At adding technology, we understand the unique challenges of accounting for a construction company. Construction accounting differs significantly from general accounting practices, requiring specialized knowledge and strategies.

This blog post will guide you through essential accounting tips tailored specifically for construction businesses. We’ll cover job costing, cash flow management, and other critical aspects to help your construction company thrive financially.

Construction accounting differs significantly from general accounting practices. Each project in construction functions as its own mini-business. This requires tracking of costs, revenues, and profits on a per-project basis. Unlike retail or service industries with standardized transactions, construction companies handle long-term contracts, varying project timelines, and complex cost structures.

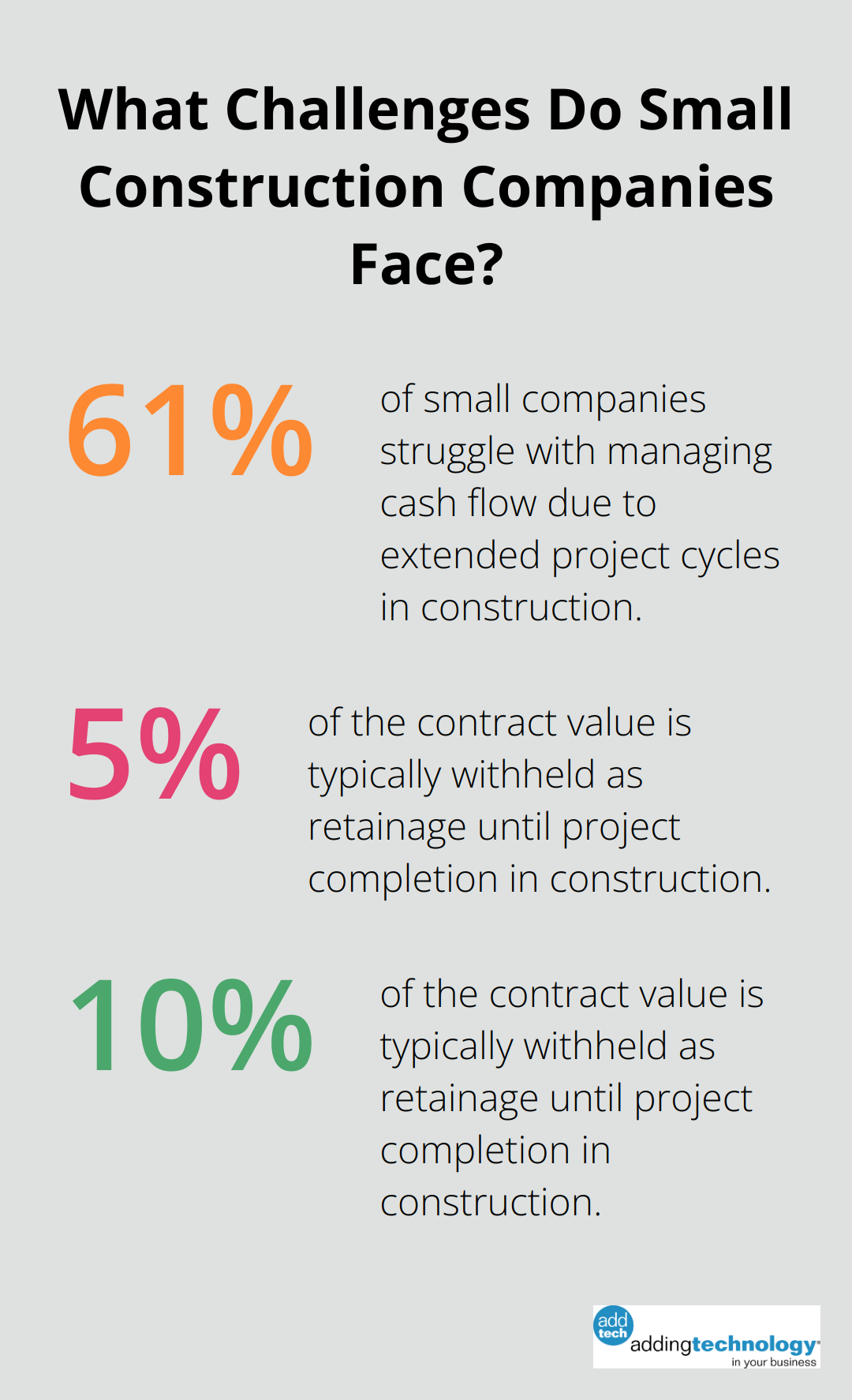

A typical construction project can span several months or even years. During this time, costs and revenues fluctuate dramatically. QuickBooks research found that 61% of small companies struggle with managing cash flow due to these extended project cycles.

Construction companies use standard financial statements like balance sheets and income statements. However, they also rely on specialized reports. The Work-in-Progress (WIP) schedule provides a snapshot of all ongoing projects, showing estimated costs, billings to date, and projected profitability.

The Construction-in-Progress (CIP) report tracks costs for incomplete projects. This helps manage budgets and identifies potential overruns early.

Job costing allows construction businesses to effectively track and allocate expenses related to each project, enabling accurate budgeting and forming the backbone of construction accounting. It involves meticulous tracking of all project-associated costs, including labor, materials, equipment, and overhead.

Effective job costing requires a robust system for cost categorization and allocation. Many construction companies have seen significant improvements in profitability after implementing detailed job costing practices.

Construction accounting must navigate a complex web of regulations. This includes compliance with the new revenue recognition standard (ASC 606), which affects how and when construction companies can recognize revenue from contracts.

Additionally, construction companies often deal with retainage – a portion of the contract price withheld until project completion. This typically ranges from 5% to 10% of the contract value, significantly impacting cash flow and accounting practices.

Understanding these unique aspects of construction accounting allows companies to better manage their finances, improve project profitability, and ensure long-term success in this challenging industry. The next section will explore effective strategies for implementing robust job costing systems in your construction business.

Our crew stands at the forefront of accounting and financial management for contractors in the construction and real estate sectors.

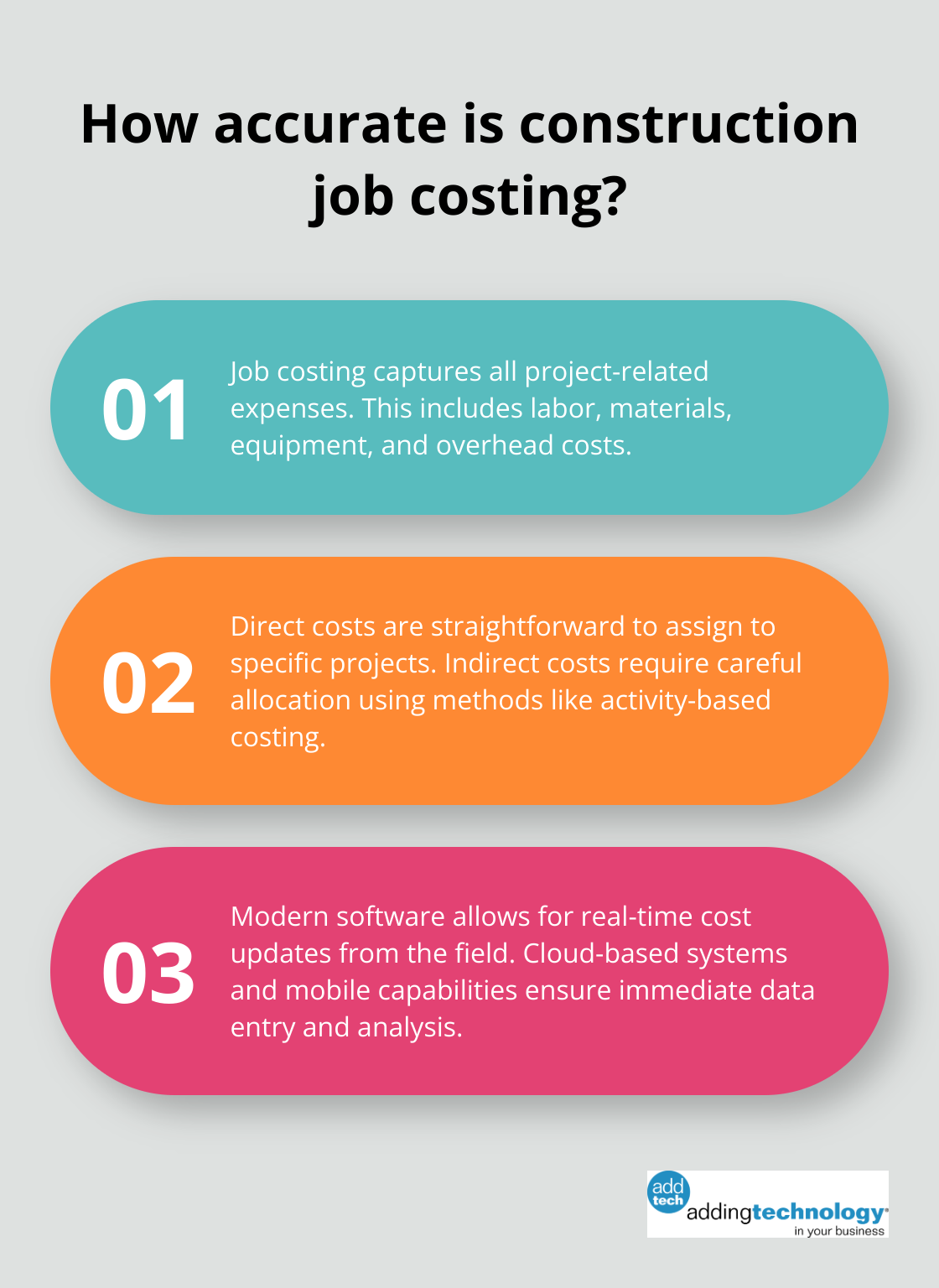

Job costing forms the foundation of effective financial management in construction. The first step to master job costing involves the setup of a system that captures all project-related expenses. This includes labor, materials, equipment, and overhead costs. Integrate job cost systems to capture and project costs to align with the budget.

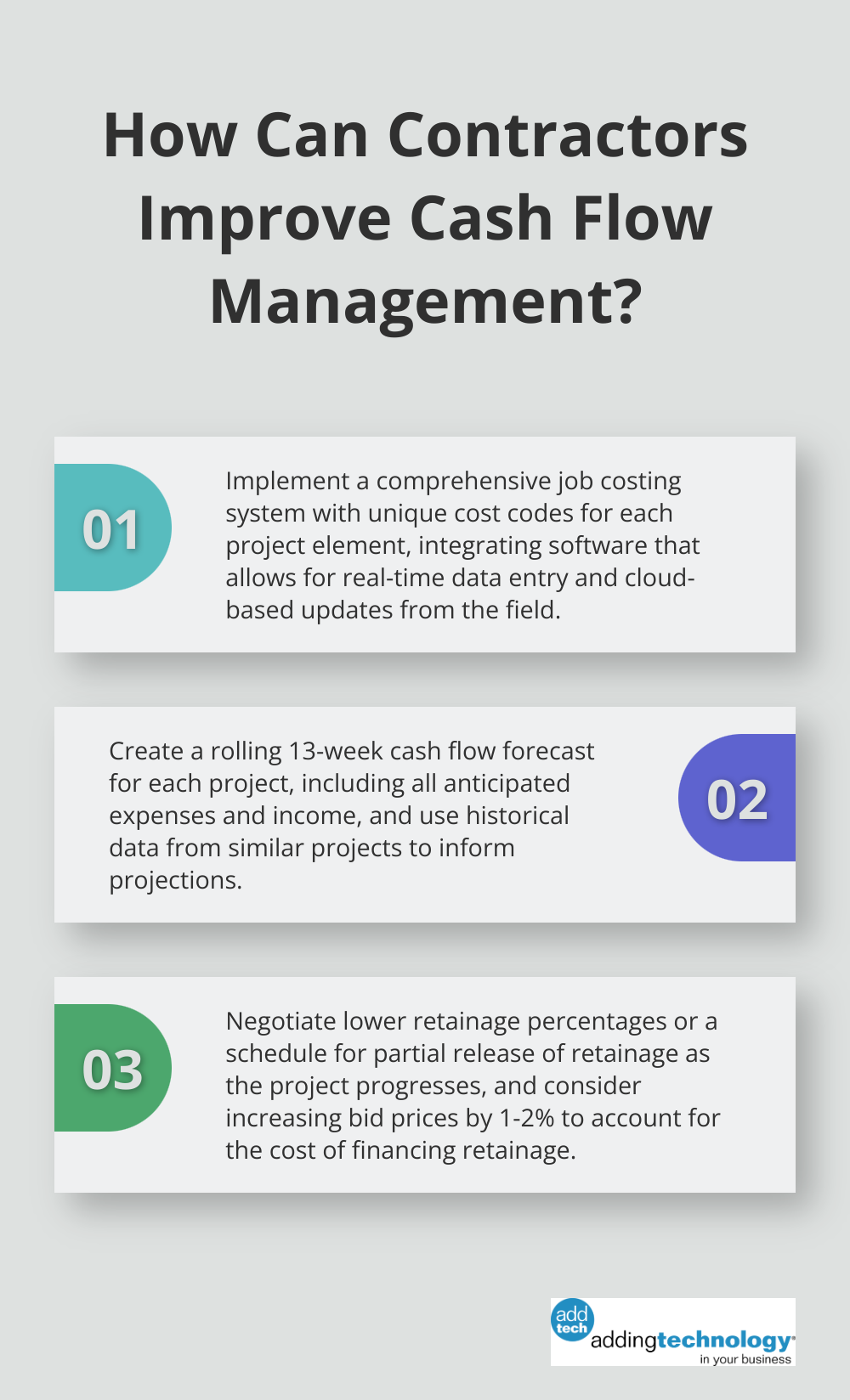

Create unique cost codes for each project element. This detailed approach allows for thorough analysis and helps identify areas of overspending quickly. Implement a process for daily or weekly cost updates to maintain accuracy.

Direct costs (such as materials and labor) are straightforward to assign to specific projects. However, indirect costs like equipment depreciation or office expenses require careful allocation. The American Institute of Certified Public Accountants (AICPA) recommends the use of activity-based costing for more accurate indirect cost allocation.

Develop a standardized method to distribute indirect costs across projects. This might involve allocation based on labor hours, project value, or a combination of factors. Regular review and adjustment of this allocation method ensure it remains relevant as your business evolves.

Modern construction accounting software has revolutionized job costing. Real-time data entry and cloud-based systems allow for immediate cost updates from the field. Autodesk Construction Cloud is valued for its comprehensive cost management features, which help track budgets and manage materials.

Invest in software that integrates with your existing systems and offers mobile capabilities. Train your team thoroughly on the use of these tools to ensure consistent and accurate data entry. Regular data analysis helps identify trends and potential issues before they impact your bottom line.

Job costing is not a set-it-and-forget-it process. It requires continuous refinement and adaptation. Regularly review your job costing methods and compare estimated costs to actual costs. This practice allows you to identify areas where estimates may be consistently off and adjust accordingly.

Try to involve project managers and field supervisors in the job costing process. Their insights can provide valuable context to the numbers and help improve future estimates. Consider implementing a feedback loop where lessons learned from completed projects inform future job costing practices.

The mastery of job costing practices sets the stage for effective cash flow management in construction projects. In the next section, we’ll explore strategies to optimize cash flow and navigate the unique financial challenges of the construction industry.

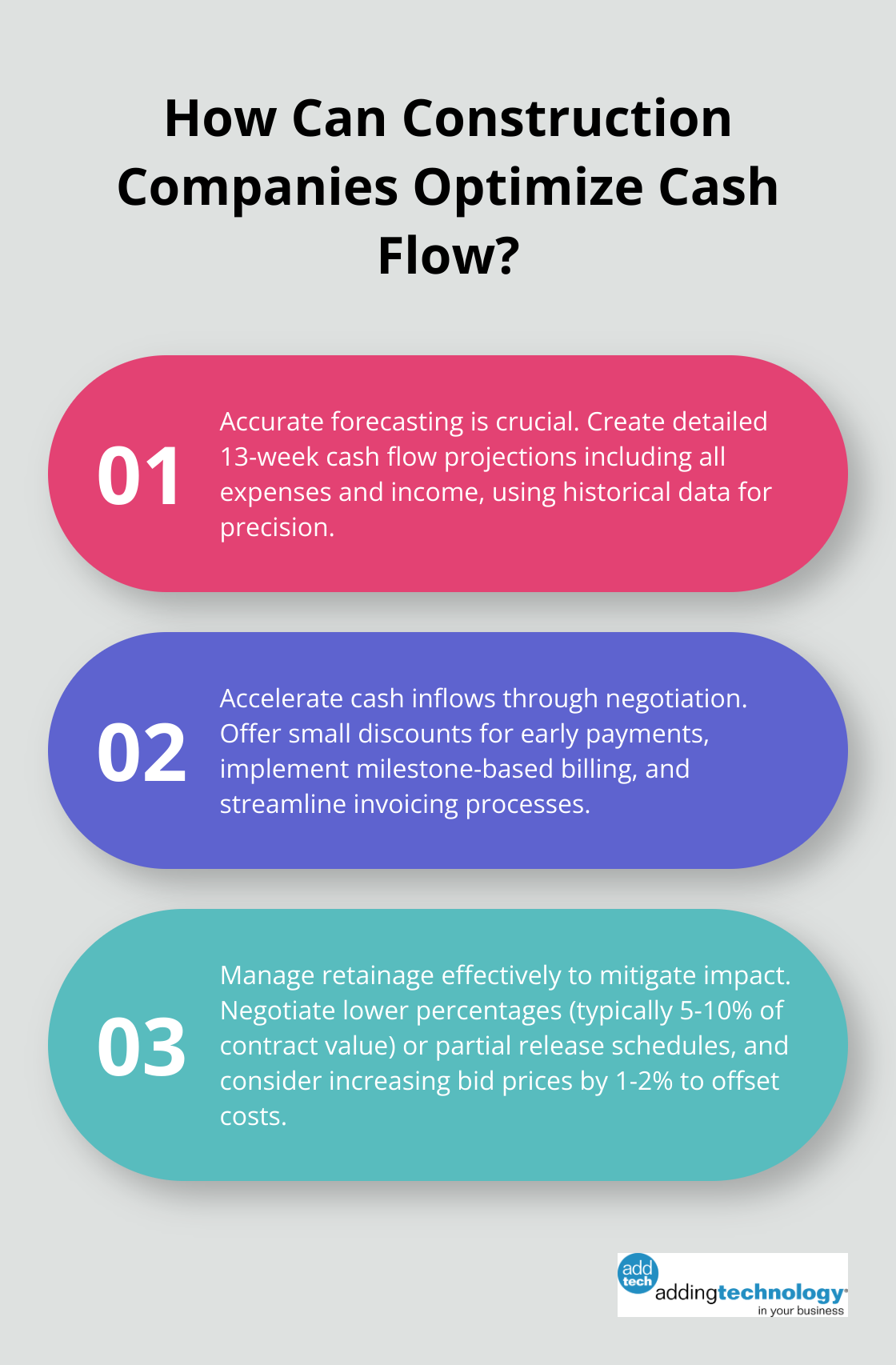

Construction companies must create precise cash flow projections. Start with a detailed timeline of expected cash inflows and outflows for each project. Include all anticipated expenses (materials, labor, equipment rentals, subcontractor payments). Factor in progress payments, retainage release dates, and potential delays for income.

Use historical data from similar projects to inform your projections. Implement a rolling 13-week cash flow forecast to provide a clear picture of short-term liquidity needs.

Improving cash flow often involves faster payments while managing outgoing expenses. Negotiate more favorable payment terms with clients. Consider small discounts for early payments or implement milestone-based billing to align cash inflows with project progress.

Streamline your invoicing process to reduce delays. Send invoices promptly and follow up consistently on overdue payments.

Retainage (typically 5-10% of the contract value) can significantly impact cash flow. To mitigate its effects, negotiate lower retainage percentages or a schedule for partial release of retainage as the project progresses. Some states have laws limiting retainage amounts, so familiarize yourself with local regulations.

Consider factoring retainage into your pricing strategy. Try increasing bid prices by 1-2% to account for the cost of financing retainage. This approach can help offset the cash flow impact without compromising profitability.

Implement a strategic approach to progress billing. Break down billing into smaller, more frequent invoices rather than waiting for large milestones. This approach aligns cash inflows more closely with ongoing expenses and reduces the risk of large cash flow gaps.

Ensure your progress billing aligns with the actual percentage of work completed. Overestimating completion can lead to disputes and delayed payments. Use project management software to track progress accurately and generate timely, accurate invoices.

Modern construction accounting software (such as the solutions offered by Adding Technology) can revolutionize cash flow management. These tools provide real-time visibility into financial data, automate invoicing processes, and offer predictive analytics for more accurate forecasting. Invest in software that integrates with your existing systems and offers mobile capabilities for on-site updates.

Accounting for a construction company requires specialized practices beyond traditional bookkeeping. Construction businesses must implement robust job costing systems and optimize cash flow management to succeed in a competitive landscape. Modern technology solutions streamline financial processes and provide valuable insights for strategic decision-making.

The adoption of specialized accounting practices is essential for construction businesses aiming to thrive. These practices improve operational efficiency, enhance financial visibility, and position companies for sustainable growth. Construction companies can significantly benefit from partnering with industry experts to enhance their financial management capabilities.

At Adding Technology, we offer tailored accounting and financial management services for the construction industry. Our expertise empowers construction companies to focus on their core business while maintaining a solid financial foundation. Construction businesses can improve their financial management and position themselves for success in an ever-evolving industry.

At adding technology, we know you want to focus on what you do best as a contractor. In order to do that, you need a proactive back office crew who has financial expertise in your industry.

The problem is that managing and understanding key financial compliance details for your business is a distraction when you want to spend your time focused on building your business (and our collective future).

We understand that there is an art to what contractors do, and financial worries can disrupt the creative process and quality of work. We know that many contractors struggle with messy books, lack of realtime financial visibility, and the stress of compliance issues. These challenges can lead to frustration, overwhelm, and fear that distracts from their core business.

That's where we come in. We're not just accountants; we're part of your crew. We renovate your books, implement cutting-edge technology, and provide you with the real-time job costing and financial insights you need to make informed decisions. Our services are designed to give you peace of mind, allowing you to focus on what you do best - creating and building.

Here’s how we do it:

Schedule a conversation today, and in the meantime, download the Contractor’s Blueprint for Financial Success: A Step by-Step Guide to Maximizing Profits in Construction.” So you can stop worrying about accounting, technology, and compliance details and be free to hammer out success in the field.