as it may need adjustment as your business grows or changes.

QuickBooks offers several features that can enhance your cost tracking efforts:

These features can save time and improve the accuracy of your cost tracking (when used consistently).

Schedule regular cost review sessions to analyze your tracked data. These reviews help identify trends, spot potential issues early, and make informed decisions about resource allocation and pricing strategies.

Try to involve key team members in these reviews to gain diverse perspectives on cost management. This collaborative approach can lead to innovative solutions for reducing costs and improving project profitability.

With these cost tracking methods in place, you’ll gain a comprehensive view of your project expenses. This visibility provides invaluable insights for making informed decisions about pricing, resource allocation, and overall business strategy. The next section will explore how to leverage this data to generate insightful reports that drive your business forward.

Job cost reports in QuickBooks provide contractors with valuable information that can significantly impact decision-making and profitability. We at adding technology have observed how these reports can transform a contractor’s financial management.

Job profitability reports form the foundation of financial analysis for contractors. These reports break down revenue, costs, and profit margins for each job, allowing you to identify your most and least profitable projects. To access these reports in QuickBooks, navigate to the Reports menu and select Job Profitability Summary or Job Profitability Detail.

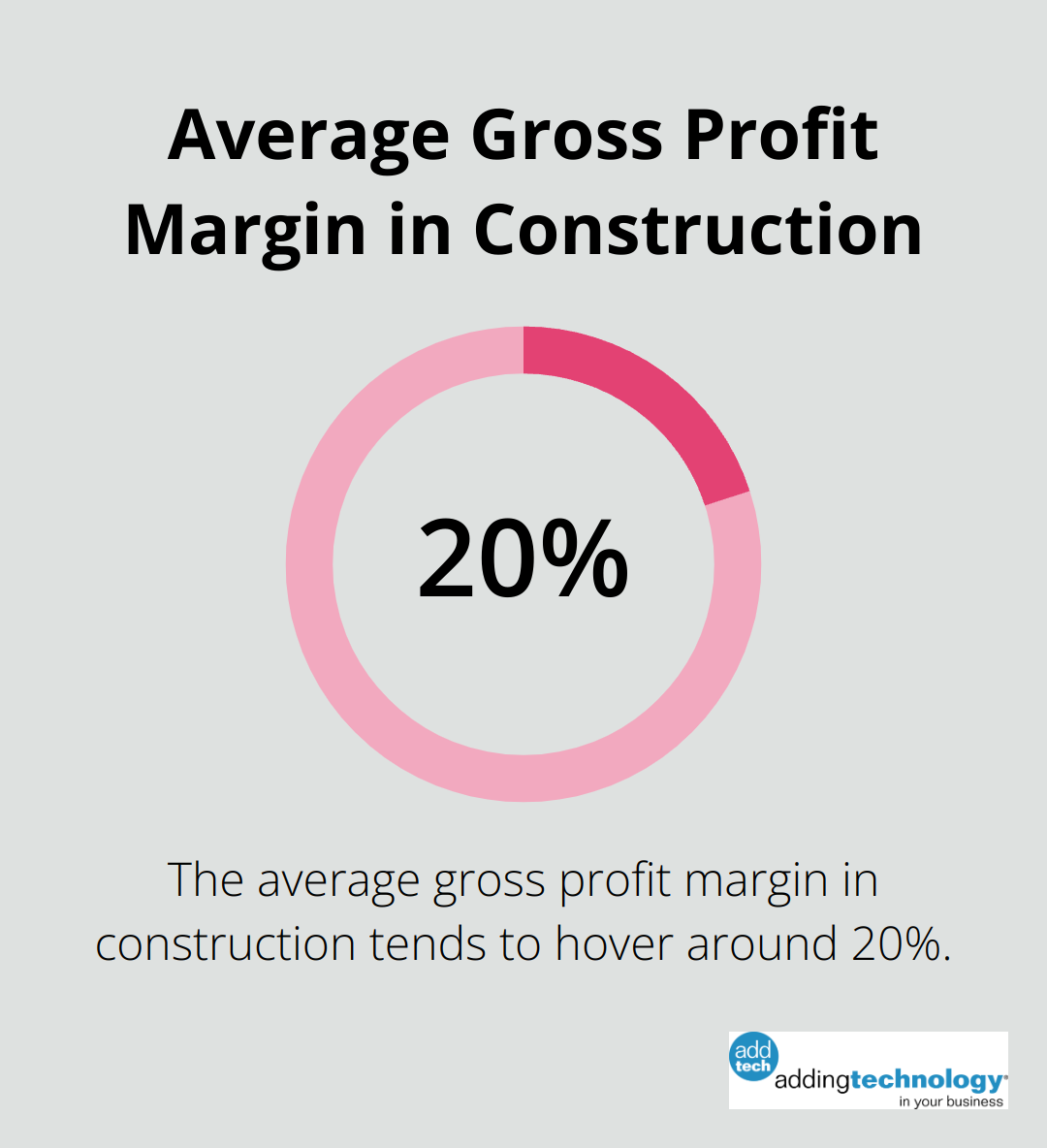

Focus on the gross profit percentage for each job. Industry standards vary, but according to industry experts, while the average gross profit margin tends to hover around 20%, the average net profit margin for construction is typically lower. If jobs consistently fall below this range, reassess your pricing strategy or find ways to reduce costs.

Work in Progress (WIP) reports are vital for contractors using the percentage of completion method for revenue recognition. These reports display the status of ongoing projects, including costs incurred, billings to date, and estimated costs to complete.

To create a WIP report in QuickBooks, use custom reporting features or consider integrating specialized construction management software. Regular review of these reports helps you monitor project progress and identify potential cost overruns early.

Comparing estimated costs to actual costs improves your estimating accuracy and project management. QuickBooks allows you to run reports that show these comparisons side by side. Look for patterns in cost variances (e.g., consistent underestimation of labor costs for certain types of work or higher-than-expected material costs).

Use these insights to refine your estimating process. For instance, if electrical work consistently exceeds budget by 10%, adjust future estimates accordingly. This iterative process leads to more accurate bids and improved profitability over time.

The power of these reports lies in regular analysis and action on the insights they provide. Set aside time each week or month to review these reports and make data-driven decisions about your business. This practice will help you maximize profitability and ensure the long-term success of your contracting business.

QuickBooks allows you to customize reports to fit your specific business needs. Experiment with different report layouts and filters to create views that provide the most relevant information for your decision-making process. Conduct a thorough review of the job cost reports and compare estimated vs. actual costs to identify areas for improvement. Use insights from these reports to refine your estimating process and improve overall profitability.

QuickBooks contractor job costing transforms financial management for construction businesses. It enables precise bidding, identifies profitable projects, and improves resource allocation. Contractors who master this tool gain a competitive edge in pricing services while maintaining healthy profit margins.

Implementing a robust job costing system requires ongoing commitment and regular reviews. As businesses grow, job costing methods must adapt to changing needs. QuickBooks offers powerful features that contractors can leverage to streamline their financial processes and gain valuable insights (such as customizable reports and real-time data tracking).

We at Adding Technology specialize in construction financial management solutions. Our team can help you implement real-time job costing and integrate advanced technologies to enhance your operational efficiency. With expert guidance and the right tools, you’ll make informed decisions and drive your contracting business towards long-term success.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.