At adding technology, we understand the importance of accurate cost accounting for businesses. Job costing and activity-based costing are two popular methods used to allocate costs and determine profitability.

In this blog post, we’ll compare job costing vs activity-based costing, exploring their definitions, key components, and applications in different industries. We’ll also examine the advantages and disadvantages of each method to help you choose the right approach for your business.

Job costing is a cost accounting method that tracks and allocates expenses to specific projects or jobs. This approach benefits businesses, especially in industries like construction, manufacturing, and professional services.

Job costing assigns direct costs, such as materials and labor, to individual jobs. It also allocates indirect costs, like overhead, based on predetermined rates. This method provides a detailed view of each project’s profitability, allowing businesses to make informed decisions about pricing and resource allocation.

Construction firms frequently use job costing to manage their projects effectively. For example, a building contractor can track costs for each house they build (from foundation to finishing touches). Manufacturing companies producing custom orders also benefit from job costing. A furniture maker creating bespoke pieces would use this method to ensure each unique item is priced correctly.

Effective job costing systems typically include three main cost categories:

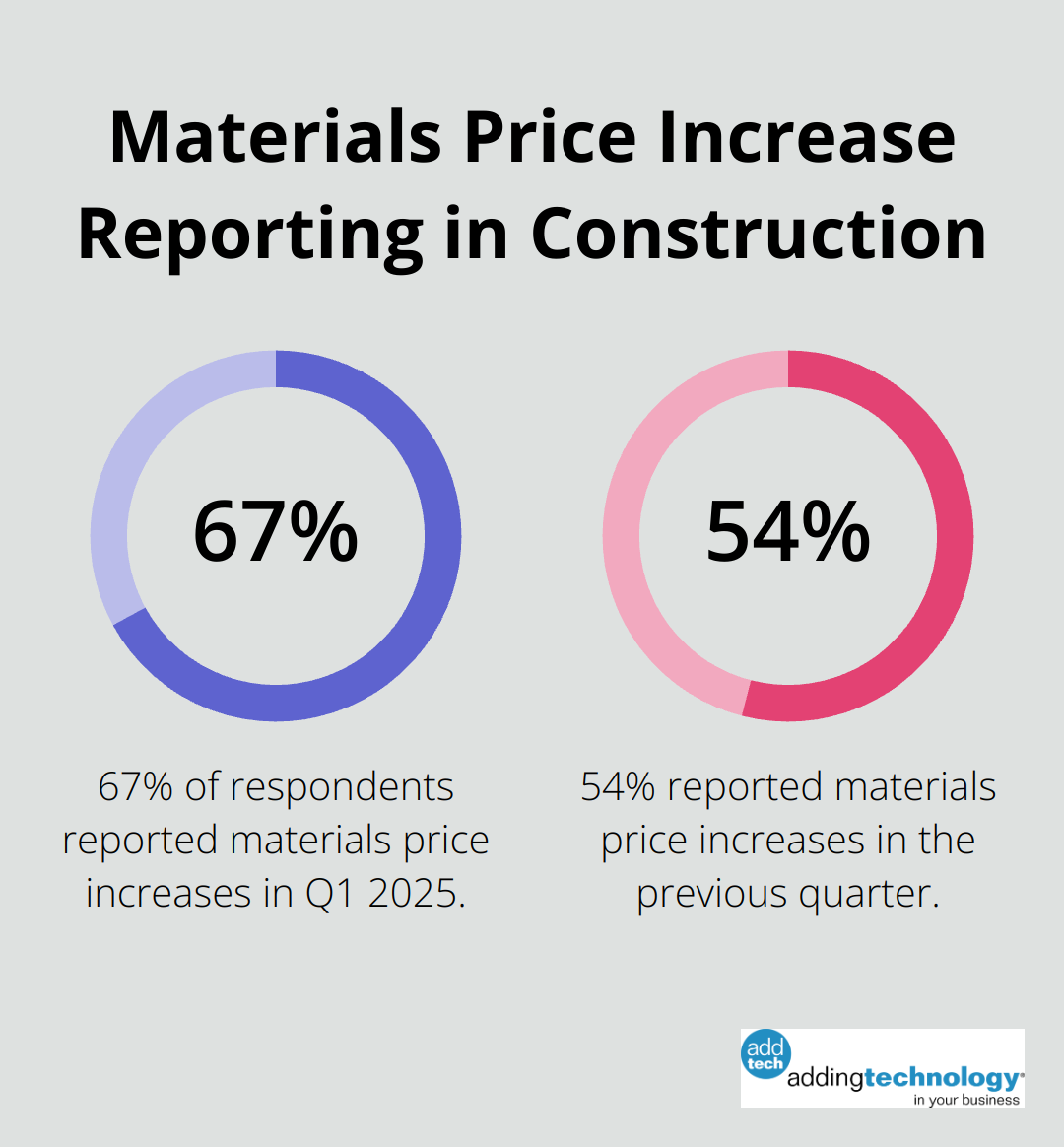

A recent survey by Engineering News-Record (ENR) found that 67% of respondents reported materials price increases in the first quarter of 2025, up from 54% in the previous quarter. This highlights the importance of accurate cost tracking in the construction industry.

Modern job costing systems leverage technology to streamline the process. Software solutions can automatically track time, materials, and other expenses, reducing manual data entry and improving accuracy. Many construction firms have implemented real-time job costing systems, allowing them to monitor costs in real time and track unposted payroll for better budget visibility.

While job costing provides valuable insights into project profitability, it’s not without challenges. Accurate allocation of overhead costs can be complex, and the method may not capture all nuances of resource consumption. These limitations have led some businesses to explore alternative methods like activity-based costing, which we’ll examine in the next section.

Activity Based Costing (ABC) is a cost accounting method that assigns overhead and indirect costs to specific activities within an organization. ABC provides a more accurate picture of how resources are consumed and costs are incurred, compared to traditional costing methods.

ABC identifies activities that drive costs and assigns expenses to products or services based on their consumption of these activities. For example, a manufacturing company might identify activities such as machine setup, quality inspections, and material handling. The costs associated with these activities are then allocated to products based on how much they use each activity.

ABC can be applied across various sectors, but it’s particularly beneficial in industries with complex production processes and diverse product lines. Manufacturing companies often use ABC to understand the true costs of different products. For instance, a car manufacturer might use ABC to determine the actual cost of producing luxury vehicles versus economy models.

Service industries also benefit from ABC. A bank might use this method to accurately allocate costs to different services (like personal banking, business loans, and investment products). This allows them to price services more competitively and identify areas for cost reduction.

Implementing an ABC system involves several key steps:

While ABC offers many benefits, its implementation can be complex and resource-intensive. Organizations must carefully weigh the costs and benefits before adopting this method. However, for many businesses, the insights gained from ABC can lead to significant improvements in profitability and competitive positioning.

As we move forward, it’s important to understand how ABC compares to other costing methods, particularly job costing. The next section will explore the similarities and differences between these two approaches, helping you determine which method might be most suitable for your business needs.

Job costing excels in industries with distinct, identifiable projects. It’s particularly effective in construction, where each building project is unique. The Construction Financial Management Association discusses the importance of a job cost system, including calculating earned revenue and identifying what a construction company expects from its financial manager.

ABC shines in complex manufacturing environments. A 2024 survey by the Institute of Management Accountants revealed that 65% of manufacturers using ABC reported improved product pricing decisions.

Job costing implementation is generally straightforward, especially with modern software solutions. Many companies successfully integrate job costing systems within weeks, leading to immediate improvements in project tracking.

ABC implementation presents more challenges. It requires a deep understanding of business processes and can take months to fully implement. However, the payoff can be substantial. A 2023 Deloitte study found that the construction industry entered 2023 marked by a 7% increase in nominal value added and a 6% increase in nominal gross output compared to the previous year.

Job costing allocates direct costs easily but can struggle with overhead allocation. This can lead to under or overpricing, especially for businesses with high overhead costs.

ABC provides a more nuanced view of overhead costs. For example, a furniture manufacturer discovered through ABC that their custom orders were significantly underpriced, leading to a 20% increase in profitability after price adjustments.

Job costing offers clear insights into project-level profitability, making it ideal for businesses that need to quote accurately on a project-by-project basis. It’s particularly useful in industries like construction, where each job can significantly impact overall profitability.

ABC, while more complex, can reveal hidden costs and inefficiencies. A tech company used ABC to identify that customer support consumed far more resources than previously thought, leading to a restructuring that improved efficiency by 30%.

The choice between job costing and ABC isn’t always clear-cut. Job costing often serves as the go-to for project-based businesses, while ABC can provide deeper insights for companies with complex operations. Assess your business needs, industry standards, and resource availability before making a decision. The right costing method can become a powerful tool for improving profitability and operational efficiency.

Job costing vs activity-based costing presents distinct advantages for different business scenarios. Job costing offers precise tracking for project-based industries, while activity-based costing provides a nuanced view of overhead allocation for complex operations. The choice between these methods can significantly impact a company’s financial health and decision-making processes.

We expect cost accounting methodologies to evolve with the integration of advanced technologies (such as AI and machine learning). These advancements will enhance the accuracy and efficiency of both job costing and activity-based costing systems. Companies will make more informed decisions about resource allocation, pricing strategies, and overall financial management.

Adding Technology specializes in tailored accounting solutions for the construction industry. Our expertise in job costing systems helps contractors improve visibility into project costs and operational efficiency. Construction businesses can focus on building while we ensure their financial foundation remains solid and compliant.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.